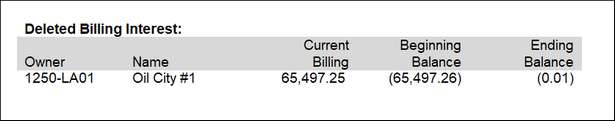

Deleted Interest occurs when you don’t receive 100% of the revenue or billing but must disburse the amount you receive. Since the DOI needs to equal 100%, you will need a “placeholder for the percentage you did not receive. Pak Accounting separates Billing Deleted Interest from the Revenue Deleted Interest into two separate accounts. This will allow you as, well as the system, to isolate any imbalances. On the billing side of things, there isn’t a one-to-one match between distribution and deleted Interest. •There could be hundreds of billing transactions recorded using the 100% amounts and one or more Deleted Interest Entries. There is no forced matching. •The Deleted Interest account for billing in our example company is 1250 and is captioned Accounts Receivable-Del Int. •It is defined in Revenue/Billing > Company Maintenance >Company > Accounts Tab. (Billing Deleted Interest Account). On the Revenue/Billing Cycle’s Owner Summary report, right before the totals, the system will give a preview of what the balance is on each Deleted Interest account broken down by Property/Sub-Account. If you aren’t holding specific transactions and keeping them from being billed, the Ending Balance should always be near zero.

Revenue/Billing Owner Summary: (If billing deleted interest is included in this distribution, then a separate line for each property will be shown.) If a Trial Balance was run as of the "Billing Thru" date, the balances at that point should be near zero (provided all the transactions were billed as of that date. This can be verified by the UnPaid/Unbilled report.)

Best Practice: Once a year, review any outstanding balances in the Billing and/or Revenue Deleted Interest accounts. Write off any penny balances found in the Billing account. |

Revenue Deleted Interest Setup

Billing Deleted Interest Setup