You will not see this menu item unless it has been setup.

Overview

Used by First Purchasers to accommodate the option to net the operators JIB expenses on their behalf. The Outside Operator option allows expenses to be netted across all of the operator’s leases or on a one-by-one basis. The system will distribute lease expenses to owners, maintain owner balances, and selectively deduct expenses. The proceeds collected will be forwarded to the operators of those properties less a handling fee.

Setup

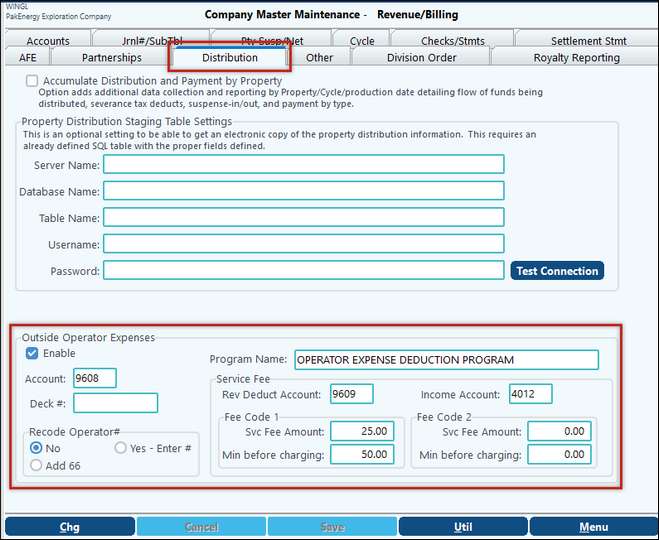

Company

On the Revenue/Billing > Company Maintenance > Company > Distribution Tab - Define the Program Name and Service Fee options allowing Pak Accounting to deduct a Service Fee for the netting, then book it to the defined Revenue Deduct (Revenue account for the Service Fee) Income account. Ensure that the service fee(s) are defined with a “Minimum before Charging” if desired, Enable the Outside Operator Expense option by checking the “Enable” box.

Account (Revenue account) /Deck – this account will be the account that the system will use when deducting from the owners and paying the operators.

Recode Operator # by selecting the Add 66 to the prefix of the operator code otherwise it will just use the operator code as it.

NOTE: Once the Company Maintenance is complete for the Outside Operator Expenses options, exit Pak Accounting or change modules from/then back to Revenue. Upon logging back in, new menu items will appear under the Outside Operator Expenses section: Property, Owner, and Deduction Report.

Enable |

Check box to turn on more options in the Purchaser Sub-Account Maintenance |

Account |

This account is a Revenue account that is set up to deduct the JIB charge from the Owner and also the account the payment is made to the operator. |

Deck# |

Normally no deck is used. |

Recode Operator # |

No: If the operator is also a receiver of normal revenue distribution the operator expense deducted would be paid on the same check if the No is selected. Will need to add the Operator to the Owner Sub-Table.

Yes – Enter #: The Owner number will need to be added to the Operator Sub-Table - Operator tab for the owner number to reimburse (see below). Normally the same owner but with a different number.

Add 66: The Owner number is added to the Operator Sub-Table - Operator tab (see below). Then the owner number will have a 66 in front of it when it generates the check or ACH. |

Program Name |

This is the name the first purchaser wants to give its program, the example could be JIB deduction program or Operator Expense program |

Service Fee |

Rev Deduct Acct: What revenue account do you want to record the amount if you charge the operator for performing this function. Income Acct: If the first purchaser charges an operator for this program where do they want to record the income |

Fee Code 1 / Fee Code 2 |

Svc Fee Amount: This allows the purchaser to have two different charging levels Min before charging: The minimum amount of fee needed before charging the operator. |

