In recent years, states have begun to adopt laws requiring interest be paid to the owner for revenue held in suspense. State laws can vary so users can add individual states and requirements for that state.

The examples provided in this document will look at how Kansas and Oklahoma laws differ (Kansas Statute Chapter 55, Article 16, 55-1614 and Oklahoma Statutes Title 52. Oil and Gas §52-570.10). It is important to be informed in order to remain compliant with state statutes.

Maintaining these requirements are the user’s responsibility. The interest given to the owner is an expense to the company holding the owner’s suspense.

Once you complete the setup procedures, the Revenue/Billing cycle manages the interest calculations when the revenue is paid out. The cycle at the run date and the check date when that revenue is paid in order to determine how many months of interest is due. The system notes the interest transactions on the owner’s statement.

Interest Bearing Days

Both Kansas and Oklahoma share the same approach for determining interest bearing days where the sale date and the payment date are excluded as interest bearing days. NOTE: at the current time, the sale date is always recorded as the last day of a month but the payment date can occur on any day.

•Example: Sale Date is January 31 and Payment Date is April 10.

oThe interest bearing dates would fall between February 1 and April 9.

oThe dates between February 1 and April 9 are counted inclusively for a total of 68 interest bearing days.

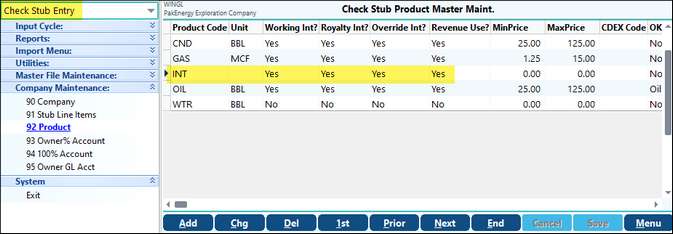

The setup will require adding a new Product Code INT and some new General Ledger Accounts for the entries. Start by adding the Product Code in Check Stub Entry > Company Maintenance > Product. This is done by clicking the Add button on the bottom of the screen and typing INT in the Product Code field. Change the No to Yes for each of the fields Working Interest, Royalty Interest, Override Interest, and Revenue Use.

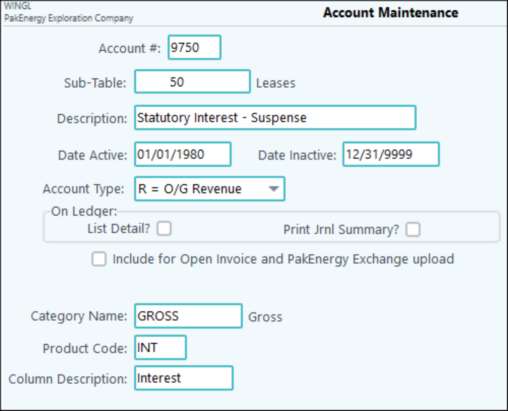

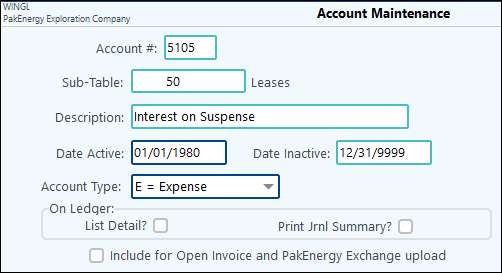

Next, determine what revenue and expense General Ledger Accounts to add and use to record the interest entries generated by the Revenue Cycle. In the examples below, we created account 9750 for the Statutory Interest – Suspense. This account will house entries paid to owners. Be sure to enter Gross as the category and the product INT for the product code. The category needs to be Gross for 1099 reporting purposes. The product code INT will direct this revenue to the 1099-INT instead of the 1099-MISC/NEC form for proper reporting of the revenue. The column description is titled Interest since this will show on the check history reports or owner statements. You must sub the revenue account by the property Sub-Table (50) in the example below. Create General Ledger Account 5105 for Interest on Suspense, which are the holder’s expense entries. The expense does not have to be subbed. However, if you want to track the expense by property, you must also sub this account by the property Sub-Table.

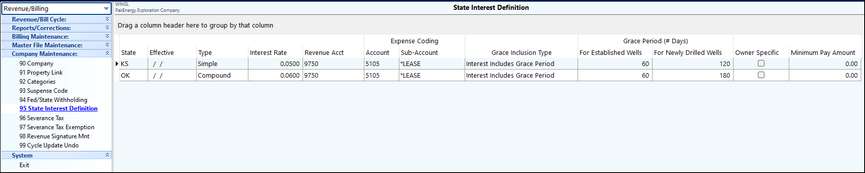

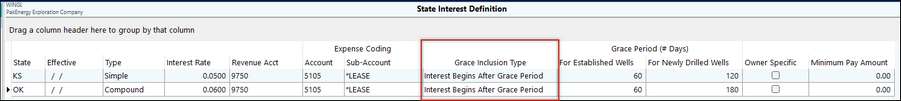

Even though the new product INT is added to the product maintenance in Check Stub Entry, there is no need to enter the General Ledger Accounts in either the Company Maintenance #93 Owner% Account or #94 100% Account. Entries to these new accounts should be system generated by the revenue cycle or other revenue processes like revenue check voids or corrections. A new menu item State Interest Definition is located in the Revenue/Billing module under Company Maintenance.

