Frequently Asked Questions about Payroll

Click on the blue link for the answer.

Please see PA City and County Taxes instructions. |

There is no “Inactive” date on company level detail codes. If you no longer want a detail code to automatically be added to new employees – you can uncheck the “Automatically Add this detail to the following Pay Types” flags on the detail code in the Payroll > # 80 Basic Options > Detail Codes > Company Detail Maintenance” screen.

There is also a utility in Payroll > # 12 Emp Detail Mass Chg menu. Select a Detail Code, and then enter in a new “Stop Date” to change from an existing stop date (of blank) to a new stop date. |

There is actually no way to void an entire cycle. Call your Customer Success Team to go over your options. It will depend on what exactly needs to be corrected and how long it has been since you posted your cycle. For example: •Was a detail code set incorrectly? A correcting cycle may need to be done. •Was an employee paid incorrectly? This solution will depend on if the employee has already been paid or not. •Was the journal entry that was made from the cycle incorrect? oIf it was just an incorrect account we may be able to fix in General Ledger and correct the Payroll setup. oWas it for the incorrect amount? We will need to check the setup and consider correcting cycles. As you can see, there are many variables with different solutions depending on the specific issue. Please call your Customer Success Team for more information. |

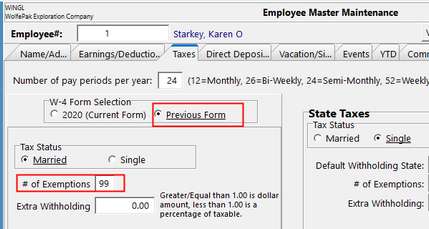

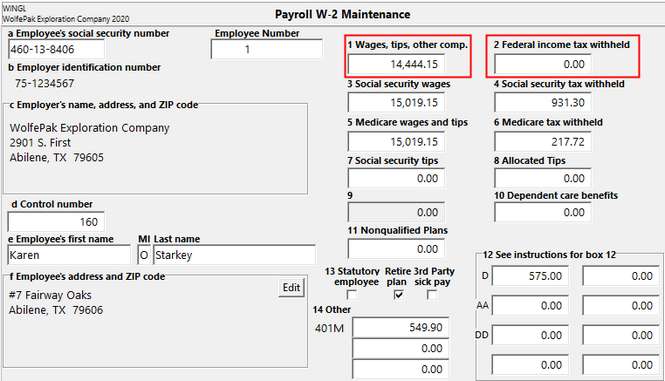

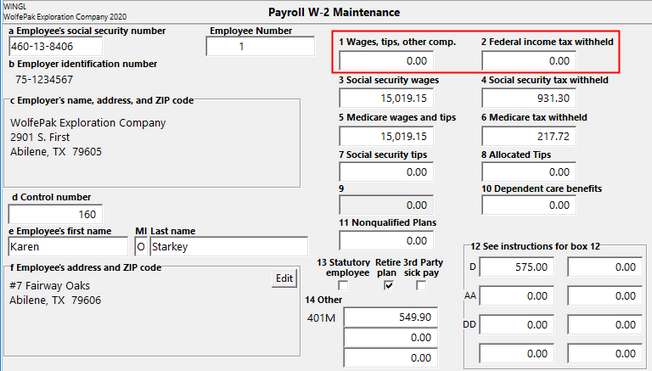

Most people are not going to be “Exempt” from Federal Withholding. They may not want you to withhold any taxes, but they still need to report wages subject to Federal Withholding on their W-2 form. In Payroll > # 10 Employee Master > Taxes tab, you can set the US Federal Taxes to the maximum '# of Exemptions”. This basically tells the program to NOT calculate any Federal Withholding tax for the employee. Their W-2 will still show wages subject to Federal Withholding in box 1, but box 2 showing Federal Withholding tax withheld would be zero. If Previous Form is selected, enter in 99 in the # of Exemptions field.

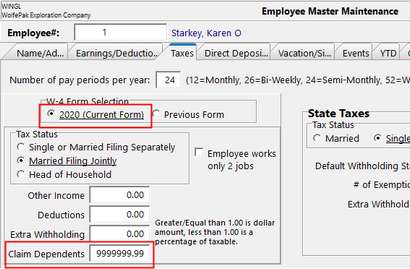

If 2020 (Current Form) is selected, enter in 9999999.99 in the Claim Dependents field.

