When the Account number is not enough to code an entry, then the Sub-Account is used to further code the entry. For example, if we have some accounts that need to be broken down between locations (Abilene, Austin, or Dallas), then we would define a Sub-Table to define this group. It is the “glue” that works behinds the scenes that defines which account(s) require a Sub-Account from this group to be coded when that account is used, and it is a “container” or way to group the Sub-Accounts together. Accounts can either have a Sub-Table associated with them or not. If they have a Sub-Table, then any coding done requires a Sub-Account from that Sub-Table to also be coded. If they don’t have a Sub-Table associated with them, then they won’t have a Sub-Account coded at all (i.e. system automatically skips that field). On accounts such as Accounts Payable and Accounts Receivable, where the amounts need to be broken down by Vendors and Owners respectively, Pak Accounting uses the Sub-Account field to do this breakdown. Typically, a separate Sub-Table is used for each (Vendors in Sub-Table 20, and Owners in Sub-Table 101). On the other hand, most companies will typically have 1 to 3 cash accounts. In this environment, cash accounts typically will not have a Sub-Table associated with them. An exception may be companies that have a hundred different cash accounts will probably want to setup one Account and then associate it with a Sub-Table that then identifies each bank account Each Sub-Table will contain one or more Sub-Accounts. Sub-Accounts code itself can be numeric or alphanumeric (mixture of letters and/or numbers). Sub-Accounts can be up to 10 characters long and the Sub-Account code can be setup in different Sub-Tables and mean something different depending on the Sub-Table. Depending on the type of Sub-Table, sometimes it is advantageous to use alpha characters as the Sub-Account code. This is a common practice when setting up companies and individuals such as setting up vendors, customers and owners. The more consistent that you are in defining the Sub-Account code, the easier it is for others to code items without having to memorize long lists of things. A common example could be a coding scheme that is made up of 3 characters of the last name followed immediately with 3 characters of the first name. For example: ADAJOS - Joshua Adams, GUTALI - Alice Gutters, SMIBET-Betty Smith, HAIMAR - Mark Hailed Just as a Cash Account is usually setup without a Sub-Table, the Accounts Receivable is just the opposite and is always associated with a Sub-Table. Even small companies want to have more than one customer! In our example, Account “1210 A/R-Customers” will be associated with Sub-Table 10, and Sub-Table 10 will contain Customers. So the four Sub-Accounts above - ADAJOS, GUTALI, SMIBET, and HAIMAR - would be associated with Sub-Table 10 - Customers. The coding of an entry to Accounts Receivable for Betty Smith would be 1210-SMIBET. If you weren’t sure which Smith it should be coded to, there is an easy way of getting a list of possible values by keying in “SMI?” By pressing the /? Key, a lookup window will pop-up and start with displaying the Sub-Accounts that start with SMI. Once the Accounts are defined (see Account Maintenance), and Sub-Table added or changed (see Sub-Table Maintenance), the Sub-Accounts can be entered using the [F12] hotkey. Sub-Accounts are logical sub-divisions of accounts. For example, rather that have a separate Accounts Receivable account for each customer who buys from the company, you could have one A/R account, with Sub-Accounts that represent the individual customers.

There are many places within Pak Accounting that an individual or company’s name and address fields are used for several important functions including: •Billing/AFE •Payments/Checks •Correspondence to owners, vendors, or customers •1099-MISC/1042 reporting •Escheat/Unclaimed Property reporting •Various internal reports

|

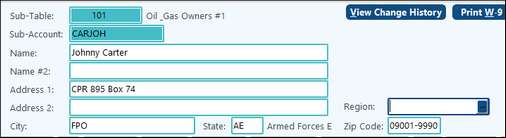

To enter a new Sub-Account select "Add" in Sub-Account Maintenance.

Sub-Table |

The Sub-Table that will contain the Sub-Account |

||

Sub-Account |

Enter the Sub-Account's 6-10 character (default) alphanumeric code. To change the character code length, select the option in Company Maintenance. Also see our Training Video General Ledger/Sub-Account/Mass Changing Sub-Account Codes. The following 7 characters are invalid ' * / ? ; ( ) |

