Severance Tax Special Options

This addresses many different “special” severance tax situations.

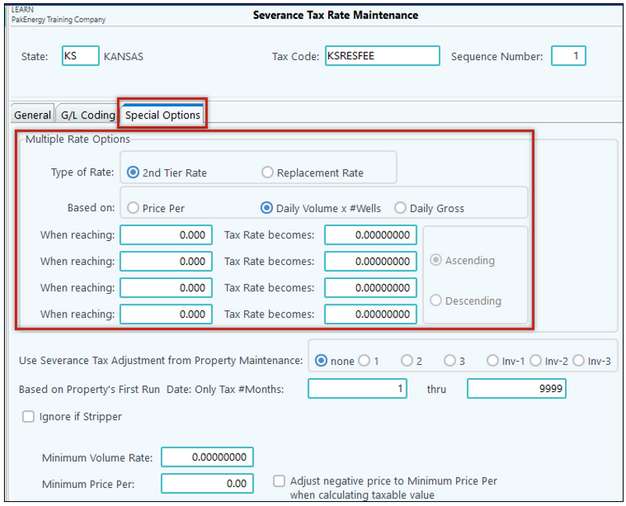

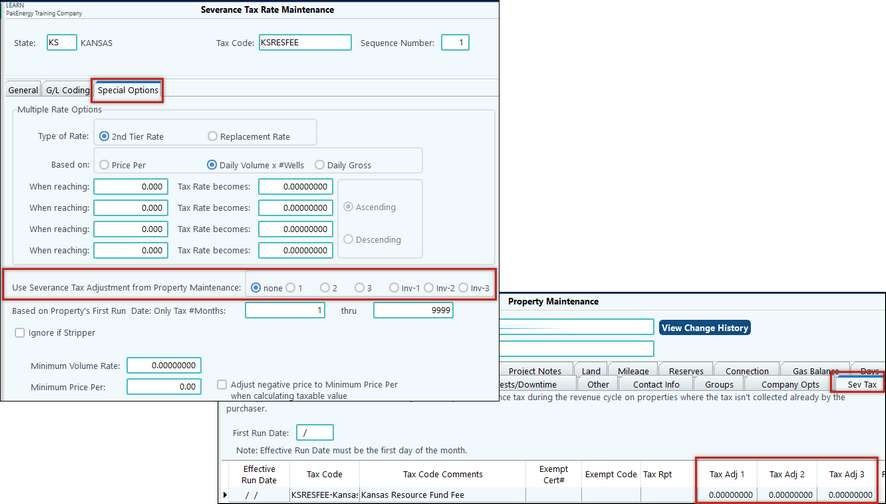

Multiple Rate Options:

This feature can accommodate multiple rates on a well by either adding to the rate (2nd Tier Rate) or replacing the rate completely when the production or price meets a specified amount.

If you need to add a third rate to a property, use the “Use Severance Tax Adjustment on the Severance Tax tab of the Property Maintenance. Use this in states where you can adjust a specified rate up or down for a specific well. For instance, a special adjustment might be allowable for one (1) well out of 100 because of production incentives.

