Also see: Financial Reporting Overview

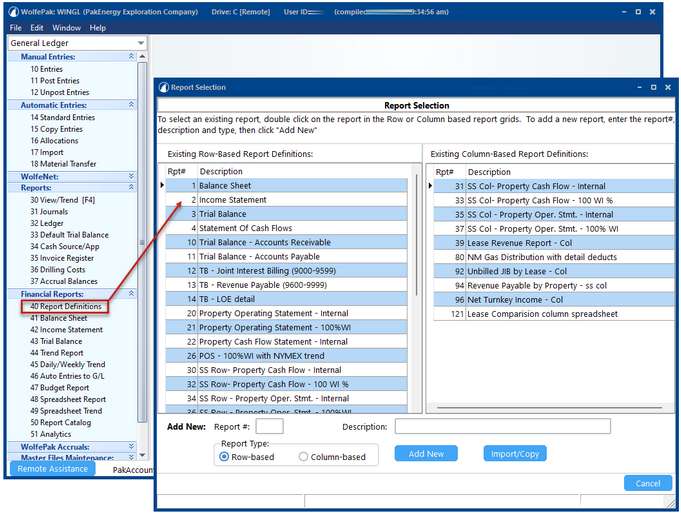

Pak Accounting financial statements are based on Report Definitions, which are formats created using the Report Definition Maintenance screen found under the Financial Reporting menu. They can be accessed two different ways.

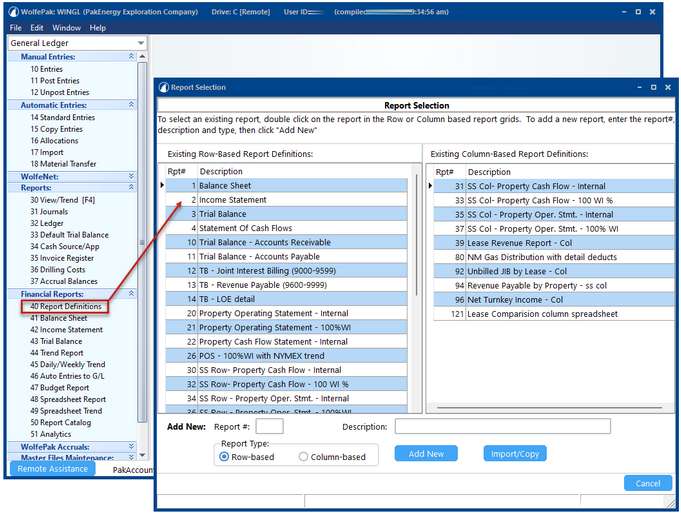

The first is through the Report Definition menu. This will open a Report Selection screen. Select the report you would like to review.

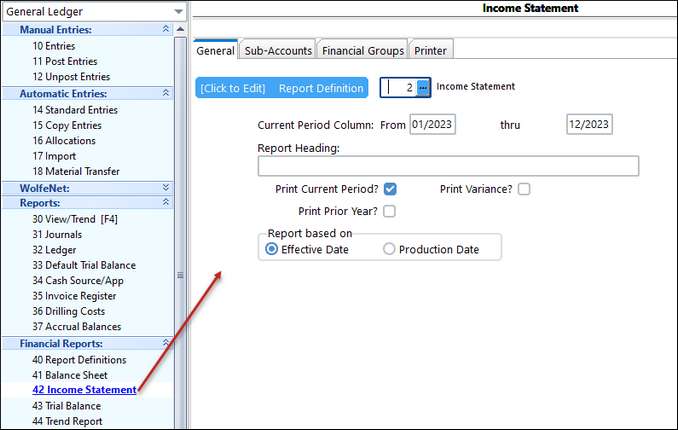

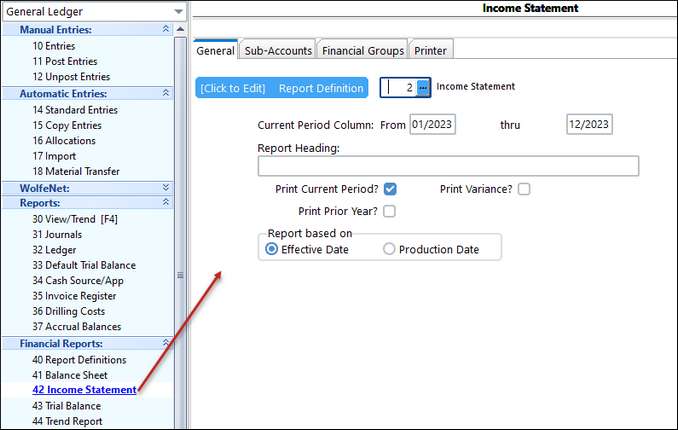

The second way is accessing them directly from the report itself – which makes going from report to definition and back again extremely easy! Go into the report menu item you will be working in, select the report you need, then, click on the [Click to Edit] Report Definition button.

Report definitions determine headings, which account(s) will be listed, and what kind of totals are to be computed and included. Understanding this powerful feature will allow you to customize standard reports, generate specialized spreadsheet listings, and create automatic entries based on report definitions.

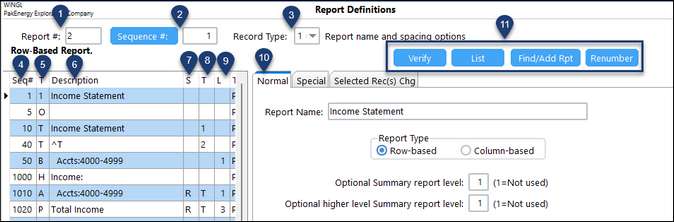

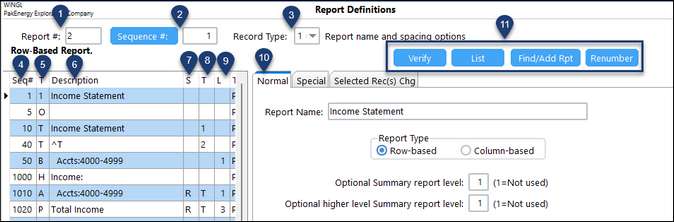

We will go into more detail on each of these throughout training. However, below is a brief description of the different items on the screen.

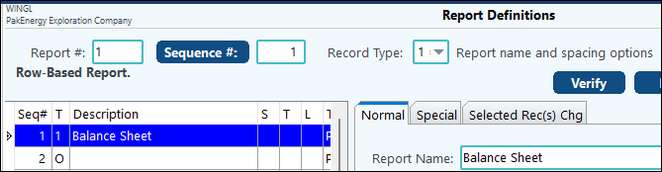

1.Each report will have a unique number. Change the number at the top of the screen to view the report definitions for each. Each company can have up to 9,999 reports.

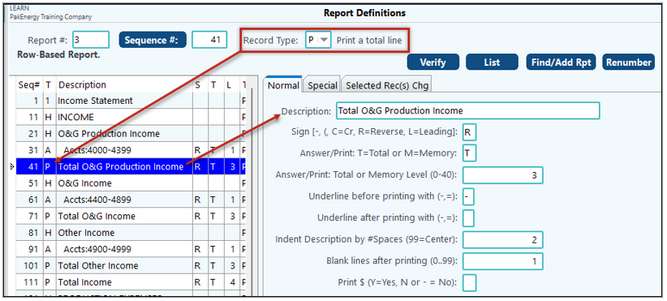

2.Indicates the Sequence Number that is selected in the table below. (Also see #4.)

3.Indicates the Record Type that is selected in the table below. (Also see #5.)

4.Sequence Number: Within each report definition, records are organized by sequence numbers. The report processes these records from the smallest sequence to the largest. The system will assign sequence numbers; however, the user can override. Spacing sequence numbers is advisable. The only sequence number that is required is #1 due to the lookup feature.

5.Record Type: There are several different record types that indicate a section of the report and how it should be handled. A brief description is listed below. We will go into more detail on each of these during training.

1

|

This record type is required on EVERY report and should only be on the report once. This gives the report a name.

|

H

|

Prints a header record before the section of accounts.

|

A / S / C

|

Determines which Accounts / Sub-Accounts will show in the report and how they will be listed.

|

P

|

Prints a total line for the preceding section of accounts.

|

B / M / J

|

Performs actions in the report.

|

O / T

|

Affects formatting.

|

6.Description: for the “H” and “P” records, this will indicate what prints on the report. For the other report types, it will indicate accounts or options selected.

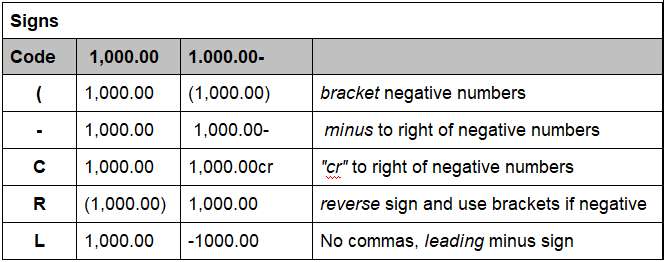

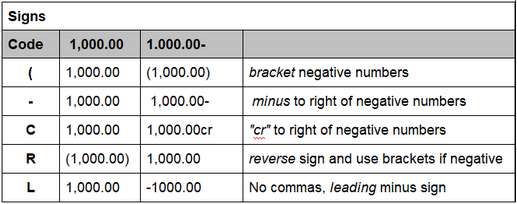

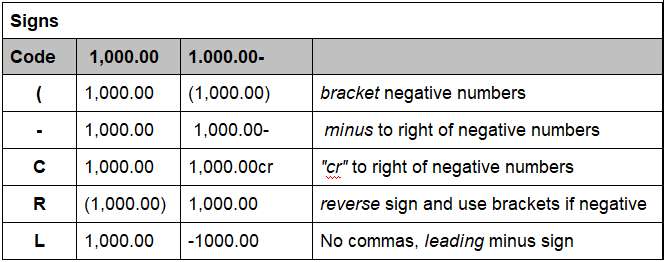

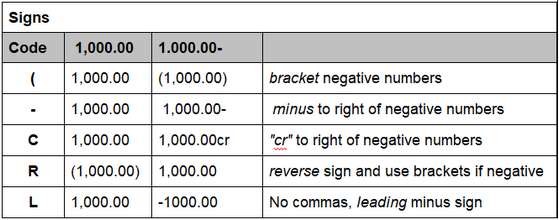

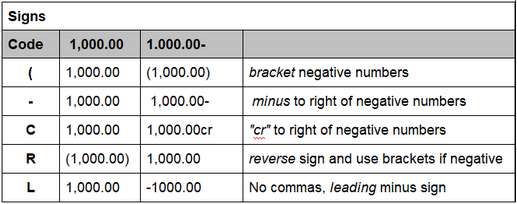

7.S (sign): this indicates how an account sign is handled.

