Frequently Asked Questions about Revenue / Billing

Click on the blue link for the answer.

A billing cycle is a process where Pak Accounting takes each unbilled charge/ invoice and allocates to each partner (owner/investor) their proportionate share. The system will observe your cut-off date (usually the end of the month), and will automatically separate the billing of the expenses by property, category of expense and expense coding. |

A revenue cycle is very similar to the billing cycle, except that it deals with income instead of expenses. The Revenue Cycle takes the revenue received from the purchaser and divides it up based on the Revenue % of the division of interest. The system will break down the revenue into 3 basic parts: Gross Proceeds, less taxes deducted, and less other deductions. |

The revenue/billing cycle has an optional "Last Statement Date". This triggers an A/R type statement showing the detail between this "last statement date" and the current balance forward that is shown on the summary statement. (i.e. this is used to provide the customer/owner the details of why their ending balance changed between the last statement they received and the beginning balance of this statement.) If the owner has made any payments or received any other misc charges and the user specifies the correct "last statement date", then it isn't unusual for very few (i.e. none) of the owners to actually have a statement printed out. If the norm is for owners to make payments, then all the owners that made a payment would get a little statement that gave them the balance forward from their last statement, their payment(s) made, and their new ending balance. |

1.Check to make sure the effective date of the invoice/voided invoice is on or before the Billing CuttOff Date. 2.If running a Revenue Billing, cycle make sure nothing is being held. a. Distribute/Combine, Hold Transactions 3.Check to make sure it’s "Ok to pay" in the Property, Company Opts tab. 4.Check to make sure the AP flag is set to "True." a.In View/Trend, AP acct, check the Open AP column. b.If set to "False," WP thinks it’s already paid even if there is no paid date. c.The solution is to right-click and change the account to a non-billable account and then do a journal entry from that account back to the billable account. |

1.The Deleted Interest Owner must have the same exemptions as the Exempt Owner. 2.Change the Purchaser setup to ENTRY on both the 100% and the Owner% for the exempt items (e.g. OTHER, TAX). 3.Enter the Owner% of the exempt item (e.g. OTHER, TAX) in BOTH 100% and Owner% columns in Check Stub Entry |

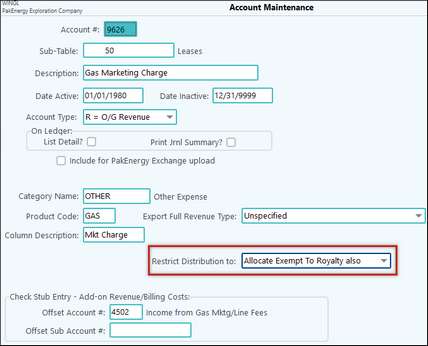

Change company option in the Revenue/Billing module > Company Maintenance > Pty Susp/Net Tab (located at the bottom of the screen) from the default No to Yes for OTHER and TAXES. For OTHER - Specifies whether the royalty owners will be excluded from being allocated any exempt OTHER amounts. If this is set to "Yes" and coded on the account master, then exempt (OTHER) amounts will only be allocated to the working interest owners. For TAXES - This excludes Royalty and ORRI from being allocated any exempt TAXES amounts (Do not use if part of the production can be exempt from the tax based on ownership. With this company option turned on it will work with an “other category type” exemption on a DOI and it will not charge the Royalty owners that are not exempt from the “other category type” charge, the burden of the exempted owner. This will be your default behavior on all DOI’s but you do have the option to not have this happen for some if you desire by using an option on the account maintenance.

If you change the setting for Restrict Distribution to: “Allocate Exempt to Royalty also” any charges to this account will behave different than the default company setting. It will of course exempt the owners that are exempt on the DOI for that charge but it will charge their exempted amount to all owners, even Royalty owners. |

Deleted Interest is the term used when distributing revenue to only some of the owners of the property because the others have already been paid and their share has already been deducted from the money you received. (i. e. you only received the monies for the interests that you are responsible for distributing). This can vary by product and Pak Accounting is one of a few systems that can handle this without resorting to setting up and maintaining multiple decks. Also see Deleted Interest Setup. |

| How do I correct State Withholding? An owner had State W/H come out of their Revenue and it shouldn't have. How to I reimburse them? |

