Overview

The purpose of Pak Accounting's Severance Tax feature is to allow specific severance taxes to be calculated and deducted from revenue distribution items entered from Check Stub. This will handle the situation where the first purchaser does not deduct the severance taxes but you are still required to do so. This is NOT a severance tax reporting feature in that Pak Accounting does not create the reports sent to your specific state agency. Special features of the calculations:

1.Calculates and combines multiple taxes (production, conservation, ad valorem, etc.) for a specific property.

2.Calculates taxes on variables based on ownership type, product type, specific periods of times.

3.Calculates taxes on various basis of tax (gross, net, volumes).

4.Specific calculated taxes are to be displayed as separate taxes on the revenue distribution record reported to your revenue owners.

5.Creates general ledger entries to record the liabilities to any severance tax payables accounts the user desires and includes an audit trail of which tax type and sequence number generated the specific tax amount.

6.Suspends the tax calculation on a revenue distribution item that already has taxes deducted by the first purchaser.

The automatic calculation occurs during the Revenue disbursement cycle at the Extract Entries menu option. To determine the results of the calculations, there are four basic "points of visibility" to which the user can refer:

1.The "Extract Revenue and Billing Entries Status Listing" during the extract give the company wide total of computed severance tax.

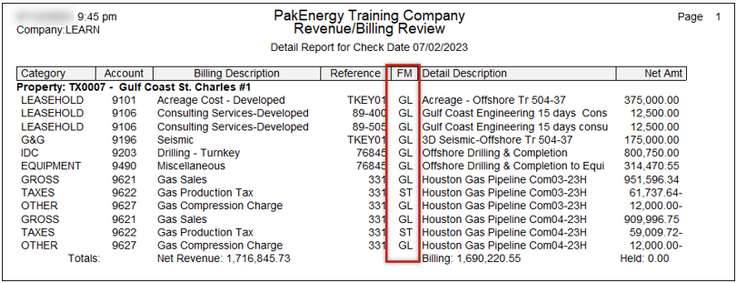

2.The listing accessed on the Distribute/Combine menu option ("List" button). Any transactions with a "From" (FM) status of "ST" is a system generated tax calculation. This gives you visibility at the distribution level.

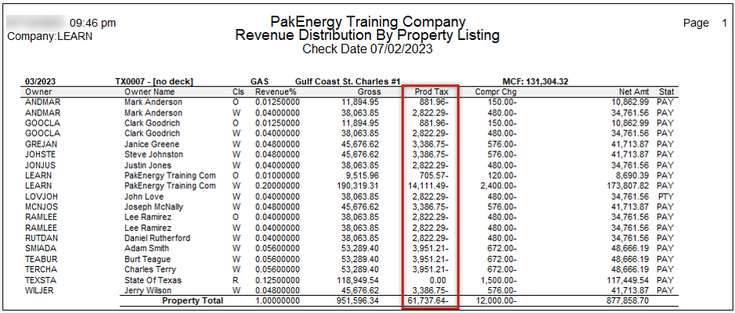

3.The Pre-Check Reports option – "Print Distribution by Property Listing" gives you the visibility at the property/owner level. The "Print Office Copy Listing" displays each tax as deducted. The After Check Reports – "Owner Copies report" displays the same information to the revenue owners.

4.The Journal Entries created when the Revenue/billing cycle is updated.

(In these entries, the description has been expanded to include an additional line containing:

•Property Sub-Account

•State

•Tax code

•Tax code sequence number

•Volume

•Gross Amount

•Tax basis amount - (This is used by the First Purchaser's system severance tax reporting)

Severance Tax Setup

There are four basic steps to create a system generated severance tax calculation:

1.Create the specific 100% Tax expense accounts in your chart of accounts. (See Severance Tax Acct Maint below).

2.Set up the Tax Rate Maintenance screen. (See Severance Tax Maintenance below).

3.Assign the Rate to a specific property. (See Severance Tax Property Maintenance below).

4.Extract the calculated entries as part of the Revenue Cycle. (See Severance Tax Calculation below).

The link between a tax calculation and a property is the unique Tax Code for that property in a specific state. Therefore, WY-1 is a different Rate Maintenance record than TX-1.

You can have multiple Tax Codes for a specific state. An example state where you may use this technique would be Wyoming where different counties have different ad-valorem rates.

Also, there can be multiple sequence numbers for a specific Tax Code. An example state where this technique may be used is Texas. Sequence 1 would calculate your gas tax on 7.5% (tax rate=.075) of the gross dollars and Sequence 2 would calculate the state cleanup fee of .0666% (tax rate=.000666) of the volume produced. The combination of the two Sequence numbers would constitute the tax calculation for that specific Tax Code. Another reason to have multiple sequences is if your tax rates change as of a specific date you can add another sequence for the new rate with the new date.

