Adding Suspense allows for easy entry of suspense items for each owner. Typically, you only need to do this when changing from another system.

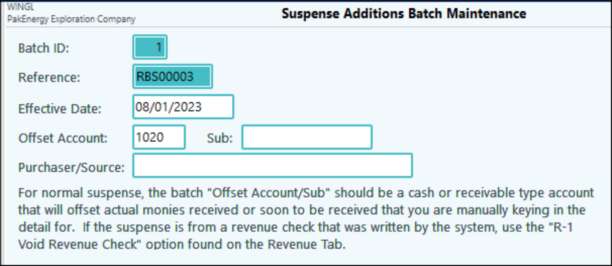

The first screen is where you enter the effective date, offset account and purchaser/source information. For normal suspense, the batch "Offset Account/Sub" should be a cash or receivable type account that will offset actual monies received or soon to be received that you are manually keying in the detail for. If the suspense is from a revenue check that was written by the system, use the "R-1: Void Revenue Check" option.

Step 1. You will simply add the Effective Date of the suspense record (it makes an entry into cash and into the Suspense Account and hence the need for an effective date). The "Offset Account" is entered to refund State/Federal taxes. Use the Liability Account in the offset for the correct detail to populate.

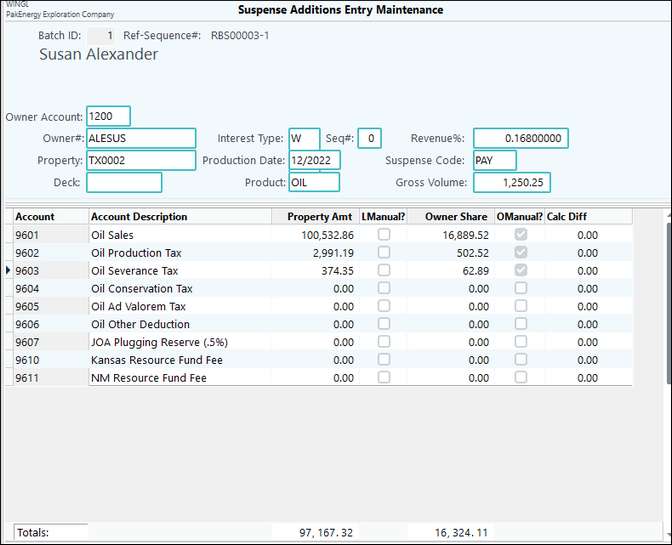

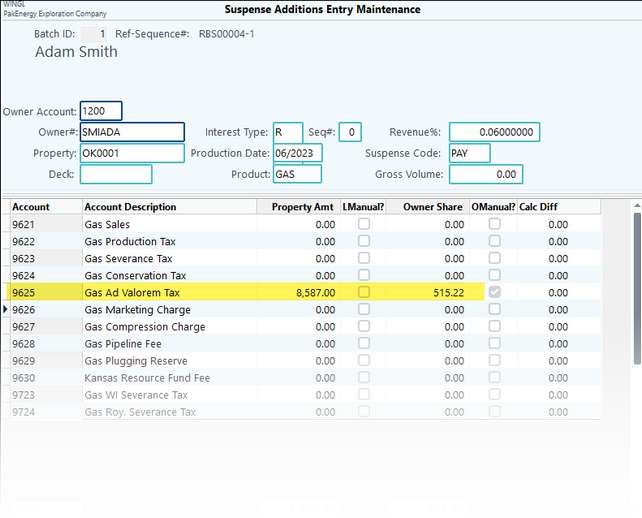

Step 2. After you enter through the Purchaser Source information it will automatically open the suspense detail screen. (You can also go to suspense detail by clicking on the SusDtl (Suspense Detail) button at the bottom). This is where you can enter the detail about the suspense being added. You will enter the owner A/R account, owner number, property, deck if applicable, Interest type, production date, product type, revenue percentage, pay code, and gross volume.