1.Make sure the tax is still turned on in Owner Maintenance (F12) > Revenue Billing tab > Withholding: Edit button. 2.Manually add the amount of State W/H into Suspense. See Adding Suspense for more information. a.Go to Revenue Billing > Reports > Corrections > 31 Change Correct Void > R-5 Suspense Add New. b.The Offset Account is going to be the liability account that is set on the Fed/State Withholding set up screen for this state. c.In the Owner Share column, enter in the amount of the State W/H that should not have been deducted from the owner. Since we are charging Tax make sure this figure is negative when entering it in. At the bottom of the screen, in the Totals section, Pak Accounting will flip the sign accordingly to show what the entry will be when posted. d.Save and Update the Suspense Add. 3.Go back into Owner Maintenance and uncheck the state in the Withholding:Edit button so withholding will not be taken out on future revenue. |

Create a manual entry to the Owner's AR account, make sure the owner is netted (F12) and on the Rev/Bill Extract/General Tab is set to net for the cycle. |

Reallocate a paid, but not billed, invoice - also see A/P FAQ

Scenario 1: The company option to Transfer Petty Suspense to A/R is set to NO and the Petty Suspense Test Rule is set to Apply After Billing Deduct. See How Netting Works in Pak Accounting Example 2 for more information and examples.

Scenario 2: The backup withholding was more than the Net Income causing it to be negative. The system won’t show negative net income so that is why no income is showing on the Settlement Statement. The revenue will go to suspense until it becomes positive income and is enough to cover the withholding. At that point, the system will actually calculate the withholding and show it on the Settlement Statement. There will be a line showing the withholding amount and deduct it from the net income. For example: Owner Level Withholding: (Gross Revenue) 389.70 * (NM Withholding) .048 = (total withholding) $18.71 Distribution by property: (Net Amt) $16.54 (Net Rev) 16.54 – (state w/h) 18.71 = (total Net Income would have been) -2.17 Places to check for above information: •Pre-Check Reports/Print Distribution by Property to find Gross Revenue and Net Amt to show Revenue Distribution by Property •F12 – Owner Maint setup to find the Owner’s Fed and State Withholding Codes. •RB/Company Maint/94 State W/H setup to find the Tax Rate and if it’s based on Gross or Net. •After Check Reports/Owner Summary for All Owners will show if the Net Income is going to Suspense. |

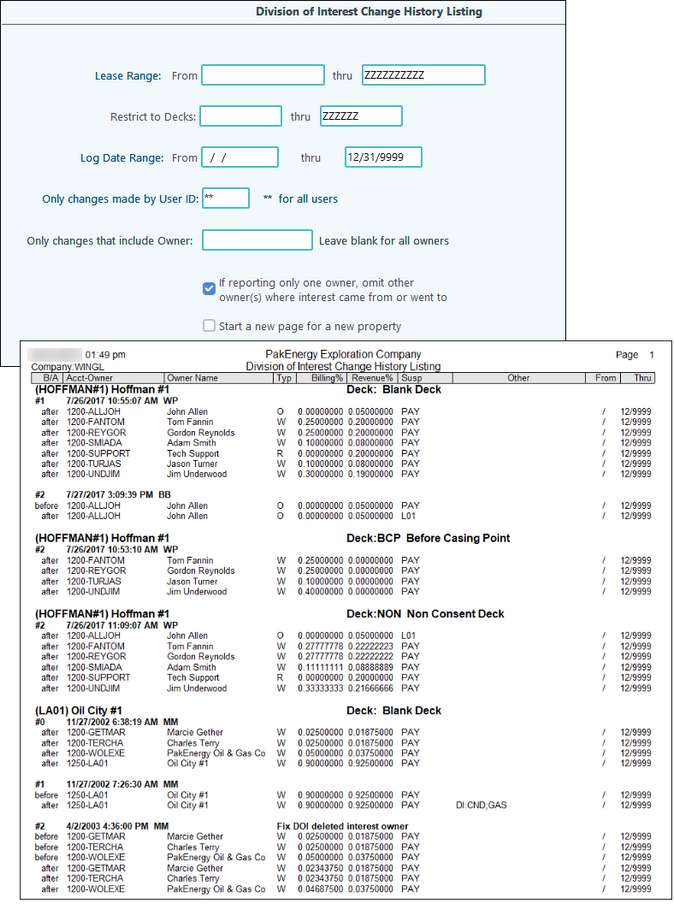

Revenue/Billing > Reports/Corrections > #30-Reports > DOI tab > Report D-3 The DOI Change History List provides an audit trail of DOI changes and the user defined reasons for the changes. This report can be run for one lease, a range of leases, or for all leases in a specified time period. To find out if a particular user made a DOI change, enter their User ID in the applicable field or enter ”**” to include all users. Further refinement to the report can be done by entering a particular owner and/or deck if necessary. If left blank, all owners will be included.

