Set up the ACH tab in Bank account maintenance if you are using the GL ACH or Revenue ACH add on module. All information, except the Cash/Journal, should be provided by your bank.

*Note: This setup is not for Payroll. Please see Payroll ACH.

Cash: Jrnl |

Enter your company's Journal to use to record the entries during the update (we recommend that you create a separate Journal for ACH). |

|---|---|

Create separate G/L entries |

Check to create a separate entry for each transaction in the cash account, unchecked creates a lump sum entry. |

Immediate Destination: |

Name and routing number of the Federal Reserve that your bank is transmitting the entries to. |

Immediate Origin: |

Name and routing number of the bank you are transmitting to. |

Originating DFI |

Defaults to Immediate origin Routing #, enter optional DFI (Depository Financial Institution) origin if required. This number must be 9 digits. |

Number of Days Required for prenote |

The bank will provide this information. Enter the number of days in advance that a prenote file must precede a "live entry" file. If left at 0 the system will not generate a Prenote file. |

Account Information: |

Your bank should provide this information. The PPD files are ACH's to employees and the CCD files are for business to business which includes payments for Child Support. The name is a shorter version of what you want to appear on the employee's deposit transaction. Check with your bank for more information. |

ACH Transmittal Sheet Fax Phone # |

Enter the phone number which you want printed on the ACH transmittal sheet |

Add CR/LF after each record? |

If bank requires a carriage return or separate live entry per ACH record, then check this box. CR = Carriage Return LF=Line Feed |

ACH File Type |

Select NACHA which is the standard type of file for most banks on CSX. NACHA2 is also available if your bank requires CCD and PPD transactions to be in separate files. CSV is also an available option. |

Payment Bank |

This is the bank code of the account your funds will be coming out of. This must be set up in the Bank Master Maintenance screen that is on the ACH Direct Deposit Menu. If this is left blank, the system will create only employee deposit entries without a company payment entry. |

Payment Account |

This is the numeric bank account number the funds are coming out of (optional). |

Account Type |

C = Checking Account or DDA, S = Savings Account. |

Optional Login |

Rarely Used - for companies whose banks require a specific header record on the direct deposit file. |

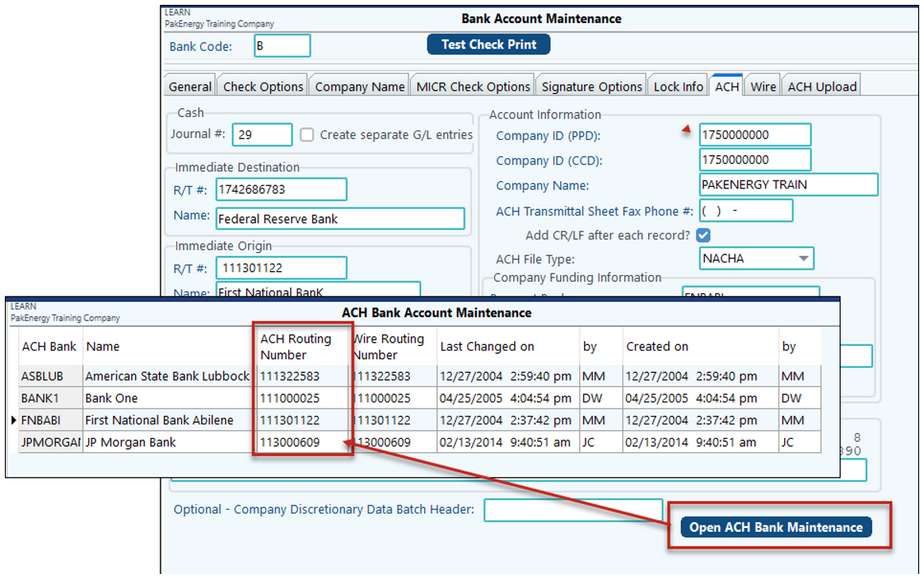

Open ACH Bank Maintenance

ACH bank accounts must be set up in order to use the G/L ACH module. All banks (your company's and all customer's) account are setup here.

•Enter identifying code for the bank being set up. This code will be used for ACH transactions only and should not be confused with Sub-Account or Bank codes.

•Enter the bank name

•Enter the routing number for that bank.

NOTE: Many credit unions will use a different routing/transit number for direct deposit vs. what is encoded on their checks. It would be a good idea to call the credit union to verify the number.