•For accounts that hold a credit balance (such as Income), you can indicate if you would like to reverse the sign to show a positive balance on your report. The system will default to reversing these accounts.

•If an account holds a debit balance, you can indicate how to show a negative balance.

8.T (total): will indicate if an item is using a Total Level (T) or a Memory Level (M). This is typically only needed on A/S/C and P records.

9.L (level): used in conjunction with Total and Memory Levels. The numbers indicate the hierarchy.

10.These tabs will help set up and format each Sequence number. The information on each of these tabs will vary depending on the Record Type.

11.These buttons are Utilities to help manage your reports.

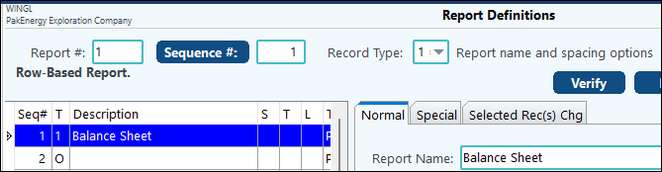

Record Type "1" - Report name and spacing options

Giving your financial reports unique names will help you find what you are looking for easily when using the drop down box for your selection. This name can be more or less descriptive than what actually prints on your report.

A "1" record type is used to define the report name and spacing options of the report printing. It is important to setup the record using sequence #1, because when doing a lookup [/?] on the report number field, the system will reference the description from the "1" record to be listed with the report definition number.

Normal Tab

|

Report name

|

User designated name for the report. Will print on report unless overridden with a "T" (title) record type.

|

Report Type

|

Row-based or Column-based. This gives the system the ability to tell if the report is designed to be row defined or column defined.

|

Special Tab

|

Margin and Widths

|

Adjustments to the left margin and width of columns

|

Override Pct Desc with

|

For the Income statement, option to print alternative column heading style. To trigger this option, put a "%" in this field. This will:

1.Print the number of month(s) above the columns instead of just saying "Curr Month" and "Year To Date".

2.It will also leave off the word "Description" above the description column.

3.Format the page number at the bottom of the page using the -x- format. |

|

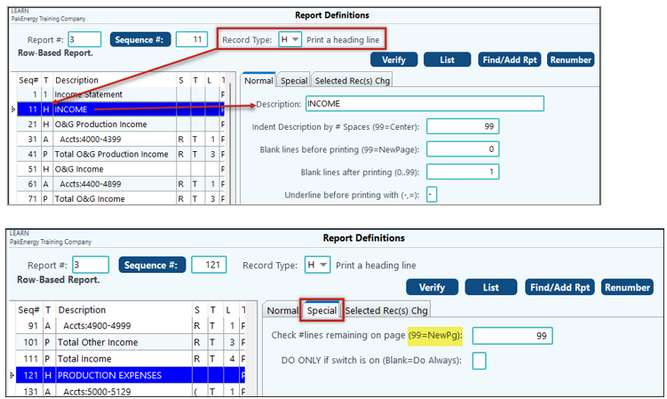

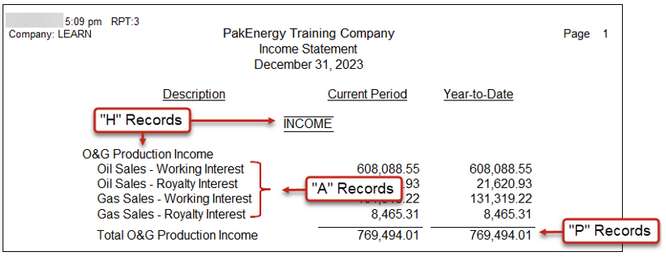

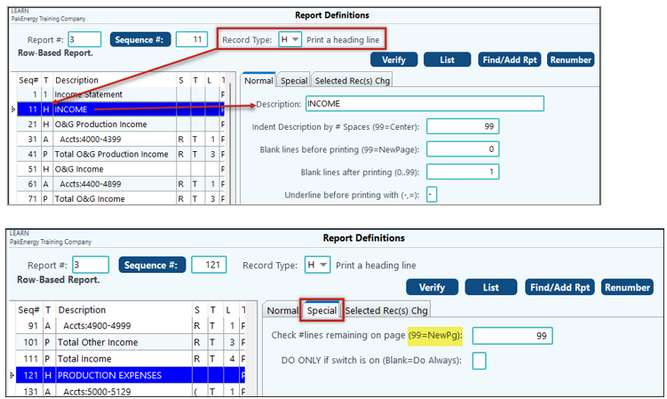

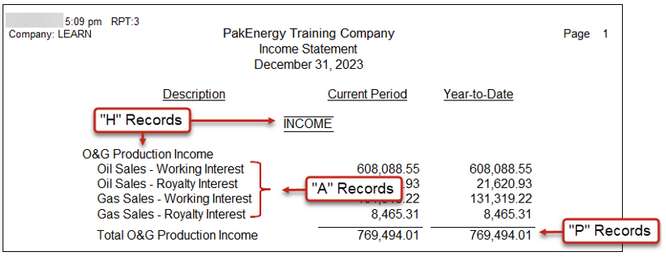

Record Type "H" - Print a heading line

The "H" record defines a Heading print line that normally precedes sections of accounts ("A" records) that will be listed next within the financial report. For example, a balance sheet will have headings such as "ASSETS, CURRENT ASSETS", etc. Below is an example of the record type "H" screen.

Description

|

On the heading (H) or total (P) record types, it contains the description printed on the report.

|

Indent description by # spaces (99=Center

|

Determines the number of characters the description should be indented (number of character positions the description should be shifted to the right on the page) If the “Print Account Number” option is “Y” in the company master, then the “H” record type indents starts 5 additional characters to the left than when the company option is set to “N”. If the company option is set to “N”, then no space is reserved and the “H” records start in the same position from the left margin as the other print lines. Working Trial balance forces this option to be “Y”. Spreadsheet report forces this option to be “N”. All other reports use whatever is in the company master.

|

Blank lines before/after printing

|

Determines the spacing between lines on the report. (0= no blank lines (i.e. single space), 1=one blank line (i.e. double space), etc). Before printing a line, the system will add the number of blank lines before, plus one or two if the underline is specified, plus one for the line itself. On record types "H", the "Check # of lines remaining on page" will be added to the total. If the total number of lines will not fit on the page, the before under character (if specified) and data line will print at the top of the next page (under all specified titles).

|

Underline before/after printing

|

1 character (Examples: blank, dash "-" or equal sign (=)) - determines if you want an extra line of the specified underline character to be printed. An underline character can be printed before a line is printed or after a line is printed. Underlining works a little differently on the heading (H) definition. On the "H" record type, the underlining will be above/below where the description is printed. On all other record types, the underlining will take place in the appropriate amount column. If printing to an HP LaserJet (or compatible), the system will use the printers underlining and double underlining capabilities to produce the underlines

|

Check # lines remaining on page (99=new)

|

(2 digits) - number of blank lines that must remain on page after the current line is printed. A 0 will have no effect. A 99 will cause the line to be printed on the top of the next page.

|

DO ONLY if switch is on (Blank=do always)

|

1 character: (blank, A-Z) - can be used to cause the report definition to only be effective if the specified switch has been turned on. The specified operation will only be performed if the indicated switch is ON. See Understanding Switches.

|

|

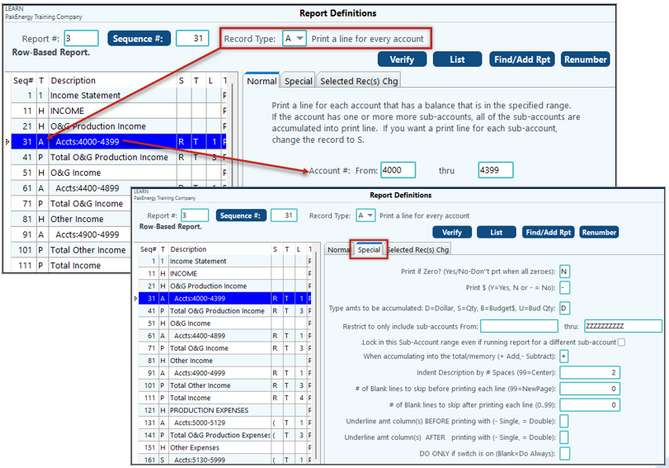

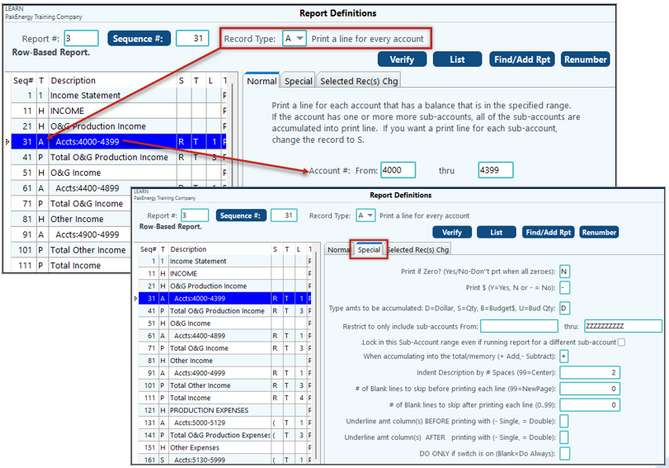

Record Type "A" - Print line for every account

The "A" record will list a separate line for each account within the range of accounts specified. This record normally follows a "H" record.

