An AFE (or Authorization for Expenditure) is a detail budget for a specific project. Oil & Gas Operators use the Pak Accounting AFE system to:

•Project or budget project costs.

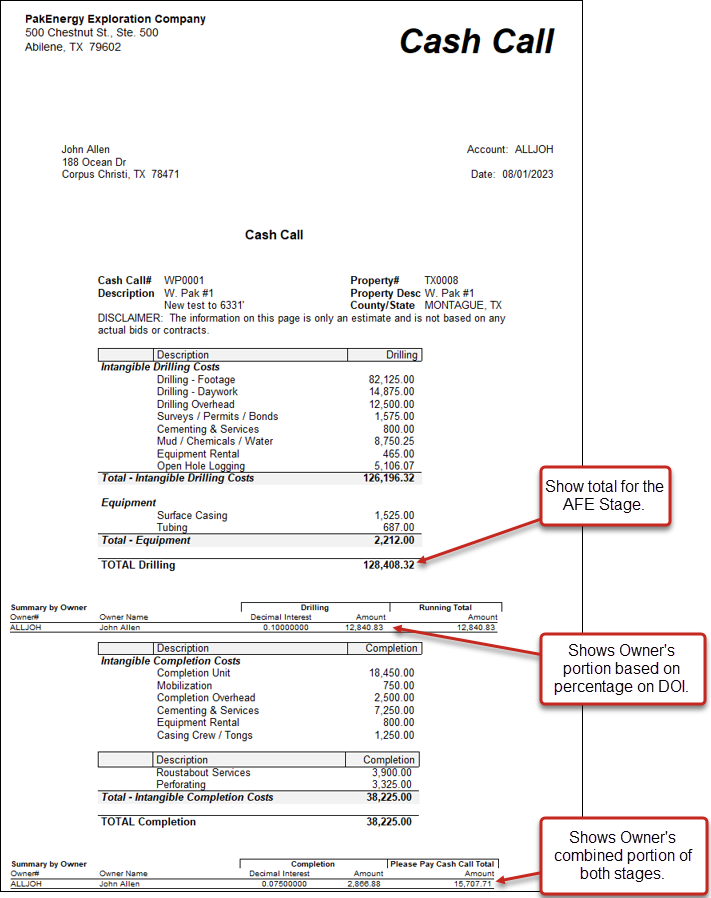

•Create a cash call (or AFE request for payment) to the partners in the project.

•Track actual costs versus the budget and report on same.

•Track the cash call receipts.

•Automatically apply the prepayments to partner’s accounts receivable when the actual charges are billed out.

•Track the amount of unused prepayments for each partner’s project.

An AFE, in essence, is a request to participate in an upcoming project. Note that the AFE request (or cash call) does not automatically create a journal entry. The first entry into the system is when the payment is received.

Pak Accounting tracks the receipt and the automatic application of prepayments via the use of AFE's. An AFE in itself doesn't require the investor to prepay. Generally, prepayments are always associated with some specific project and/or drilling program. However, prepayments can be received and if applied manually to an investor's account doesn't require an AFE. (Warning: Prepayments can not be applied on multiple active AFE's for a specific property within a cycle.)

NOTE: See Investor AFE Tracking to be able to track AFE's without the Revenue/ Billing module.

Setup and Features

•One time setup – Company options and AFE Templates

•AFE Maintenance screen - Establish your Budget for the Project

•List Owner or Office Copy – Generate your Cash Calls

•AFE interface with other modules - Deposit Entry and Accounts Payable

•AFE Reports - including AFE Comparison (Generate a current Cost vs. Budget report) and Payment Status Report

•Billing Cycle Features – Owner Prepayment status and application

One Time Setup:

1.You will need to setup a specialized General Ledger Account for Prepayments in the Liability section of the Chart of Accounts for example #2400 Prepayments. The new account needs to be assigned to Sub-Table for owners, for example #101.

2.You will also need a Journal setup for AFE's in Journal Maintenance.

