Overview

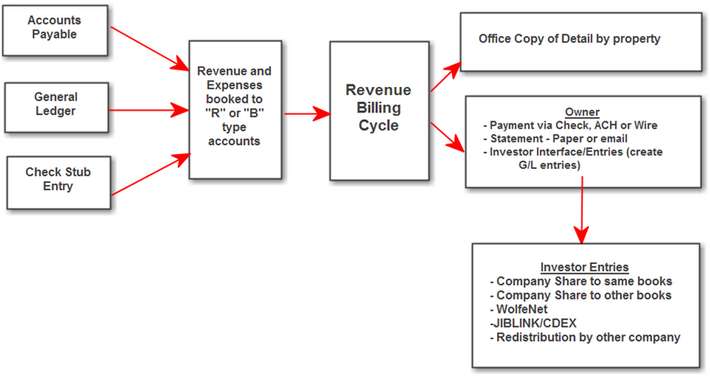

Revenue/Billing is an optional part of the General Ledger System. This system is used to produce revenue and expense statements by property for each investor-owner. The Revenue and Billing components of the system can be run as one combined cycle or independently as separate cycles. You can bill the owners in each property for their share of costs. You can produce checks to the owners for their share of each property's income. You can also elect to produce a 'net-check' for each owner's revenue less costs.

Although this system is designed to handle any partnership (shared ownership) situation like real estate and farm/ranch, it is particularly useful for your oil and gas distribution and accounting needs. For example, the system has the ability to handle petty and legal suspense, state income tax withholding, and specialized check stub disclosure requirements.

You can customize the revenue/billing cycle to meet your needs. Within the cycle, the user has the ability to review all transactions by property prior to printing checks or billings, to hold transactions, and to print reports at the property or owner level. You have complete control over the revenue and billing accounts reported to the owners. You have no limit to the revenue product types or billing category types reported.

The Revenue/Billing System is integrated with Pak Accounting's Check Stub and General Ledger Systems. The different systems share the same master files for owners and leases. Check Stub creates entries in the General Ledger that are used by the Revenue distribution process. Also, automatic entries can be made to the company's books or to an affiliate's books for that owners' share of revenue or costs. The Bank Reconciliation File is also shared across all systems.

Revenue/Billing is used to produce individual Investor/Owner statements for each property they are in. The Revenue and Billing components can be run as a single combined cycle or as old fashion separate Revenue and Billing cycles.

The Revenue/Billing module pulls information out of the General Ledger which can originate from a number of different Pak Accounting modules, or even third-party systems. The different modules share the same master files for owners and leases.

For Revenue Distribution - the Check Stub system is normally where the entries originate from. The entries can be entered at various times during the month until it is time to distribute the funds. In Check Stub, the entries can be manually entered, imported via generic imports, or CDEX imports. Revenue/ Billing entries can also be downloaded via WolfeNet from other Pak Accounting users. Other optional Pak Accounting systems such as First Purchaser, Gas Plant/Allocation, Service Ticket, and House Meter can also originate Revenue Entries.

Billing Entries can originate from Check Stub’s Added Costs, A/P, Standard Entries, or manual G/L Entries, with each having various imports of their own. The billing system itself can even generate Overhead entries during the Billing Cycle.

The Revenue/Billing Cycle can assemble all of the different entries from all the various sources, apply the appropriate DOI/deck (ownership percentages) to them, separate entries by Property and AFE creating owner amounts.

The system, based on the owner’s setup, determines:

1.If the owner is to get paid.

2.If the owner is to get automatically deducted what they owe (net check).

3.How much the check has to be before they will get paid (Petty/Minimum Suspense).

4.If the owner is to receive their statement via e-mail or paper.

5.If it is to be in detail or summary.

6.And even how the owner will get paid (Check, ACH, or Wire). At any time in the process prior to the last “Update/Post” step; the process can be stopped and entries changed, ownership changed, owner options changed, etc., and the process restarted without having to restore!

You can customize the Revenue/Billing Cycle to meet your needs. Within the cycle, the user has the ability to review all transactions by property prior to printing checks or billings, to hold transactions, and to print reports at the property or owner level. You have complete control over the Revenue and Billing Accounts reported to the owners. There are no limits to the Revenue Product Types or Billing Category Types reported.

The payments ((Checks, ACH (Direct Deposit), or Wires)) are all recorded in a common check history file that is also used by Payroll and A/P. This enables the one or more bank accounts to be easily reconciled at the end of each month and for electronic positive pay information to be uploaded to the bank on a daily basis.