•If the accounts to be printed are not continuous, then multiple "A" records are used to define what account(s) need to be printed.

•The sequence the records are defined in will determine the sequence the accounts are printed in. If you want to combine several accounts together and only print their total, see the "C" record. If an account has multiple Sub-Accounts, then the Sub-Accounts will be automatically accumulated into an account total.

•Only accounts with some activity will print (balance forwards count as activity).

•Zero balance accounts can be suppressed using the "Print when zero?" field.

BEST PRACTICE: It is important to use account ranges that include ALL possible account numbers. The reason for not leaving “holes” in your account range is for future financial reporting. If the account ranges are limited to the accounts being used but a new account is added six months later, this account would not be brought into the report unless someone remembered to manually add it. This would cause that particular report to be misstated. Creating account ranges to include all accounts, whether defined or not, will incorporate any new accounts into the report, thus avoiding any misstatements.

Understanding Accumulation in Report Definition - See Total Levels and Memory Cells

Account range from/thru

|

Determines the account range to be accumulated or printed.

|

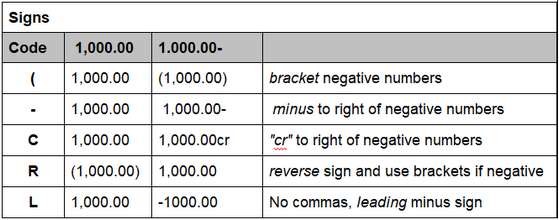

Sign

|

(1 character) - determines the type of sign to be used. Depending on whether the amount is positive or negative, the amount will print as follows:

|

Answer/Print T=Total or M=Memory & Level

|

(1 character: M for Memory, T for Total), (Level: 2 digit: 0-26)

|

Print if Zero?

|

If this option is set to "N" (no), then the report line being described will not print provided all the amounts that would normally print are equal to zero The "Y" (yes) option causes the report line to print even if all the amounts are zero. Only accounts with some activity will print (balance forwards count as activity).

|

Print $

|

Y or N for printing dollar signs.

|

D=Dollar, S=Quantity, B=Budget

|

What type of field is being printed.

|

Restrict to only include Sub-accounts from/thru

|

Up to 10 characters, can include alpha or numeric. This range will default from a blank Sub-Account thru "ZZZZZZZZZZ" (the highest possible Sub-Account). On most reports the Sub-Account range should be left to these default values.

If "*GROUP" is entered as your Sub-Account range when running a financial report:

•For the entire company: it will pull in the full range of Sub-Accounts

•For a group: it will only pull in the Sub-Accounts/accounts listed in the group maintenance

•For a single Sub-Account: it will not pull anything in for that definition |

Accumulate by +/-

|

(1 character: + for Add, - for subtract) - determines if the amounts should be added or subtracted from the indicated Total/Memory.

|

Indent description by # spaces (99=Center)

|

determines the number of characters the description should be indented (number of character positions the description should be shifted to the right on the page)

|

Blank lines before/after printing

|

Determines the spacing between lines on the report. (0= no blank lines (i.e. single space), 1=one blank line (i.e. double space), etc). Before printing a line, the system will add the number of blank lines before, plus one or two if the underline is specified, plus one for the line itself. On record types "H", the "Check # of lines remaining on page" will be added to the total. If the total number of lines will not fit on the page, the before under character (if specified) and data line will print at the top of the next page (under all specified titles).

|

Underline before/after printing

|

1 character (Examples: blank, dash "-" or equal sign (=)) - determines if you want an extra line of the specified underline character to be printed. An underline character can be printed before a line is printed or after a line is printed. Underlining works a little differently on the heading (H) definition. On the "H" record type, the underlining will be above/below where the description is printed. On all other record types, the underlining will take place in the appropriate amount column. If printing to an HP LaserJet (or compatible), the system will use the printers underlining and double underlining capabilities to produce the underlines.

|

DO ONLY if switch is on (Blank=do always)

|

1 character: (blank, A-Z) - can be used to cause the report definition to only be effective if the specified switch has been turned on. The specified operation will only be performed if the indicated switch is ON.

|

|

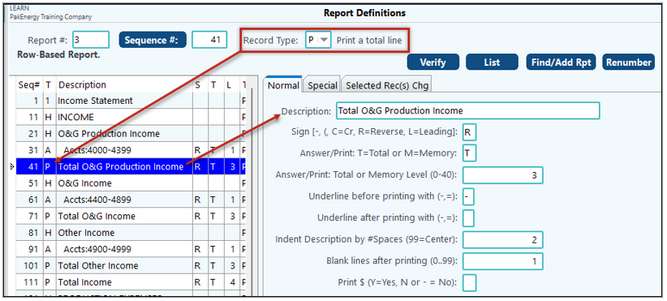

Record Type "P" - Print a total line

The "P" record will print a Total Line for a specified total level or memory cell. A "P" record normally follows an "A," "S," or "C" record. Typically, the total level, underlining prior to printing, and description are set in this type of record.

Description

|

Description to print on the line

|

Sign

|

(1 character) - determines the type of sign to be used. Depending on whether the amount is positive or negative, the amount will print as follows:

|

Answer/Print T=Total or M=Memory & Level

|

(1 character: M for Memory, T for Total), (Level: 2 digit: 0-26 ).

|

Underline before/after printing

|

1 character (Examples: blank, dash "-" or equal sign (=)) - determines if you want an extra line of the specified underline character to be printed. An underline character can be printed before a line is printed or after a line is printed. Underlining works a little differently on the heading (H) definition. On the "H" record type, the underlining will be above/below where the description is printed. On all other record types, the underlining will take place in the appropriate amount column. If printing to an HP LaserJet (or compatible), the system will use the printers underlining and double underlining capabilities to produce the underlines.

|

Indent description by # spaces (99=Center)

|

determines the number of characters the description should be indented (number of character positions the description should be shifted to the right on the page)

|

Blank lines before/after printing

|

Determines the spacing between lines on the report. (0= no blank lines (i.e. single space), 1=one blank line (i.e. double space), etc). Before printing a line, the system will add the number of blank lines before, plus one or two if the underline is specified, plus one for the line itself. On record types "H", the "Check # of lines remaining on page" will be added to the total. If the total number of lines will not fit on the page, the before under character (if specified) and data line will print at the top of the next page (under all specified titles).

|

Print $

|

Y or N for printing dollar signs.

|

Print if Zero?

|

If this option is set to "N" (no), then the report line being described will not print provided all the amounts that would normally print are equal to zero The "Y" (yes) option causes the report line to print even if all the amounts are zero.

|

DO ONLY if switch is on (Blank=do always)

|

1 character: (blank, A-Z) - can be used to cause the report definition to only be effective if the specified switch has been turned on. The specified operation will only be performed if the indicated switch is ON.

