Costs can be added in Check Stub. There are several different types depending on if the entries are going into Revenue/Billing or if these are your share (General Ledger).

1.Manually adding REVENUE costs to the Revenue Cycle. Examples are:

a.Adding compression costs and pipeline fees to the revenue to be disbursed.

b.Adding severance taxes to the revenue to be disbursed.

Note: An easier and more automatic way of adding Severance Tax is letting the system compute it during the Revenue/Billing cycle.

c.Adding an administrative fee to the revenue to be disbursed.

Note: An easier and more automatic way of adding your costs to a revenue distribution is via the "Rev Deducts" tab on the property master. Rev Deducts can be based on Gross dollars, volume or be a fixed dollar amount. If you are needing to be able to override the computed amount, use this added cost option in Check Stub.

2. Manually adding BILLING costs to the Billing Cycle

This is typically used to assist in the entering of outside operated property costs that need to be billed to your partners. Utilizing Check Stub deposit entry is the choice because these costs are normally associated with revenue received. These costs can be either billed separately or netted against the revenue you received. When the costs are netted, you may have a positive revenue check to enter or a net bill to pay.

SETUP

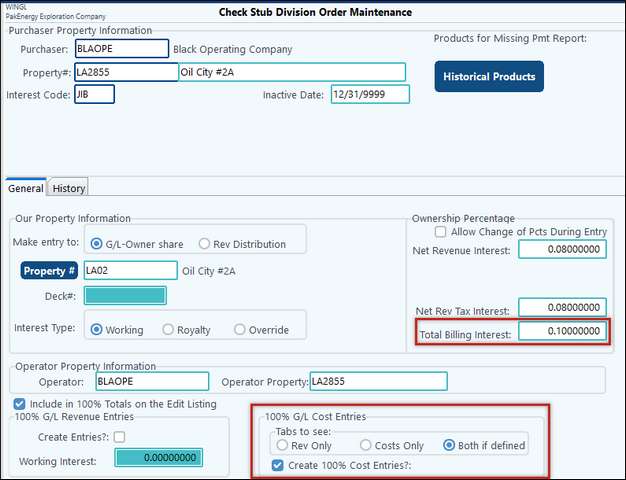

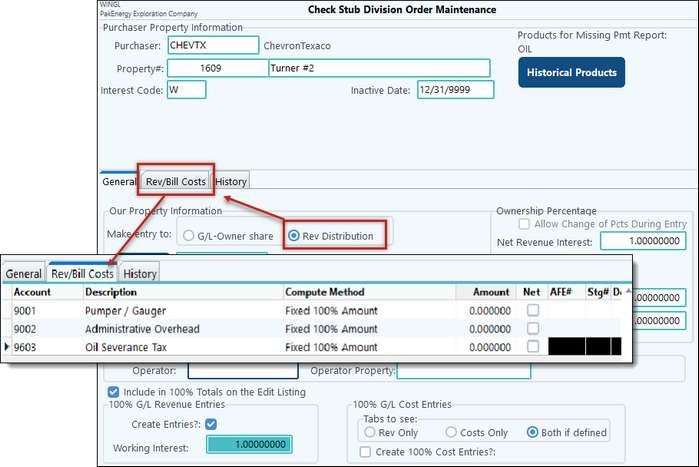

1.On the Division Order:

a.Check the appropriate option under the 100% G/L Costs Entries section in the bottom left-hand corner of the screen. Typically, the “Both if Defined” will be selected, but if you would rather only have the Costs tab, then select that option.

b.Enter the Total Billing Interest percentage. This will default to 100%, but you may need to change it.

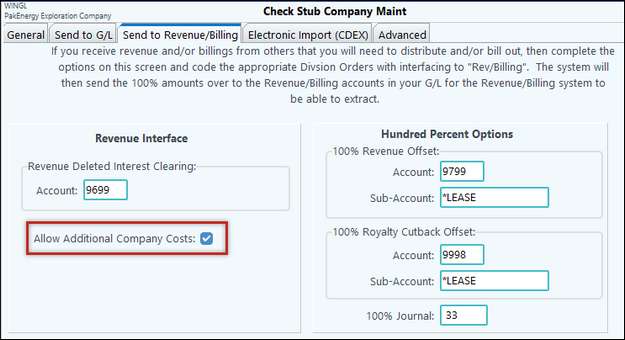

2.In Company Maintenance > Send to Revenue/Billing tab, check the box to “Allow Additional Company Costs”.