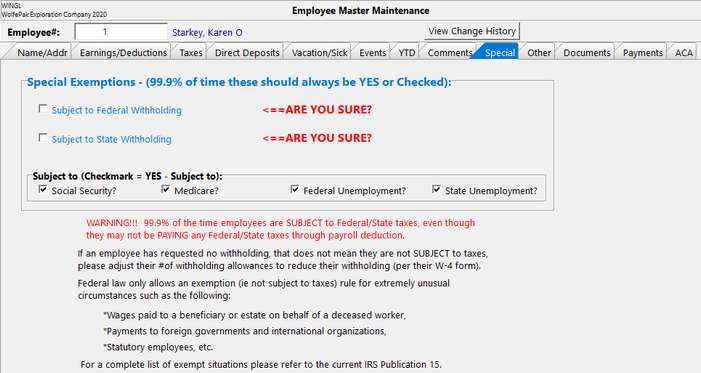

There is another tab on the employee master called “Special”. This tab is where you flag an employee subject to the different taxes. IF you uncheck the “Subject to Federal Withholding” flag – you’ll get a red “ARE YOU SURE” flag, a red message will appear on the screen warning you that this is unusual, and the tab will turn blue. IF you set an employee as NOT Subject to Federal Withholding, their W-2 box 1 will show zero. None of the wages paid to the employee will be tracked for wages subject to Federal Withholding.

As the screen states that is EXTREMELY rare.

NOTE: If all the boxes on the Special tab are unchecked, no W-2 will be created for that employee.

Many times when the employees say they are exempt, they really don’t want any Federal Withholding tax withheld. You are still required to report wages paid to them in box 1 of their W-2 form.

This would be where you check with your tax accountant, and do due diligence to make sure if they turn in a W-4 marked as exempt from taxes, that they really are “exempt”. |

See Payroll > Master File Maintenance > Cycle Lock Status |

Can any user change the cycle lock status?

Yes, any user that has access to payroll can change the status of the lock (i.e. the original user who locked the cycle does not have to be the one to unlock it, any user can at this point).

If I open it up for others to key in payroll time, will I have to do anything special to print checks? No, the system will automatically change the cycle’s Lock status from “Summary is Open” to “Locked” when you go into the Print Checks option. Others users can print Hours proof lists if they want to, but only you (the User-Id on the cycle’s lock) will be able to Print Checks. When the status does get changed to “Locked” and one of the other users try to key in some additional time or make other changes to the employee’s being paid, they will immediately be warned that you have a cycle in process and to wait to do the changes.

I use a Pak Accounting time entry system, does payroll cycle locking affect importing my time into payroll?

Cycle Locking at this point does not affect the time entry system that you might be importing time from, it concentrates on the payroll cycle function. While a payroll cycle is being created, the entire employee master is locked while the cycle is being formed. After that, only the employees getting paid are protected from being changed (i.e. via employee master). |

On a quarterly or annual basis, a balancing process should be run on your Payroll Liability Accounts. These type of accounts should be checked periodically. This is an easy look after processing payroll. Go to View Trend (F4), find your account- 2360 in our case. The account balance won’t be zero, but you can see the balance of that account. Most of these accounts are paid on a quarterly basis, some are paid on a monthly basis. Depending on what month you pay those in, some of those accounts may be zero at some point.