|

|

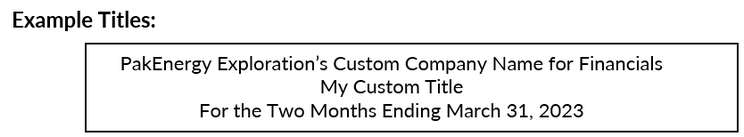

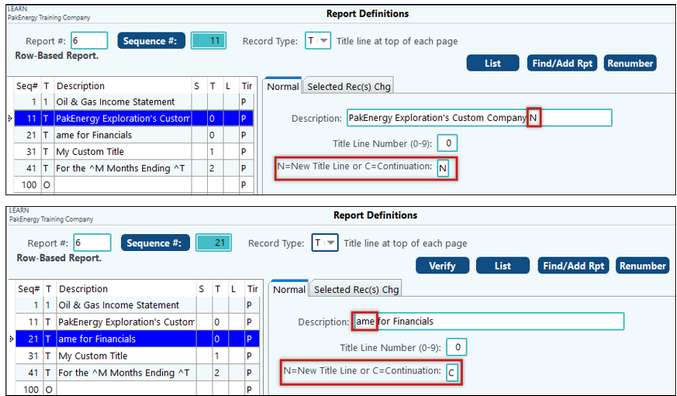

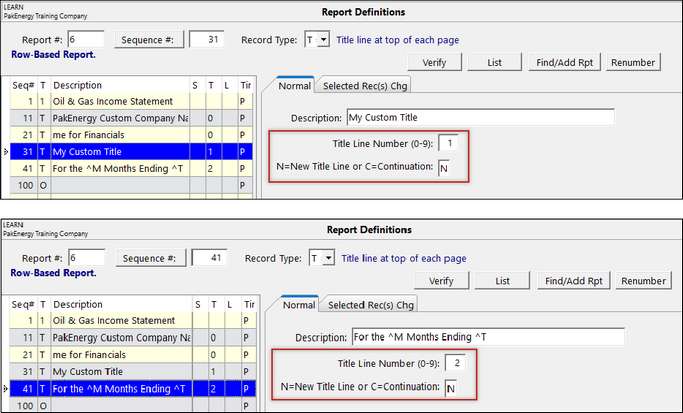

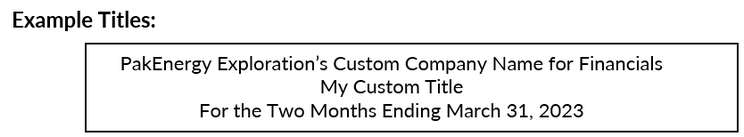

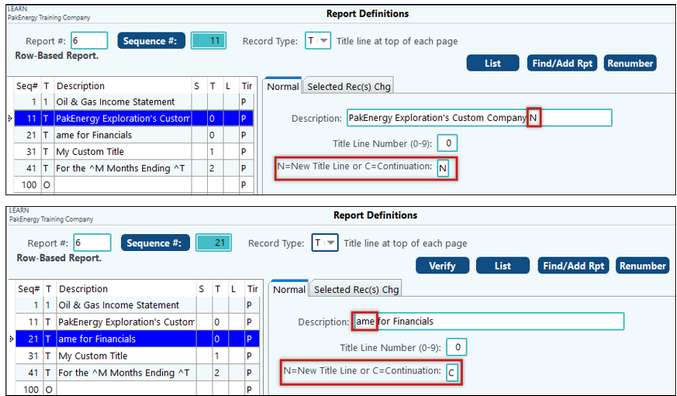

Record Type "T" - Title line at top of each page

The "T" record will print a Title line at the top of each page of the financial statements. The Title line(s) print directly under the Company Name. Up to 10 different lines can be used (0 thru 9). Multiple definitions can be combined to form titles that are longer than 40 characters (Titles can be as long as the page width.) Title will automatically be centered on the page, and blank titles will be omitted. To print a blank title line, define a title description of a single dash.

When entering a title line more than 40 characters, if a space is required between the first piece and the next piece, the description on second T record should start with a space. Trailing spaces on a description are ignored.

When requesting a financial statement, the "Report Heading" (H) option will be printed directly under the specified title lines. The Heading can be thought of as the 11th Title line. It will be printed on every page of the financial report regardless of what Titles are specified.

Title line 0 contains the Company name by default. If a different name is needed on the report, re-define record 0. The description can also contain 2-character substitution codes. These codes can insert dates, number of periods, etc. into the titles at print time.

Description

|

Description to print on the line.

|

Title Line Number

|

Line on the report to print the title. Title line 0 contains the Company name by default.

|

New title line or Continuation

|

Is this a new title or a continuation of a previous title. (ie. title line 1 continued over to title line 2).

|

Also see Financial Statement Presentation

|

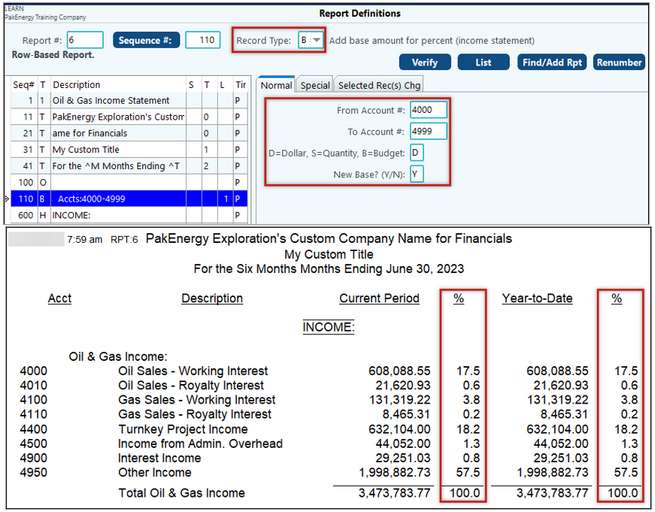

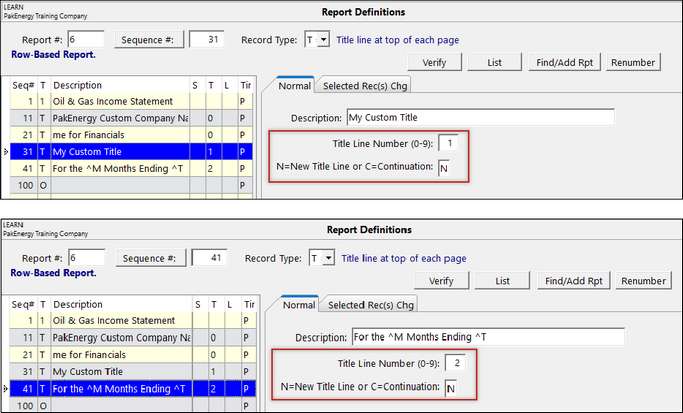

Record Type "B" - Add Base amount for %

The "B" record type sets the specified range of accounts as the base percent for the report. In other words, it defines what the 100% amount should be. The income statement uses a base percent. Usually an income statement will have a single "B" record that defines what range of accounts make up Total Income. If used, the "B" record is usually specified before any "H", "A", or "P" records.

If a different base amount is needed for another section of the report, the "New Base Amount?" field can be used to indicate that a new base amount is being specified. If more than one account range is required to properly total the 100% base, the 2nd and subsequent B record types should have the New Base Amount? = No. If a section of the report is to be printed without percentages, that section should start with another record type B with an Account range of 0 thru 0, and New Base Amount? = Y.

When printing a Balance Sheet or Trend Report, the "B" record is ignored.

Account range from/thru

|

Determines the account range to be accumulated or printed.

|

D=Dollar, S=Quantity, B=Budget

|

What type of field is being printed.

|

New Base (Y/N)

|

Y=base is new and will only include the account range specified, N=accumulate account range with a previous base.

|

Sub-accounts from/thru

|

6 characters, letters only, right justified - for the above account range, only includes those accounts with this Sub-Account range. This range will default from a blank Sub-Account thru "ZZZZZZ" (the highest possible Sub-Account). On most reports the Sub-Account range should be left to the default values (blank Sub-Account thru "ZZZZZZ").

|

Divide Amounts by Base

|

Divides the totals by the base amount. Rarely Used.

|

|

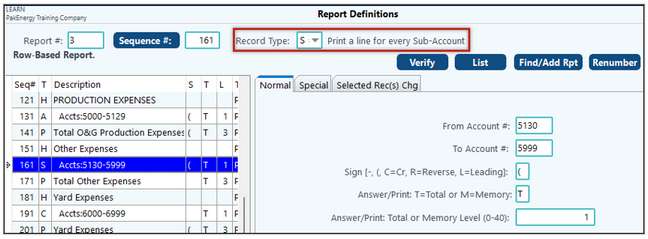

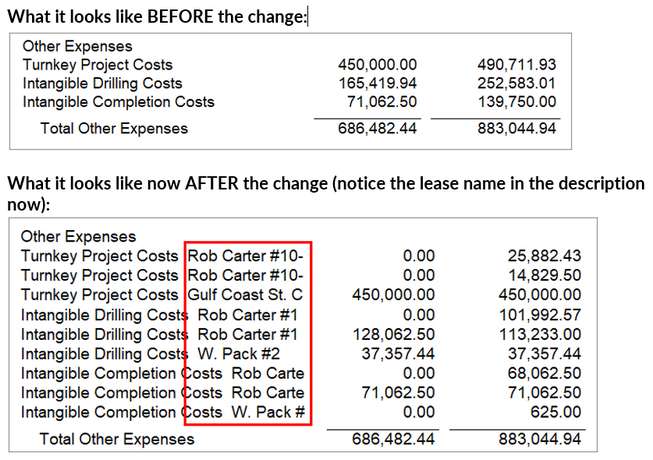

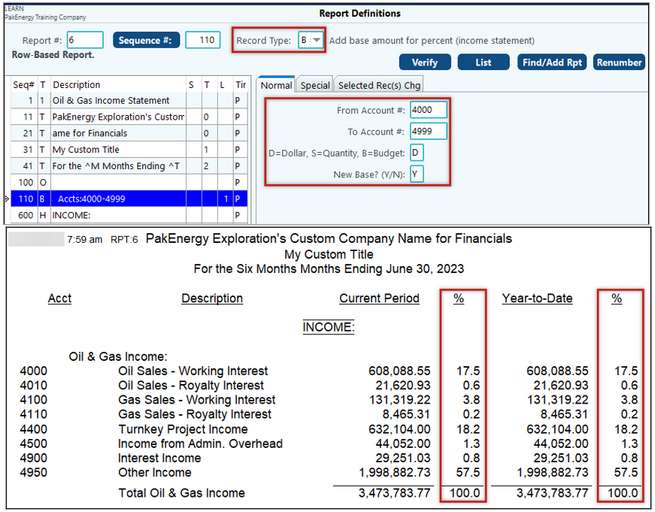

Record Type "S" – Print a line for every Sub-Account

This record type would be used instead of an “A” record. The “A” record prints activity at the account level; however, occasionally it is necessary to view activity in an account at the Sub-Account level. This can be accomplished for any account that has a Sub-Table attached to it.

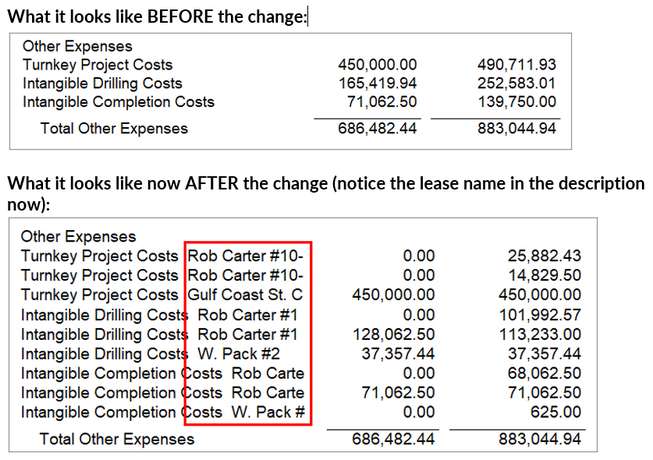

For instance, regarding the Income Statement, upper management would like to view the Other Expenses (5130-5999) by Sub-Account. These accounts have the Property Sub-Table attached to them. This will help management to see what production expenses were in relation to the properties and to be able to make financial decisions accordingly. But how do we do this in Pak Accounting?