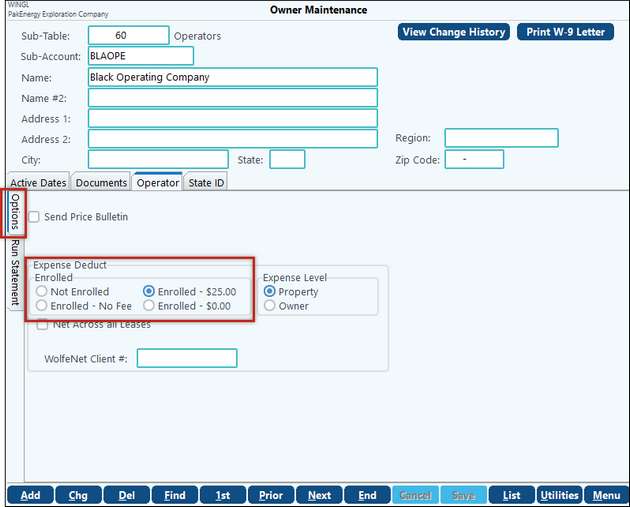

Operator Sub-Account

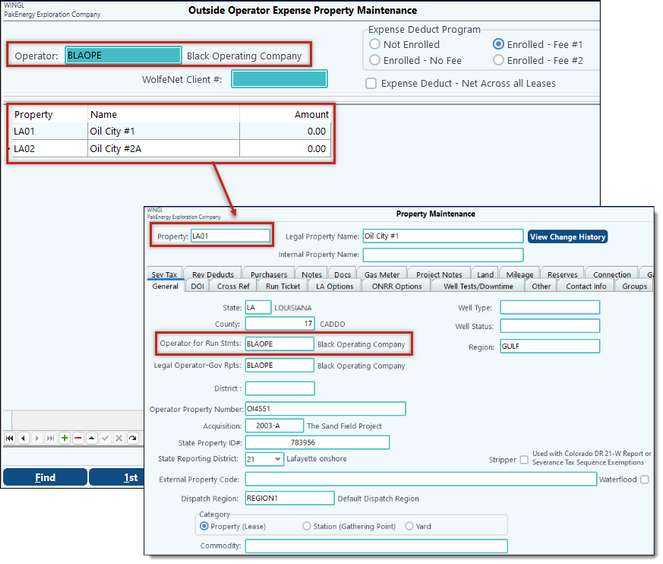

In Sub-Account Maintenance > Operator Sub-Table > Operator Tab for the operators that will participate in the program, select the appropriate option for the Expense Deduct Program box: Not Enrolled, Enrolled-No Fee or Enrolled-$25.00. Then select the “Expense Deduct-Net Across all Leases, “if applicable.

NOTE: Make sure this is the same Operator Sub-Table that is set in First Purchaser > Company Options > Miscellaneous tab.

Enrolled |

Not Enrolled: This box is checked when the operator is not participating in the Operator Expense Deduction Program Enrolled – No Fee: The operator is in the program but not charged a fee. Enrolled – 0.00: The operator is enrolled and charged the fee per lease set up in the first service fee. Enrolled – 0.00: The operator is enrolled and charged the fee per lease set up in the second service fee. |

Expense Level |

Property / Owner – see below for more information |

Net Across all Leases |

The expenses provided by the operator can net against all leases operated by the operator. |

Owner # to Reimburse Owner Deducts to |

Owner number that is the recipient of the Expenses deducted from the working interest owners. |

Outside Operator Expense menus

In the Outside Operator Expenses menu items, go to the “Property” menu item and add the properties that will be participating in the program by using the (+) on the browse bar in the lower left. The only properties that will be available for selection are properties that have the selected operator defined on the Property Maintenance in the Master File Maintenance of the Revenue/Billing module. Notice that the “Expense Deduct Program” information and the Expense Deduct-Net Across all Leases” is visible on this screen for informational purposes only. These options may not be changed from this screen. The “List” button at the bottom of the screen will provide a Property Listing by operator for the leases and the amounts. This report can be viewed, printed, or saved as a file.

a.If the operator is going to give you property level or 8/8 numbers for the operating expenses, you need to setup the properties. There is an option on an operator by operator to Net the Outside Expense for the owner across all leases or just the lease that generated the expense. Even though you are provided the 100% lease operating amount, not all of the Working Interest Owners need to participate, they can be made Exempt by Exempting the Working Interest Owner from the Outside Operator Expense Deduction Previously Defined.