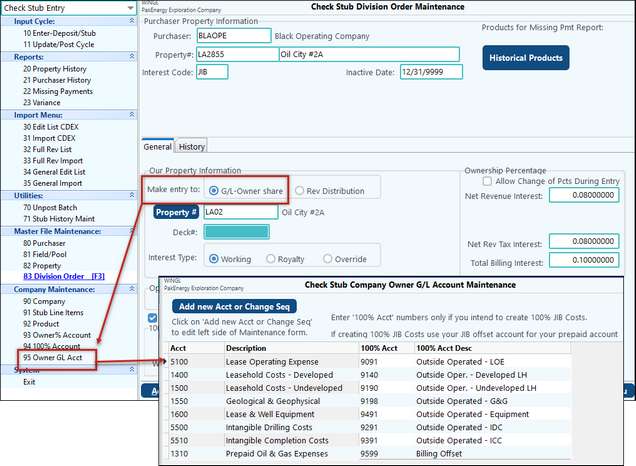

3.Set the Account numbers the Costs should be coded to.

a.If G/L Owner share, go to Company Maintenance > Owner G/L Acct.

•Only the Acct column is required.

•How detailed you want your entries will be up to you. Add as many lines as needed for the level of detail you want in the G/L later.

•OPTIONAL:

1.The 100% Acct column is optional and only if you want the ability to run 100% reports in G/L Financial Reports.

2.If you want to record 100% Accounts, then you will also need to go to Company Maintenance > Company > Send to G/L tab – enter in a 100% Costs Journal.

b.If Rev/Dist., a new tab will show on the Division Order.

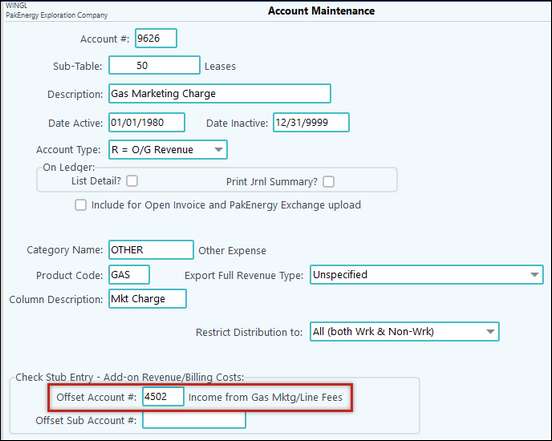

•If adding charges that are not being netted, you may need to set up offset accounts on your 9xxx accounts. See the next section for more information.

c.EITHER OPTION

•On either option, enter in at least one account that will populate on the Costs tab during Enter > Deposit/Stub.

•More detail and lines can be added on the fly later, but it’s best to enter in any defaults here.

USE – what are you adding, and how should it affect the check received?

Summary of Added Revenue (A), Billing (B), General Ledger (G) Costs Characteristics