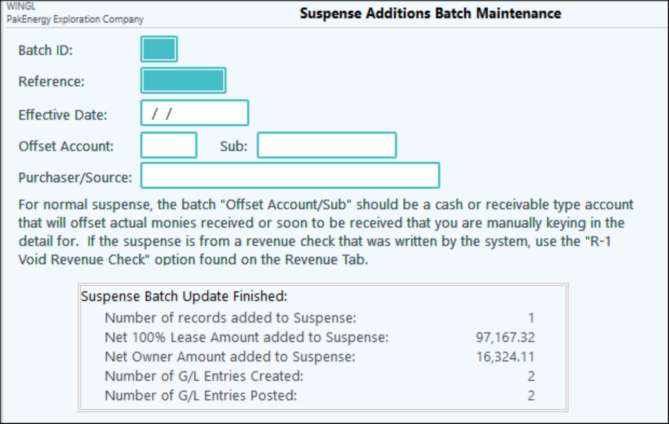

After you are finished, you will "Menu" back to the original "Suspense Additions Batch Maintenance" screen and click on the "Update" button on the lower right hand corner.

HINT: If the grid does not fill in with account numbers, make sure revenue accounts are set with a "R" Account type. Also the system will prevent withholding from being manually added to suspense.

Suspense Additions Entry Detail |

|

|---|---|

Owner |

The owner code. The owner code must be set up in Sub-Account Maintenance |

Property/Deck |

The property code. The property must be set up in property master. |

Interest Type/Seq# |

1 character code identifying the type of ownership. Valid class codes are W for Working, R for Royalty, and O for Override. The Seq# is normally zero. It is only used if you have multiple interests of the same code, for example, 2 different Working Interest percents. |

Production Date |

The month and year of production in mm/yyyy format. Note: current month (by system date) production dates will not be allowed to be entered. |

Product |

Code identifying the type of product. The bottom half of the screen will fill with accounts depending on the product code entered here. |

Revenue % |

Will auto-fill if a DOI match is found or enter the proper ownership percentage. |

Suspense Code |

Select the desired Legal or Petty suspense code. |

(Property) Gross Volume |

Enter the Property (100%) Volume. Also enter the Property Amount or the Property Amount will automatically calculate if you enter the Owner Share. |

Property Amount |

Enter the 100% dollars for each row that requires information. The 'LManual?' box will be checked if that field was entered manually. The system will automatically calculate the opposite column for you. |

Owner share |

Enter the Owner share dollars for each row that requires information. The 'OManual?' box will be checked if that field was entered manually. The system will automatically calculate the opposite column for you. |

Step 3. You must select Update on the first screen to create a journal entry, with a system assigned unique reference number, that debits Cash (or selected offset Account/Sub-Account) and credits the appropriate Petty or Legal Suspense Payable account. The matching suspense detail will also be added to the suspense file.

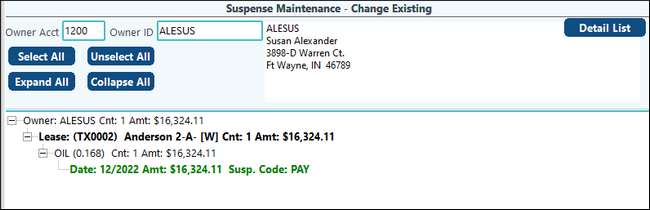

Step 4. Finally, you can go to the Owner Maintenance (F12) / Suspense Maint button to see the effect of the suspense addition. In this example, this is a negative suspense record. A positive suspense record is achieved with the same process.

Adding Ad Valorem Tax to Suspense. Example:

Another reason to use Suspense Add New, is if you have received an Ad Valorem Tax that you have paid on an owner's behalf and the owner needs to reimburse for.

1.Add the effective date of the suspense record and the offset account/Sub-Account. Click on the "Detail" button at the bottom of the screen.

2.Enter the detail about the suspense being added. You will enter the owner A/R account, owner number, property, deck if applicable, Interest type, production date, product type, revenue percentage, pay code, and gross volume. After you are finished, you will menu back to the original Suspense Additions Batch Maintenance screen and hit the Update button on the lower right hand corner.

3.Select Update on the first screen to create a journal entry, with a system assigned unique reference number, that debits Cash (or selected offset account/Sub-Account) and credits the appropriate Petty or Legal Suspense Payable account.

4.You can go to the Owner Maintenance (F12) / Suspense Maint button to see the effect of the suspense addition.