Texas Low Producing Oil Lease Severance Tax Credit Exempt Type 11

Processing Operator’s leases that qualify & creating refunds

Processing a New Month going forward

Example how to correct rejected files

Example how to process a Tax Credit in the future

Pak Accounting allows the calculation of Texas Severance Tax Exempt type 11 for Low-Producing Leases and the proper reporting.

Taxpayers whose oil leases qualify as low-producing are entitled to a tax credit. The amount of the credit is based on the average taxable price of oil, adjusted to 2005 dollars, during the previous three months as certified by the comptroller and published in the Texas Register.

Please note: the determining threshold used by the comptroller is based on his determination of average market price over the month and the prior 2 months, all adjusted to 2005 dollars. Don’t worry about this computation; just wait until the comptroller publishes at what exemption/credit level the tax should be for the low producing wells.

The comptroller has this going back to September 2005. New postings are made around the 5th of each month for the prior month. The Comptroller’s page is located at: https://comptroller.texas.gov/taxes/crude-oil/low-producing-leases.php

Texas Tax Code Section 202.058(a)(2) defines a “qualifying low-producing oil lease” as a well classified as an oil well that is part of a lease whose production during a 90-day period is less than:

(A) 15 barrels of oil per day of production; or

(B) five percent recoverable oil per barrel of produced water.

The Operator must file form AP-216 (PDF, 73k) for oil leases meeting the production requirements indicated above in order to claim the credit. The production per day is determined by using the monthly lease production report filed with the Texas Railroad Commission for three consecutive months and dividing the monthly lease production by the number of well days within the three-month time frame. (A well day is one well producing for one day.)

This Severance Tax Code setup will contain multiple sequence numbers. The Gross/Price Per part of the tax must be setup first, then the regulatory part (based on volume) will be the last sequence in the setup. We’ll leave a number of sequences in between to allow for multiple periods where the rate changes and/or credit don’t apply for the month.

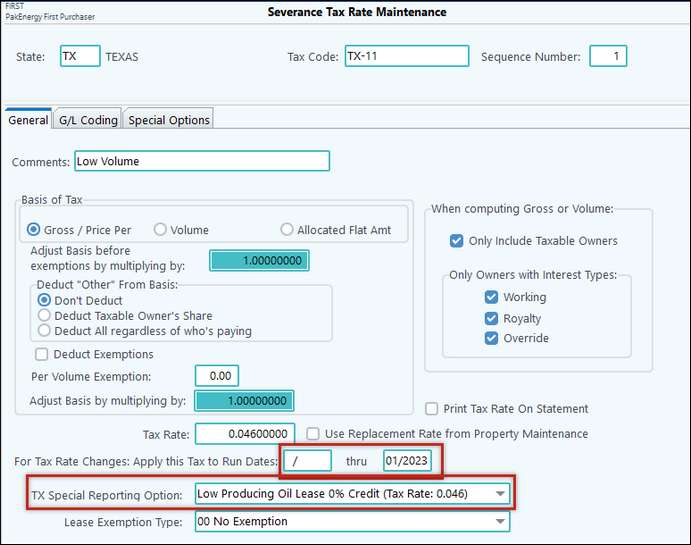

Sequence 1: Add a new Tax Code that ends with “11” (example State: TX, Tax Code: TX-11, Sequence number: 1). Be sure to have your Tax Code set up with 11 at the end of Code, this allows for the system to know what exemption code to place on the EDI file.

Examples that follow are of the setup in Severance Tax Rate Maintenance for Exempt Type 11 properties:

Sequence 1 – General Tab - will have the full standard tax rate, and an effective run date from the beginning of time (blank) thru 1-2023. Also specify the TX special reporting option of Low Producing Oil Lease 0% credit. On the G/L Coding Tab define the Severance Tax Payable Account, Product Code OIL and the Oil Tax Account.

Add a new sequence (Sequence Number 2) for the rate change for the first month that will reflect the credit.

