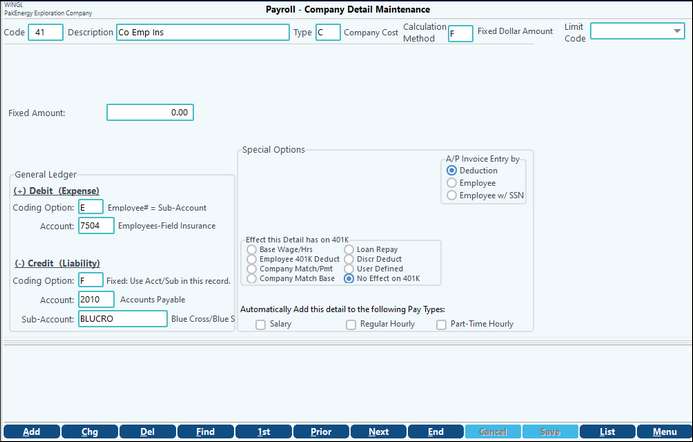

Company costs are ways you can track employee expenses of the company that do NOT AFFECT the net pay of the employee. A great example of a company cost that many companies need to track is company provided health insurance. These costs can be “accrued” to the proper department through the payroll cycle each payroll and automatically sent to A/P for payment (or to an “accrued” liability account).

Since this is a cost to the employer and a 3rd party company will need to be paid, this Detail Code will require both an Expense Account and a Liability Account.

If using an A/P account in the Credit/Liability section a new box will appear called A/P Invoice Entry by. This field will determine what information is in the Invoice Description. This description will print on the check stub when the invoices are paid, in the View/Trend description field, and anywhere the description would print on a report.

Also see: Using Company Costs to Track Expenses

Detail Maintenance |

|

|---|---|

Description |

Describe the detail number item. |

Type |

C - Company Cost is ignored when calculating net pay. |

Calculation Method |

F – Fixed dollar amount P - Percentage of earnings. The percentage is based on total earnings. If P is selected, the system will prompt for “which percentage rate”. N – Rate (Non hours) K - Company’s matching portion of 401(k) account. Has no effect on employee’s check, but must be entered to properly calculate company costs. |

General Ledger (+) Debit (Expense) |

|

Coding Option: Exp. Sub-Account |

E - Employee Number D - Expense Sub-Account as coded on the employee's master (dept) A - Reallocate expense using this Account + Earnings Sub-Account. If earnings are allocated, the allocation is based on the total hourly earnings and any lower numbered detail items. (i.e. as appears on the Payroll Register report.) F – Fixed: Use Account/Sub-Account in this record U - Acct # from Accrual Accts + Alloc Sub V - Acct # from Accrual Accts + Alloc Sub W - Acct # from Accrual Accts + Alloc Sub X - Acct # from Accrual Accts + Alloc Sub L - List of Acct/Sub |

Account |

(1 to 4 digit number) representing the account the expense is to be posted to: Salaries Expense, etc. |

General Ledger (-) Credit (Liability) |

|

Coding Option: |

E – Employee # = Sub-Account D – Expense Sub-Account F – Fixed: Use Account/Sub-Account in this record |

Account |

Used by the system to record the liability for the deduction or company cost; for example, Insurance Payable. |

Special Options |

|

Round Amount? |

Check how you want rounding, either by Whole Dollar or by Cents. |

Effect this detail has on 401K |

Check how this detail item effects the 401K deduction. Options are: Base Wage/Hours (earnings), Employee Deduct (employee 401K deduction), Company match/pmt (Company portion), Company Match Base (separate 401K amount that is then subtracted from the calculated 401K company cost) Loan Repay (deduction for repayment of 401K loan), Discr deduct, User Defined and No effect on 401K/ |

Automatically Add this detail to employee groups: |

Pick all the detail groups the detail item is applicable. You can select more than one. The detail code will automatically add to the employee as a new employee is set up in that employee group. |