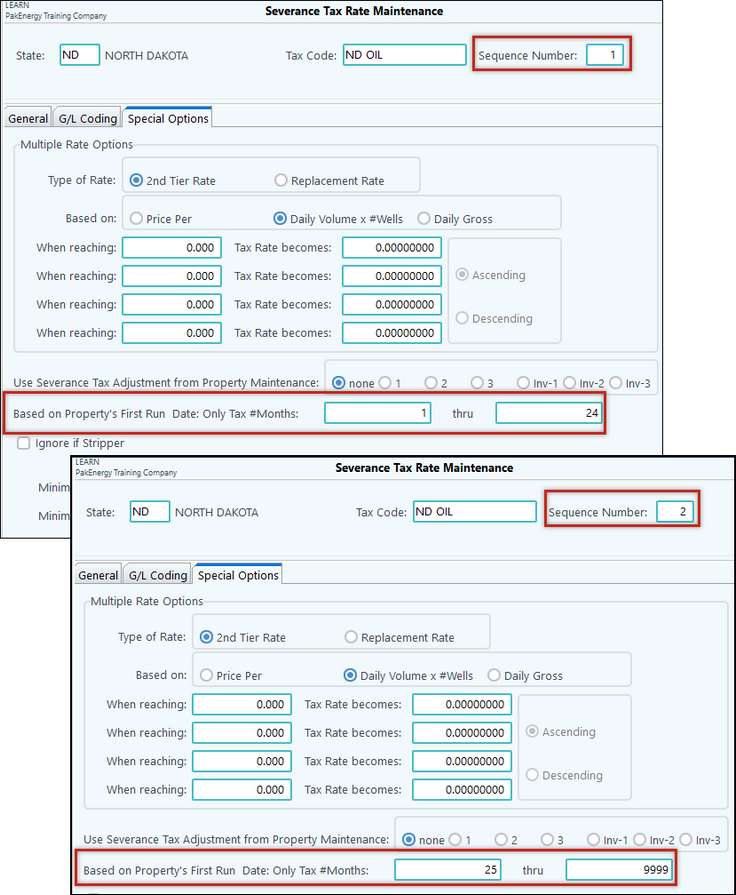

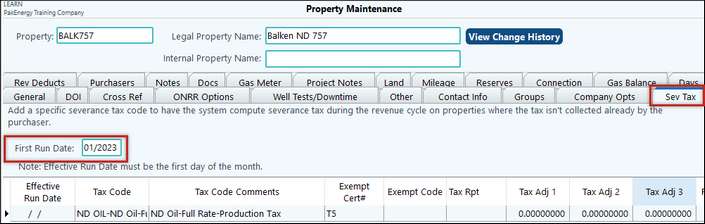

If the tax rate is based on the first production date:

You must use this option in relation to the specific property’s Beginning Production month as defined in the Property master. Used for states that have different rates for the first number of specific production months. For instance, if your state has one rate for the first 24 months of production (only months 0 thru 24) and a different rate for the rest of the life of the well (25 thru 9999), create two different Sequence Numbers for that Tax Code.

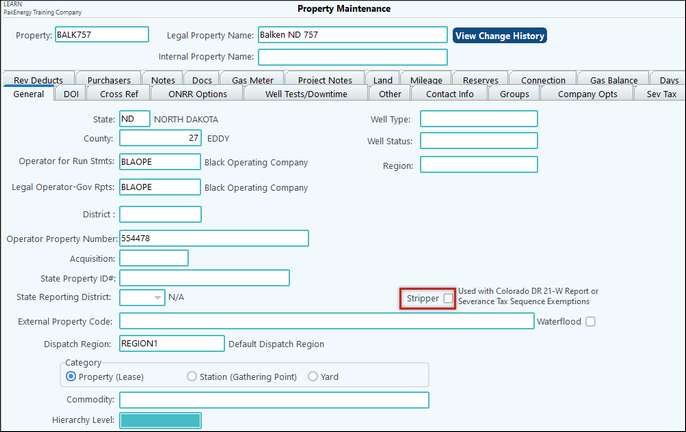

Ignore if Stripper Well:

This option must be used with the property master stripper switch to allow the severance tax sequence to be exempt from the calculations. The Colorado Severance Tax Report uses this.

Minimum Volume Rate: This option allows for a different rate to apply when volumes reach a designated level.

Minimum Price Per: Used for oil contained in tank bottoms or other materials purchased from producers (Reclaimed Oil). During the Revenue cycle - Distribute and Combine menu - it will calculate taxes based on the minimum price per unit. This field has two (2) decimal places only. With this option, the system will take the gross amount divided by the quantity to determine the price per unit and if the price per is below the minimum in this new field then it will use the value in the field to calculate the tax. If above, then it will use the actual.