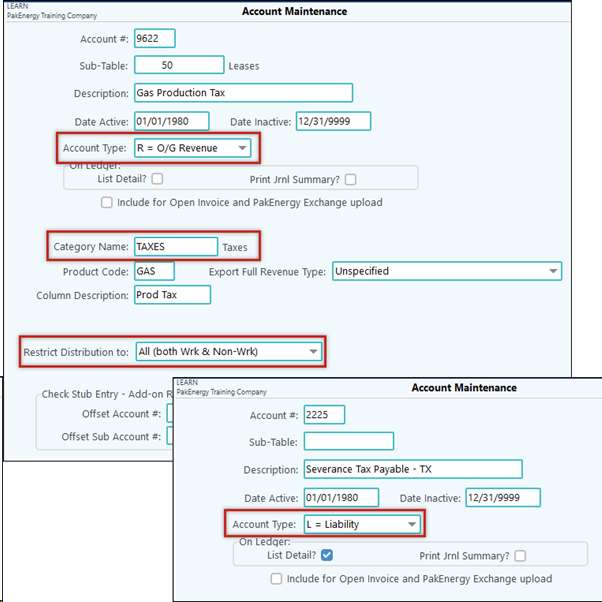

First Step: Account maintenance [F11]

Minimum of two accounts are needed to be set up. 1.Set up a separate account for each stub detail line on check. To make the accounts available to Revenue it must have an “Account Type” of “R” for Revenue, it must have a “Category Name” of “TAXES” and it must have the correct Product Code assigned. The “Applicable Interest Types” defaults to “A” for all (owners). Only change this switch if the tax is applied to Working or Non-Working (royalty) only. 2.Set up a separate Liability account for each governmental entity you are responsible to remit payments too. This account clears out when you make that payment.

Account numbers and descriptions – Pak Accounting recommends that you keep your account descriptions as generic as possible so that the accounts can be used by all states. The other alternative is to setup specific accounts for each state tax. |

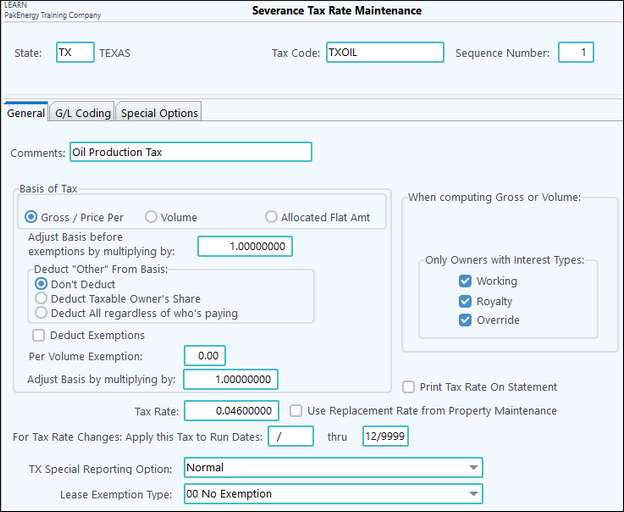

Second Step: Severance Tax Rate Maintenance

Set up the tax codes and sequence numbers for each state to compute the tax(es).

NOTES: •When using the Allocated Flat Amount on the General tab, enter in the Flat Dollar Amount (Typically WV Severance Tax uses this for tax credits). oThe Allocated Flat amount is to be used to issue a severance tax credit. oThe purpose is to calculate the full amount of the severance tax due with the first sequence and issue a credit with the second sequence. This can be used for any state. oRequired set-up: The severance tax code must contain at least 2 sequences. ▪Sequence 1: Must contain a valid tax to calculate during the Rev/Bill cycle. ▪Sequence 2: Should contain a credit in the form of a flat amount (for example 50.00-) This credit will reduce the amount of tax calculated in sequence 1 by the flat amount entered. If more than 1 property uses this severance tax code each property is subject to the full amount of the credit. (50.00- for each property so a total of 100.00-) ▪The amount to be credited in sequence 2 cannot be greater than the full amount of tax calculated in sequence 1. If the credit in sequence 2 is greater than the severance tax calculated in sequence 1, the system will not issue the difference as a credit. Instead, the system will calculate zero taxes.

•The cycle Update/Post process will include the number of wells when using the Second Rate option. 1. The sequence that the severance taxes are defined determines what is included in the basis of the allocation. If a type of severance tax shouldn’t be in the basis of the allocation, then assign it a sequence number that is greater than the Basis: Severance Record. 2. If a credit tax is being issued with this sequence, it will be limited to the basis amount. 3. The system will limit each allocation group to a single amount for this cycle. The allocation group is made up of the Property Master, State Code and Acquisition Code.