The update can send owner share entries back into the company’s books, or it can automatically record entries for one or more owner(s) whose books you are keeping (i.e. owner’s family or other inside owners) and/or send entries to other users via CDEX, EnergyLink, or WolfeNet.

Outstanding checks (those that haven’t cleared the bank) can either be reprinted or be voided and all the detail entries flow back into suspense. Monies sitting in suspense because of the death of the owner/investor (i.e. Legal Suspense), can be easily split up and released/paid when appropriate to individual heirs. Revenue and/or Billing mistakes – such as items coded to the wrong property, or the wrong ownership was setup, or a long list of other errors - can also be easily corrected across all the affected time periods via powerful correction utilities.

After the monies sit in suspense a couple of years or longer, based on the owner’s last known address, that state’s unclaimed property rules kick in and the unpaid revenue will eventually be paid to the owner’s last known state.

Deciphering the cycle

The Big picture of steps surrounding a Revenue/Billing Cycle:

1.Deposit Entry

Record funds received from the sale of oil into bank account & print deposit slip.

2.Check Stub Entry

Enter for each Purchaser’s check detail by Lease & Production Date.

3.A/P Entries

Enter each Billing/JIB related Invoice received.

4.Billing/JIB cycle

Bill investors.

5.Revenue cycle

Pay owners/investors.

(Billing & Revenue can be done at the same time to give investors a complete picture of how they are doing)

6.Pay A/P

Print and mail checks for JIB Invoices.

Working Interest Owner – refers to an investor that shares with other owners to fund the expenses to drill & produce the lease. They absorb all the costs to produce the well including exploration, drilling, completion costs, and monthly operating expenses. They share in the income after the Royalty and Override Interests have been paid. Royalty Owner – refers to the interest a landowner is “awarded” for allowing people to drill for oil on their land. They do NOT share in any expenses of drilling the well, they ONLY share in the income of the well. What a deal!! Override Owner – Similar to a Royalty Owner in that Override interest do NOT share in any expenses of the well, they ONLY share in income. Commonly occurs as a share is “given” to key players in the lease acquisition. Examples include: Landmen, Scouts, and Geologists. Well/Lease/Property/Prospect - These are used interchangeably within Pak Accounting. A property can contain a lease, and that lease can have several wells on it. For purposes of Pak Accounting we group them into what is called the “Property Master”, usually used at the lowest level for reporting purposes. If those items need to be rolled up, we have that option. For example: If you set up your “Properties” in F12 at the well level but you need to report at the lease level, we can set up a Financial Group. This will group the wells in a lease. Investor – An individual or company that takes a Working Interest in a deal. Operator – An E&P Joint Venture participant that managers the joint venture costs and bills the venture’s Non-Operators for their share of the venture costs. Division of Interest - Also called a DOI, a Division of Interest tells the system how to divide up the bills and how to distribute the revenue. The % of interest will vary on the revenue side from the billing side because the Royalty and Override Owners only share in the revenue and not the expenses. |