3.In the Revenue/Billing module, Company Maintenance screen:

a.Accounts tab - at the bottom of the screen, in the Prepayment Collection Acct (Sub by owner) field, enter the prepayment Account

b.Jrnl #/Sub Tbl tab, in the Journal when applying Prepaid to AR field, enter the new AFE Journal.

4.If an entry is not coded to a specific AFE, it’s called an Operation cost. This means that the item will not be covered by Prepayment funds and will need to be paid separately.

Pty Susp/Net tab, in the Netting Option - AFE/Operations field, use the drop-down to select the netting options. This determines how we want the system to treat (and present) the AFE prepaid funds (last three options only). See Netting Options - AFE/Operations for examples

AFE Maintenance Screen:

1.Before you can set up your AFE, you must set up:

a.Property: (Revenue/Billing > Master File Maintenance > Property)

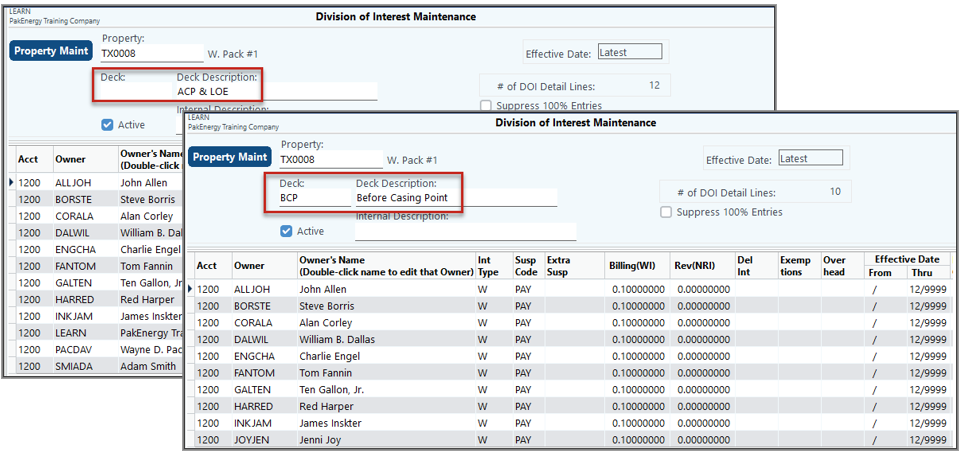

Multiple decks allow for separate DOI’s for the same property during the same billing period. This could be used if there are different sets of owners or different breakout of percentages for different stages that are going on simultaneously.

b.Division of Interest: (Revenue/Billing > Master File Maintenance > Division of Interest)

Make sure your DOI’s are setup – if they are not already created. Don’t forget to set up your owners first.

