When making corrections, first, determine the method of creation for the severance tax. If the Revenue/Billing cycle automatically calculated the severance tax, then the entries made to the Revenue Tax Accounts will be with a Journal 30. These entries will also have information embedded with the entry. It is the extra information in the description field used for severance tax reporting.

On the other hand, if the system did not calculate severance tax, but added through Check Stub Entry, the entries post with a Journal 11. Corrections for these entries would be a reversing check stub and reentry with the correct amounts. These corrections typically come from the Purchaser. If you attempt a Revenue Correction the severance tax ‘omit’ button will not be available.

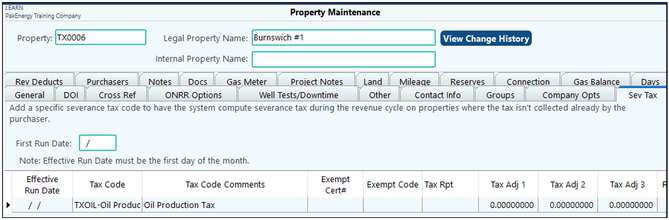

For the revenue severance tax corrections, first update the severance tax code in the Severance Tax company options, Property Maintenance severance tax tab, or both. If the property is subject to a lower tax rate, then add a new tax code to the Property Maintenance screen with an effective date change. With the property level Revenue Distribution Correction utility, you can make the severance tax corrections.

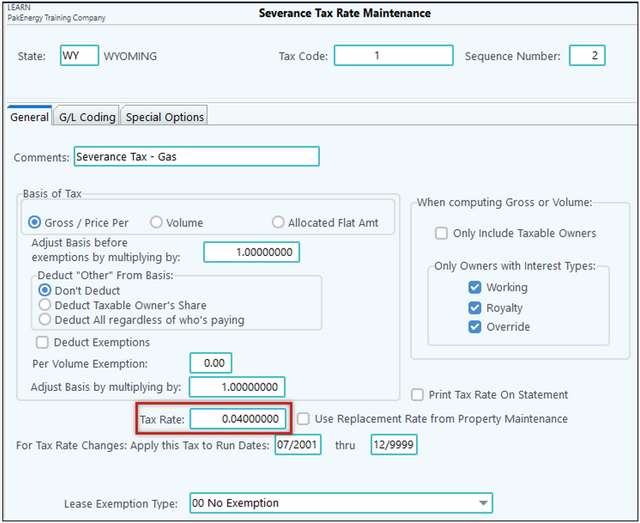

For the following example, we updated the tax rate on the Tax Code to 0.04000000. If this rate applies to all properties using this code, then adjust the tax percentage. If the adjusted rate applies to only one property, then usually a new tax code is set up and assigned to that property.