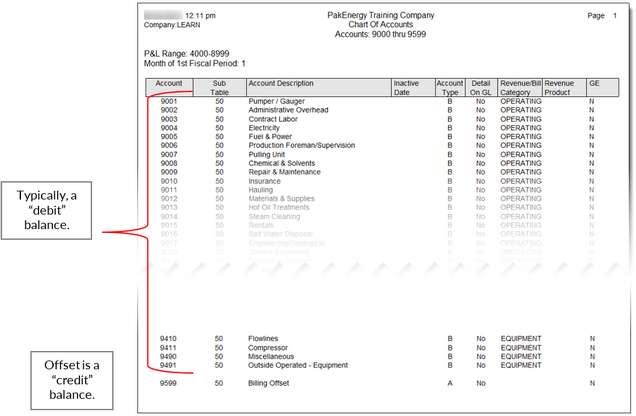

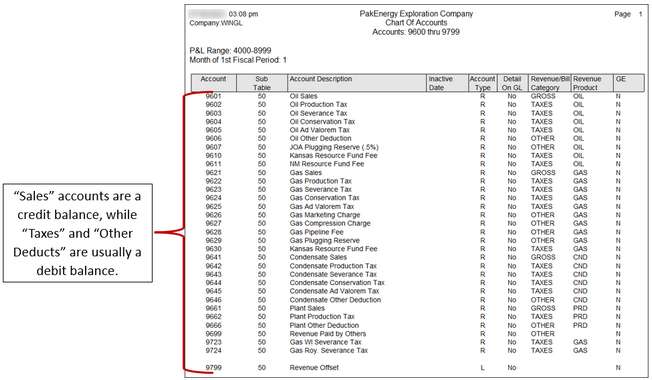

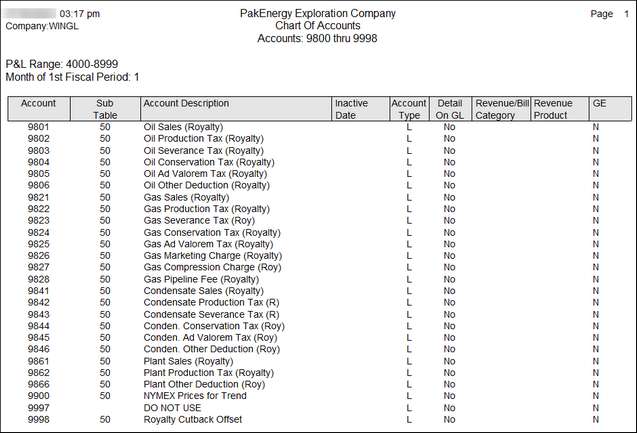

The table below shows an example chart of accounts, summarized by account range. Most Revenue/Billing users could follow this pattern.

Notice that the entire 9000 series of accounts are reserved for your Billing and Revenue accounts. We have these defined at the end of your chart to isolate them from all the other accounts which reflect your company’s share of things. The accounts will contain unbilled and unpaid transactions prior to a Revenue/Billing Cycle (i.e., Asset/Liability entries). They should be excluded from the Profit/Loss range via the company option that sets the ‘High Income/Expense Number’ at 8999.

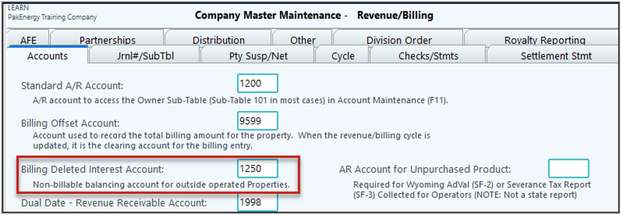

Pak Accounting is unique in utilizing regular G/L entries to process Billing and Revenue Entries. Reserving accounts at the end of the chart enables the ledger to be printed without including these accounts. Since the system utilizes regular G/L accounts to record transactions, this enables any module, from Payroll to Invoicing to specialized Oil & Gas modules, to send entries to the Revenue/Billing process. After the Revenue/Billing process is completed, the system retains the net activity instead of affecting each individual account for easy financial reporting. Instead, it utilizes a billing and revenue offset account to record what was Billed/Paid. These offsets are typically defined at the end of their respective ranges. If you observe good date cut-offs and you bill all the expenses and distribute all the revenue, then the sum of all billing ranges will equal zero. The same theory applies to the sum of the range of revenue accounts (and the revenue offset). After the Revenue/Billing has been completed, the individual entries are marked with a Billed/Paid date to indicate they have been processed and prevent them from being processed again. The Balance Sheet for the Default Operator’s books will be set up to summarize the Billing accounts and Billing Offset into a single line item on the balance sheet called Unbilled JIB. When setting up your company in this manner, allowance must be made in your Balance Sheet report, as defined in the Financial Report Definition Maintenance, for these types of accounts. A typical way to report dollar balances contained in these accounts are: B - Billing accounts (9000 to 9599) are reported in the Current Assets section and described as ‘Billings (or JIB) in Progress’ or Unbilled JIB. R - Revenue accounts (9600 to 9799) are reported in the Current Liability section and described as ‘Revenue (or Oil & Gas) Payable’. The Revenue/Billing system utilizes five (5) distinctive accounts: 1.Billing Offset—we have used account 9599 in our example. The billing journal uses this account. Entries to this account are created when the Billing cycle is updated. The account is used to “clear out” or credit the billing range for the amount of each property’s expenses. The entire billing range (9000-9599) will net zero dollars for that property’s billed transactions. 2.Revenue Offset—we have used account 9799 in our example. The revenue journal uses this account. Entries to this account are created when the Revenue cycle is updated. The account is used to “clear out” or debit the revenue range for the amount of each property’s revenue disbursed. The entire revenue payable range (9600-9799) will net zero dollars for that property’s disbursed revenue. 3.Revenue Paid by Others (the Revenue Deleted Interest account)—we have used account 9699 in our example. The entry to this account is created when the Check Stub deposit is updated and clears out when you update the Revenue Cycle. This account is used when you receive less than 100% of the revenue for a property, and it adjusts (lowers) your distribution to the actual amount to pay. 4.Billing Deleted Interest—is needed if: a.You have a working interest in a non-operated property. b.There are other working interest owners directly billed by the operator. c.You have sold any of your working interests to other investors and need to further bill for expenses billed to you by the operator. d.You want to reflect the owner’s actual working interest percentage in the well. Typically, this account is in the Accounts Receivable section of the Chart of Accounts (Acct 1250). It records the portion of the 100% costs billed directly by the operator to the other working interest owners. The first entry to this account is created when you enter the costs from your operator, typically through Accounts Payable or Check Stub Entry modules. The difference between your actual share and the 100% amount is entered as a credit to 1250—your Deleted Interest Account. When the billing cycle is updated, a debit entry is made to 1250 for the same amount. The portion billed to your owners is debited to their Accounts Receivable, and the credit is to the Billing Offset 9599 for the 100% amount. 5.Revenue Payable - Suspense a.2210 – Revenue Payable – Legal Suspense: contains the funds due to owners not being paid due to a legal reason, i.e., waiting on a signed division order or will in probate. b.2220 – Revenue Payable – Petty Suspense: contains the funds due to owners who have yet to meet their minimum payment threshold.