Users can provide requirements for more than one state, if necessary. Each line will be the rules for that specific State. You can leave the Effective Date blank to set the date to the beginning of time. If the rate changes, then simply add a new line for the state and put a new effective date on the record. There are two different types of interest calculations to choose from: Simple or Compound. •Simple Interest formula:

•Compound Interest formula allows interest for previous periods to add to the principal for the calculation of interest. It is important to note that only annual compounding is currently available. •Interest for the nth period = (Principal + Interest for period 1 +…+ Interest for period n-1) x Interest rate per period

Continue the setup by entering the annual Interest Rate to be paid, the Revenue Account and the expense account which in this example was 9750 and 5105 respectively. If you sub either account by the property table when created, enter *LEASE in the Sub-Account field. For the Grace Inclusion Type, use the drop down to select the type required for this state. The options are to have interest begin after the grace period or that the interest includes the grace period. Again, state laws can be specific about when the holder of suspense starts paying interest to the owner. Grace Periods can differ depending on the type of well. There are two options in this category: established wells and newly drilled wells. |

Entries Posted During Cycle

The Revenue Cycle will use the property’s state and spud date (Other tab of Property Maintenance), the Production Date on the revenue and the criteria set in the State Interest Definition to determine if any interest is due and then how much is due. The interest will be presented as a separate revenue transaction on the owner’s check detail with a Product Code of INT.

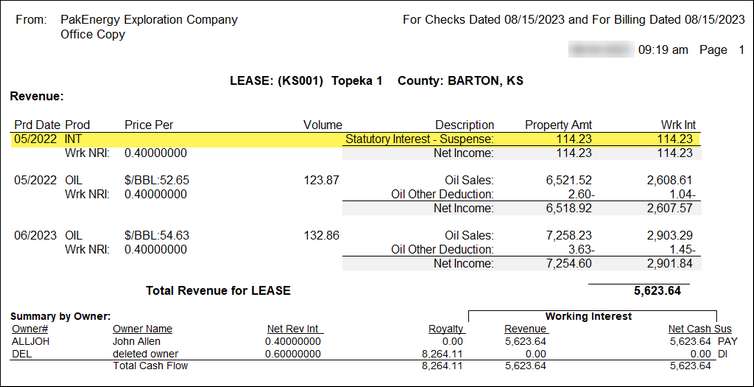

Kansas Example

Kansas provides an automatic 60 day grace period where no interest will be due.

•Example: If payment is made 62 days after the purchase date, then only 2 days would be subject to interest

Kansas provides and automatic 120 day grace period for newly drilled wells where no interest will be due.

•Example: If payment is made 122 days after the purchase date, then only 2 days would be subject to interest.

To demonstrate how this works for the state of Kansas, assume Check Stub revenue with a production date of 05/2022, and other of 06/2023; a spud date of 01/2022 on the property; and the Rev/Bill check date is 08/15/2023 and billed date of 8/15/2023.

wing

wing

Kansas has grace days that are not included in the interest calculation. Use the drop-down menu in the Grace Inclusion Type column to select the needed option.

•Interest will calculate only for the 05/2022 run date.

•There are 440 days between the 05/2022 run date and the check date of 08/15/2023.

•Since Kansas has a 120-day grace period for new wells, we can subtract 120 days from the 440 to get 320 days for which interest is due

•The interest is due on the net revenue amount paid to the owner which is $2,607.57 in the example.

•We calculate net interest as:

o($2,607.57 X 0.05) / 365.25 (avg days/year with leap year adjustment) = 0.357

o0.357 X 320 days = $114.23 of interest to pay the owner.

The third entry shown on the revenue statement above shows the production date of 06/2023. The grace period for an established well is 60 days. There are only 45 days between the production month and the check date (31 days for July and 14 days for August since the last day of the production month and the check date are not included in the number of days to be paid). So, no interest is due for the 06/2023 production month.

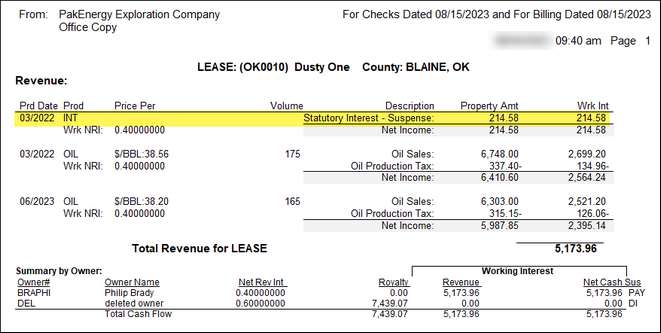

Oklahoma Example

Interest for Oklahoma is compounded annually. Basically, that means for the first 365 days beginning the first day of the month following the production month the calculation is the same as that for simple interest. That interest is then added to the revenue amount and then interest is calculated on that new total until it is paid. Like Kansas, the check date is not included in the number of days.

However, unlike Kansas, if the revenue is not paid within the grace period, interest is due for the full number of days where Kansas excludes the grace days. For example, assume net revenue of $2,564.24 with a run date of 03/2022, net revenue of $2,395.14 with a run date of 06/2023 and a check date of 08/15/2023.

For the 03/2022 revenue, there is a total of 501 days (365 from 04/01/2022 thru 03/31/2023 plus 136 from 04/01/2023 thru 08/14/2023).

•The first 365 days has simple interest.

$2,564.24 X 0.06 = $153.86

•Now, you add the $153.86 to $2,564.24 to get a new revenue amount of $2,718.10.

•That interest calculation looks like this:

($2,718.10 X 0.06) / 365.25 = 0.447

0.447 X 136 (the remaining 136 days) = $60.72.

•Add this $60.72 to the $153.86 to get $214.58 for the total interest due for the 03/2022 run date.

The days between the 06/2023 production month and the check date of 08/15/2023 is only 45 days which is less than the 60-day grace period. Therefore, there is no interest due for the 06/2023 production month.

NOTE: As long as the owner is in suspense, the interest amount for that suspense will be found in suspense maintenance for that owner. Once you remove the owner from suspense, then the interest will cease to calculate.