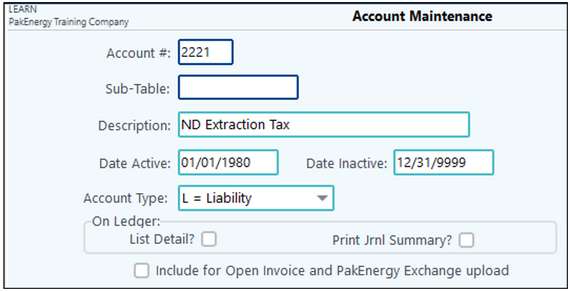

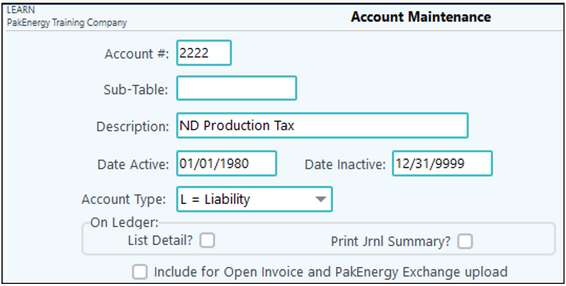

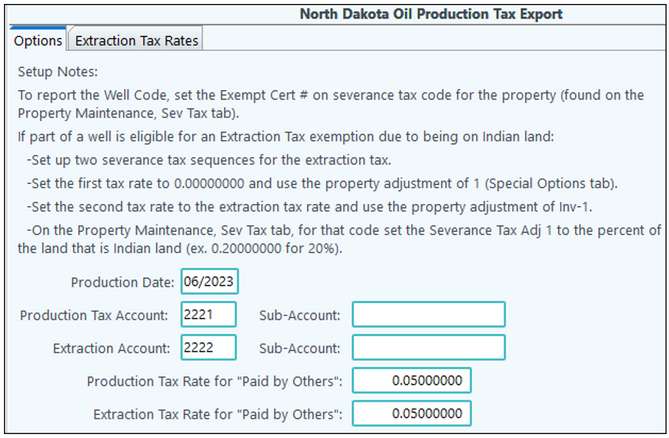

North Dakota severance tax has multiple complexities to reporting taxes, especially if your lease is on Indian Land and has Government Exemptions. All which Pak Accounting has ways to accommodate. General Set-up: 1.Separate Liability Accounts: When setting up severance tax for ND states, you must make sure your general ledger has two (2) separate liability accounts, one (1) for production tax and one (1) for the extraction tax. For example, account 2221 is for the ND Production tax and account 2232 is for the ND extraction tax.

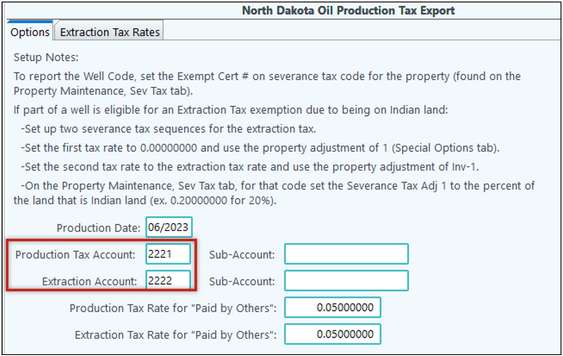

The Severance Tax report can be found in Revenue/Billing > Reports/Corrections > Reports > State/Fed Reports > State: North Dakota. When running the report, fill out the screen accordingly:

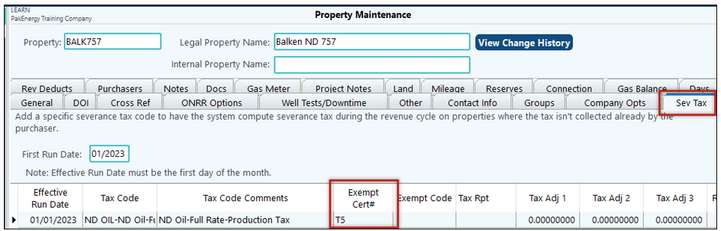

Extraction Tax 1.Well Code: If the Commissioner assigned a well code, enter the Well Code in the Property Maintenance > Severance Tax tab > Exempt Cert#.

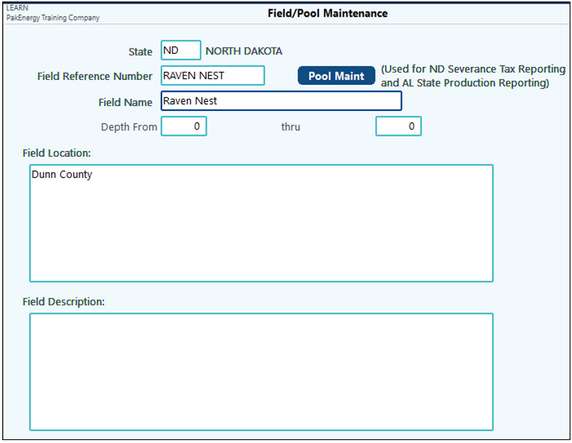

2.Pool Code: To set up Field Pool, go to First Purchaser or Revenue/Billing > Field/Pool

