Severance Tax Code Error-No Accounts Have Been Defined for a Specific Product

Pak Accounting's Revenue System will find potential problems that occur when a product being distributed does not have a severance tax rate set up. This error will stop the cycle, let you know this situation has occurred, and require action before you can extract your entries and continue. Suppose you are not required to deduct severance tax on this product (for example, the first purchaser already deducts the severance tax on gas but not on oil), and you are certain you will never have tax on any gas products. In that case, you need to set up a zero rate on this product.

This is an example of the error message you will receive:

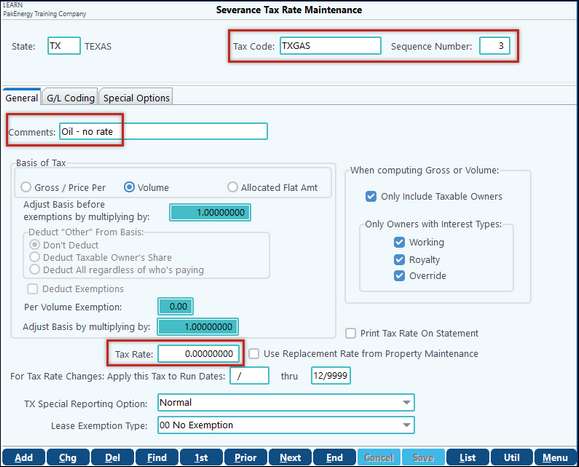

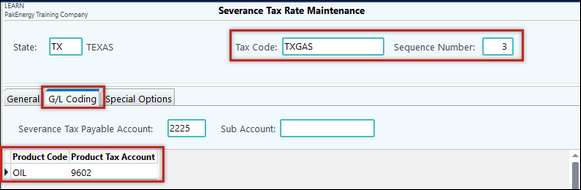

Example of setting up a Severance Tax Code to eliminate the error “For Severance Tax, No accounts have been defined for a specific product”.

For this example, we will use a Severance Tax Code called “TXGAS” for properties located in the State of Texas. This code will be assigned to specific properties that will receive Gas revenue, for which you must calculate and pay severance tax. You could also receive Oil revenue on these same properties, and the purchaser will deduct and pay the production taxes on the Oil.

In the State of Texas, there are two different severance taxes on Gas, one based on Gross Revenue and one based on Gross Volume. Therefore, there are two sequences needed to calculate each of these taxes. To eliminate the above error, there must be a third sequence with Oil coded on the G/L coding tab and a zero tax rate. See the examples below.