The “S” record type will cause the specified range of account & Sub-Account combinations to print on the financial statement. Only the Account & Sub-Account combinations with activity this fiscal year will print (balances forward count as activity).

The account range should always be specified.

NOTES:

•If a range of more than one account number is given, an "account name" will print before the Sub-Accounts.

•If a range of only one account number is given, the "account name" does not print.

•If an "account name" is needed on a single account number range, precede the type "S" with a type "H" record.

Sub-Account Desc, Account Desc

|

S= prints the Sub-Account description on every line (standard); A=prints the account description on every Sub-Account line. When printing an "S" record type and the record includes more than one account number and the description calls for the Sub-Account description to be printed, the account description will be added in front of the Sub-Account description. If necessary, the description column width can be made wider on the "1" record/Special tab.

|

Account range from/thru

|

Determines the account range to be accumulated or printed.

|

Sign

|

(1 character) - determines the type of sign to be used. Depending on whether the amount is positive or negative, the amount will print as follows:

|

Answer/Print T=Total or M=Memory & Level

|

(1 character: M for Memory, T for Total), (Level: 2 digit: 0-26).

|

D=Dollar, S=Quantity, B=Budget

|

What type of field is being printed

|

Print if Zero?

|

If this option is set to "N" (no), then the report line being described will not print provided all the amounts that would normally print are equal to zero The "Y" (yes) option causes the report line to print even if all the amounts are zero. Only accounts with some activity will print (balance forwards count as activity).

|

Print $

|

Y or N for printing dollar signs.

|

Sub-accounts from/thru

|

6 characters, letters only, right justified - for the above account range, only includes those accounts with this Sub-Account range. This range will default from a blank Sub-Account thru "ZZZZZZ" (the highest possible Sub-Account). On most reports the Sub-Account range should be left to the default values (blank Sub-Account thru "ZZZZZZ").

|

Accumulate by +/-

|

(1 character: + for Add, - for subtract) - determines if the amounts should be added or subtract from the indicated Total/Memory.

|

Indent description by # spaces (99=Center)

|

determines the number of characters the description should be indented (number of character positions the description should be shifted to the right on the page)

|

Blank lines before/after printing

|

Determines the spacing between lines on the report. (0= no blank lines (i.e. single space), 1=one blank line (i.e. double space), etc). Before printing a line, the system will add the number of blank lines before, plus one or two if the underline is specified, plus one for the line itself. On record types "H", the "Check # of lines remaining on page" will be added to the total. If the total number of lines will not fit on the page, the before under character (if specified) and data line will print at the top of the next page (under all specified titles).

|

Underline before/after printing

|

1 character (Examples: blank, dash "-" or equal sign (=)) - determines if you want an extra line of the specified underline character to be printed. An underline character can be printed before a line is printed or after a line is printed. Underlining works a little differently on the heading (H) definition. On the "H" record type, the underlining will be above/below where the description is printed. On all other record types, the underlining will take place in the appropriate amount column. If printing to an HP LaserJet (or compatible), the system will use the printers underlining and double underlining capabilities to produce the underlines.

|

DO ONLY if switch is on (Blank=do always)

|

1 character: (blank, A-Z) - can be used to cause the report definition to only be effective if the specified switch has been turned on. The specified operation will only be performed if the indicated switch is ON.

|

|

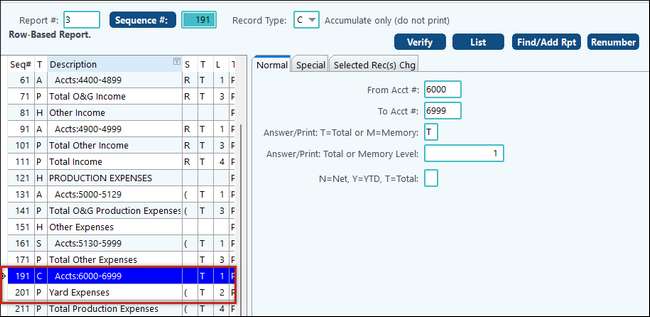

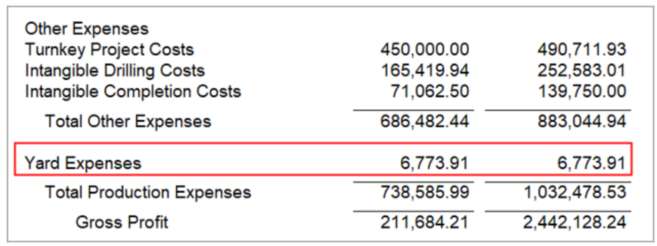

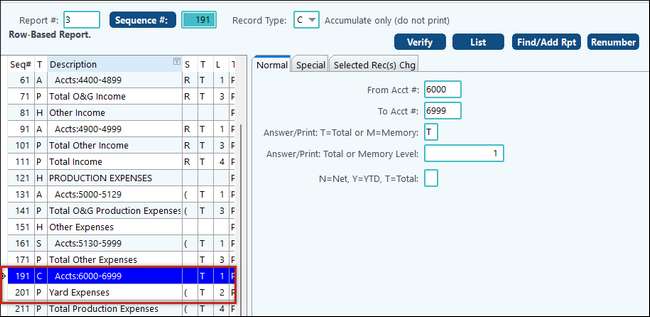

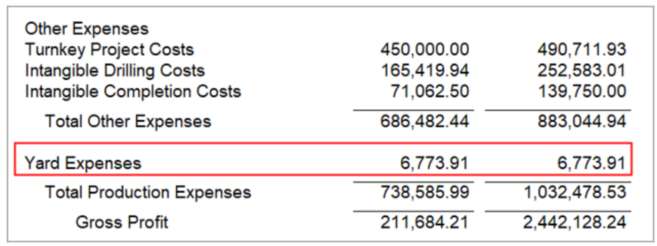

Record Type "C" – Accumulate only (Do not print)

This record type would be used instead of an “A” record. There are many occasions on different reports where it is more feasible to have accounts accumulate instead of printing out one at a time using an “A” record. Accumulating accounts is accomplished using a “C” record which is discussed in more detail below.

•The "C" record will cause the specified range of Accounts/Sub-Accounts to be accumulated (not printed) into a specified total level or memory cell. This is an especially useful tool if the report involves a large range of accounts that are very similar in nature and when listing all the accounts is not practical or if the Chart of Accounts is large.

•Usually, a record type C will be followed by a record type P to print the accumulated amount. For example, there are several general ledger cash accounts, however, on the Balance Sheet report definition, the user only wants one line that reflects "Cash". The "C" record would be used to accumulate the cash accounts, and the "P" record would be used to print the total of those accounts.

•The “C” record does not need a preceding header record.

This record type is used to combine multiple accounts onto one line on the financial report. For example, if a company has account number 4301 thru 4305 and 4601 as their payroll expense accounts, and on their income statement, they want those accounts to be printed on one line called "Payroll Expense". Two C records would be required in this case to handle the two separate ranges of accounts.

The required report definitions would be:

Record Type=C, Accounts: 4301 thru 4305, ACCUMULATE INTO "+ T 1"

Record Type=C, Accounts: 4601 thru 4601, ACCUMULATE INTO "+ T 1"

Record Type=P, ACCUMULATED AMOUNT "T 1", Desc: "Payroll Expense"

Account range from/thru

|

Determines the account range to be accumulated or printed.

|

Answer/Print T=Total or

M=Memory & Level

|

(1 character: M for Memory, T for Total), (Level: 1 digit: 0-9).

|

D=Dollar, S=Quantity, B=Budget

|

What type of field is being printed

|

N=Net for months, Y=YTD, T=Total

|

Net/YTD indicates the time period covered. For balance sheet accounts, the YTD amount would also include the balance forward amount.

|

Sub-accounts from/thru

|

6 characters, letters only, right justified - for the above account range, only includes those accounts with this Sub-Account range. This range will default from a blank Sub-Account thru "ZZZZZZ" (the highest possible Sub-Account). On most reports the Sub-Account range should be left to the default values (blank Sub-Account thru "ZZZZZZ").

|

Accumulate by +/-

|

(1 character: + for Add, - for subtract) - determines if the amounts should be added or subtract from the indicated Total/Memory.

|

DO ONLY if switch is on

(Blank=do always)

|

1 character: (blank, A-Z) - can be used to cause the report definition to only be effective if the specified switch has been turned on. The specified operation will only be performed if the indicated switch is ON.

|

See Understanding Switches

|

Record Type "M" – Perform Math Operation

There are times when it is necessary to have the ability to compute specific formulas or ratios within a report to provide the required information to management. The purpose is to allow management to assess the efficiency of certain operations within the organization in amounts and percentages. All that is needed are a few report definitions, and with the click of a button, the report is generated with all the math computations management wants to see!

