Prepayments

If requiring a prepayment from some or all owners:

1.Collect money from investors – enter deposits, code to Prepaid account & code AFE # that payment is for. Use the office copy of the AFE to check off the ones received.

2.To run a list of the prepayments received, print a Ledger List of the Prepayment account.

3.When Owner's settlement (revenue/billing cycle) the balance of each Prepaid AFE will appear and will show when monies are applied to the billings.

If there is money left over in prepayment account, use one the following options

1.Refund money back to investor – write A/P check – code invoice expense to the prepayment account. (internal note: make sure this asks for AFE# on invoice entry)

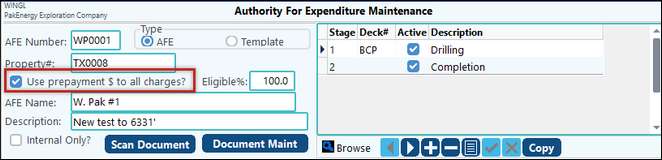

2.Allow non-AFE expenses for this property to be paid using the prepayment amounts. On the AFE Maintenance screen, check the "Use prepayment $ to all charges?" option.

3.Give the owner credit for the remaining balance on their account. Make an adjusting G/L entry, debit: Prepaid Account, Sub-Account is the investor for the balance remaining prepaid for this owner; credit: A/R account, sub-acct is the investor. (internal note: make sure G/L entry ask for AFE# on the entry to the prepaid acct).

4.Roll the remaining funds over into another AFE. Make an adjusting G/L entry: Debit the original AFE# for the balance remaining and credit the number AFE#. The working interest owner must be on both DOI's to post the entry. The owner can be added with a zero percent interest when making the adjustment.

Use Prepayment $ to all charges

Normally, the prepayment balance for an AFE is used only for expenses coded to that AFE. This check mark is used to apply prepayments to ALL costs associated with this property, not just AFE costs. This option is commonly used after an AFE is completed to 'Drain' any unused prepayments by allowing operating expenses and other non-AFE expenses to be paid with the remaining balance in the prepayment account..

The eligible % is used when you advanced a % of the cost of the project. For example, if you did a cash call for 20% of the actual cost, enter 20% in the Eligible % field and the result would be only 20% of the current month billing cost would credit against A/R from the prepaid account.

This is normally NOT checked unless:

•The AFE goes under budget

•You prefer to apply the remaining balance to Operations costs.

Advanced Company Options

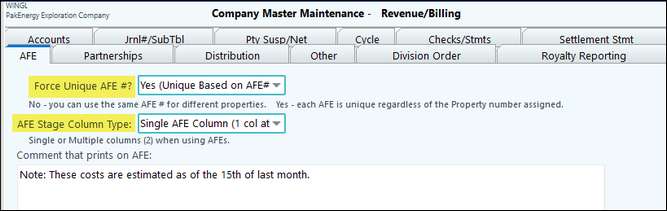

The Force Unique AFE has two options: Yes (Unique Based on AFE # only). AFE #'s can be duplicated, but not on the same property. No (Unique Based on AFE# and Property #). No Multiple AFE #'s allowed

The AFE Stage Column type also has two option: Single AFE Column or Multiple AFE columns. Our examples so far have been the Single Column format. See below for Multiple column Owner copy of the AFE.