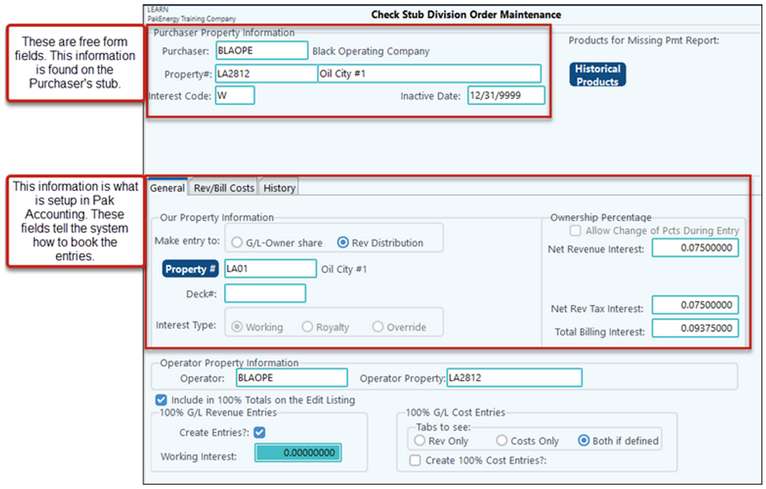

The Division Order (DO) is where you start to combine all the information you have been setting up and set up a cross-reference between the Purchaser and Pak Accounting.

NOTES:

•Product Information will be setup on the Purchaser.

•Historical Products button should be used only to optimize the Missing Payments report.

Setup

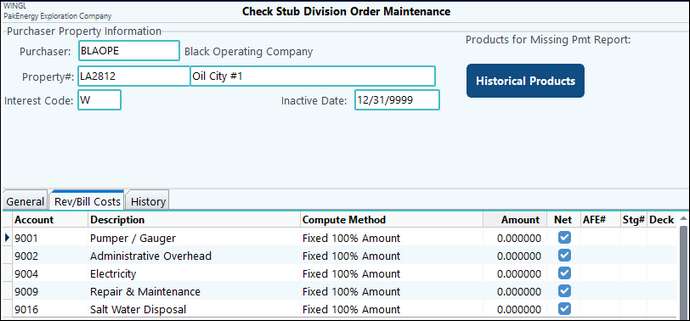

The top part of the screen is the Purchaser Property Information; this should be entered EXACTLY as it appears on the stub. A new DO will need to be setup for each Purchaser, Property, and Interest Code combination. For example, if for a single Purchaser, you have 3 properties, and in each property, you have 2 interest types (working and royalty), then you would need to set up 6 Division Orders.

Purchaser Property Information - this information is typically found on the stub. |

||

|---|---|---|

Purchaser |

Code number, or short name, as entered in the Purchaser setup that identifies the purchaser. |

|

Property # |

This information is how the purchaser names or identifies the lease. Each ownership type (working, royalty, and override) should be entered separately. For example, if the purchaser's lease number is P1234 and the company owns both a working interest and an override interest in the property, you will want to enter that lease number (P1234) on separate screens using a different interest code type (“W” or” R”) each time. |

|

Interest Code |

Identifies your interest in the lease as working, royalty, or override as defined on the stub. Enter the appropriate code to match the stub line ownership type. If the company receives two or more different types of interests in the same property, set up each one separately. |

|

Historical Products |

Used for Missing Payment Report only. All products are defined on the Purchaser Setup. This section is automatically defined by the Historical Stubs. Use the selection arrows to move over products you no longer want to identify on the Missing Payment report. NOTE: The products used for Missing Checks will display above the Historical Products button. |

|

General Tab - Our Property Information |

||

Make Entry to G/L or Rev Distribution |

Identifies the type of entry that is to be created during the update: “G/L – Owner Share” •Check Stub ‘only’ users always select this option. •Entries use ledger accounts based on the Owner % Account settings; •Entries are not candidates for revenue disbursement •This is the standard option for investors who do not redistribute to anyone and have their share go directly to their P&L. Note: You may choose to create 100% entries to track the 8/8ths income and expenses. This situation is rare. If you chose this feature you will need to complete the Working Interest field in the 100% G/L Entries section on this screen AND complete the 100% Account Maintenance screen.

"Rev Distribution" •Used if you need to redistribute to ANY other owners – even if your company has a share. This will be handled in the Rev/Bill module •Entries use ledger accounts based on 100% Account settings. •Entries are used by the Revenue system. •Your share of the revenue is not recorded until the Revenue System Disbursement. See the Investor Entry screen in Revenue/Billing for more details. Create 100% G/L Entries is normally set to ‘Yes’. See “Create Entries” option under DOI setup for more details. |

|

Property # |

Our property (lease) code that matches the revenue property master. Used in G/L as the Sub-Account when creating GL entries. If this is a new Lease (property) number, you will be prompted for a chance to automatically create the Property Master. The Sub-Account is automatically created. |

|

Deck # |

Used for Rev selections only. Normally blank unless multiple DOI’s exists for the property in the Revenue/Billing system. |