|

In the Outside Operator Expenses menu items, go to the “Owner” menu item. Owners for the participating properties will populate from the DOI and only if they are marked as Working Interest Type (W). This screen will show any Balance Forwards and Payment Adjustments per owner. Manual entries can be made to the Bal Fwd and Pmt Adj columns if necessary. |

Expensing Owners

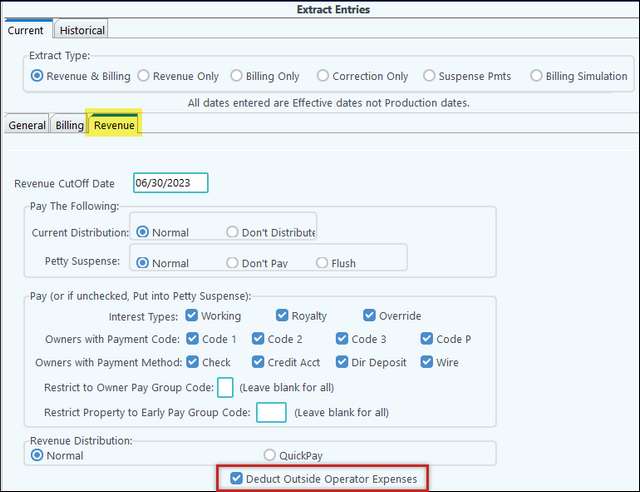

1. Revenue/Billing > Extract Entries > Revenue tab

To deduct the operator expenses the cycle time “Deduct Outside Operator Expenses” must be checked during your Revenue Cycle.

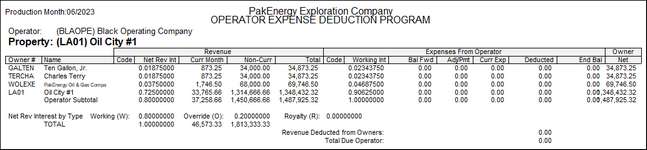

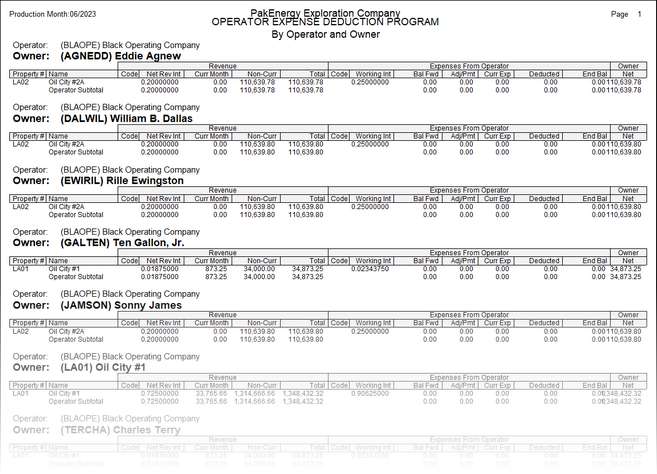

2. There is a new After Check Report > S-6 Outside Operator Expense Deduction Report.

•Once the deduction has been made from the working interest owners, the reimbursement is made to the Owner # in the “Owner Number to Reimburse deducts to. Usually this defined as an owner that does not receive other lease revenue.

•It can be emailed to the operator during the Email process of sending emails at the cycle completion.

•A copy of the PDF is also maintained for that cycle in the Comp\PRT\RevBil\CycleXXXX folder.

The Deduction Report will provide information regarding the Revenue and Operator Expenses per property per owner to arrive at the owner net. Balance forwards and adjustments will be taken into consideration. Code: Part = owners that are participating in the deduction program and N/P – owners that are exempt on the DOI thus not participating in t he deduction program. This report is ran during the After Check Reports in your cycle but you can run it at any time to see the owners expenses. Example: By Operator/Property

Example: By Operator/Owner

|

When extracting a Revenue/Billing cycle, make sure that the “Deduct Outside Operator Expenses” is checked. This option is found on the Revenue tab at the bottom. Continue with the cycle as normal. The After Check Reports will contain an additional report for your review/records: S-6 Outside Operator Expense Deduction Report. |