Basis of Tax: Gross/Price per

Tax Rate: 0.0345

Run Date: 2/2023 thru 2/2023

TX Special Reporting Option: Low Producing Oil Lease 25% Credit.

G/L Coding same as Sequence 1

Add Sequence Number 3 for the next rate change. This will cover both March and April since both were eligible for a 50% credit.

Basis of Tax: Gross/Price per

Tax Rate: 0.023

Run Date: 3/2023 thru 4/2023

TX Special Reporting Option: Low Producing Oil Lease 50% Credit.

G/L Coding same as Sequence 1

As of the date of this document 5/2023 the date is set to return back to no credit as the determination is made subsequent to the production month. To do this add Sequence 4

Basis of Tax: Gross/Price per

Tax Rate: 0.046

Run Date: 5/2023 thru 12/9999

TX Special Reporting Option: Low Producing Oil Lease 0% Credit.

G/L Coding same as Sequence 1

The Texas Cleanup fee would be your last record for oil. Allow the sequence number to be a high sequence number (recommended to use Sequence 99) to allow for multiple changes of the severance tax credit through the months and years.

Basis of Tax: Volume

Tax Rate: 0.00625

Run Date: Blank thru 12/9999

TX Special Reporting Option: Normal

G/L Coding same as Sequence 1

Processing Operator’s leases that qualify & creating refunds

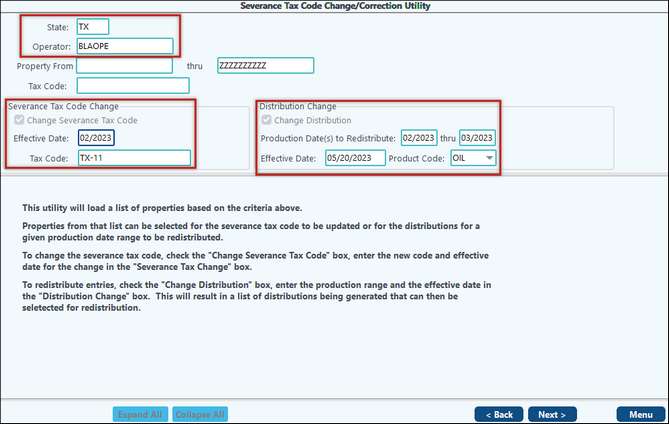

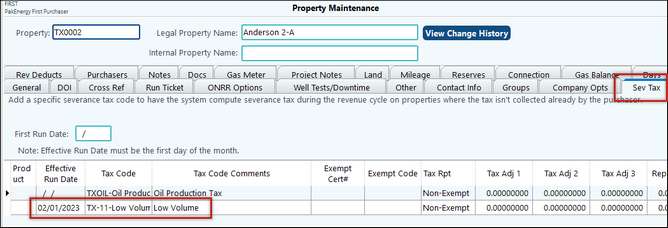

To change the Operator’s leases to have the new Severance Tax Code and creating refunds use the New Severance Tax Code Change/Correction Utility located in Revenue Billing > Change/Correct/Void > select the Severance Tax Code Change/Corrects option. Here you have the ability to process Exemption Forms from an Operator and/or Issue credits to all coded properties for a prior period.

•Select the Process Exemption Forms from an operator option, it defaults to Texas for you then select the Operator that you need to change.

•Severance Tax Code Change: The system will default to the effective date of 2-2023 since that is the first date that the credit can be taken. In addition to defaulting the first Severance tax code with the exemption code 11 defined.

•Distribution Change: here the system will default to 2-23 thru two (2) months prior the current month. (These options should be what you need when processing for the first time on an operator but you can modify if needed).