|

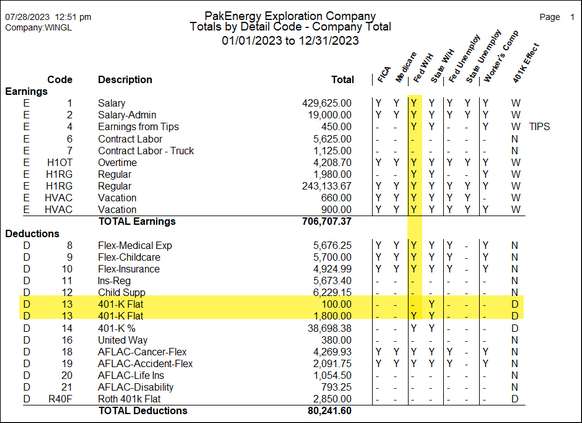

Pak Accounting has provided the capability to be able to make payroll corrections for detail codes that have been setup incorrectly. This utility will make the process easier. In addition to making the correction to the detail code, the correction utility will also correct any changes made on the Special Tab in the Employee Master Maintenance. Audit Process: 1.User will need to run the H-10 Totals by Detail Code for each employee to see the incorrect settings of detail code(s). 2.Correct the switches on the detail code(s) in question. Note: This utility will only correct types E or D. 3.Decide how you want to run the correcting payroll - all, active employees only or employees extracted in current cycle. Pak Accounting strongly suggests that you run this correcting cycle as a stand-alone cycle and not mix with a current payroll cycle. User also needs to be aware of the implication of dates. Check dates in the correcting cycle determines the quarter that these corrections will be reported, i.e. 941, SUTA, G/L entries. 4.Start your payroll cycle after making these determinations. 5.Once the payroll cycle is updated, run the H-10 Totals by Detail Code again to make sure corrections were made properly. For example, the 401F (401-K Flat) detail code was changed incorrectly in regards to Federal and State Withholding. See below:

|

1.Backup files in case of error in process. 2.Run the Totals by Detail Code (H-10) under Reports, Historical tab for employee(s) in question. Make sure you have the date range defined properly. 3.If options on the Special tab in Employee Master have been changed to be correct, user will need to set them back to way they were (the incorrect way). 4.Setup a detail code for the difference that will incur with processing the correcting payroll cycles. 5.Start a payroll cycle with the proper dates. User will need to back out any earnings and/or deductions to reverse the original check. Enter the difference to the new detail code that was setup in step 4. Check amount should be zero. 6.Run this process for all employees affected. 7.Run cycle as normal – Update. 8.Change the options on the Special Tab in Employee Master to the correct settings. 9.Start a payroll cycle with the same dates used in previous cycle. Enter the earnings and/or deductions to get the correct taxes calculated. Enter the difference to the new detail code that was previously set up in step 4. 10. Run this process for all employees affected. 11. Run cycle as normal – Update. 12. Run the Totals by Detail Code (H-10) report now to verify that all corrections made were done correctly. 13.The difference left in the new account associated with the new detail code that was setup, will be the amount that the employee owes the company for taxes not withheld initially. Those will need to be deducted from their next check for reimbursement to the company. 14.There will be taxes due to the IRS. The EFTPS page will be available with the last correcting cycle. |

An employee must be in the most current cycle or unused vacation will not be printed on the check stub as it is considered historical at that point. |

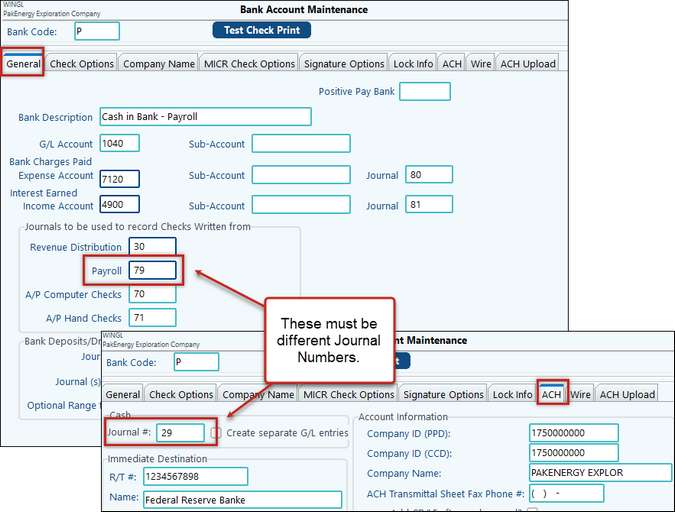

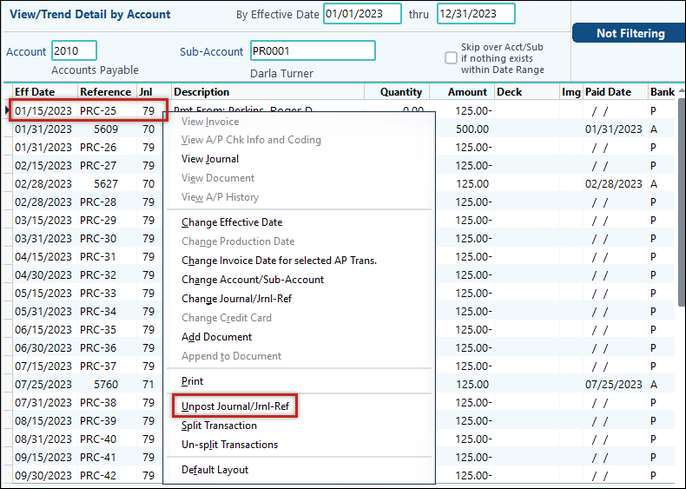

In Payroll, go into Master File Maintenance, Bank Account Master. Find the Bank that is being used for Payroll. On the ACH tab, make sure the Cash/Journal is not the same as the Journal being used for the Payroll Cycle. If it is, change it to anything else. Even though Payroll does not use the ACH tab in Bank Account Maintenance, it flags whatever journal that is on the ACH tab as a Payment Journal, and therefore; will try to treat it accordingly.