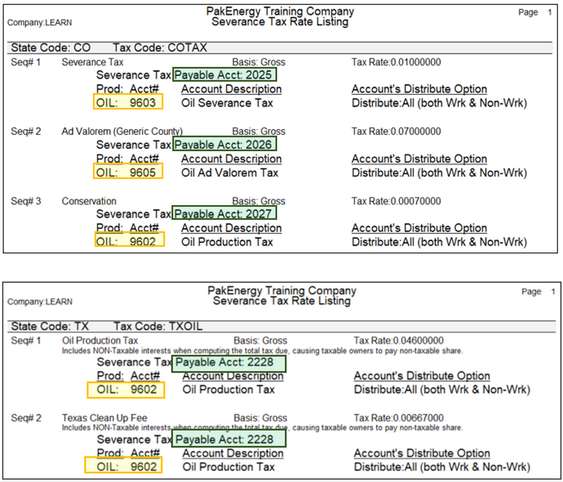

•Now that you are done with setting up your severance tax codes you can use the List button on the Severance Tax Rate Maintenance screen. This will allow you to see each tax code and each sequence, as well as it is set up.

For example, the CO Tax code: 1.All of the Revenue Tax Accounts are different accounts so that each tax will show as separate stub detail lines on checks. 2.The Severance Tax Payable Accounts are different accounts to allow for tracking Liabilities in separate G/L accounts so that you can balance your account per governmental entity. Where the TX code above is set up differently: 1.The Revenue Tax accounts are the same account for gas and will show up as one stub detail line on the check. 2.The Severance Tax Payable Account is also one account per State Severance Tax.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

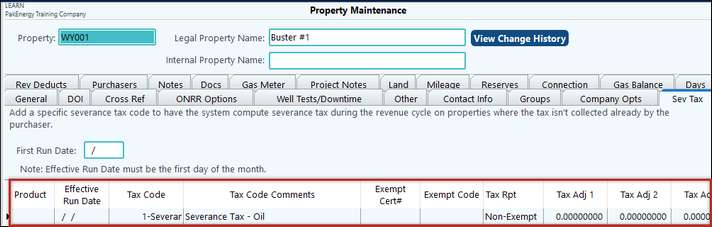

Third Step: Property Maintenance > Severance Tax tab

On the Property Maintenance for each property, enter the state on the General Tab, and on the Severance Tax Tab enter the Severance Tax Code to be used to calculate the tax. Sev Tax Tab

TECH TIP: Use the Effective Date only if you have any date sensitive tax needs, such as a property has an exempt certificate for 5 years then it becomes taxable. You are still liable for the “clean up fee” so you will need a tax code with just that one sequence.

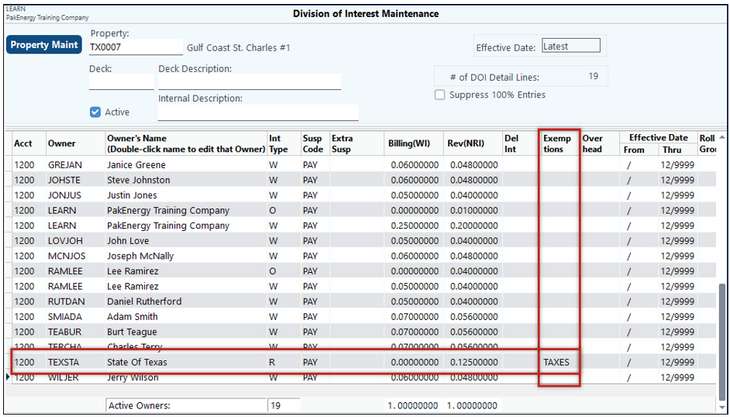

Special Situation – Tax Exempt Owner. To exempt a specific owner/owners from the severance tax calculation, enter "TAXES" in the exemption column of DOI Maintenance.

|

1.After you have Extracted your Revenue/Billing Cycle, on the Distribute/Combine menu item is a List button to view how the calculated the Severance Tax for each applicable property (Note: the “ST” in the From (FM) column below).

2.After you Distribute/Combine, on the Pre-Check Reports, Print Distribution by Property, you can see the Severance Tax calculation that is being netting out of the revenue check. This allows you to double check the calculation in addition to your exemptions.

3.Now that you have deducted the State Severance Taxes from the distributions how do you report and pay to the state? In the Revenue/Billing Module > Reports > Property Tab > Historical Distribution report will help you fill out your State Severance Tax reports. |

Also see:

•Training Videos under Revenue/Billing - Setup

•Severance Tax Error-No Accounts Have Been Defined for a Specific Product

•Texas Low Producing Oil Lease Severance Tax Credit