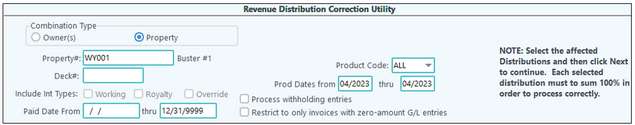

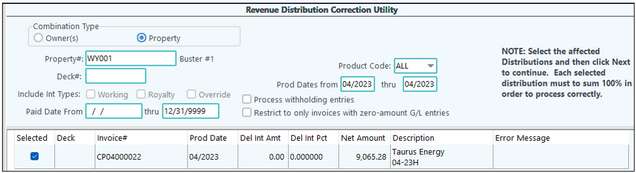

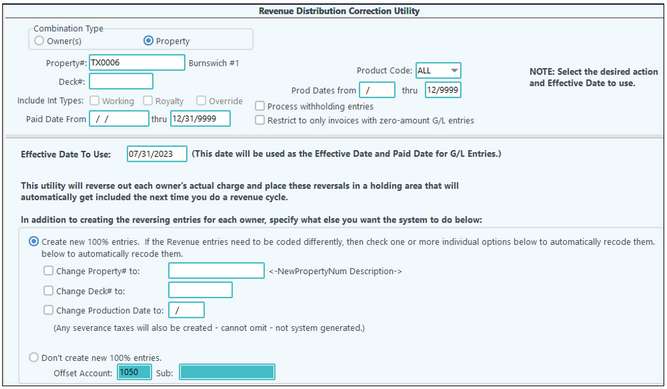

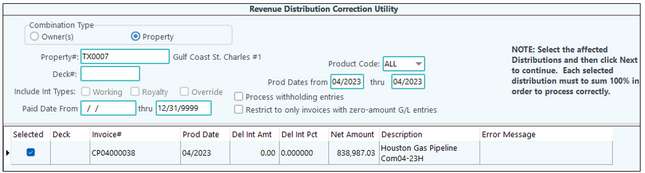

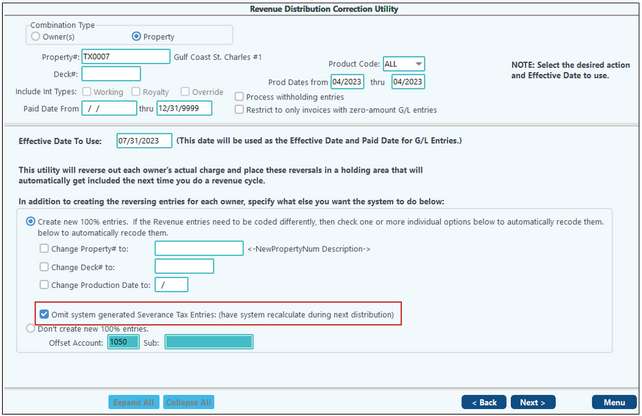

Correcting severance tax needs to be a property level Revenue Distribution Correction. If you have multiple products on a lease, you want to specify the product. Generally, one can also specify the run dates (production date). You may not need to correct all run dates.

Select the entry to correct. This entry will show the 100% net number for the entry.

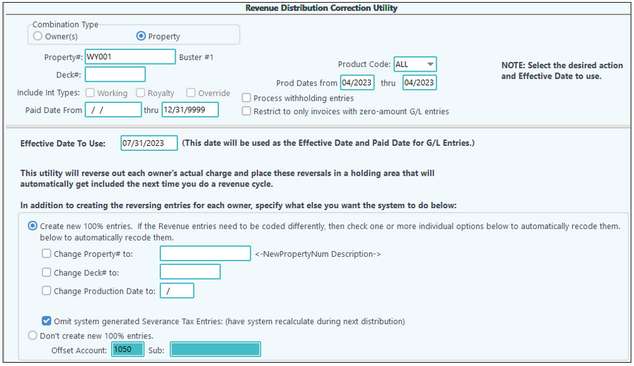

On the next screen, check the option to have the system recalculate the new severance tax entries. If the check box is not visible, the system did not generate the severance tax entries. Proceed and allow the system to generate the severance tax amounts.

Once the correction finishes, Pak Accounting makes a reversing entry in the gross sales, tax, and other deduct and revenue offset accounts. The new corrected calculation of gross, severance tax liability account, and suspense will post to the respective GL accounts.

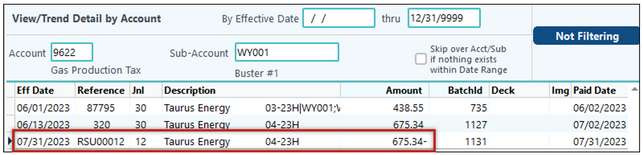

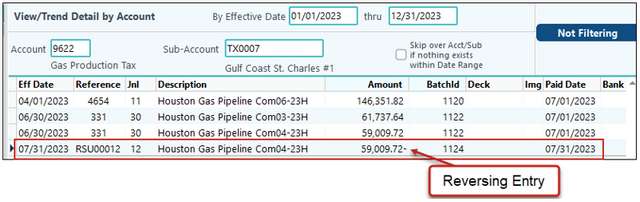

Since the new entry has no severance tax entry to the revenue tax account, the cycle will calculate the severance tax at the corrected rate or the property’s new tax code rate. Looking at the gross account, a new revenue entry has been created so that severance tax can be recalculated through the next distribution cycle:

