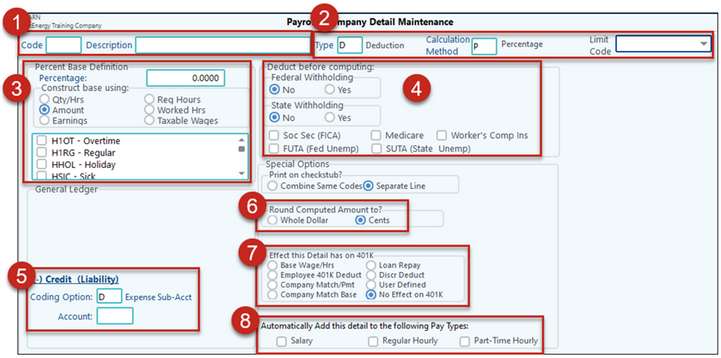

This is an example of a deduction screen.

The Deduction Code has some similarities to the Earning Code.

1.The Code and Description will work like Sub-Account Maintenance. Enter in your code and description to easily identify the Detail Code.

2.The Type and Calculation Method will determine how the code will “work”.

3.In the Earning Code section there was a Fixed Amount example, this time I want to show you the Percent option. There are so many options here because Pak Accounting wants to know exactly “what” to take a percentage from.

4.The taxes section is where you can select if an item is pre-tax or not. “Deducting before Computing” means – do you want to deduct this amount/detail code from the gross earnings before computing the tax; therefore, reducing your tax base. You will need to consult with your CPA on if an item is eligible to be pre-tax or not.

5.Typically, a deduction is a Liability because the money being taken from an employee’s check is NOT income to the company, rather, is being collected to pay another 3rd party such as an insurance company. There are 2 ways to handle this:

a.Code this directly to an A/P account so that an invoice will be created when the PR cycle is posted. This is nice since the invoices created should match the bill received from the vendor. If it doesn’t, then any mistakes can be caught right away.

b.Code to a Liability account. Then you will need to manually create an A/P invoice when you are ready to pay the vendor. However, you will need to make sure to code to the same Liability account as Payroll. Also, you will want to audit the liability account periodically to make sure everything clears out.

6.Since I selected “Percentage” a field will open up asking how I want to round my figures.

7.How will this code affect the 401(k), if applicable?

8.Last, which group do you want to add this code to? Be selective. For example, if part-time employees are not offered insurance, you would not want to automatically add that Detail Code to that group.

Detail Maintenance |

|

|---|---|

Description |

Describe the detail number item. |

Type |

D - Deduction will be subtracted to calculate net pay. |

Calculation Method |

Determine how the detail amount is calculated. (Options may vary depending on the Detail Item chosen above): B - Balance of G/L Account D - Summary or Detail of Account Balances. Very similar to the B record. This calculation method is typically used with the First Purchaser module since it allows for additional reporting. F - Fixed dollar amount P - Percentage of earnings. If P is selected, then you will be prompted to enter the field "Construct Base Using" to determine a percentage of what amount(s). N - Rate (Non hours) |

For each of your various Deduction detail codes, set the “Limit Code”:

•Child Support – Child Support Deduction itself. Selection of this option will cause the employee deduction screen to change in order to gather more information about the deduction. •CS Fee – Child Support Fee – Employers can in most states elect to charge some limited fees for deducting and paying of child support. Most employers don’t. Deduction amount counts toward CCPA limit. •Tax Levy – based on start date - If prior to a child support deduction, deduction itself is not subject to CCPA limit, but Tax Lien amount counts toward maximum deduct for CCPA purposes. •Federal Agency Debt - Limit 15% current detail or disposable earnings over (or the amount by which the employee’s disposable pay exceeds 30 times the federal minimum hourly wage then in effect), limit 25% all CCPA deductions (Federal agency debt collection, student loans) •Limit to 25% DI – General wage garnishment, wage attachment or income execution (all court ordered). The maximum amount of an employee’s “disposable income” that can be garnished to repay a debt is the lesser of: 25% of the employee’s disposable earnings for the week; or the amount by which the employee’s disposable pay exceeds 30 times the federal minimum hourly wage then in effect. oNote: some state laws may limit this even more. oIf more than one, deducted up to the limit in the sequence they are received in. •Min Wage Limit – Example: goods and services connected with employment, such as tools, required uniforms, and company-provided security – can only be deducted such that they don’t bring the employee’s wages below the minimum wage. Repayment of principal amount on loans, salary advances, and/or overpayments deducted, are not subject to a limit, but any interest or administrative costs are subject to the minimum. Penalty due to lateness (docked beyond just the time lost), cash shortages, etc. •No limit – generally limited to the net amount of the check (unless you have permission & process for the employee to pay you back. Payroll does permit negative ACH deposits): oBankruptcy – generally ceases all other garnishments (i.e. so there shouldn’t be both) except for child support. Child support comes first, then Bankruptcy deduction. Doesn’t appear to be any limits on bankruptcy deductions. oVoluntary deductions such as supplemental insurance, United Way, Employee A/R that isn’t a requirement of work and isn’t interest or profit oNote: Deductions that could be exceptions in some states: Union Dues, Nondiscretionary retirement contributions, Medical/Hospitalization Insurance, Disability Insurance, deductions required as a condition of employment |

