To setup Tips in Payroll:

| 1. | On the Payroll / Master File Maintenance / Basic Options / Pay Detail Tab, setup a deduction detail for tips. |

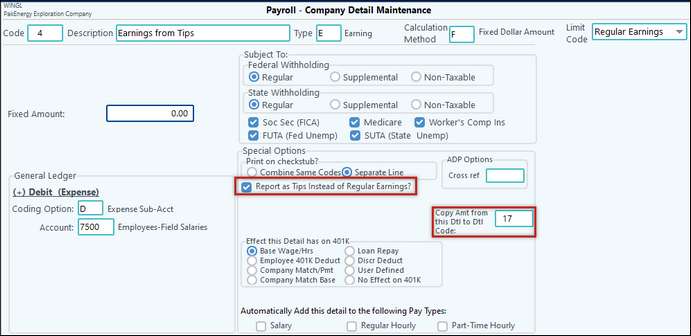

| 2. | On the Payroll / Master File Maintenance / Basic Options/ Pay Detail Tab, setup an earnings detail for tips. Note: If employees might have the possibility to not meet minimum wage requirements. Also, setup an earnings detail for Other earning, to allow you to enter additional pay to meet minimum wage. |

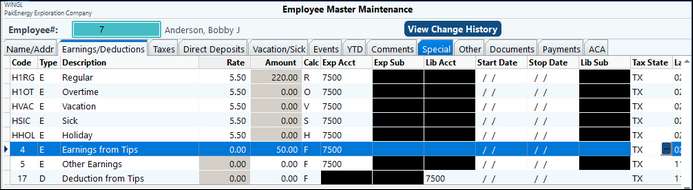

| 3. | On the Employee/Check Maint > Employee Master Screen, enter the Tip earning and deduction details on applicable employees. |

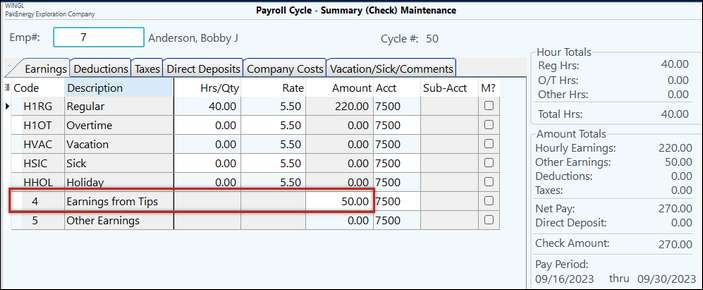

| 4. | Start a Payroll cycle following normal procedures. On the Pay Summary Maintenance screen, enter the tip earnings for each employee. When you enter the tip earnings the deduction amount is automatically copied, you do not have to enter the amount in. |

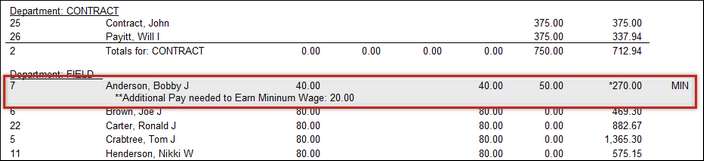

| 5. | Print the Hours Proof list to verify that all employees meet minimum wage requirements. An error message will print on the Hours Proof list is an employee does not meet the minimum. You add the additional pay on the pay summary maintenance / Other earnings. |

| 6. | Finish the payroll cycle as normal. |