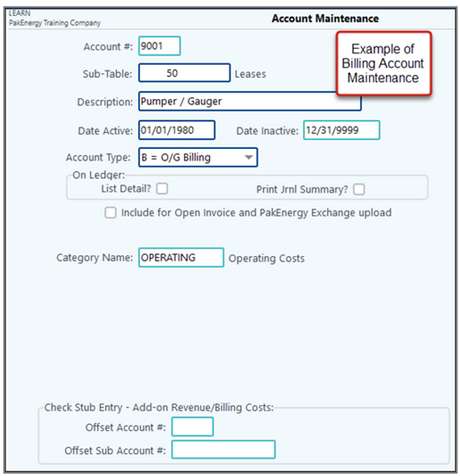

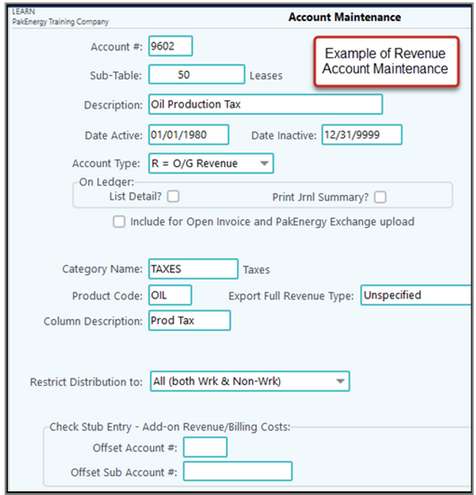

Pak Accounting’s Chart of Accounts is set up in Account Maintenance [F11]. The Account Type field determines if the account will be set up as a billing (B=O/G Billing) or revenue (or R=O/G Revenue) account. This is how the distribution knows what type of item it is: Income (Revenue) or Expense (Billing). Also enter the billing type "Category Name" (A drop down list is available). The "Offset Account/Sub-Account #" field is used by the Check Stub program when you are using the Additional Company Costs feature to add charges to a lease that are not already deducted by the purchaser/operator.

If the account is a Revenue account, enter the category name, the product code, the Column Description, and applicable interest types.

Pre-defined product types and revenue/billing categories: For your Billing type accounts, several pre-defined cost categories are available for your convenience. For Revenue type accounts, you have three basic categories: GROSS, TAXES and OTHER pre-defined. You also have two pre-defined Product Codes: OIL and GAS. For more information on adding products, see the appropriate section in the Check Stub Help.

See Report Definitions section for more details on accumulating (Record Type C) and printing (Record Type P) a range of accounts. |