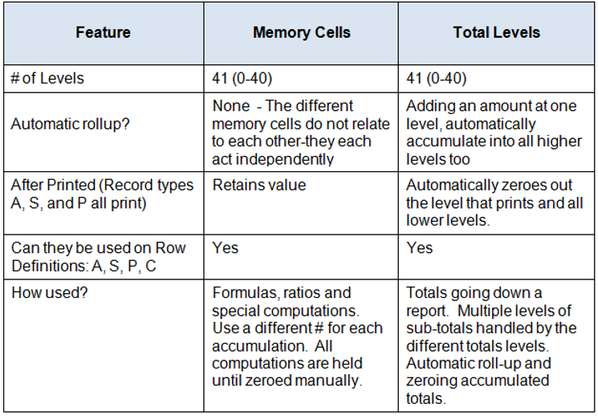

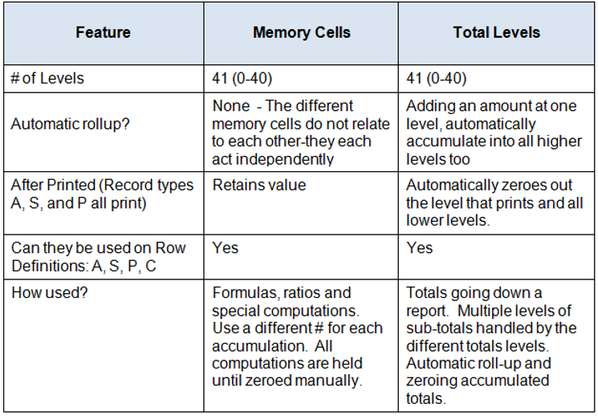

Memory Cells and Total Levels

Memory Cells work like the memory function on a calculator.

•The Memory level defines up to 41 different memory numbers (0-40) in which to store different values.

•The different memories do not relate to each other; they define forty-one separate cells that can be used in math functions.

•Memory numbers can be used to store intermediate values or compute statistics.

•A key point to remember is that memory numbers do not clear after they are printed and do not roll up to higher levels.

•Memory numbers (represented by M0, M1, M2… M40) can be added to each other in order to accumulate values. For instance, M1 plus M2 can be stored in M3 or M1 plus M2 can be stored back into M1.

Total Levels store accumulated amounts to be printed.

•The system handles up to 41 levels of sub-totals (Levels 0-40).

•The Total Level determines which other totals are included in a printed total.

•Adding something to one level automatically adds value to the next higher level.

•If the total is to include the prior amount(s), it needs to be a larger total level. If the total acts as an equal colleague, it needs to be at the same or smaller level.

•When a total level is printed, that level and all lower levels are reset to zero.

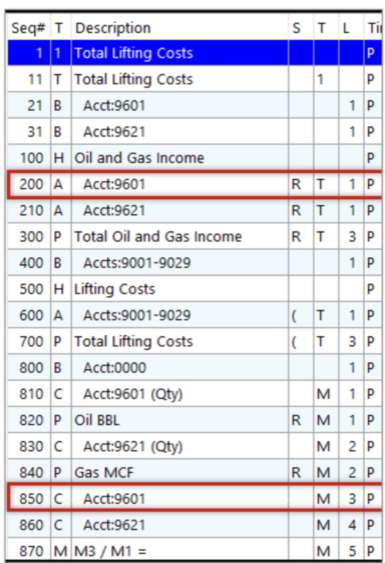

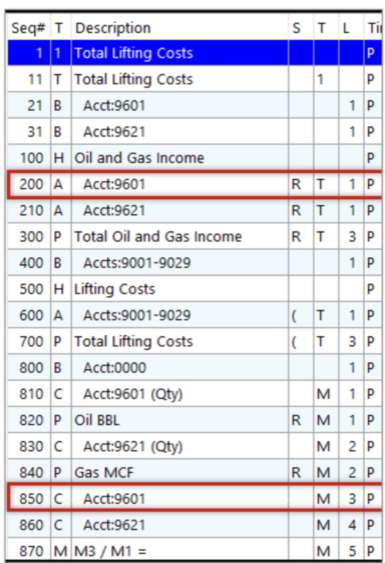

Example

The “M” record type provides the ability to perform math operations for total levels, memory levels, or a Base/Constant. Typically, the math functions are used with memory levels since each level is independent of the other. If a total level is used, then it would only be able to be used once to be pulled into the math function correctly.

Huh? What do I mean by that? In the example, account 9601 is showing on my report and is attached to a Total Level of 1. If I wanted to use that account in a math function, I would have to list it again and put it into a memory level. Why? Because there are several Total Levels 1’s so, I couldn’t pull T1 into a math function.

To keep things simple, an “M” record can only manage one math function at a time (add two numbers together, subtract one number from another, multiply two numbers together, divide one number by another). Depending on what you are trying to do, multiple “M” records are necessary to perform a math function with two or more operands.

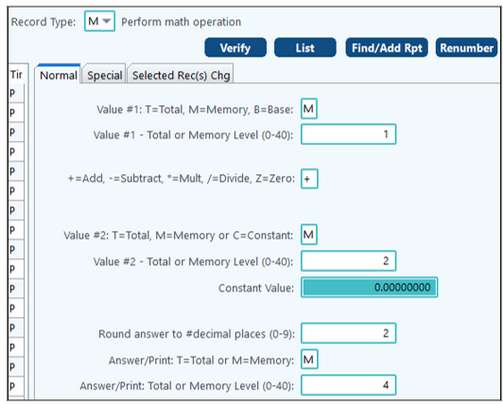

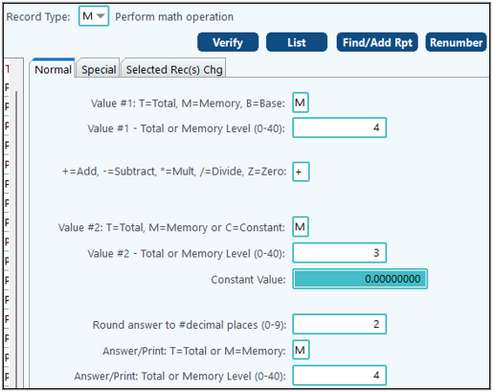

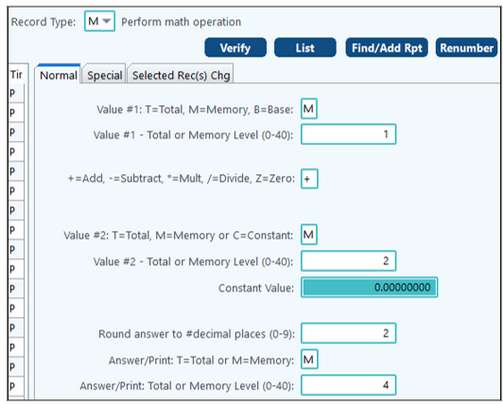

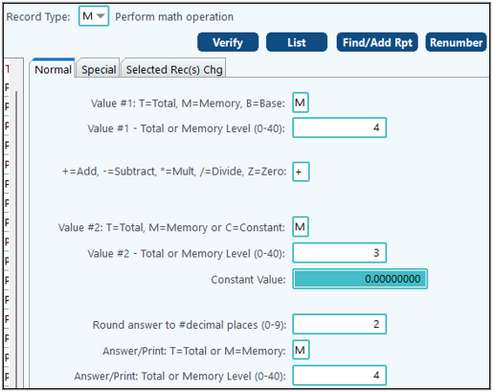

Example Formula: Memory1 + Memory2 + Memory3 with the results stored in Memory4.

We will shorten it down to M1 + M2 + M3 = M4

To break it down into just two operands at a time:

M1 + M2 = M4

M4 + M3 = M4

For our example formula, we will:

•Enter in our Value #1 (M1).

•Tell it what to do (add).

•Enter in our Value #2 (M2).

•Tell it where to store the answer (M4).

We will repeat the process for the second step:

•Enter in our Value #1 (M4).

•Tell it what to do (add).

•Enter in our Value #2 (M3).

•Tell it where to store the answer (M4).

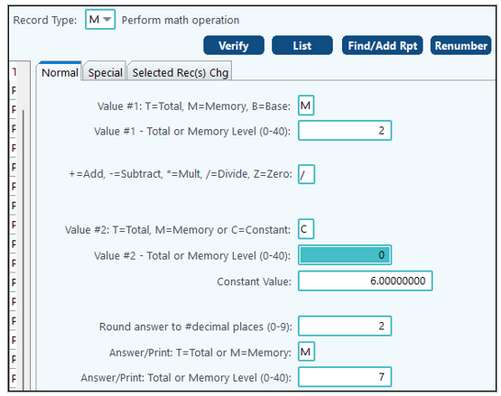

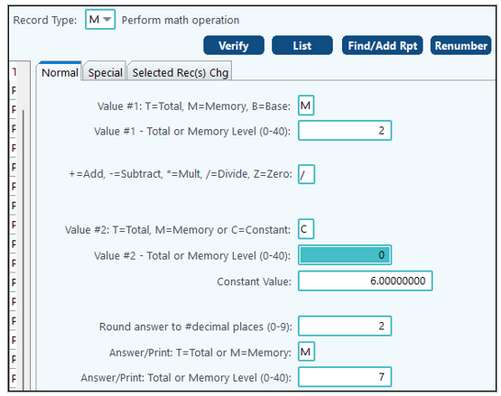

However, there are times when a Constant is needed. For example, to determine the BOE, you would need to take the Gas MCF and divide it by 6 (for the first part of the calculation). If our Gas MCF was stored in M2, and we needed to save our answer in M7, our setup would look like this