Solution: •Do a backup of your company in Utilities > Backup/Restore > 20 Backup WolfePak Data •You will need to unpost the Payroll Journal Entries through View/Trend by right-clicking on the entry and selecting Unpost Journal > Jrnl Ref. Leave the next screen as the default and click on OK.

•Change the Journal on the Bank Account Maintenance > ACH tab to something other than your default Payroll Journal. •Go into General Ledger > Manual Entries > #11 Post Entries. Post the entries back into General Ledger. No changes should have been made to them. |

If you are unable to enter an amount into a detail line or the line is blue this indicates that the detail line was not selected to be included in this cycle. Go to the Start-Payroll Cycle screen. In the bottom right-hand corner of the screen make sure the detail code is checked. Once checked you should be able to make changes to it on the Enter-Pay Summary screen. |

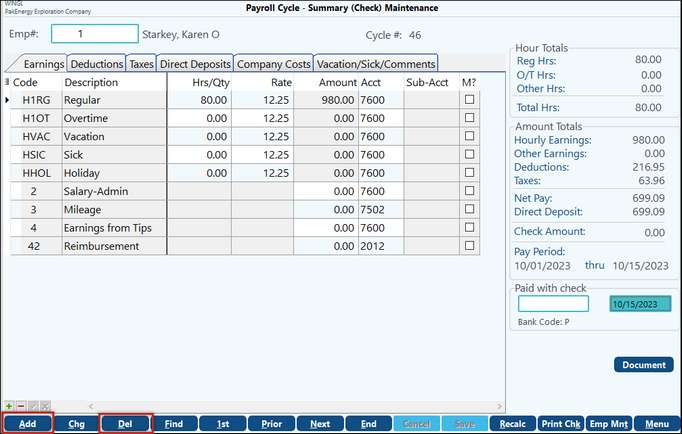

Go to #2 Enter-Pay Summary, select the Add or Del, at the bottom left of the screen.

The Add option will give you the options to Add new employee, add detail to employee or add new employee and timecard info.

|

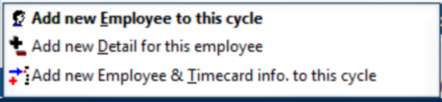

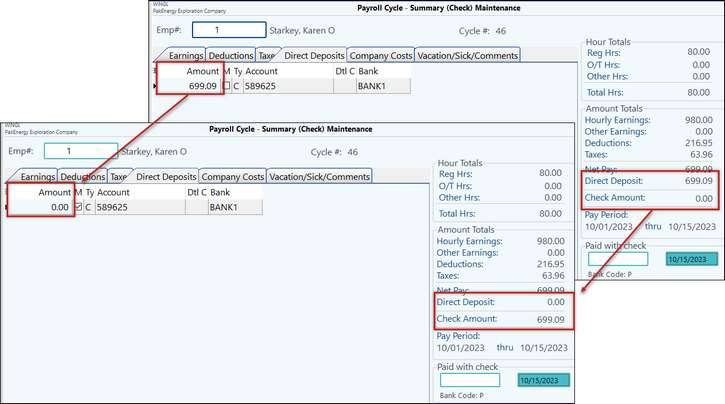

In the #2 Enter-Pay Summary screen, go to the Direct Deposit tab, change the amount to $0.00. This change on the check from Direct Deposit to Check amount and allow it to be included in the print check page.

|

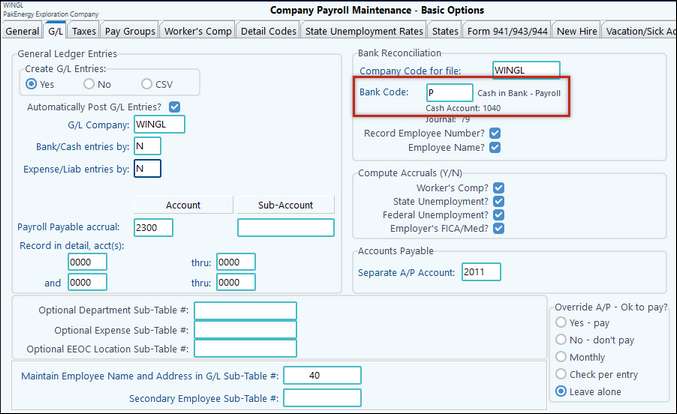

You can change this option in Payroll > Master File Maintenance > #80 Basic Options > G/L tab.