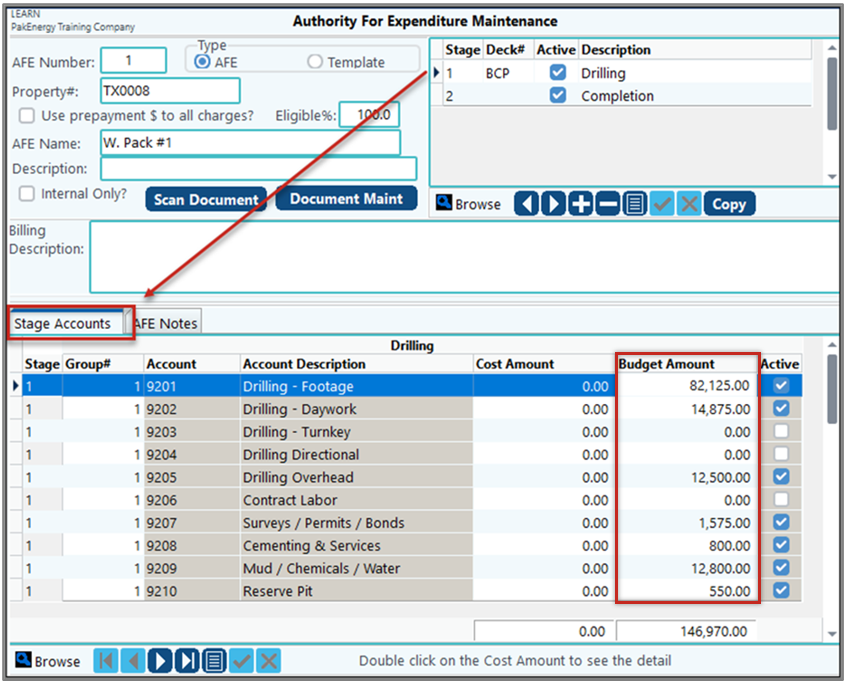

2.Creating the AFE/Cash Call on the AFE Maintenance screen (Revenue/Billing > Billing Maintenance > Authority for Exp). This is where you create and maintain your AFE budgets.

a.Click Add in the lower left-hand corner of the screen.

b.Select the option to Create a new Template, Create a new AFE, or Copy from an Existing Template or AFE.

Notes on creating AFE’s:

•Creating a Template can make it easier to create new AFE’s in the future.

•After saving the template, it is available to copy to an AFE using ADD / Copy from existing Template or AFE. On the main Maintenance Form, select [Add], then select “Copy from Existing Template or AFE (including existing dollars)”.

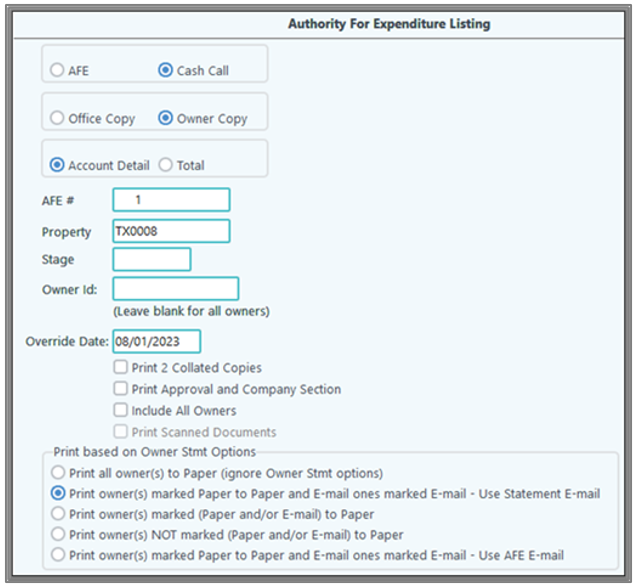

List Owner or Office Copy

1.To Print the AFE/Cash Call, select the List button on the menu bar of the AFE Maintenance.

2.Select the Owner or Office Copy.

3.See AFE Reports for more information on the report options.

Enter in PrePay and Expenses

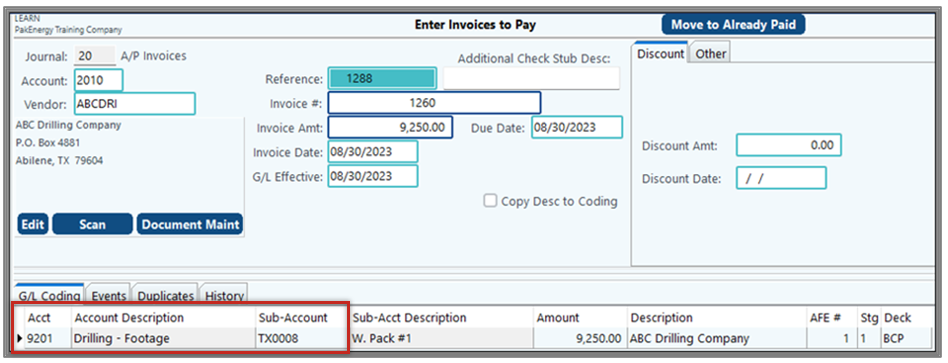

•Entering Expense through A/P

When entering AFE Charges via Accounts Payable invoice entry or General Ledger and you use an active Billing Account from the AFE, it will pre-fill the AFE#, Deck and Stage. The system will automatically code to the correct AFE and stage as long as the AFE# / Stage / Account# is active.

