Fringe Benefits are employment benefits given in addition to one's wages or salary. Below is an example of how fringe benefits for an automobile allowance are recorded in the system.

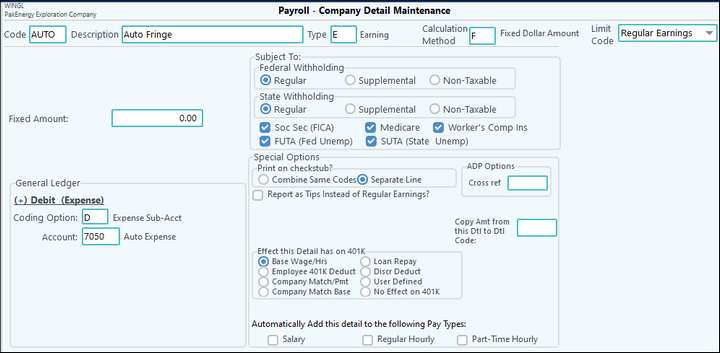

Fringe Benefits setup:

Set up your Earnings Detail code with the proper switches selected. NOTE: You will need to find what it is subject to.

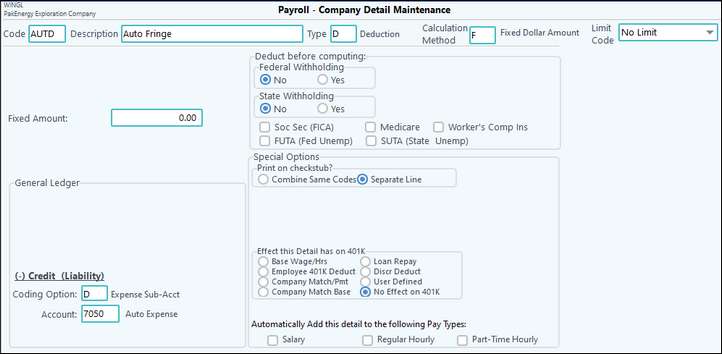

Next you will set up the Deduction Detail code with the proper switches selected:

Add both detail codes to the employee - run through the payroll cycle. This will calculate taxes on the Earnings fringe benefit. Then use the deduction to offset the Earnings codes. This will leave the balance that the employee owes to the company for the taxes. The company can either absorb that balance or charge back to a Receivable account to be deducted from the employee's regular pay cycle. They may also run through with a regular payroll cycle and have the taxes calculated with fringe benefits along with regular payroll.

NOTE: If this is for you to capture earnings only, then don't use the Deduction Detail code. This process can be used throughout the year to capture costs or at year end.