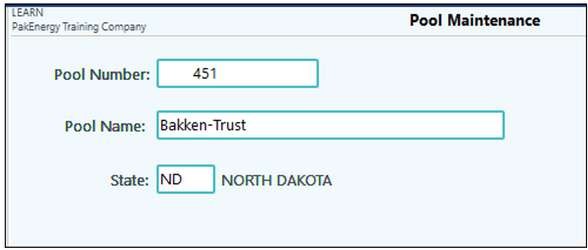

Once you have the Field set-up, click on the Pool Maintenance to add the Pools for each field:

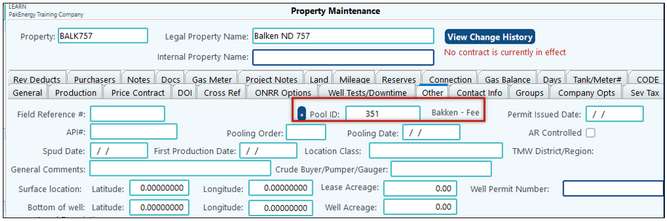

Once completed, add them to the Property > Other tab > Pool ID. The Pool ID field is only available through the First Purchaser module.

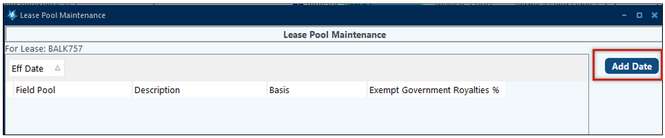

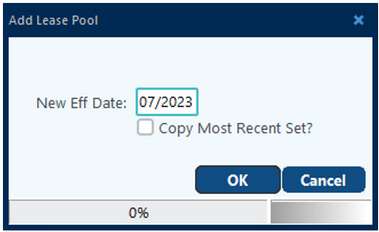

If multiple Pool Codes exist, click the plus sign (+) next to the Pool ID field. Make sure the field is blank. A new screen will pop up. Select the Add Date option to add multiple pool codes and enter the Production date.

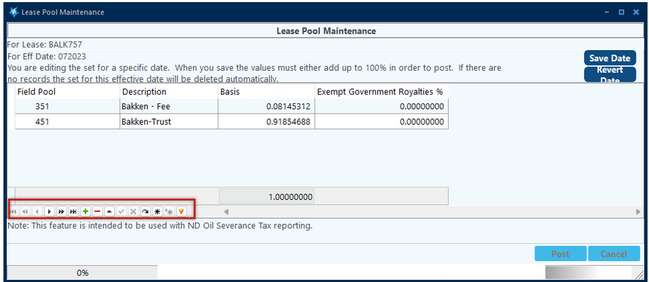

Click the plus sign (+) and add the multiple pools with the applicable percentages under the Basis column. If there are Government Royalties, enter that percentage too. When finished, select Save Date.

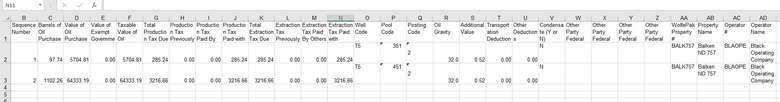

On the Lease Pool Maintenance Screen make sure to select Post to Post your changes. If multiple pools exist, you will see the property listed multiple times on the severance tax report. Once for each pool:

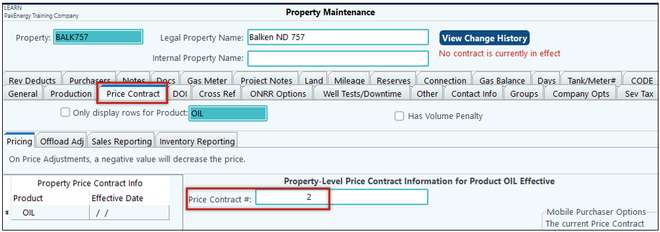

Another item to keep in mind on the North Dakota Severance tax report is the Posting Code. The Posting Code is the Price Contract Number. You can verify this by looking at the Property > Price Contract tab > Price Contract #.

