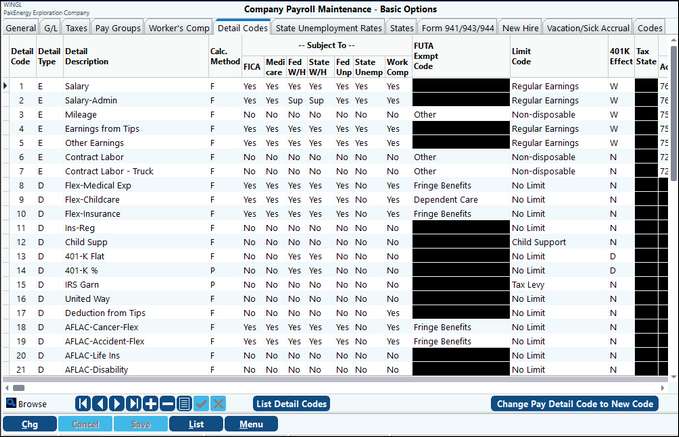

Detail Codes are the pay codes used during the cycle. There are Earnings, Deductions, Company Cost, and Tax-User Defined. Then, there are Calculation Methods for each such as Fixed, Percentage, or Balance which can be used for Employee Reimbursements.

NOTE: If a new Detail Code is added while a cycle is in progress, it will be added to the current cycle.

Some things all of the codes will have in common. There are 3 ways to create a new code:

1.Click on the “+” sign in the navigational grid row.

2.Right-click anywhere on the screen and select Add.

3.Double-click on one of the existing Detail Codes to get to the Detail Maintenance, and click Add from that screen.

When setting up Pak Accounting from a template company, there will be a few default Earning Detail Codes that will automatically be created. These are Salary, Regular (hourly), Overtime, Holiday, Sick, and Vacation.

Detail Maintenance |

|

|---|---|

Detail Code |

4 digit alpha-numeric code for each detail item. |

Description |

Describe the detail number item. |

Type |

C - Company Cost is ignored when calculating net pay E - Earnings. Amount will be added when calculating net pay D - Deduction will be subtracted to calculate net pay T – Tax – User defined The entry also determines where (under which column) to print the information on the check stub and payroll register. |

Calculation Method |

Determine how the detail amount is calculated. (Options may vary depending on the Detail Item chosen above): B – Balance of G/L Account C – Complementary Hours F – Fixed dollar amount H – Holiday Hours O – Overtime P - Percentage R – Hours (Regular) S – Sick Hours V – Vacation Hours N – Rate (Non hours) K - Company’s matching portion of 401(k) account. Has no effect on employee’s check, but must be entered to properly calculate company costs. |

The Change Pay Detail Code to New Code button in the bottom right-hand corner of the screen gives the option to change a Detail Code to another Detail Code number or merge 2 codes together. In the Payroll Change Detail Code Utility window, you can either create a new detail code or merge with an existing code. To create a new code, manually key the alpha/numeric code into the New Detail Code field. To merge, use the drop down menu in the same field and select the needed Detail Code.

Once a detail code is set up and payroll cycles have been run, it has history against it, any flags (tax) should not be changed. If they are changed, it WILL NOT change history. If they are being changed because of an error in setup, then correcting payrolls need to be processed. In addition, if an employee is set up with a detail code as a Fixed Amount, changing the master to Percentage will not replicate down to the employee level.

NOTE: What's a company cost? Company costs are company-provided benefits, expensed to G/L through the payroll system. An example is group insurance costs, paid by the company.

See Earnings screen example

See Deductions screen example

See Company Cost screen example

See Sliding Scale OT example

See Tips example

See Employee A/R example

See Employee Reimbursements example

See Employee A/R with Balances example

See Child Support example

See Fringe Benefits setup

See Non-Taxable Earning Reimbursement example

See PA City and County Tax Setup example

Also see Contract Labor