||

Name |

Only enter in one name. If 2 names are on the account, use the NAME #2 field. Do not use any punctuation or abbreviate the first word of a company’s name. Not only is punctuation discouraged at the post office, it is typically not allowed on the 1099 or Unclaimed Property files. On internal reports, names will print as they are entered into the Name field. For this reason, you may want to consider entering in the name using the LastName*FirstName method. The name field can be up to 40 characters long. However, some reports have limited space and cannot print the entire 40 character name. In those cases, the name would be cut off. If the name has been entered in using the previously mentioned method, then at least the last name would show on the report. •When using: LastName*FirstName*Suffix •Any prefix/title or middle name should be entered as part of the first name •The Suffix is optional •When printing items going to the individual, the names will get “normalized”. The asterisks will be removed and the names will be put in correct order. However, on any internal reports the name will show as it is entered. Example: Sir John Z Doe Jr would be entered as Doe*Sir John Z*Jr Note: See Special Considerations for Escheat for more information on setting up names. |

||

The Name #2 field does not have to be populated. This field should only list out a second name or an additional owner, as applicable. If not needed for an additional name, leave it blank. This is especially important for the 1099 and Unclaimed Property processes which need to list additional owners separately. Do not use the “*” in Name #2 as suggested for the Name field. •Use the wording "or/and/&" at the end of the Name field or the beginning of Name #2 field for Pak Accounting to identify two separate individuals. Otherwise, Pak Accounting will assume that it is a continuation of the Name field.

•Using any form of “Account of” in either the end of the Name field or the beginning of the Name #2 field will cause the Name and Name 2 fields to flip within the 1099 and Unclaimed Property processes. Example: City Bank Acct of City Bank Acct City Bank Account of Will Print as: |

|||

Address |

The address fields can be up to 40 characters long; however, the United State Postal Service (USPS) recommends a maximum of 30 characters. Based off the Postal Services rules, here are some recommendations from Pak Accounting: •Do not use periods. •If using the # sign, there must be a space between the sign and the following number. Example: 425 Flower Blvd # 72 •If lines are not needed, don’t use them. If these lines are blank they will be omitted when printing. For example: if you have an items such as STE 400, put that in Address Line 1 and do not put on a separate line. •If dual addresses are used, place the intended deliver address on the line immediately above the city, state, and Zip. Normally, this is the Post Office Box address. The other address must be placed on a separate line above the Delivery Address Line. •The Attention Line is place above the Recipient Line, that is, above the name of the firm to which the mail piece is directed. Example: Attn John Doe ABC Company 1401 Main St Abilene, TX 79602 •Military Addresses:

•Common abbreviations from USPS Pub 28

•Also see: Entering International Addresses |

||

Region |

Region can be used for location, area, region, etc. This will allow users to setup Financial Groups by this field. This field looks at the Region Sub-Table found in General Ledger - Master File Maintenance - Company Maintenance - Company - Financial Reporting tab - Advanced tab - Region Sub-Table field. |

||

View Change History button |

Shows changes made to the owner's Sub-Account Maintenance. |

||

Print W-9 Letter button |

Clicking on this box will print a W-9 letter a cover letter to the printer or to a PDF file. See Sub-Table Maintenance on how to add notes to the cover letter. Box 7 of the W-9 will populate with the Company Code, Owner Sub-Table, AR account number, and Sub-Account code to help you easily identify upon return. |

TECH TIP:

•If you add City, State, and Zip on Address line 2 instead of in proper fields the A/R statement will print USA.

•The system will not allow the possibility of the Master Record to be deleted if documents are associated with it. The record can be made inactive on the Active Dates tab. In addition, If a Sub-Account has prior activity (transactions). Pak Accounting will prevent the deletion of the Sub-Account. The system will provide a warning that transactions exist and must be recoded to delete the Account or that the Sub-Account can be made inactive.

![]() Special Considerations for Escheat

Special Considerations for Escheat

•The Additional Owner Name Info tab in Unclaimed Property Reporting > 52 Owner Maintenance will not appear unless the Name #2 field is set correctly. Please see the section for Name #2 field for more information. •If the Name or Name #2 field does not contain Or/And/& as stated in the Name #2 instructions, then it will be assumed that the field is part of the Address and will print accordingly. •Owners with a Tax Class of Individual/Sole Propriety and include the following keywords in the Name field will be reported as a Company. Company names will show in the Last Name field.