Billing Cycle

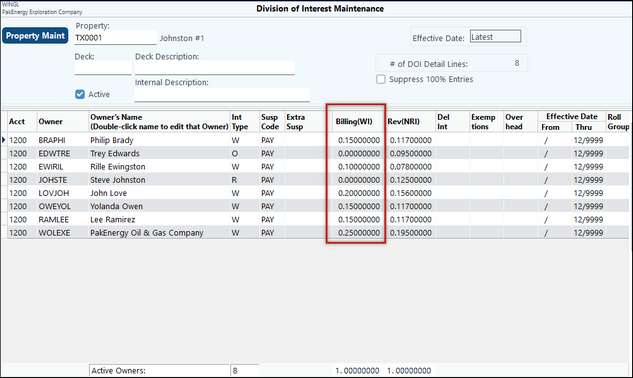

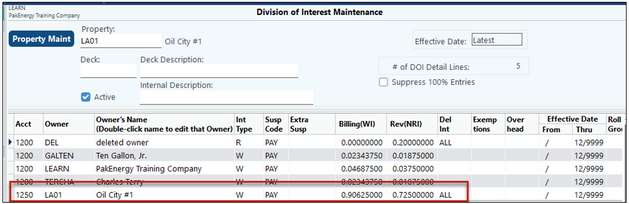

A Billing Cycle is a process where Pak Accounting takes each unbilled charge/ invoice and allocates to each partner (owner/investor) their proportionate share. The system will observe your cut-off date (usually the end of the month), and will automatically separate the billing of the expenses by property, category of expense, and expense coding. How does it know how much each person owes? When you setup a new property, you enter the Division of Interest for the property that defines who owns what % of the income and what % of the expenses. The income % is called the property’s Revenue % or NRI (Net Revenue Interest). The expense % is called the Billing % or Working Interest %. Sample of the Division of Interest:

In the above Division of Interest (DOI), Philip Brady owns 15% of the Working Interest and for every charge incurred on this property; he will be responsible for reimbursing the Operator 15% of it (i.e. When we run our Billing Cycle, we’ll send him a bill for the 15% that he owes. It is amazing how fast and easy it is to use Pak Accounting’s Joint Interest Billing module and the tremendous number of calculations it can do with a touch of the button! |

What is a JIB? A Joint Interest Billing in layman’s terms is similar to a partnership in the “normal” accounting world. A group of partners share in the expenses of drilling and producing an Oil & Gas property. The joint interest “billing” is the detail of what bills have been incurred on the property and shows the expense itself (i.e. 100% amount) and each partner’s “share” of the expenses. For an Operator, the section of the chart for Joint Interest Billing is 9000-9599. When all expenses are billed to partners, this range of accounts will equal zero on the Operator’s books! During the month, as invoices are coded to the Billing Accounts, the Balance Sheet has been defined to automatically accumulate the total of all the unbilled amounts into a line item called “Unbilled JIB”. This will appear on the Operator’s Balance Sheet in the Asset section, similar to Accounts Receivable. After the “Billing Cycle” has been done and if everything is billed, then the Unbilled JIB will be zero and the Balance Sheet has been setup to not print it if it is zero. If some of the charges are held, then the net amount of those charges will start accumulating on the Balance Sheet until they are either written off or billed. Usually, the total amount of the charges incurred producing the Oil & Gas does not represent income OR expense; the entries are just “flowing through” to the owners. The Operator is paying the bills and the other owners are reimbursing the Operator for their share of them. In most cases, the Operator and/or related party is also an owner in the property. These “in-house” owners are setup up just like any other owner and their ownership percentages are defined in the Division of Interest (DOI) for each property just like any other owner. What turns these ordinary owners into “special” owners is by setting up the “Investor Interface” for them, thus enabling the system to automatically create G/L entries recording that owner’s share of the income and expense to the appropriate set of books. This “share” usually gets recorded to the “normal” Income and Expense Accounts defined for the company (i.e. typically found in the 4xxx & 5xxx series of accounts). |

A sample chart for the JIB section might look something like the following:

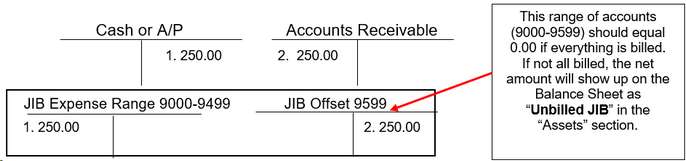

As billable expenses are incurred on the property, they are coded to one of the Billing (9000-9598) Accounts. Note the “Billing Offset”, Account 9599 is a “special” account used by Pak Accounting as an offset when the billing is completed (this will be illustrated later). You should never code anything to this Billing Offset Account!

Invoices are received related to the property: Debit Credit 1. Billing Account(s) are debited (9000-9598) 250.00 Accounts Payable is credited 250.00

A Joint Interest Billing is sent to the Partners (Owners/Investors) 2. Accounts Receivable for each Partner 250.00 JIB Billing Offset (9599) is credited 250.00

You will notice that the Billing Accounts are sub-divided into categories. This helps the partners (owners/investors) understand what “kind” of expenses are being incurred and summarizes the expenses to make it easier for them to be recorded on their books. |

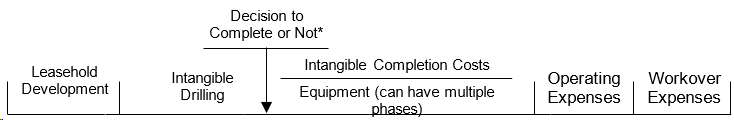

Expenses to drill, produce and keep an Oil & Gas Property operating can be broken down into “phases”, or “groups”, represented by this example timeline:

*Decision to Complete is a point in time that occurs after the well is drilled and before any substantial equipment has been placed on the well. It is the logical time for the investors to decide if they think the well will be “viable” (i.e. Produce enough oil & gas to pay for itself) to be worth spending more money on completing the well. AFEs are typically divided into these two stages, sometimes with their own separate cash calls. By sorting and totaling the billings into these same categories, the reporting enables the investor to reconcile between the budget (AFE) and the actual expenses.