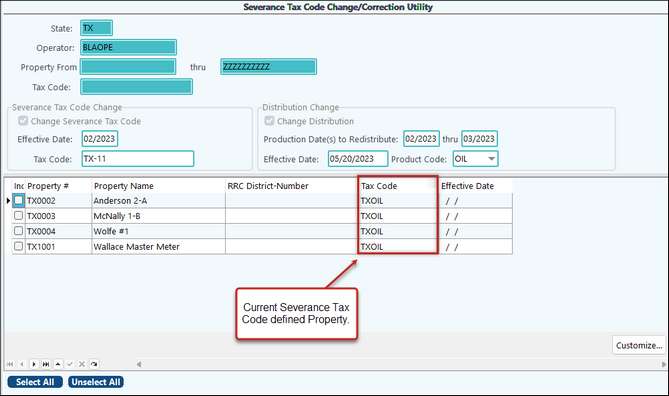

On the next screen you will select all the operator leases that qualify for the exemption.

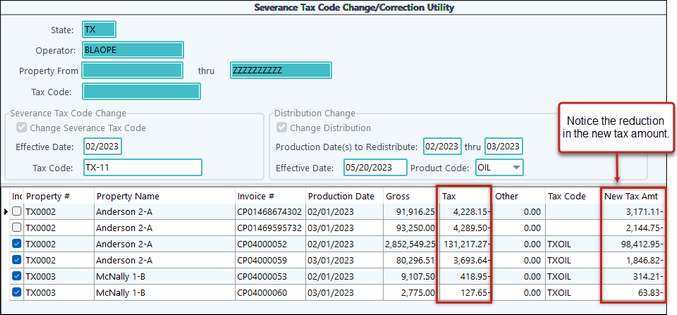

After you have selected all the leases that you need to change to the new severance tax code you will have the option to select which distributions to correct.

You’ll notice that you have the old tax amount, the old tax code used and the new tax amount based upon the settings of the new severance tax code. In the example above we have 25% credit for 2-23, and 50% credit for 3-23. Next, there is a review report so that you can verify each change. Once you finish the process you will have all the leases with the new severance tax code and the corrections waiting to be distributed thru the revenue cycle.

Process the corrections with the next month’s regular distribution. (or you can make a special cycle with all the corrects if you prefer to write separate checks for the severance tax refunds verses the normal distributions.) Note: On the Revenue Distribution By Property Listing, by Check Date, the corrections will be listed first, then the Current Month using the full tax rate.

Now that your distribution is complete, run current month’s TX Severance Tax Report (the code 11 will not show on Current month’s report if it is the full tax percentage), the corrected severance tax report will populate with code 11 for each month that was corrected. Note: Corrections with earlier production dates will appear on the file.

After you close the current months report your correction reports will generate, they will display the “backing out” of the original tax amount and then the new tax code 11 amount. You will get a corrected report for each month that you correct.

Processing a New Month going forward

1.Around the 5th of a new month, the Comptroller will post at if the prior month is eligible for an exemption and if so, at what rate. DO NOT DO ANYTHING AT THIS POINT! If you go ahead and enter this, when you submit your tax report, the comptroller will reject it! This credit cannot be taken until the State Comptroller’s office receives the production data from the RRC. In the normal timeline of a first purchaser, this means this must be handled as a correction in the following month.

2.Around the 10-20th, Process the prior month sales like normal. At this point, the effective tax rate for the prior month sales should be the full amount.

3.Around 25th, file the Texas Severance EDI for the prior month oil severance tax (and corrections for months prior to that).

4.On/around the 4th of yet another month, run the severance tax change/correction utility. Limiting the selection to leases with your severance tax code for this exemption (TX-11 in this example) and a production date of 2 months ago.

5.Prior to your normal distribution, process any new Tax Credit paper work you have receive. (Based on a copy of the return letter from the comptroller). Verify that their first historical date listed starts with February. If for some reason, some don’t, then they need to be separated out by historical start date.

1.Suppose today is/was May 5th and you see that the Comptroller has published April’s eligible exemption amount. DO NOT DO ANYTHING AT THIS POINT! Remember you cannot submit a current month’s tax report with the exemption.

2.Now around May 15 Process your April sales like normal with the full amount of tax withheld.