|

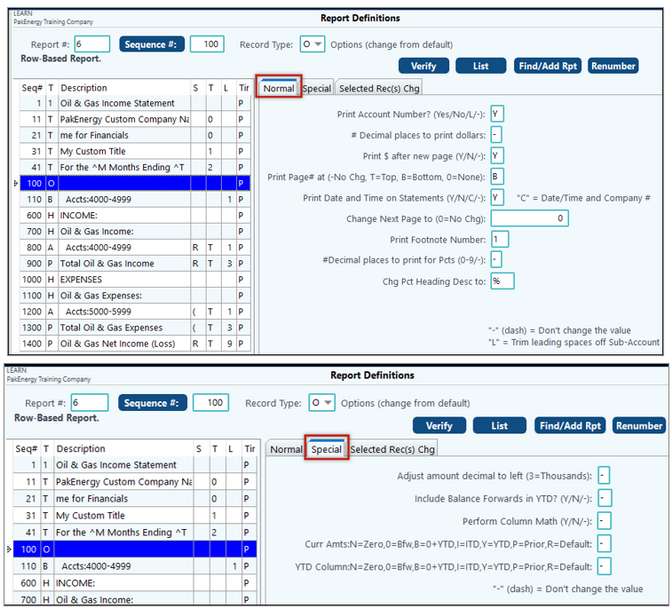

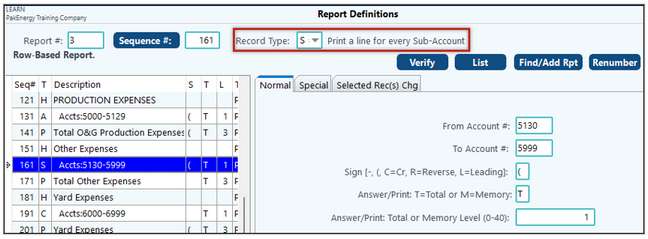

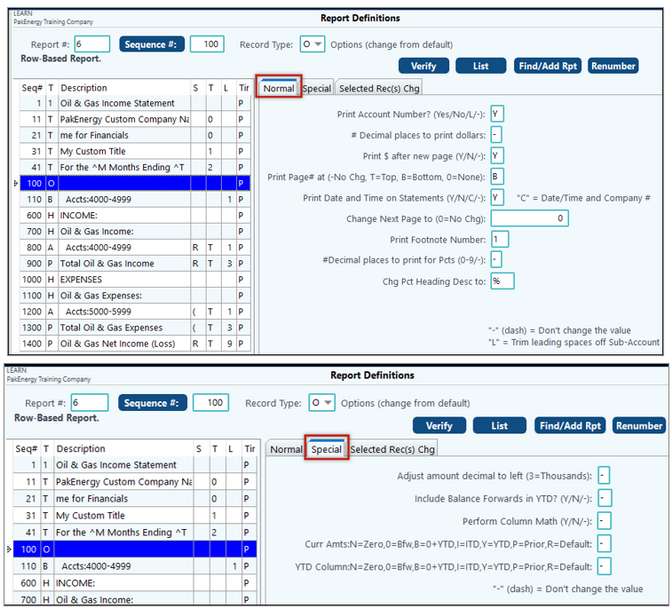

Record Type "O" – Options (change from default)

The “O” Record will affect the report it’s in. Sometimes, we may need to override the company options to have a report look a certain way. In this case, we can add a special record type. “O” records should be defined at the beginning of your financial report definitions, right after titles, if you want it to affect the whole report. If you only wanted the options set in a later section of the financial, you would add the “O” record right before the section you want the options invoked for. The options defined on the “O” record are report-by-report and will override general company options set in company maintenance.

For example, on one financial report the user does not want the account numbers to print. Change the option, "Print Account Number" to N and the account numbers will not print on this one report only.

Another use for this record is to change how the system accumulates and prints certain balances on the income statement, budget, and trend reports. To print inception to date income/expense reports, an "O" record in the beginning of the report definition with "Y" to the prompt which says "Include Balance Forward in YTD" is mandatory.

Print Account Number?

|

"Y" will print the account number on statements; "N" will suppress it. "L" will trim leading spaces off of the Sub-Account(s).

|

# of decimal places to print

|

Specify a "2" for dollars & cents. Specify a "0" for whole dollars.

|

Print $ After New Page

|

Prints a "$" as the first character in the first row of amounts on new page. For Income Statement, Budget, and Trend Reports only.

|

Print Page Number

|

Defines where (or if) to print page numbers print on the report.

|

Print Date & Time on Stmts

|

"Y" prints the date and time in the upper, left-hand corner of the title. "C" = Date/Time and Company # to printed on the report.

|

Change Next Page Number to

|

Allows the page number to be adjusted in the middle of a report. This could be used to reset the page number to 1 between sections, or leave a space open for explanatory pages, etc.

|

Print Footnote

|

Accepts a value of 0-5. The footnotes are set up in the Utilities module/Default Forms/#101-Footnote Maintenance. To define the footnote to print on the financial statement, go to the General Ledger module/#80-Company/Financial Reporting tab/Advanced tab.

|

Adjust decimal to left

|

Determines rounding on the report. For example, if you want the amounts on the report rounded to the nearest thousand, specify "3 "(Adjust decimal point to the left), and "0" decimal places.

|

Include Balance Forward in YTD?

|

"Y" includes the Balance Forward amounts in the YTD amount. "N" does NOT include the Balance Forward amounts. A dash "-" keeps the default set by the report being produced. The Balance Sheet, Working Trial Balance, and Spread Sheet Report default to "Y." The Income Statement, Budget Report, and Trend report default to "N."

|

Perform Column Math

|

Default Value is "Y" on all reports. By setting the field to a "N", the totals will accumulate down the page instead of being computed across the page.

|

Current Amounts

|

N = Zero (amount col prints zero), 0 = BFW (includes balance forward), B = 0 + YTD (Balance forward plus year to date), I = ITD (includes inception to date amounts), Y = YTD (includes Year to date), P = Prior (includes prior year amounts), R = Default (restores the original defaults). NOTE: Options "P", "0" and "B" will NOT include ITD (ie BF) amounts in the Profit and Loss range set in Company Master Maintenance.

|

YTD Column

|

N = Zero (amount col prints zero), 0 = BFW (includes balance forward), B = 0 + YTD (Balance forward plus year to date), I = ITD (includes inception to date amounts), Y = YTD (includes Year to date), P = Prior (includes prior year amounts), R = Default (restores the original defaults). NOTE: Options "P", "0" and "B" will NOT include ITD (ie BF) amounts in the Profit and Loss range set in Company Master Maintenance.

|

|

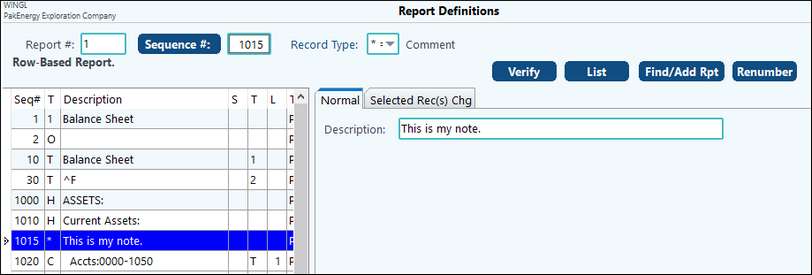

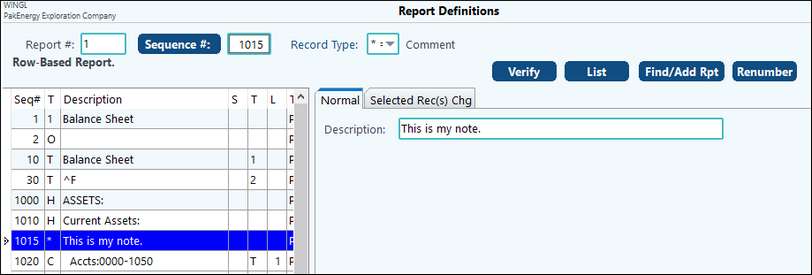

Record type "*" -Comment

This record is a comment record that allows for a comment to be printed on the List / Report Definitions Listing but not on the report itself.

|

Column Based Report

When defining the Row Based Report definitions, we used various Record Types (H, A, P, T, etc.) to describe how we wanted the report to look going down the page. To define each column, we also use different record types to define the different elements and/or data sources. To accomplish this, we use the following Column Based Record types:

U - Defines the title that will print for the column.

E – Defines one or more account ranges to be accumulated for the column.

N – Defines one or more math/formula for a column.

For each column, you will have a “U” record for the column to print. Then depending on the contents of the column, you could have one or more E or N records (either/or not mixed).

NOTE: when doing advanced math functions, there are times that you may want the system to look at an account but not print on the report. In that case, you would set up your E or N record but not associate it with a U record.

Sequence #1

This sequence works very similarly to what we have discussed previously in training. However, noting that the Special tab can adjust the column widths is good.

Also see Spreadsheet Report

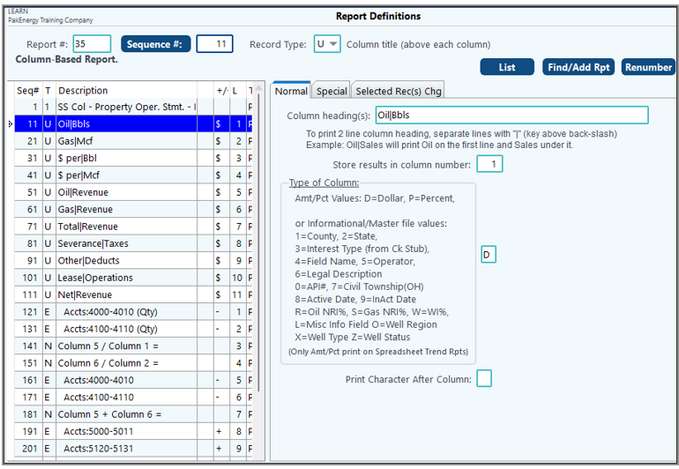

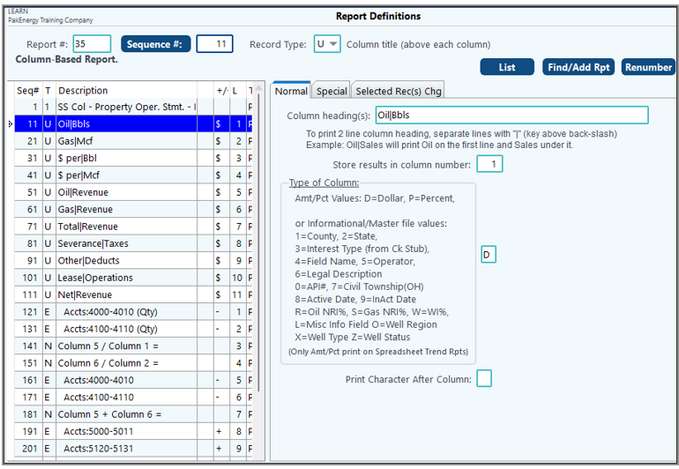

Record Type "U" – Column Title (Spreadsheets)

The "U" record is used to define what column heading you would like to print directly above each spreadsheet column.