|

If owners have been escheated in the prior year, another due diligence letter is not required. |

Run a G/L Ledger with Print detail date from Blank thru the ending period of the Balance Sheet, for your Billing Accounts only with List Account Detail set to All. On the Secondary Options tab enter the Paid Dates after last cycle date to 12/31/9999 and check the Include Unpaid to see all Unbilled items. Ex. if you are looking at your Balance Sheet as of 8/31, enter 9/1 for the beginning Paid date. |

This is from Owner amounts not meeting their minimum payment option on their Owner Maintenance. |

How to handle this situation in Pak Accounting depends on what you want to do. If you want to give the owner the prepayment money back and separate the funds, an A/P check can be written to refund the money. However, if the AFE is closed out and you want the money to be used for other charges, check the box on the AFE to "Use the prepayment $ to all charges". This will ensure that any money that is not used will be used for other expenses. |

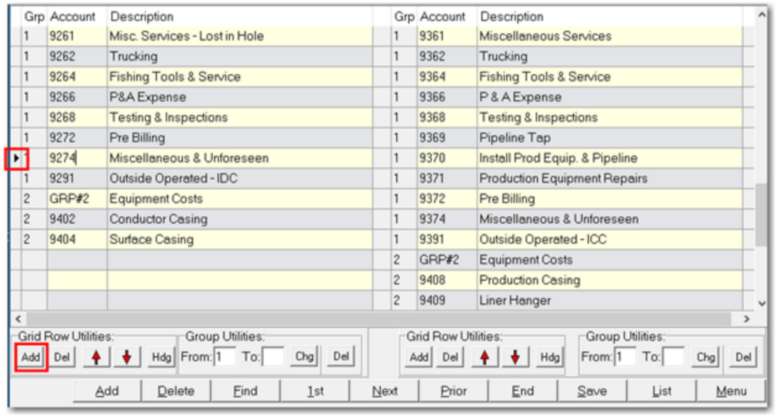

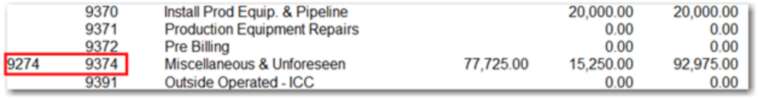

The stage 1 account numbers should line up with the corresponding stage 2 account numbers. However, if you run the report and notice that the stage 1 and stage 2 account numbers do not line up properly then changes can be made in #42 AFE > Util > Detail Line Maint (add/delete/rearrange). In this example, there were charges for stage 2 account 9370, but not for the corresponding stage 1 account 9270:

This causes the report to pull the account description for the stage 1 account listed on the same line. To correct this, you will need to make changes in “Util” by choosing “Detail Line Maint (add/delete/rearrange)”. You will see that the account 9274 and 9370 are on the same line.

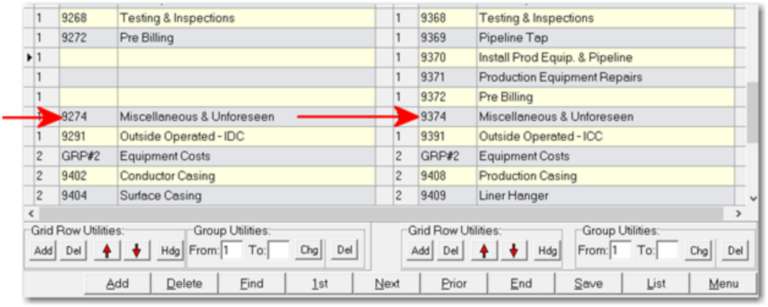

You will need to add blank lines on the left side in stage 1 so that the account 9274 lines up with the corresponding stage 2 account number 9374. Click on the stage 1 account 9374. This will put a black selection arrow to the left of the “Grp” number. Click the “Add” button in the “Grid Row Utilities” box to insert a blank line.

Continue to do so until the account 9274 lines up with the stage 2 account 9374.

When the stage 1 account numbers match to the corresponding stage 2 account numbers, the “A-1 Owner or Office Copy” report shows the information correctly.

|

If your logo and company information was printing on your statement and then it just stopped, check to see if you recently set up partnerships. See Partnership Separate Checks/Stmts for a special warning on attaching Bank Codes. |