3.May 25 submit your April’s severance tax to the comptroller.

After the 25th of May:

4.Change the Severance tax rate for April’s sequence:

| From: 0.04600000, 4/2023 thru 12/9999 Low Producing Oil Lease 0% Credit (Tax Rate 0.046) |

| To: 0.02300000, 4/2023 thru 12/9999 Low Producing Oil Lease 50% Credit (Tax Rate 0.023) |

a. Add a new sequence (Sequence Number 5) for 5/23 thru 12/99.

| When adding the new sequence make sure it is for the current month taxes with the Tax Rate .04600000 and Low Producing Oil Lease 0% Credit (Tax Rate 0.046) |

Don’t forget to specify the same G/L coding as on the previous sequences.

| 5. | After you have the Severance Tax Rates set up you need to run the Severance Tax Code Change/Correction Utility for April’s tax credit, limiting the selection to only lease with your exemption tax code. |

On the Correction utility select the Issue credits to all coded properties for a prior period option. This will default with your first severance tax code with 11. Select the 4/23 thru 4/23 for the production dates.

After you have the correct tax code and production dates, select next for all of the properties that have tax code 11 on them. Note: Only properties with the Tax Code 11 will display.

| Be sure that you have all the properties that you need to correct selected and click next. This will display each distribution that can be corrected. Note: Tax Code displays % of tax credit that was used and new current tax credit. |

Once you have verified all distribution to be changed click the next button to finish the correction process.

The April corrections are there and waiting for you when you run your June’s distribution.

| 6. | Prior to running June’s distribution, process any new tax credit paperwork you have received. Process the Severance Tax Change/Correction Utility using the Process Exemption Forms from an Operator option. |

Example how to correct rejected files

If the comptroller rejects the correction file because a lease(s) does not qualify for a particular month then you will need to change that lease’s severance tax code using date sensitive for this month to a non tax code 11. How do you do that you might say? Well you can use the same Severance Tax Code Change/Correction Utility, other option. Since it is just one property you can filter to just that one property to make things easier. Select the Severance Tax Code Change and insert the effective date that the property does not qualify for the tax credit. Insert in the non code 11 severance tax code that you want to change this property to for this month. While we are here let’s correct the previously corrected distribution.

Complete the correction process. Now your property has the Severance Tax Code for the non code 11 for the month of March, 2023 forward.

Note: Since this property has qualified as a low producing lease you should put the severance tax code 11 back on it for the next month.

To do this you can manually add it to the property on the severance tax tab or you can use the Severance Tax Code Change/Correction Utility just changing the Severance Tax Code. Again be sure to change the Severance Tax Code using the following month (4-23) with your tax code 11.

Next you will need to run a distribution with the same dates and then rerun the corrected severance tax file. Note: The new corrected file does not have the rejected lease because we reversed the original correction.

Example how to process a Tax Credit in the future

1.Let’s jump ahead to February 5th, 2017 the Comptroller posts that January 2024 is eligible for an exemption, you have not been eligible for over 6 months now. DO NOT DO ANYTHING AT THIS POINT! If you go ahead and enter this, when you submit your tax report, the comptroller will reject it! This credit cannot be taken until the State Comptroller’s office receives the production data from the RRC. In the normal timeline of a first purchaser, this means this must be handled as a correction in the following month.

2.Around the 10-20th of February, Process the prior month sales like normal. At this point, the effective tax rate for the January sales should be the full amount.

3.Around 25th of February, file the Texas Severance EDI for the January’s oil severance tax.

4.On/around the 4th of March, 2024, run the Severance Tax Change/Correction Utility. Limiting the selection to leases with your severance tax code for this exemption (TX-11 in this example) and a production date of January, 2024.

5.Prior to your normal distribution, process any new Tax Credit paper work you have receive. (based on a copy of the return letter from the comptroller). Verify that their first historical date listed starts with February of 2023. If for some reason, some don’t, then they need to be separated out by historical start date.