For Extraction Tax Exemptions, see the ND Severance Tax Report Screen for set-up instructions:

|

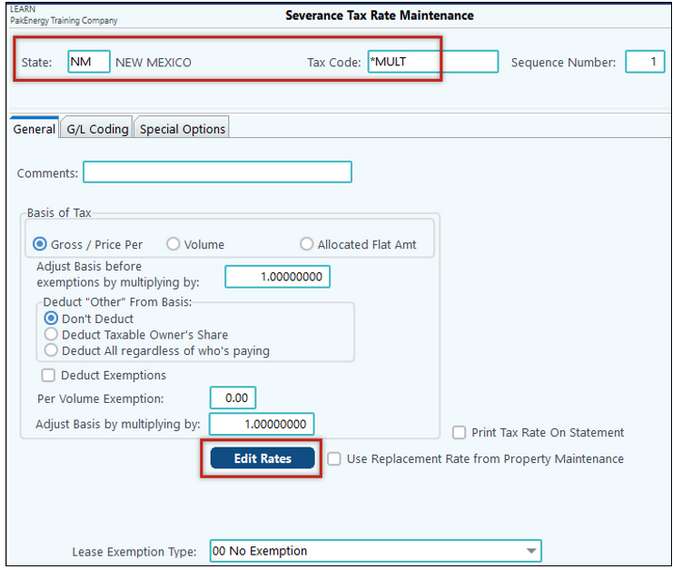

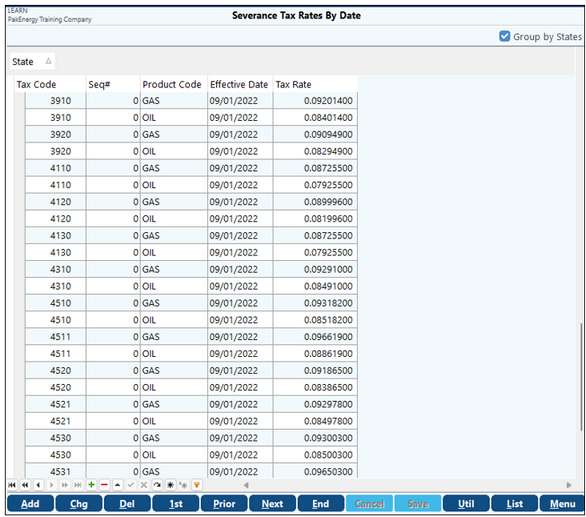

New Mexico has multiple rates for each county, one for each type (Federal, State, Indian, or Private). Pak Accounting has these rates available in an import file, which we can provide to you upon request. Just call your Customer Success Team. Once you have the file, save a ton of data entry time by importing it. In order to import the many New Mexico tax rates, first navigate to Severance Tax Rate Maintenance. Then click on Add and enter in the NM in the "State" field, *MULT in the "Tax Code" field, and 1 as the Sequence Number. Then click on "Save" at the bottom of the screen.

Once in the Edit Rates screen, click on Util then, click OK at the bottom of the Import screen to browse to the saved file. Once Imported you will receive an overview screen that will let you know if the import was successful and if there were any errors. Click on Menu to close out of the Import and go back to the Tax Rate page.

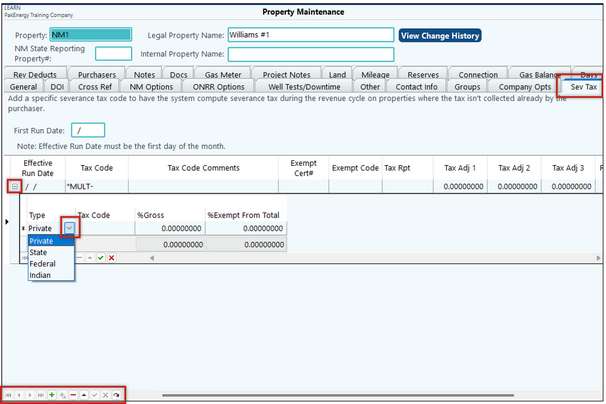

Once the file has been imported, navigate to the Property Maintenance > Severance Tax tab and find the property. •Enter *MULT as the Severance Tax Code. •Next, click on the "+" sign to expand the menu •Enter the Type, Tax Code, % Gross, and % Exempt from Total (if necessary). NOTE: The % Gross and the % Exempt from Total must equal 100%

|

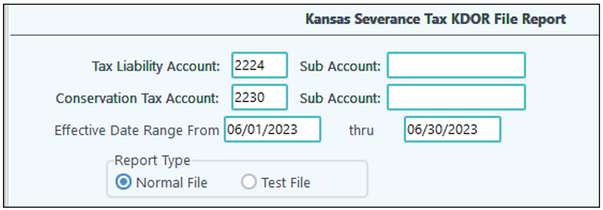

You should have two separate Severance Tax Liability accounts and Revenue Deduct accounts, one (1) for the Production Tax and one (1) for the Conservation Tax. Run the severance tax report with the applicable liability accounts.

