Employee Reimbursements via Payroll Cycle

Example: Paying Medical flex reimbursement via payroll.

| 1. | Set up a new Payable account called “Expense Reimbursement. Assign Sub-Table 40 (employees) to this account. |

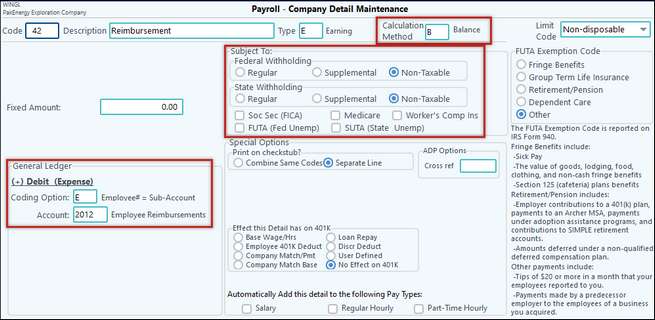

| 2. | Set up a company detail code for the reimbursement with a calculation method of ‘B’. Note that all “Subject To:” taxes are “None” and all other tax/accrual deductions have been unselected. Also, the expense account is the new payable account. Set the Coding option to “E” for table 40 (employee). |

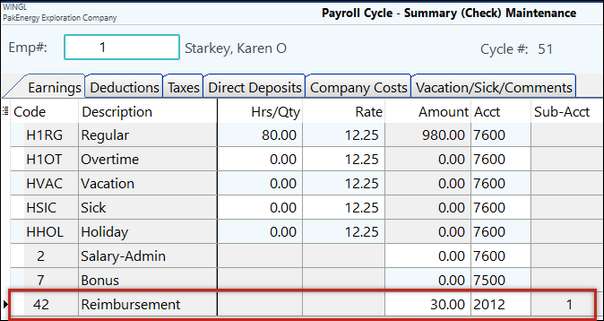

| 3. | Add the detail code to the employee level. |

4.When an employee turns in a flex reimbursement request, record the Flex reimbursement request through normal A/P procedures (i.e. Enter Invoices to Pay), instead of coding it the normal A/P account, record to the special purpose A/P account. Our example uses account 2012 – “Employee Reimbursement” that we set up in step 1. Use the employee # as the vendor. The “expense” coding for the A/P entry will continue to be coded to the 2180-Flex Medical Payable (with employee # as the Sub-Account.)

| 5. | Next time you run a Payroll, the employee will automatically get paid for all the reimbursement(s) posted at the time of the payroll. It will show on their check stub in the “earning” section and will have the description “Reimbursement.” |