NOTE: If the Expense Account is not associated with the AFE, the AFE#, Stg, and Deck fields will be grayed out.

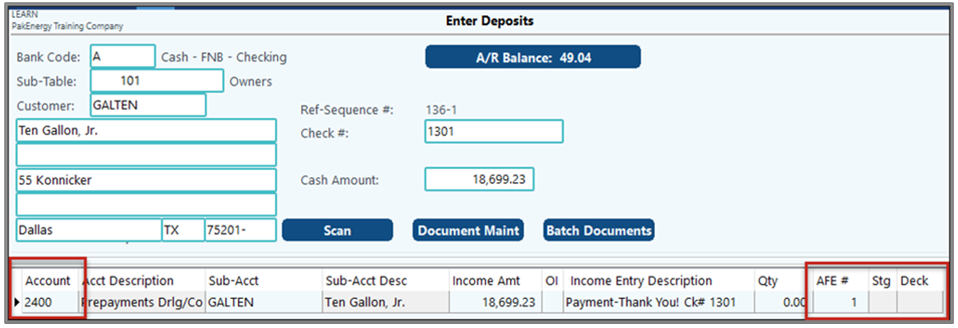

•Receiving and posting prepaid dollars, tracking of returns

When entering a Prepayment received (a deposit) through Deposit Entry or General Ledger Entry, use the AFE Liability Account (ex. 2400). You must enter the related AFE #.

AFE Reports (R/B > Reports > AFE tab) there are several reports to track which owners have/have not paid, what has been Billed vs the Budget, and how much of an Owner’s Prepayment has/has not been used.

Billing Cycle Features – Owner Prepayment status and application

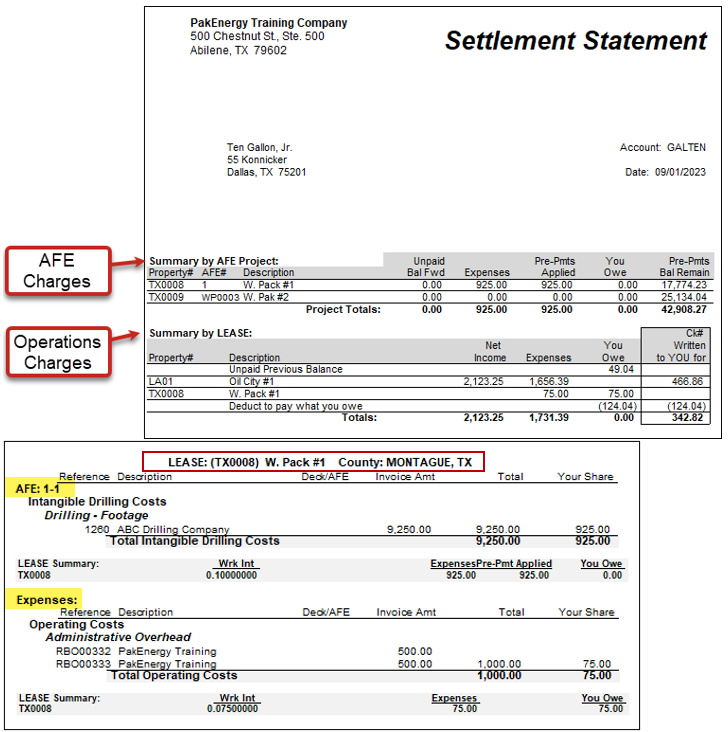

•Current month AFE Billing Charges are automatically offset by any unused Prepayments. In effect, A/R is credited when charges occur not when Prepayment is received.

•Owner Settlement Statement shows a reconciliation of unapplied Prepayment for each AFE that the owner has a participation.

•Owner Detail of Charges accounts for all costs charged to the AFE.

•Operating Costs (charges not associated with the AFE) will be separated out.

1.Setup Division of Interest (DOI)

2.Create AFE

3.Print AFE/Cash Call

4.Enter in Expenses through A/P

5.Enter in received prepay through Deposit Entry

6.Sample Rev/Bil Statement

|