|

Interest Type |

The property interest type: Working, Royalty, or Override. Use Working if you receive 100% of the interest. Only used if “Make entry to = GL.” |

|

General Tab - Ownership Percentage |

||

Allow Change of Percentages During Entry? |

Checked indicates you will be able to override the default percentages set up in the following fields during check stub deposit entry. Unchecked means you cannot change those at the entry level. Unchecked is the normal option. Note: Option is disabled if entries are going to revenue. |

|

Net Revenue Interest |

The decimal rate the purchaser or operator pays you for revenues. |

|

Net Rev Tax Interest |

The decimal rate the purchaser or operator charges you for tax deductions. This may differ from Net Revenue Interest if there are any non-taxable owners in a particular property. Also see #Allocation if using an allocation within Check Stub. |

|

Total Billing Interest |

(This field is optional) The decimal rate the purchaser uses to deduct lease expenses. You only need enter a number if JIB expenses are deducted from your revenue check. |

|

General Tab - Operator Information |

||

Operator |

(This field is optional, a Sub-Account, up to 6 characters, alphanumeric) The number or code used in the Sub-table that is defined in the Check Stub Company Maintenance screen. After the Operator code is entered, the system will display the operator's name. This field is used by the system when generating the Missing Payments Report by operator instead of by purchaser. |

|

Operator Property |

(This field is optional. Up to 12 characters, alphanumeric) The code or number used by the operator to identify the property. |

|

General Tab - 100% G/L Entries |

||

100% G/L Revenue Entries |

||

Create Entries? |

If "Making Entry to:" is set to Rev Distribution |

Then always set this to YES (checked) unless this is the second Division Order for the same Purchaser and Lease. For example the first DO is for a Working interest stub line, then set to YES. If the second DO is for an Overrride interest stub line, then set to No, Will allow you to run 100% Financials. See option (2) in table below. |

If "Making Entry to:" is set to G/L Owner Share |

Then this is normally set to NO (Unchecked). Will have no 100% reporting capability |

|

Working Interest |

This field will only be available if "Make Entry to:" is set to G/L Owner Share and the "Create Entries?:" is checked. This is the NRI (net revenue interest) total for the working interest partners for the entire well (not just your share). For example: if the WI owners have 80% of the NRI then use .8000000. You can calculate this if you know the NRI and WI percentages for an owner. (NRI/WI = .025/.03125 = .8000000). |

|

100% G/L Costs Entries: This section is used when adding billing/costs through Check Stub. |

||

Tabs to see: Rev Only |

Will only display the Revenue tab for this division order. |

|

Costs Only |

Will only display the Costs tab. This can be used for G/L and Rev/Bill added costs. |

|

Both if defined |

Standard behavior during deposit entry: Revenue Tab will always display. G/L Cost Tab will display if DO set to GL. Rev/Bill Cost Tab will display if DO set to R and added costs are defined in the DO on the Rev/Bill Cost tab. |

|

Create 100% Cost entries? |

Turn on to create entries for this DO. |

|

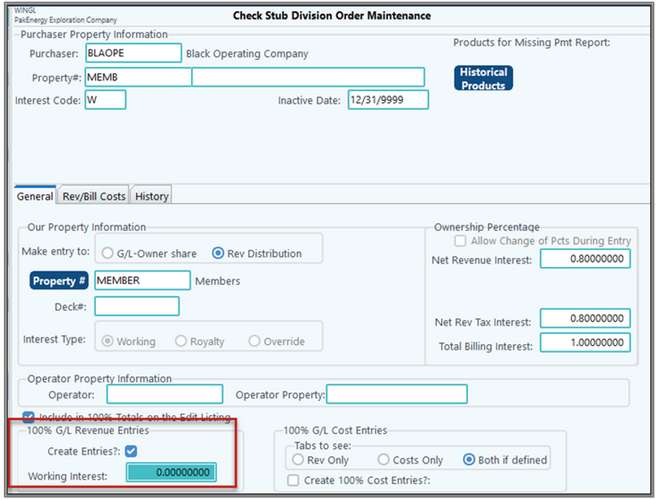

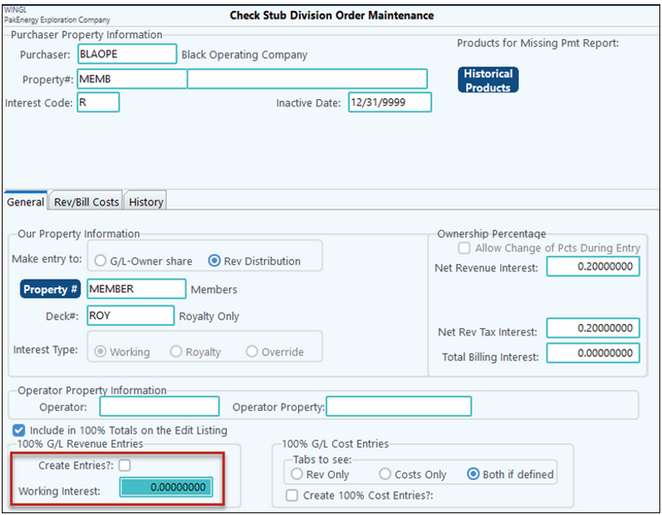

Scenario: •You receive multiple interests for the same property •The Purchaser splits the detail out on the check stub (i.e., there is a line for Working Interest at .80 and a line for Royalty interest at .20) •You redistribute through the Rev/Bill module Solution: •Create 2 Division Orders (one for each interest amount) •But only check the box to create 100% entries on one type of interest, not both, so that the 100% numbers are not doubled. oIt is recommended to create 100% numbers for the Working Interest but not the Royalty Interest.

