Sliding Scale Overtime: To use a sliding scale overtime (computing overtime for salaried employees on a sliding scale basis), you must have the company option "Sliding Scale Overtime" checked. The employee must not have an hourly rate, and must have some type of salary amount set up. The overtime amount is computed as follows for sliding scale employees: An Overtime factor of ".5" will correspond half time and a "1" will correspond to Double time.

Half Time Formula:

Rate=Salary / ( (2080 / #pay periods) + OT Hours)

(Rate/2)*OT Hours = Earnings

Double Time Formula:

Rate=Salary / ( (2080 / #pay periods) + OT Hours)

(Rate*2)*OT Hours = Earnings

This is done in accordance with the U.S. Department of Labor's Wage & Hour Division form WH-134 (Rev. May, 1980).

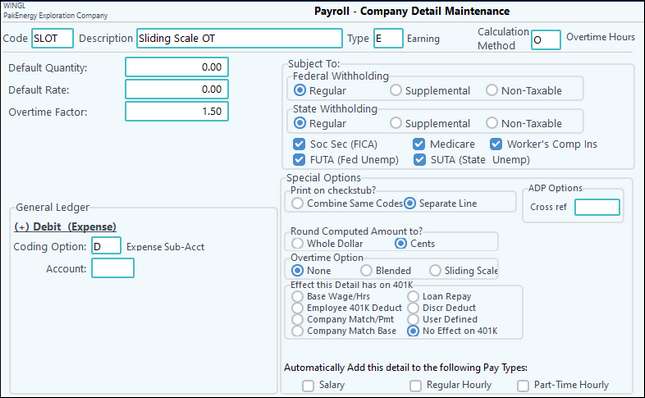

| 1. | Set up a earnings pay detail for sliding scale overtime for the company as a whole at Master file maintenance > Basic Options > Pay Detail Tab. |

|

| 2. | Start a Payroll cycle. On the Pay Summary screen, find the employee to add the overtime hours. Click on Add, and add new detail for this employee. Add the Sliding scale detail, and enter the amount of OT hours. Make sure the Manual Override of extended amount is off so that the system will automatically calculate the amount. |