# |

Description |

A1 – Added Revenue Costs. No Netting |

B1 – Added Billing Costs. No Netting |

B2 – Added Billing Costs. Netting w/ Check |

G1 – Added Billing Costs. Netting w/ Check |

|

Requires Offset Account/Sub (F11) |

Yes |

Yes |

No |

No |

|

WI% required on DOI |

No |

Yes |

Yes |

N/A |

|

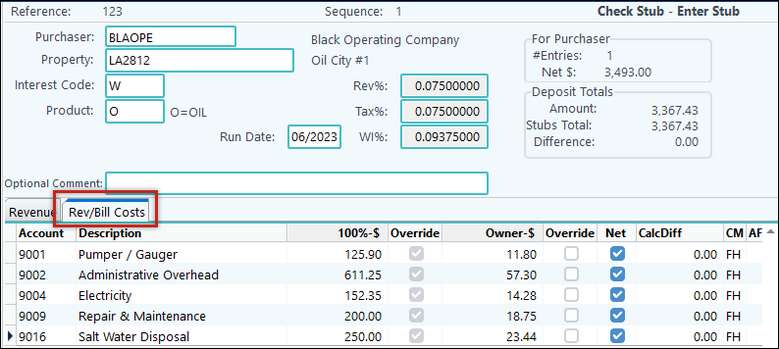

Cost Tab – check the Net? box |

Yes |

No |

Yes |

Yes |

|

DO set up as |

Rev Dist. |

Rev Dist. |

Rev Dist. |

G/L Owner |

|

Account Range |

9600 - 9699 |

9000-9599 |

9000-9599 |

5000-8999 or 1000’s if prepaid |

Revenue Costs will hit the 9600 range of accounts and will get charged to ALL Owners.

Billing Costs hit the 9000 - 9599 range of accounts and will only charge WI Owners.

Netting will reduce the amount received from the Purchaser.

Not Netting will add charges separately from the Purchaser entries.

Requires Offset Account: This is done in Account Maintenance on the 9xxx account. At the bottom of the screen there is a place for an additional P&L account.

Entry

During Stub entry, the gross revenue will go on the Revenue tab and the gross costs will go on the Costs tab. Fill in either the 100% or Owner % columns based on the information you receive – much like a normal Check Stub entry. The corresponding column will populate based on the WI% shown on the screen (which is set on the DO).

What if my Costs are more than my Revenue?

This will depend on if the Purchaser (or Operator if you are an Investor) requires a payment or will recoup on the next cycle.

If they require a payment, then on the Deposit Screen, instead of offsetting to Cash or a Clearing Account, you can offset directly to A/P. You would just need to make sure that your Purchaser/Operator is set as a vendor.

If they will recoup on the next cycle, then offset the Deposit to the Purchaser Clearing Account and let it ride till the next month.

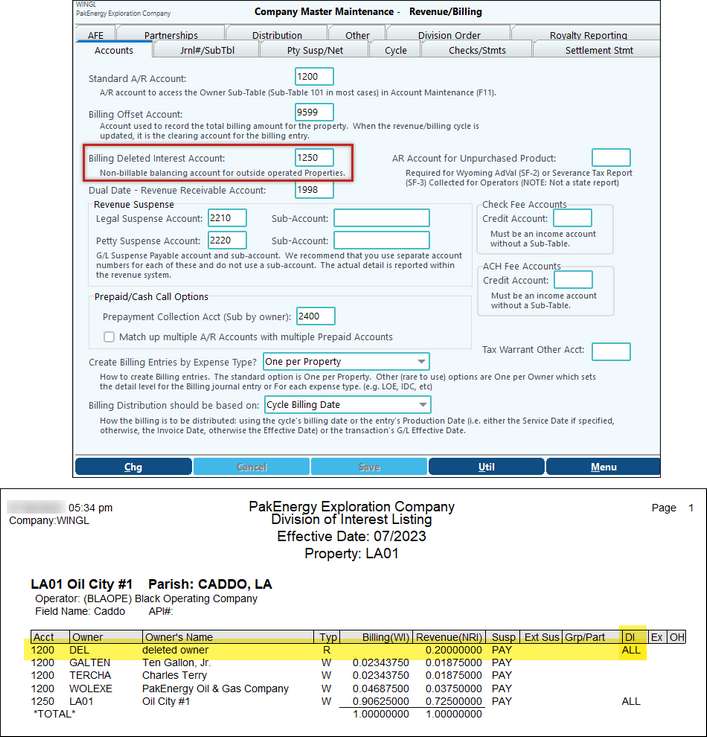

Notes on B: Outside Operated BILLING Costs - Company settings & Revenue DOI

When entering Outside Operated BILLING Costs, “Deleted Interest Account” is a required field. Notice that this Account (F11) uses table 50 (Properties) for is Sub-Table. The DI account is also used during Revenue Division of Interest set up for any WI Owners that you do NOT bill.

Note: You will go to the Revenue/Billing module > Company Maintenance > Company to access this screen.