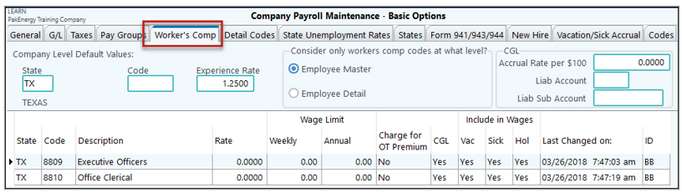

For purposes of Workers Comp insurance, employees are classified according to their job classification. Standard four digit numeric codes have been assigned to these different classifications. Usually, an employee has only one Worker's Compensation code (WC Code). In some situations, an employee may be classified under multiple worker compensation codes, depending on the different tasks performed. For Commercial General Liability (CGL), if you are required to participate, you will be notified. Otherwise leave this field blank.

Refer to your insurance policy to obtain the information required for Code, description and rate.

In order to include Overtime Premium in regular wages for purposes to compute the amount, enter a N in the "Charge for OT Premium" field.

NOTES:

•Only a few Worker's Compensation policies limit the applicable wages. Unless your policy limits the wages, this should be coded as 0.00

•Experience rate default is zero, if it is zero the workers comp accrual will not compute. Should be at least 1.0.

•Choose Employee Master if employees only have 1 Worker's Comp code. If the employee(s) could be assigned to multiple codes (depending on the job performed) then choose Employee Detail. This will allow you to assign a different Worker's Comp code on each Earning/Deduction detail code.