Employee A/R – How can I track it?

1.Setup an account for Employee Receivables-subbed by Employee table (40 most of the time).

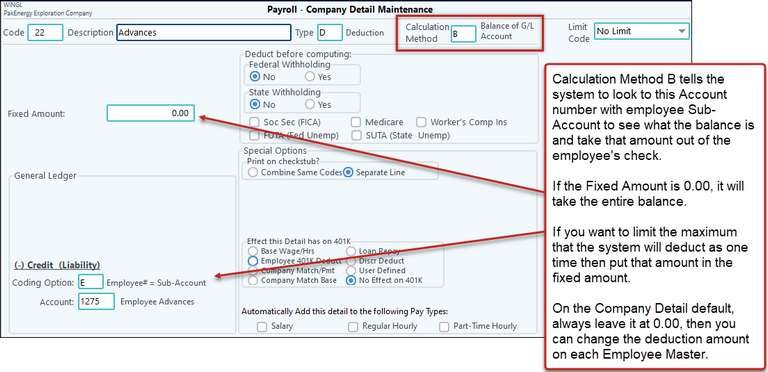

2.Create a new detail Code for Employee Advances in Master File Maintenance/Basic Options.

3.Setup all employees with the new detail code defined above (Code 22 in our example above) or automatically add the detail to all employees

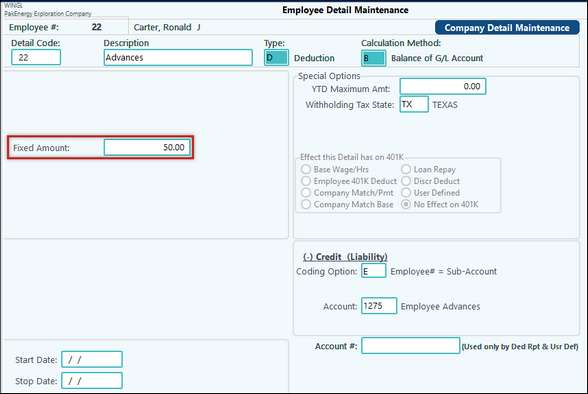

Example: We wrote a check for $1,000.00 on May 1st to Karen Starkey as an advance to be paid out at $50.00 per paycheck. When the QuickCheck was written, it was coded to 1275 (Employee Advances), Sub-Account 1 (Karen Starkey’s employee # is 1).

So if we want to only take $50.00 then we will need to change the “Fixed Amount” to 50.00.

If the fixed was left at 0.00, it would attempt to take the entire $1,000.00 out of her next check, or as much as her net would allow.

The BEST part of this feature is the system will continually track the balance in the account and when her loan balance goes to zero it will automatically quit deducting the 50.00, no need to remember when to turn it off! And if another advance check gets written to her, it automatically adds that to her ongoing balance and there is no need to change anything in the payroll system!

NOTE: The "B" calculation method will also pull a deduction amount for an employee just like it pulls a pay amount.