Reporting

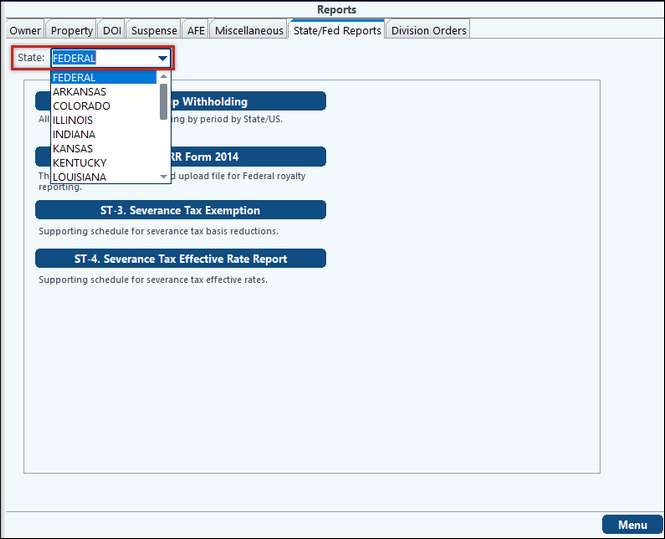

Generate reports from the Revenue/Billing module. Find the Severance Tax reports by selecting the Report menu option and then the State/Fed Reports tab.

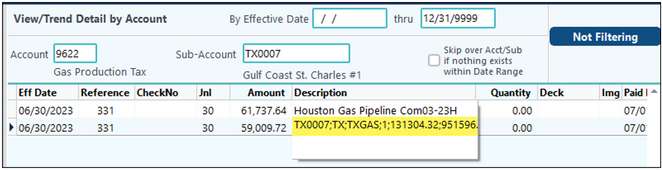

As a reminder, the Severance Tax Reports will comb through the General Ledger tax accounts looking for specific data tied to the entries.

If the entries in the tax account are missing the information in the Description column, as seen when hovering over the item, then the amount tied to this line item will not appear in the Severance Tax report.

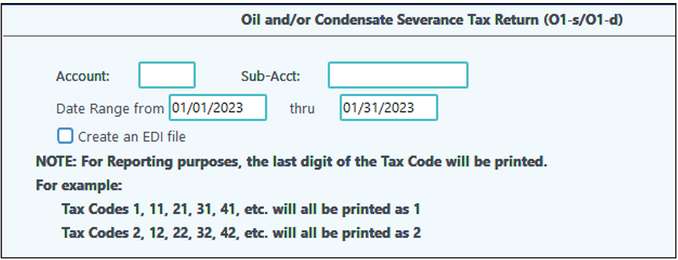

For states that file online, the system automatically creates an EDI file when you view the report. Each state may have different requirements, and the system has accommodated as necessary.

How to File Severance Tax Reports

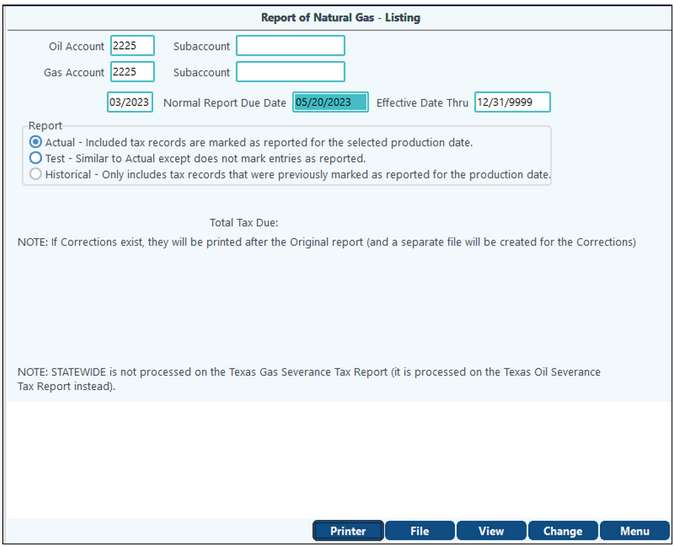

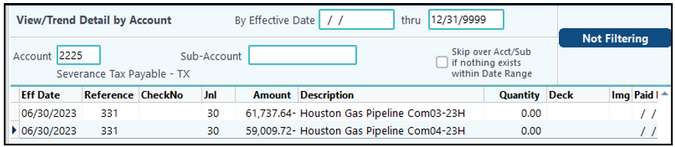

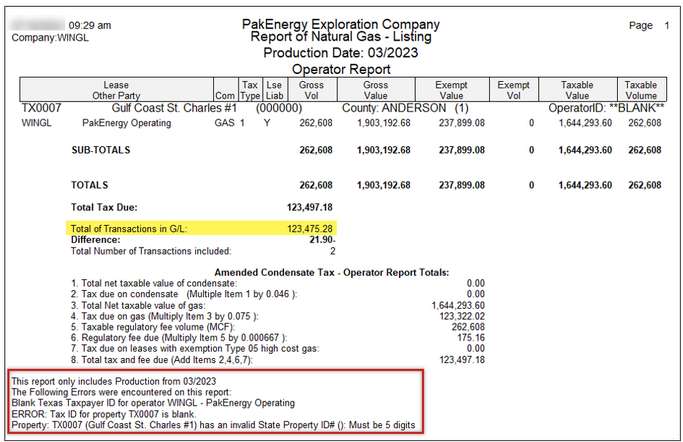

As you run Revenue/Billing cycles and severance tax is calculated, the payable tax amount to the state is held in a payable account. When running the severance tax report, the amount held in the payable account should match the figures on the report.

State reports that require electronic filing have an EDI (Electronic Data Interchange) file generated when viewing the report. The file is saved in the Company code folder/EDI folder. You use this file to import your information on the State’s website. The user will log into the specific state’s website and can browse to find the file to upload. See Folder Transfer/Compare if needing to access files from WPA.

It is important to remember that generating the report requires the Payable Account associated to that state.

Entering the wrong Payable Account into the report, the numbers expected will not be the numbers listed in the report. The reports will list any errors that need correcting as well. Ledger Listings for the payable amount and all properties for the production date given on the Severance Tax report will give you the data needed to match up entries.

When the system creates the reports, as either PDFs or electronic files, it creates the severance tax reports that meet the specific state requirements.

Some states have the option to create a PDF report as well as an EDI file. For example, If the Louisiana Severance Tax Report will create both formats.

Correcting Submitted Reports

If you submit a report and then later need to correct, you need to make Revenue Distribution Corrections to correct the amount in the Liability Account. Once you make the corrections and post the correcting cycles, you can generate a new Severance Tax report and send to the state.