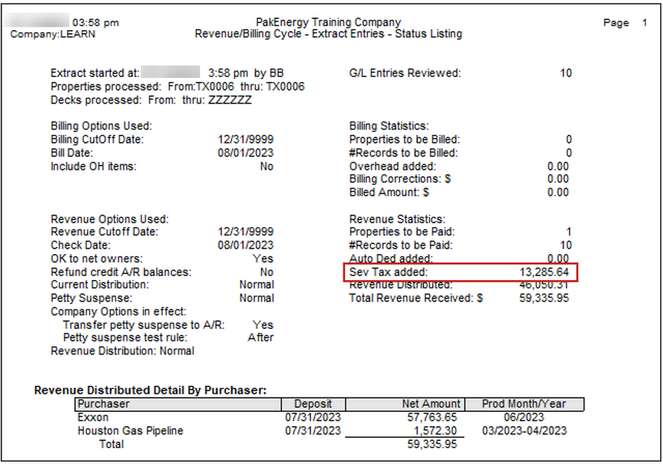

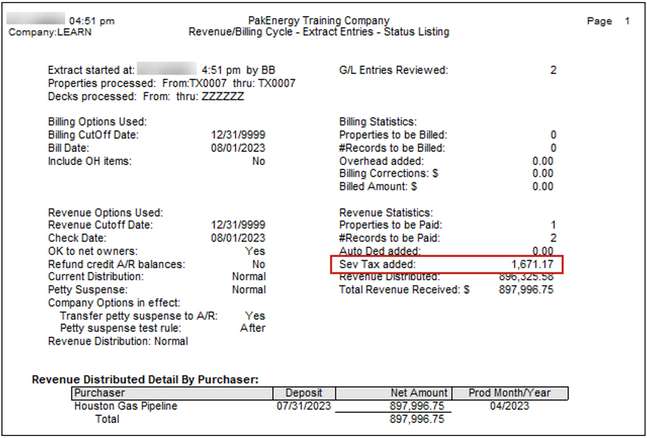

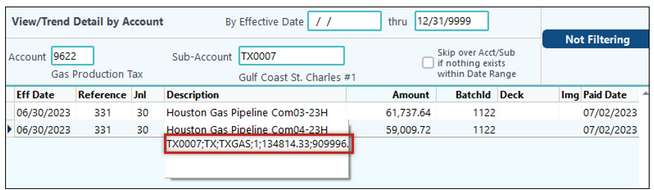

Begin a Revenue Cycle. The preview page from the Extract Entries screen will show the calculated severance tax amount. Once the cycle is complete, the new entries will be available in View/Trend:

|

Should a Revenue/Billing cycle run without a severance tax code added to a property, it is possible to add a tax code after the fact. The system will look at the associated revenue tax accounts. If there are no entries for that production month, then the system will calculate the entries needed for that property, even after processing the gross sales for that production month through a cycle. Using a blank effective date will set the Tax Code to the beginning of production. If this property has several untaxed production months, then run a correction for the range of production months needed.

After adding the Tax Code to the property, run a Revenue Distribution Correction for the production months that had no severance tax entries. Notice that as the correction is made, the omit box is not available. This is because system did not originally calculate the severance tax since the property did not have a Tax Code applied for that production date:

After creating a correction, run a Correction Cycle. The new severance tax entry will appear in the Extract Entries preview as follows:

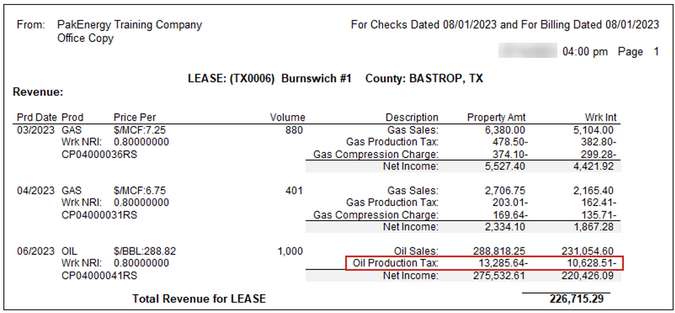

The Office Copy will also show the newly created severance tax amount:

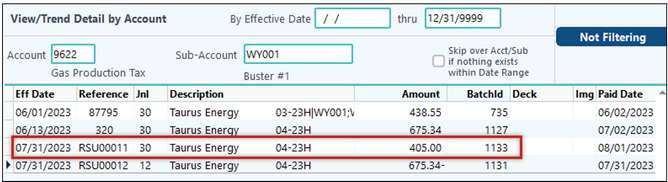

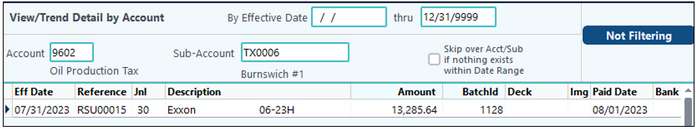

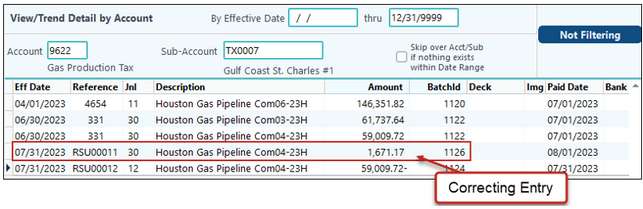

Once the cycle updates, the General Ledger account for the Oil Production Tax will show the entry.