Working create 100%:

Royalty Interest:

|

100% G/L Revenue Entries (Example) |

||

Create Entries? |

Checked |

Unchecked |

9601- Oil Sales (credit) Purchaser/ Run Date |

- |

9601 (debit) Revenue Check Written |

9602- Oil Production Tax (debit) Purchaser/Run Date |

- |

9602 (credit) Purchaser/ Run Date |

1050 Purchaser Clearing (debit) Purchaser |

- |

9999 (credit) Royalty Cutback |

100% G/L Cost Entries (Example) |

||

Create Entries? |

Checked |

Unchecked |

1050- Purchaser Clearing(debit) |

9601- Oil Sales (credit) Purchaser/ Run Date |

- |

4000- Oil Sales Working Interest(credit) |

9602- Oil Production Tax (debit) Purchaser/ Run Date |

- |

5000- Production Tax Oil Sales (W) (debit) |

9999- Royalty Cutback (debit) |

- |

COSTS TAB

Costs Tab - See Added company cost for purpose of Cost ta |

|

|---|---|

Account |

Account(s) to automatically prefill on cost tab during deposit entry |

Compute Method |

Fixed (100% or Owner) – enter a fixed amount or leave blank for dollar amounts that vary monthly; BBL/MCF x Amount (100% or Owner) – calculate quantity x InitAmt field; Gross x Amount (100% or Owner) – calculate dollars x InitAmt field |

Amount |

Fixed dollar amount or percent depending on compute method option chosen. |

Net |

Rarely used |

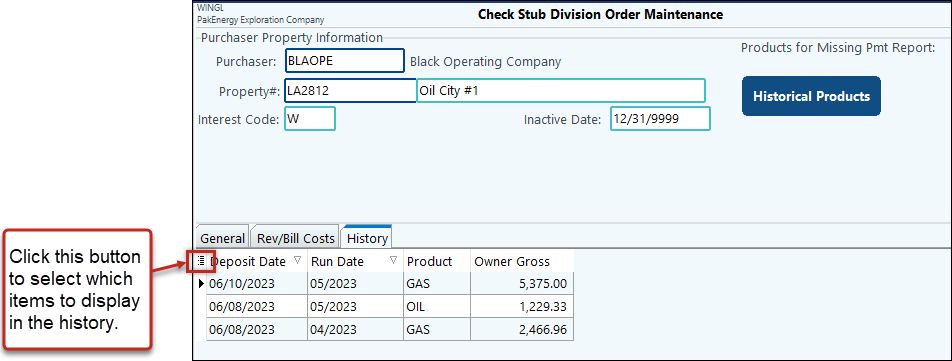

HISTORY TAB

Utility Button

This gives you the options to Mass change, copy from another Division Order, Mass delete Division Orders, Remove Unused Product codes and Import Division orders from another Pak Accounting Company.

•Change Division Order Interest Type - This additional utility allows for the interest type to be changed on a Division order, its respective check stub history, and GL transactions This utility only changes the interest type for one Division Order at a time. The user making the change will be required to have the security rights to be able to unpost check stubs and change a Division Order. Additionally the user may also need the rights to change the posting allowed date range or GL entries will only be changed for the posting allowed date range that the user is authorized for. This utility will change Division Orders coded to GL only. At this time changing Revenue Division Orders is not supported.

•Import From Excel - Import Division Order's from Excel by creating a template. Required fields for this import are the:

oPurchaser

oLease

oInterest Code

oGLOrRev (Make Entry to G/L or Revenue Distribution)

oGLSub (Our Property Number)

oOurInterestCode (Interest Type)

oRPct (Net Revenue Interest)

Select desired optional fields and click on the "Create Template" button. Two tabs are include in the template: Division Order and Instructions. The instructions tab contains the fields that are listed in the column headings on the Division Order tab along with their respective descriptions. All percents are 8 decimal places and their must be column headers in the file to facilitate matching to the fields. This import DOES NOT include information for the Cost Tab or the Purchaser. The Purchasers must be setup that pertain to the Division Orders you are importing before performing the import.

List Button

•List View- prints a listing of division orders by purchaser or Sub-Account. Printing the list as a file allows you to print in a CSV format.

•Grid View- The grid view for the Division Orders includes data from the lease master, Sub-Account master, and check stub history. See Master Grid Views for common features and tips on how to use the grid.

NOTE: The Total Gross is the Owner gross amount, not the 100% gross amount.