|

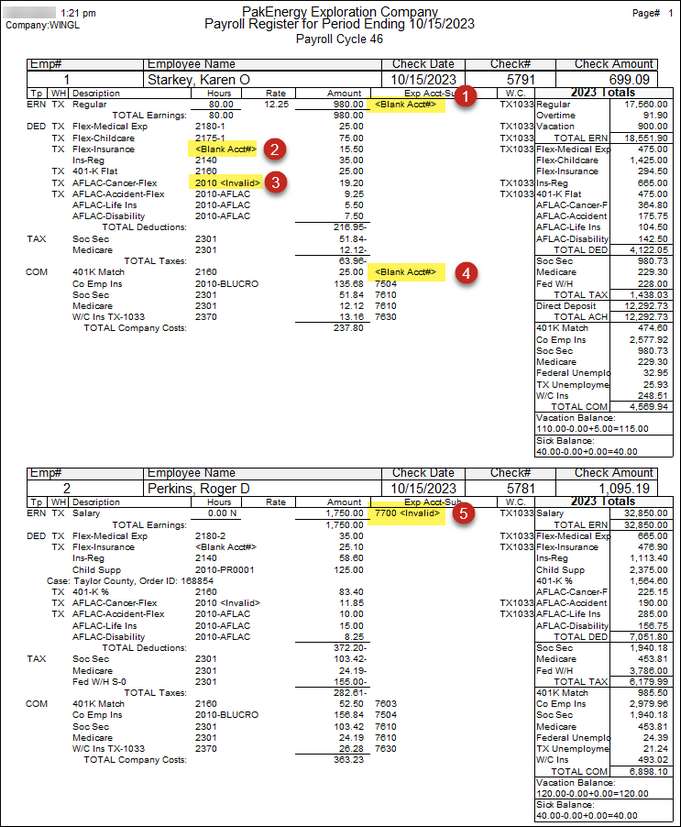

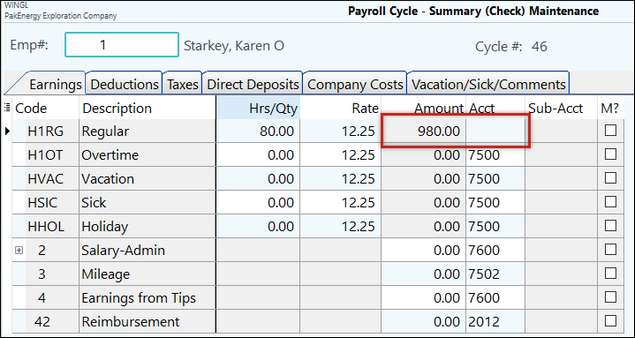

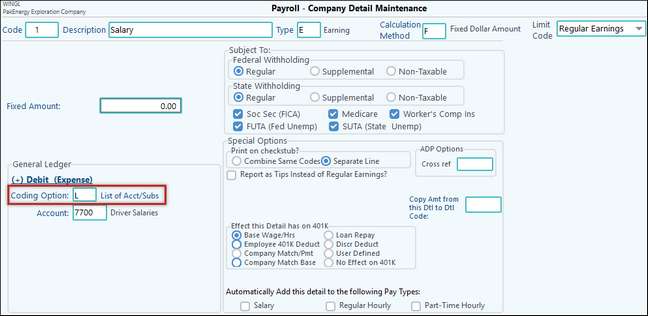

Depending on the location of the error in the payroll register will help you determine the solution. 1.You can see this is the Expense portion of the Regular earnings detail code. So, your first step is to look at that employee’s detail code in the cycle or in employee maint. *Note: In cycle changes will only affect the one cycle, to change permanently, change it in the employee master.