|

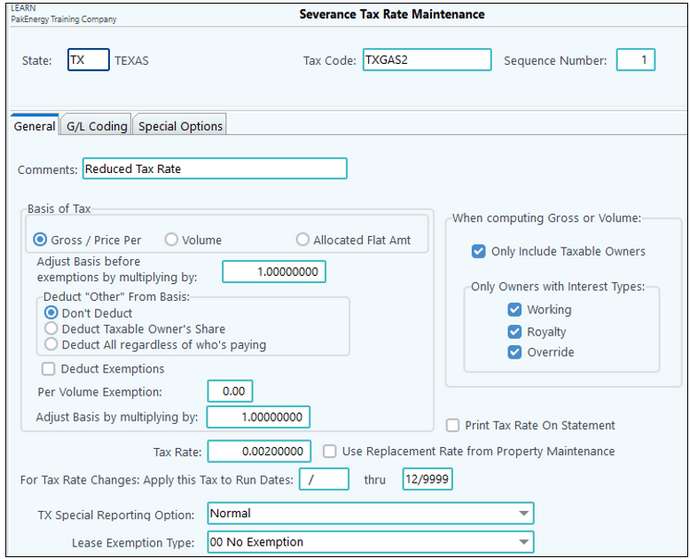

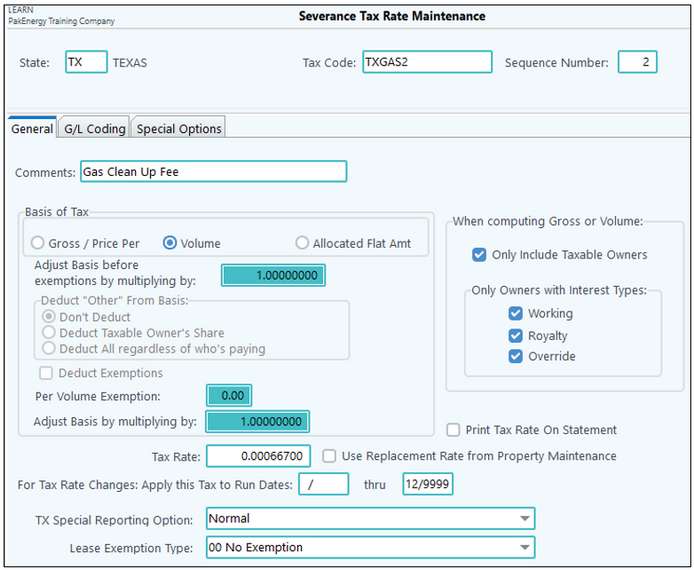

If a property has an approved lower tax rate, but was originally charged at the normal rate, first make sure Severance Tax Codes in Revenue/Billing Company Maintenance reflects the lower rate.

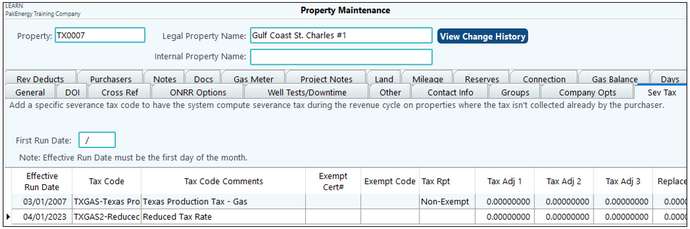

Next, make sure to apply the new tax code to the property with the correct effective date.

Once the rates are established and the correct tax code is on the property, a Revenue Distribution Correction is needed. This will be a property level correction for the 04/2023 production date. Locate the entry to process.

Remember to check the option “Omit system generated Severance Tax Entries: (have system recalculate during next distribution)”.

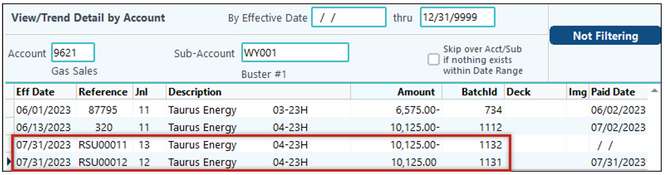

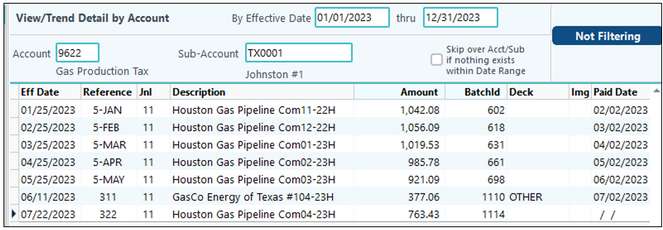

A correcting entry will be visible in View/Trend:

Run a Correction Only cycle. The Extract Entries screen will list the correct calculated Severance Tax.

When the cycle updates, the new tax entry is posted to the Revenue Gas tax account.

|

Corrections

1.Ensure the tax is still turned on in Owner Maintenance (F12)/Revenue Billing tab/Withholding: Edit button.

2.Manually add the amount of State W/H into Suspense. See Adding Suspense for more information.

a.Go to Revenue Billing > Reports Corrections > 31 Change Correct Void/R-4 Suspense Add New.

b.The Offset Account will be the liability account set on the Fed/State Withholding setup screen for this state.

c.In the Owner Share column, enter the amount of the State W/H that should not have been deducted from the owner. Since we are charging Tax, ensure this figure is negative when entering it. At the bottom of the screen, in the Totals section, Pak Accounting will flip the sign accordingly to show what the entry will be when posted.

d.Save and Update the Suspense Add.

3.Go back into Owner Maintenance and uncheck the state in the Withholding: Edit button so withholding will not be taken out on future revenue.