Deduction “D” Calculation Method

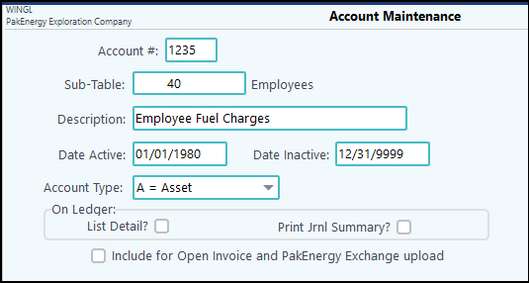

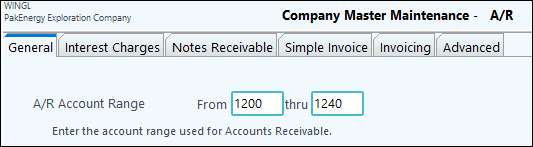

1.Create accounts to be used. These accounts must be in the A/R range - they cannot be a Rev/Bill account. They must also use Employee Sub-Table. The range can be found in Accounts Receivable > Master File Maintenance > Company AR Options. For this example I set up 1235 and 1240.

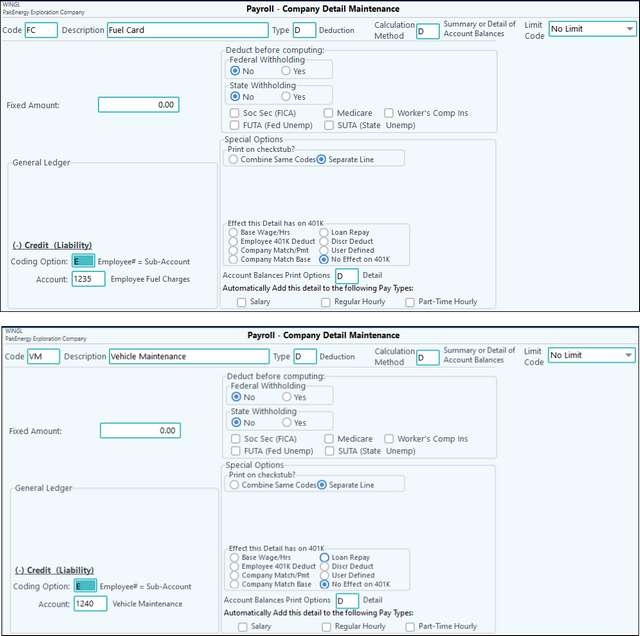

2.Create Deduction Code. Coding Option must be “E” so it’s grayed out. Have option to print Account Balance – either Summary (one line with total) or Detail (line per entry).

Examples:

3.Add codes to employee. Leave the Fixed Amount as $0. Unlike the "B" Calculation Method, the system will not limit the amount pulled into each pay cycle.

4.Enter in charges to the A/R Account either through A/P or Journal Entries.

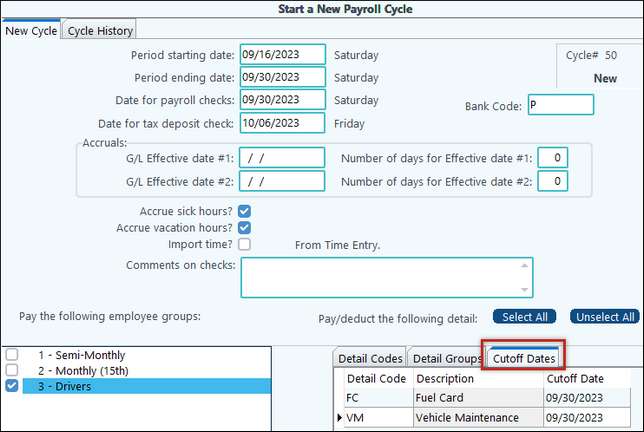

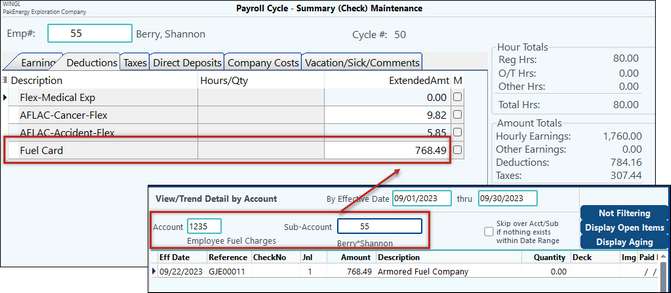

5.Start your cycle. There is a new tab “Cuttoff Dates” where you can limit what entries will pull into the cycle. NOTE: When time is being imported from First Purchaser, the dates will default to be the latest ticket date on the tickets pulling into the cycle. Otherwise, it will default to the Period Ending Date of the cycle.

6.Review the employee’s earnings/deductions. Notice only the charges before the cutoff date pulled in. If deductions are more than earnings you will either need to create an earnings code to advance them enough pay to cover it.

7.On the stub you will see the amount being deduction.

8.There are new reports under Payroll Review.

•The Detail Report should show the summary or detail of the deduction(s). There will be one page per employee.

•The Driver Pmt Report is tied to First Purchaser.

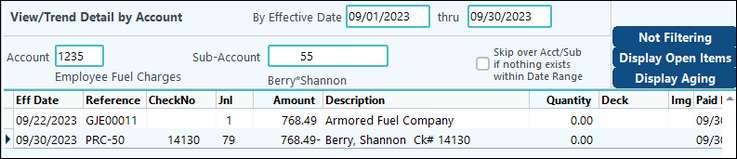

9.Once the cycle is posted (1) a journal entry will post into the A/R account and (2) a paid date will be put on the entry in the RB Extract field.

10.There are new reports in Payroll > Reports > Historical tab > H-18 Historical Statements.