Common “Phases” or Categories of billing might include: Leasehold Development: Expenses incurred in acquiring the lease and getting it ready to be produced. This would include expenses such as bonus payments to the landowner, legal fees involved in leasing the land, etc. These costs are recorded as an Asset on the partner’s books. Intangible Drilling Costs (IDC): Expenses incurred in the initial drilling of the well. This would include things such as rig expenses, mud, chemicals, labor, drill bits, perforating, wireline, flow testing, etc. Most individual partner’s books are setup on a Tax Basis, so Intangible Costs are usually recorded as an expense. On public and/or larger companies that have other financial reporting responsibilities, Intangible Drilling can be found in the Asset section and the amounts written off (depleted) over the life of the production. Intangible Completion Costs (ICC): Expenses incurred in completing the well and getting it ready for production. This would include things such as Completion Units, Workover Units, Contract Labor, etc. The same types of costs can occur as with the Intangible Drilling Costs Phase, the only difference is the timing of when they occur. Some investors will combine IDC and ICC together when recording the amount on their books. Operating (LOE <Lease Operating Expense>): These are expenses incurred in the “normal” operations of the well, including expenses such as pumper, chemicals, administrative overhead, etc. These costs are always expensed on the partner’s books. Equipment: These are amounts incurred in the purchasing of recoverable equipment that is installed during the drilling, completing or operations stage of a well. This would include things such as casing, tubing, pumping equipment, separators, compressors, etc. Most of the equipment costs are incurred during the completion phase, some equipment can be installed in other phases as well. These costs are recorded as an asset on the partner’s books. Workover: These costs are usually major investments that are incurred that are not part of the normal day-to-day operation of the well. The costs are incurred when something major fails, or when attempts are made to revitalize the well with some procedure (frac, acid, different equipment, etc) such that it will extend the economic life of the well. Some operating agreements require workovers over a specified amount be approved by the partners. Some Operators will issue a cash call for the estimated cost of the workover. Sometimes wells are abandoned or put on hold when the price of oil cannot justify the workover expenses. As the price of oil goes up, the well may become feasible again and will require work to get it back to a performing level. |

Revenue Cycle

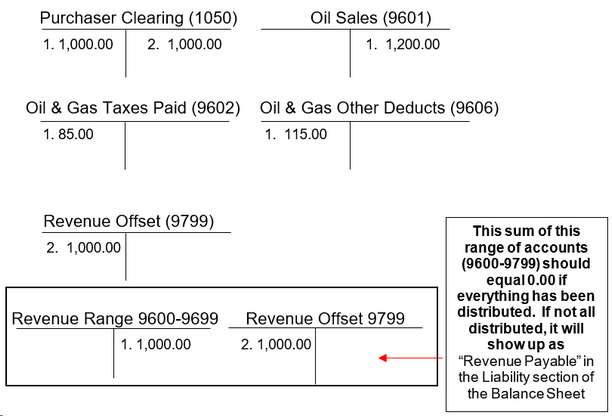

A Revenue Cycle is very similar to the Billing Cycle, except that it deals with income instead of expenses. The Revenue Cycle takes the revenue received from the Purchaser and divides it up based on the Revenue% of the Division of Interest. The system will break down the revenue into 3 basic parts: Gross Proceeds, less Taxes Deducted, and less Other Deductions.

The section of the chart that deals with recording and disbursing the Oil & Gas Revenue is the 9600-9999 Account Range. This section of the chart is similar to the JIB section in that after all revenue you have received has been distributed to the partners, the net amount for this range of accounts will equal zero.

|

When you receive a check from an Oil & Gas Purchaser, you will enter the details from the check’s stub into Check Stub Entry. After the entire stub is entered for a check, it will balance with the net amount of the check and the check is updated. As part of this update, the system will automatically make entries for you into the 9600-9699 range of accounts. If a Balance Sheet is ran at this point, you will see a new line item in the Liabilities section called Revenue Payable. This will reflect the net amount of all the checks you have received and updated that have not been distributed yet via a Revenue Cycle. The Revenue Cycle will take these undistributed revenue entries, divide up the amounts to their rightful owners, and write checks. The system will also automatically make an offset entry into the Revenue Offset Account (9799), and a cash entry for the checks written. If all checks received have been paid, then the net amount for the 9600-9799 range will be zero. If all checks received have not been disbursed to partners, the balance will show up on the Balance Sheet as “Revenue Payable”. |

Debit Credit A Check is Received from the Purchaser 1. Cash is debited (1050) 1,000.00 Oil Gross Sales is Credited (9601) 1,200.00 Oil & Gas Taxes Deducted (9602) 85.00 Oil & Gas Other Deductions (9606) 115.00 Note: these entries are automatically created by the system when the stub detail is entered into Check Stub Entry and updated.