Normal Tab Options:

Column Heading(s)

|

Contains the column heading(s). If a two-line heading is desired, separate both headings in the description field with a "|" (Shift \ on most keyboards).

|

Store results in column Number

|

Indicates which column the results will be stored in.

|

Spreadsheet and Trend Options/Dollar or Percent Column

|

This will print the columns with a dollar value or as a percentage.

|

Spreadsheet One-Line Options:

|

Options are County, State, Interest Type (from Check Stub), Field Name, Operator, Legal Description, API #, Civil Township (OH), Active Date, Inactive Date, Oil NRI %, Gas NRI%, WI%, and Miscellaneous Info.

|

Type of Column

|

Set what type of information should pull into the specified column.

|

1 = County

|

Property Maintenance/General tab

|

2 = State

|

Property Maintenance/General tab

|

3 = Interest type

|

Division Order

|

4 = Field name

|

Property Maintenance/Other tab

|

5 = Operator

|

Property Maintenance/General tab

|

6 = Legal

Description

|

Property Maintenance/Other tab and will add an additional column.

|

0 = API Number

|

Property Maintenance/MMS Tab.

|

7 = Civil Township

(OH)

|

Available for users licensed for Land. This option is only associated with Ohio properties.

|

8 = Active date

|

Property Maintenance/Company Opts tab.

|

9 = Inactive date

|

Property Maintenance/Company Opts tab.

|

R = Oil NRI%

|

Property Maintenance/Groups Tab.

|

W = WI%

|

Property Maintenance/Groups Tab.

|

S = Gas NRI%

|

Property Maintenance/Groups Tab.

|

L = Misc. Info Field

|

Property Maintenance/Groups Tab/Miscellaneous Info field.

|

O = Well Region

|

Property Maintenance/General Tab.

|

X = Well Type

|

Property Maintenance/General Tab.

|

Z = Well Status

|

Property Maintenance/General Tab.

|

Print character after column

|

By putting a character in this field, you are effectively separating the columns by this character.

|

Tech Tip: To use these codes in a spreadsheet report enter a “U” record with the desired code (For example, a “U” record with code “1” for county). The report must have a minimum of one column that pulls in financial information (For example, a “U” record with a “D” or “P” code that has a corresponding “E” Record).

Special Tab Option:

NOTE: This is an older method of trending data and was typically used with more advanced row report definitions. However, using the Trend Report menu option is much easier and eliminates the need for manual report trending.

Subtract # Time Periods being included in report: Enter the number of months to subtract data for the column. Used in trend reporting.

•Entering 1 with a report that is being run for a 1 month period will print the prior month.

•Entering a 1 with a report that is being run for a 12 month period will print for the prior year.

•Entering a 2 with a report being run for a 12 month period will print the amount for the year before last.

Selected Rec(s) Chg Tab:

This tab provides the ability to delete selected sequences, move column numbers up or down, move selected records up or down, change Sub-Account restrictions, or change the Accumulate by sign on selected records.

Special Spreadsheet Setup Example:

Spreadsheet Report with Months in columns

There is a special setup for a spreadsheet report where each month is in a separate column. These settings are entered on the “U” records on the “Special” tab in the “Subtract # Time Periods being included in report” field. For January, enter an “11”. For February, use “10”. For March, use “9” and so forth for the remaining months decreasing the number by 1 for each subsequent month. December will have a zero. On the report screen, the dates for the Current Period Column From and Thru must be the last month of that year – 12/2023 thru 12/2023.

|

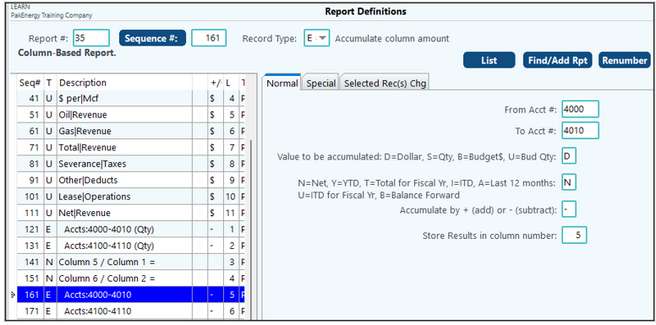

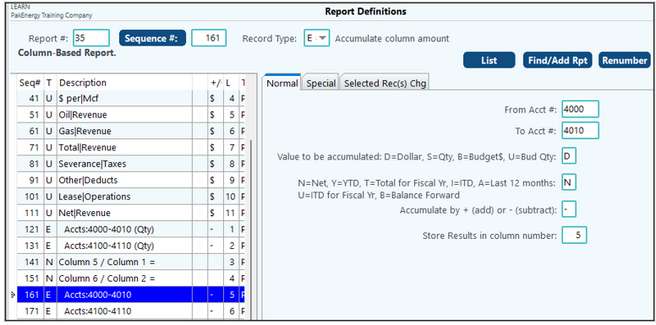

Record Type "E" – Accumulate column amounts (spreadsheets)

The "E" record is used to accumulate the information to be printed in a Spreadsheet column. The accounts and/or Sub-Accounts defined in this record limit the spreadsheet column information to only include the range specified. this record also defines the period to accumulate the information for (i.e. Net period, Year to Date, Inception to Date, ITD as of from, or Total for Year).

NORMAL TAB

|

Account range from/thru

|

Determines the account range to be accumulated or printed.

|

Store results in column number

|

•Column number on the spreadsheet to store the value. |

N=Net for months, Y=YTD, I=ITD, A= last 12 mths, U=ITD for Fiscal Yr

|

•Net/YTD indicates the time period covered. For balance sheet accounts, the YTD amount would also include the balance forward amount. |

D=Dollar, S=Quantity, B=Budget

|

•What type of field is being printed.

|

Accumulate by +/-

|

(1 character: + for Add, - for subtract) - determines if the amounts should be added or subtract from the indicated Column.

|

SPECIAL TAB

|

Sub-accounts from/thru

|

10 characters, letters only, right justified - for the above account range, only includes those accounts with this Sub-Account range. This range will default from a blank Sub-Account thru "ZZZZZZZZZZ" (the highest possible Sub-Account). On most reports the Sub-Account range should be left to the default values (blank Sub-Account thru "ZZZZZZZZZZ").

|

Wildcard Sub-Account

|

The Wildcard feature is only used with reports that have different accounts going down the page and Sub-Accounts going in to different columns. It should not be used with the option that prints a separate Sub-Account on each line going down the page.

|

SELECTED REC(S) CHG TAB

This tab provides the ability to delete selected sequences, move column numbers up or down, move selected records up or down, change Sub-Account restrictions, or change the Accumulate by sign on selected records.

|

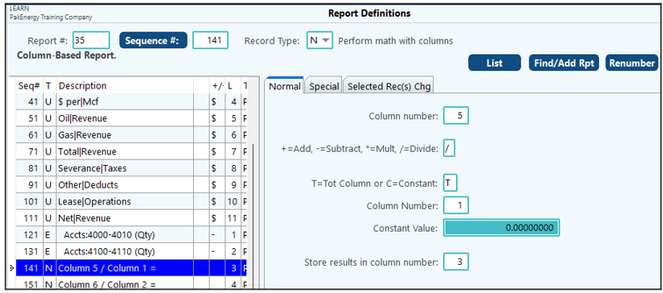

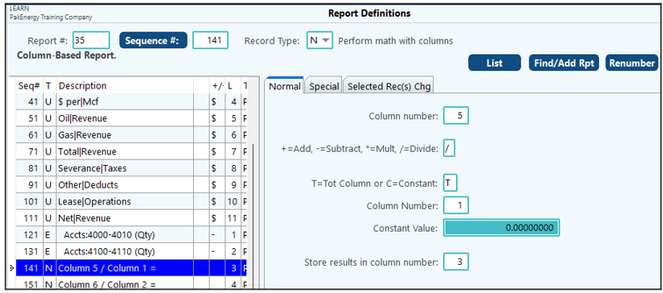

Record Type "N" – Perform Math with column (spreadsheets)

The "N" record is designed to perform math operations within spreadsheet reports. For example, Column 1 can be added to Column 2 to produce Column 4. Math operations are performed in the sequence they are coded in. They are performed just prior to printing a line on the report. The Total or Memory must be coded "T" for Total Column or "C" for Constant value (number).

Column Number

|

Designate a column number in the spreadsheet to perform the math function.

|

Add, Subtract, Multiply, or Divide

|

Enter the desired math function to perform.

|

Total column or Constant

|

Will the column be divided (or whatever math function is selected) by another Column (total) or by a constant value (number)—for example, a column multiplied by .25.

|

Store results in column number

|

Print the results of the above calculation in the defined column.

|

|

Also See:

Financial Reporting Options

Financial Statement Presentation

Memory Cells and Total Levels

Substitution Codes

Summary Report Level Options

Switches

Drill Down Feature

Summary Groups