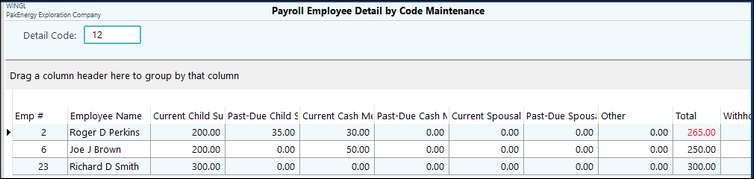

Feature in Pak Accounting to help make calculating payroll child support deductions easier and creating ACH records for payment.

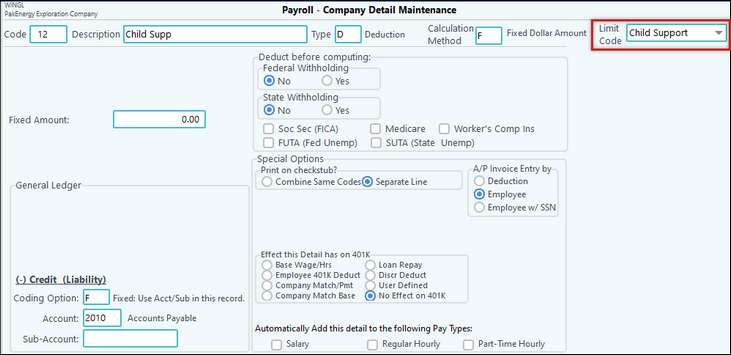

Company Level Setup - create deduction code

| 1. | Set up a Deduction Detail code. Make sure the Company Child Support detail code is identified as a “Child Support” deduction code (Limit Code). This will open up some fields on the detail code maintenance at the employee level that are required for sending ACH Child Support. |

| Note: If you have more than one detail code for child support, be sure all the “limit code” is set correctly on all of the child support detail codes. |

| 2. | For each of your various Earnings Detail codes, set the “Limit Code”. These limits will come into play when determining limits on Child Support Deductions. |

| 3. | For each of your various Deduction Detail codes, set the “Limit Code”. |

Example of Child Support detail code:

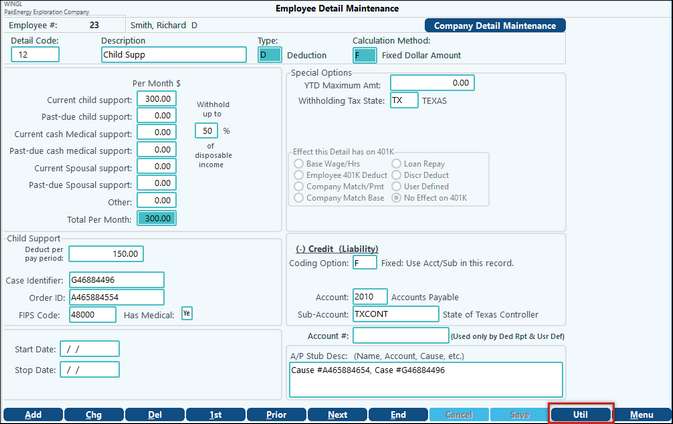

Employee Level Setup – entering the order

When you receive your Child Support order from your state SDU, you will need to add a Child Support deduction detail code to the employee.

1.Add the Detail Code to the employee. You will click on #10-Employee Master, find the employee, and then click on the “Earnings / Deductions” tab. On this screen you will click the “+” (plus sign) towards the bottom of the screen on the line that says “Browse” .

2.This will bring up the “Employee Detail Maintenance” screen. You will select the Child Support detail code in the “Detail Code” field. This will allow you to edit the Detail Code.

Either the […] button can be clicked on the /? Key pressed to bring up a lookup for available codes to be selected from.

3.Enter all the numbers provided by the state order. The system will attempt to determine what the amount of Child Support should be deducted per pay period. It will give a warning message if the amount you entered in the “Deduct per pay period” field does not agree with what the system calculated.

NOTE: At this time, the limitations calculations have not been implemented. We are still analyzing the various state regulations regarding limitation rules. We will provide an announcement via email when it is ready.

Deduct per pay period: If the Employee is salaried and the amount is higher than what is allowed by state law, the amount can be lowered here. If the employee is hourly and their hours vary from pay period to pay period, then put in the full amount of the order and override the amount at the payroll cycle level.

Case Identifier: When you fill in this field, the “Order ID”, and save the changes, the system will fill in the “A/P Stub Desc” field area for you. If you are sending a check, this information will print on the check stub. If you are filing via ACH, the information is sent in the electronic ACH file. See ACH Child Support Setup for more information on this option.

Example of State order entered:

NOTE: To enter child support amounts for multiple employees at the same time, it is beneficial to use the "Amounts Grid". This is accessed in the Employee Master. Double click on the child support detail code that has been added to an employee. Then click on the Utility button at the bottom of the screen and choose "Amounts Grid". This needs to be done before the limitations are in place in the system.