All the money Received is Paid to the Partners 2. Revenue Offset (9799) is Debited 1,000.00 Cash is Credited (1010) 1,000.00

|

Other Concepts

Royalty Cutback is the amount deducted out of the 100% monies received from the Purchasers that is getting paid to the Royalty Owners. This usually amounts to somewhere between 12.5 to 25% of the revenue. The system automatically creates these cutbacks for us, just in case at some point in the future, we want to do some financial reporting at the Working Interest Level. The “Cutback” is the amount “carved out” of Income, or a Contra-Revenue Account for the payment of the Royalty Owners. The Royalty & Override amounts come off the top of the income and are not considered an “expense” of the lease, but rather a reduction of the income. During the Revenue Cycle when Pak Accounting is distributing the revenue, it looks at the type of interest (Working versus Override and Royalty) coded on the Division of Interest and combines all the Royalty and Override amounts when creating this cutback amount. The cycle’s update will automatically make the entries that record these reductions in revenue and will create an offsetting entry to the “Cutback Offset” Account. At ALL times, the sum of the 9801-9998 accounts should be zero.

Debit Credit Royalty Cutback Entries After Update: Royalty Cutback-Oil Sales (9801) 150.00 Royalty Cutback-Oil Tax (9802) 10.63 Royalty Cutback-Oil Ded (9806) 14.38 Royalty Cutback Offset (9998) 124.99

|

Suspense is money held by the operator and not paid out to the owner/investors for various reasons. "Suspense Payable" is a Liability Account in the Chart of Accounts. Petty suspense is money held because the amount is too small to write a check (would you want to get a check for 25 cents?) Legal suspense is money held for reasons other than petty, such as: •Waiting on a division order •No address (or incorrect address) for an owner, etc. •Owner deceased and waiting on division order What if some owners are in suspense, how is that reflected on the financials? Let’s assume 10% of our owners in example #2 above did not receive a check. This was due to us coding their Division of Interest (DOI) as being in legal suspense because we have not received their signed Division Order. This is normal standard operating procedure in the oil patch, i.e. that their proceeds be “Held” until we receive the signed Division Order. What happens to that money we didn’t pay? Debit Credit Amounts Held in Legal Suspense: Revenue Offset (9799) is Debited 1,000.00 Cash is Credited (1010) 900.00 Legal Suspense Payable (2210) 100.00 The money remains in the Cash and Legal Suspense Payable Accounts until the signed Division Order is received. The Suspense Payable is reported on the financials in the Balance Sheet section, under “Liabilities”. |

Deleted Interest occurs when you don’t receive 100% of the revenue or billing but you have to disburse the amount that you do receive. Since the DOI needs to equal 100% you will need a “place holder” for the percentage that you did not receive. The system separates out the Billing Deleted Interest from the Revenue Deleted Interest into two separate accounts. This will allow you as well as the system to isolate any imbalances. Revenue Deleted Interest In this example: only 80% was received from the Purchaser, 20% goes to Deleted Interest. Debit Credit A Check is Received from the Purchaser 1. Cash is Debited (1050) 800.00 Oil Gross Sales is Credited (9601) 1,200.00 Oil & Gas Taxes Deducted (9602) 85.00 Oil & Gas Other Deductions (9606) 115.00 Deleted Interest (9699) 200.00

A Deleted Interest Owner is set on the DOI so when the $1,200 flows through the DOI, the 20% that went to the Deleted Interest will not be paid out.