|

Subject To:

On deductions, if the deduction amount is be subtracted from the taxable earnings before the tax is computed, then check the option. If the amount of the deduction does not affect the amount of the tax, then do not check the option. |

|

Federal Withholding: And State Withholding* |

This option will determine if an item is considered pre-taxed or not. No - Don't subtract the deduction before calculating Fed Withholding (most items fall under this option). Yes - If the detail item is a tax-deferred item (401k, etc), Subtract this item before calculating Fed Withholding |

Soc Sec/Med*: |

Off - Deductions should not be checked unless the detail item represents a deduction that should be subtracted from FICA-taxable wages. ON - Subtract this deduction before calculating - taxable wages. |

Fed unemp wages*: |

Off - Deductions should not be checked unless the detail item represents a deduction that should be subtracted from FUTA - taxable wages. ON - Subtract this deduction before calculating - taxable wages. |

State unemp wages*: |

Off - Deductions should not be checked unless the detail item represents a deduction that should be subtracted from wages subject to state unemployment taxes. ON - Subtract this item before calculating state unemployment wages. |

Fixed Amount |

If the Fixed Dollar amount is selected under Calculation Method the system will prompt for Fixed amount to be added or deducted each paycheck. |

Percentage Base Definition |

If the Percentage Method is selected under Calculation Method the system will prompt for Percent Base Definition. The Percentage Box allows you to enter the percent to be used. The Construct base using: Quantity/Hours or Amount, allows you to set the base for the percentage. The next box will contain all Detail Maintenance set up and allows you to check which maintenance you want to be the base of the percentage. |

* NOTE: |

If the Deduction is "Pre-Tax", the tax options would be selected or set to "Yes". Normal deductions are all set to "N" or not selected. |

Ledger (-) Credit (Liability) - Deductions |

|

Coding Option: |

E – Employee # = Sub-Account D – Expense Sub-Account F – Fixed: Use Account/Sub-Account in this record |

Account |

Used by the system to record the liability for the deduction or company cost; for example, Insurance Payable. |

Special Options |

|

Print on checkstub? |

Combine Same Codes – check if you want to combine same codes into one line item on the checkstub. Separate Lines – check if you want each code printed separately on the checkstub. |

Round Amount? |

Check how you want rounding, either by Whole Dollar or by Cents. |

A/P invoice entry by: |

An option only if you coded the Liability to the A/P account. There are three options to choose from: •Deduction: Entry to be as one deduction for the total payroll run. •Employee: Entry listed by each employee. •Employee w/SSN: Enty listed by each employee with SSN. Also, determines what prints on the payroll check stub detail. For example, one child support check may have multiple employees, set the invoice entry to be by employee and the stub will print each employees deduction. Another example, a 401K check to the bank, you may not want to list each employee, so set the invoice entry to be by Deduction and the lump sum will print on the stub detail. |

Effect this detail has on 401K |

Check how this detail item effects the 401K deduction. Options are: Base Wage/Hours (earnings), Employee Deduct (employee 401K deduction), Company Match/pmt (Company portion), Company Match Base (separate 401K amount that is then subtracted from the calculated 401K company cost) Loan Repay (deduction for repayment of 401K loan), Discr deduct, User Defined and No effect on 401K/ |

Automatically Add this detail to employee groups: |

Pick all the detail groups the detail item is applicable. You can select more than one. The detail code will automatically add to the employee as a new employee is set up in that employee group. It will also be added to any existing employee in that group. |