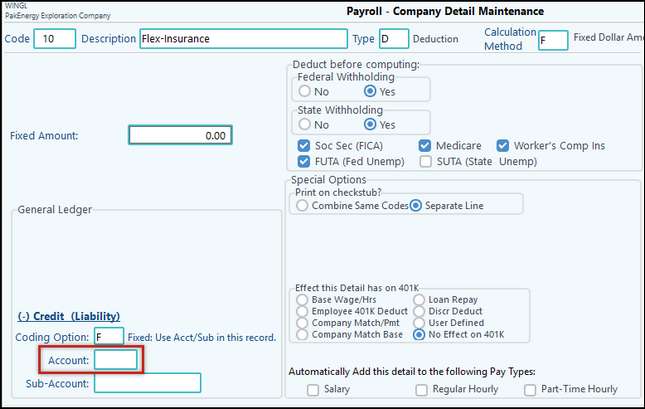

2.The Deductions tab in the Pay Summary will not allow you to add an account, like the Earnings tab will. You will need to go to the Employee Maint. Detail Codes tab and go into the detail code itself and add the account.

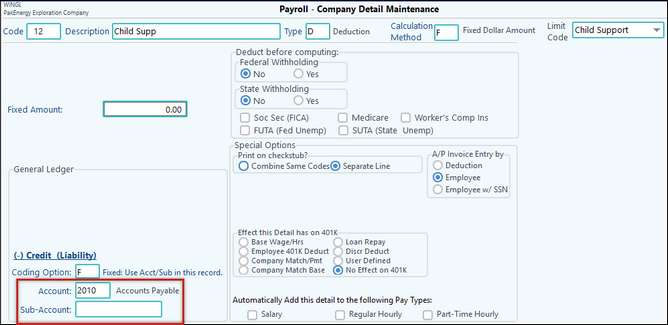

3.Similar to the last issue, the change will need to be made in the employee maint. This issue involves the Sub-Account, either the sub- account needs to be added or the Coding Option needs to be changed. Depending on the situation, depends on the solution.

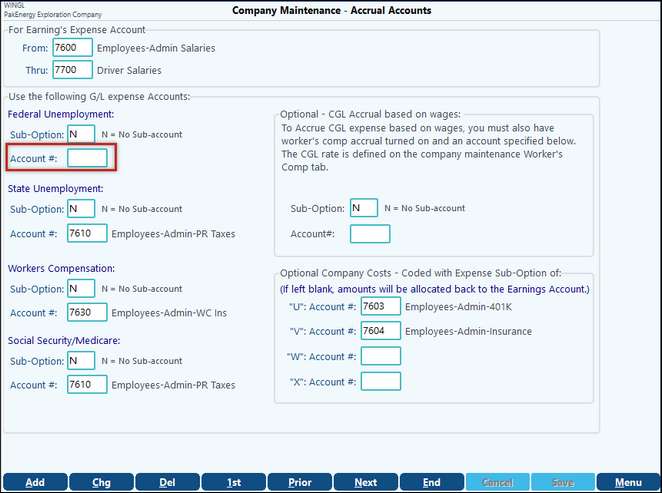

4.Accrual Accounts for each Earnings code. You can have multiple setup options for each earrings account or you can use a range to include all earnings account.

5.This is an example of the Coding option needs to be corrected. The example has account 7500 that is subbed by properties but has an “L” coding. Depending on the situation will depend on the correct coding, coding list below.

|

||||

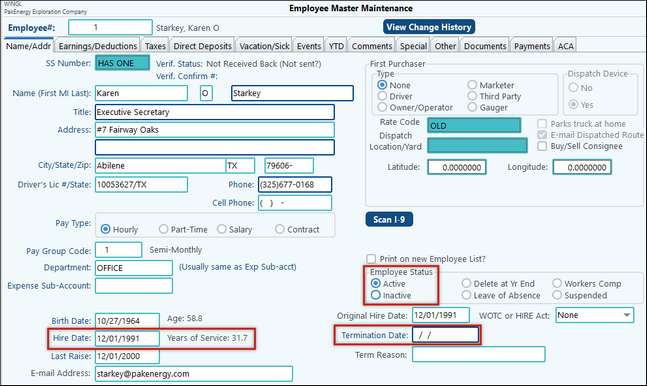

The Term date in the Employee Master is not time date sensitive, if there is a date the system marks them as inactive. The client will need to remove the term. date, run their last cycle, and then add the term date back into the employee master. In order to remove the term date, you have to remove the term date and mark as Active, select Rehire and change the Hire date to any date. (you can go back and change it to the original hire date later) Run the cycle and put in the term date.

If you select Cancel, it will not allow change to the Term date.

|

Form 1094-C: Pak Accounting automatically fills the form out with all of the information, so there is no need for the client to purchase blank forms. |