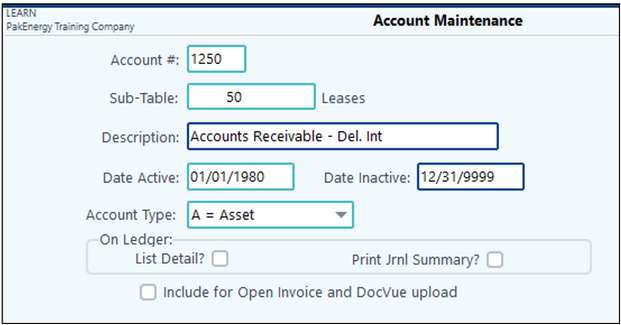

Billing Deleted Interest Billing Deleted Interest is similar to Revenue Deleted Interest except that it is recorded at the property level instead of the owner level. What do I mean by that? In the above example the DEL Interest was added to an A/R Account that had owners attached (1200). In the case of Billing Deleted Interest we are going to set up a new separate account number that will be subbed out by property instead of owner. 1.Setup the Deleted Interest Account for Billing. This account is used on the DOI for the percentage that is not billed by you. The account needs to be subbed by the Property Sub-Table (50). See the below example:

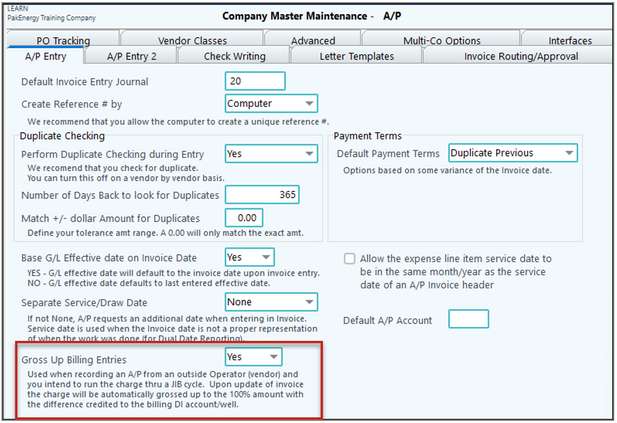

2.Make sure that the "Gross Up Billing Entries" option is set to "Yes” in the Accounts Payable module / A/P Entry tab.

3.The Billing Deleted Interest Account should already have been setup in Revenue/Billing Company Maintenance.

4.An example of a property setup with Deleted Interest Billing:

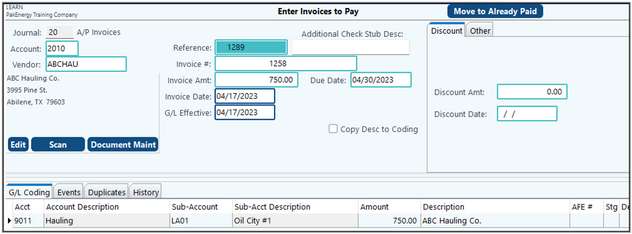

5.Enter your A/P invoice for “your” amount to pay as the Operator has billed you.

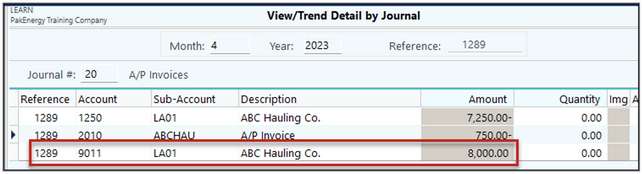

6.After you update, the system will create entries to gross up the JIB amount to 100% numbers. The Deleted Interest Account (1250) will be Credited, and after the Billing Cycle is updated, the 1250 Account should clear to zero. Journal entries that are created:

|

NOTE: Overview is based on the company WINGL defaults.

Example Entry:

Example Entry:

NOTE: The deposit entry is done to create the deposit slip and get the checks deposited into the bank. Check Stub entry, based on the length of the stub, could take much longer to key in. Also, the check stub entry in many cases can be done via an electronic CDEX file.

Example Entry:

NOTE: Multiple billing accounts can be used. Billing account range is 9000-9599 See COA setup for Rev/Bill

Example Entry:

A) Using Revenue Offset (Normal) (Check Stub division order 100% entries set to YES) Example Entry:

B) Reversing 100% Entry (Check Stub division order 100% entries set to NO)

Example Entry:

Example Entry:

C) Royalty Cutbacks for 100% financial reporting only. If there are not Royalty owners setup on the DOI deck, these entries will not be created during the revenue cycle. The set up for these accounts are in the Check Stub module under the 100% Account maintenance.

A) Transfer between Legal and Petty - Uses journal #30, Automatic Reference using RSU#

Example Entry:

B) Manual Delete Suspense Entries - Uses journal #30, Automatic Reference using RSU#

Example Entry:

C) Manual adds of suspense - Uses journal #30, Automatic Reference using RSU#

Example Entry:

7. INVESTOR ENTRIES: A) Billing entries - Uses journal #52, Automatic Reference using RIB#

Example Entry:

B) Revenue entries - Uses journal #31, Automatic Reference using RIR#

Example Entry:

Example Entry:

|

Also see:

Revenue/Billing Setup Checklist

Rev/Bill Master File Maintenance