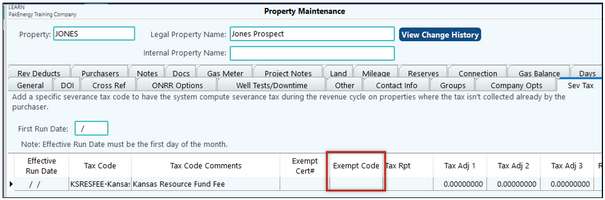

If the state has assigned an Exempt Certificate number, enter that number on the Property > Severance Tax tab > Exempt Cert# field:

|

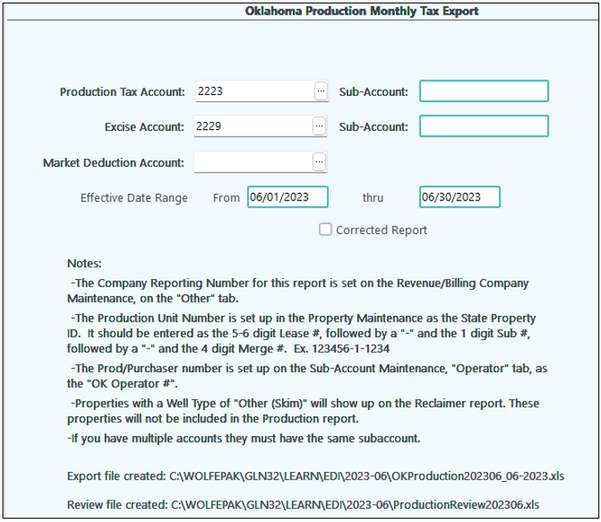

This report requires two separate liability accounts, one (1) for the Production Tax and one (1) for the Excise Tax.

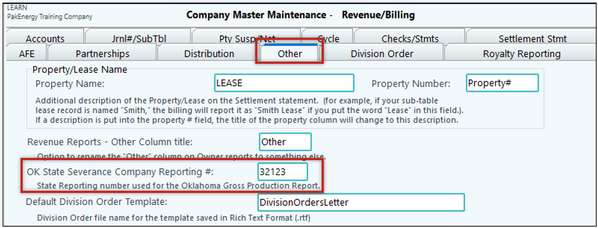

Enter the Oklahoma State Severance Tax Company Reporting number in the Revenue/Billing > Company > Other tab > OK State Severance Company Reporting #:

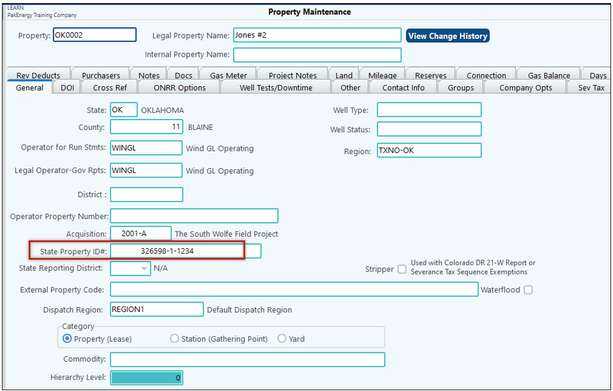

Enter the Production Unit Number (PUN) in the Property Maintenance > General tab > State Reporting ID field. This number should be the 5-6 digit lease number followed by a dash followed by the single digit sub # followed by a dash followed by the four (4) digit merge number. See example below:

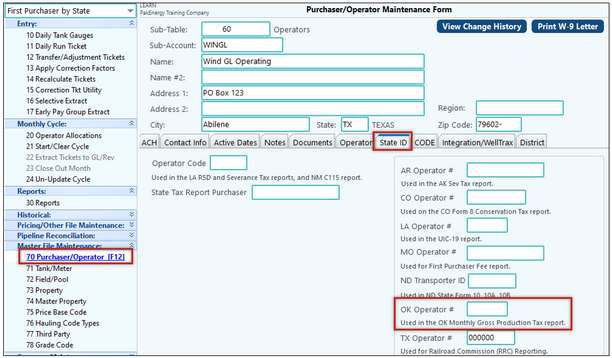

Enter the OK Producer/Purchaser number in the First Purchaser > Operator Sub-Table > State tab > OK Operator #.

|