Notes tab – check box “Contacted”. The contacted box triggers a time/date stamp note for the user to create a notation in regards to what form of contact was made with the owner. If the “Contacted” box is not check marked, the note will not trigger a restart of the dormancy period. The note will just serve for informational purposes. Any “Contacted” check boxes during the dormancy period triggers a restart on the dormancy period for that particular owner, meaning they would not be escheated in the current escheat process. |

See A/P Options Tab

See A/P Coding Tab

Record the insurance information for vendors, sub-contractors, and/or vehicles. Also, use the "Print Insurance Letter" to print a letter to your sub-contractors requesting insurance certificates. CGL (Commercial General Liability) coding allows you to code contract labor vendors as Contract or Service. The Checks by Payee listing in Bank Reconciliation can be printed based on the coding. A listing of Sub-Accounts with expired insurance can be printed in A/P/Reports / Insurance Reports. |

See A/R Options Tab

Enter the ACH information per Sub-Account (owners, vendors, etc) on the ACH tab. ACH files can be generated for checking, savings. loan payments, and bank GL type transactions.

NOTE: The Special Instructions fields are memo fields for notes.

|

Record the contact information for the vendor or customer. Users that are added are considered active. Right-clicking on the user provides the option to deactivate a user if necessary. If the user is deactivated, they will not appear on any lookups or reporting that provides contact information.

• Note: The Email field is validated for a proper email address.

•Comments: Any comments are contained here and do not print on any reports.

•Statement Email: Enter an email address for this customer in order to send an A/R statement by email. If sending to multiple email addresses enter a semi-colon (;) after each email address. See A/R statements. This field is also used for GL ACH statements that are being emailed as well.

•A/R Statement - Attn: Entering a name on this line will print an attention line on the A/R statement. This will help you direct the statement to the correct individual at a company. |

If the Sub-Account belongs to a group, then the groups associated with the Sub-Account will be displayed. See Financial Summary Groups. Note: If the check box option to print the property information on property level reports only is checked, then when running financial reports at the group level, the property information will print only on the individual property reports and not on the group total report. |

Set the Sub-Account as active or inactive by setting the dates. NOTE: If a vendor is no longer used, do NOT delete the vendor so you can keep the history. Mark the vendor inactive by entering an inactive date. The vendor will no longer show up on reports. NOTE: To make a Sub-Account active when it was previously inactive, enter 12/31/9999 in the Property Inactive Date on the Company Options tab in Property Maintenance. |

Enter any date sensitive notes related to the Sub-Account. Click on the "+" sign in the middle of the screen to access the field in which to add the note. Click on the "check mark" button in order to save the note when finished. This tab also contains a check box for "Contacted." This allows you to indicate whether contact has been made with the customer/vendor or owner and will be associated with a note entry that is date and time stamped. This is used with the Unclaimed Property process. Any Contacted check boxes during the dormancy period triggers a restart on the dormancy period for that particular owner, meaning they would not be escheated in the current escheat process. List gives the ability to filter Notes to Print Associated Docs, see All, Yes-Checked or No-Unchecked. |

Pak Accounting’s scanning option gives the user the ability to scan documents with any Sub-Account defined in Sub-Account maintenance. An unlimited number of documents can be stored for each Sub-Account as Documents, Pictures, or a W-9. When a W-9 is scanned on the Documents tab, a box called "Has W-9" will be checked on the A/P Options tab to alert you that the W-9 exists and has been scanned for this vendor. A user provided name for each document (one or more pages) provides for a great deal of flexibility and for easy retrieval. Some examples would be:

1)Accounts Payable – vendor contracts 2)Accounts Receivable – customer information - written changes of address or other pertinent information explicit to one particular customer 3)Payroll – employee information - all entrance and exit forms such as Drivers License, Social Security Card, Application, Resume, Letter of Accommodations, Signed Authority for Payroll deduction 4)Leases – Contracts with land owners, maps

Sub-Account Maintenance has an “A/P Invoice Scan Setting” and “Duplex Options”. These settings are used when scanning in accounts payable invoices. There is no need to change them on this screen. If you change the scan settings when scanning an invoice, the system will automatically “remember” the new setting for that Vendor. For example, if a vendor has invoices with detail on both sides, but has preprinted verbiage on the back you don’t want scanned. Then before scanning the invoice, override the “Auto-Detect” Duplex Option with the “1 Sided” setting. In the future this vendor’s custom setting will be remembered. The "Global Default" option points back to the settings that were selected for scanning in the Utilities Module > Global > #96-Default Scan Settings. See also Scanning Master Documents. |

The fees tab is used in Revenue/Billing and is only visible on the Owner Sub-Table. Also see: Check Fee. |

List See: Listing and Labels, Sub-Account Views

Also See: Sub-Account Utilities and Owner Maintenance.