Key concepts:

Audit risk is the risk that an auditor may issue an qualified report due to the failure to detect a material misstatement caused by error or fraud. Organizational management and auditor's have a responsibility to detect fraud or error through internal controls and financial reporting audit procedures. Using Pak Accounting's security measures will help to institute good internal controls. See the system's Security section to utilize user level security and user level passwords, Multiple Posting Dates, and Check Writing Approvals. In addition Pak Accounting recommends running the Audit Report of Changes in the Management Dashboard module on a regular basis to investigate any activity that is deemed suspicious. The Change Log and other reports throughout the system will also assist in verifying specific changes.

Works Cited

AFC Discusses Role of Internal Audit in Detecting Fraud . (2013, October 15). Retrieved from Audit & Risk: http://auditandrisk.org/uk/news/afc-discusses-role-of-internal-audit-in-detecting-fraud |

How Netting Works in Pak Accounting

Pak Accounting keeps revenue and expenses separate. •Revenue maintains a balance forward, known as petty suspense that existed prior to the current cycle. Generally, petty suspense for an owner is combined with the current distribution and the sum is the balance that is payable to that owner (unless the cycle option “Petty Suspense: Don’t pay” is specified) which will either pay as a whole or not. Reversals can also be included. Significant reversals will force the owner’s current revenue to be sent to petty suspense until the current revenue produces a high enough positive balance. The owner level determines whether an owner is to be paid or whether the amount is to be sent to petty suspense. •Billing also maintains a balance forward. Credits can be put through on expenses, but they are still expenses and not Revenue. Credit balances are either “refundable” or not based on the cycle’s option. If you are coding an owner’s prepayment directly to their A/R account (instead of using the system’s AFE/Cash call & prepayment features), then perhaps credit balances should not be refunded. Or if you issue some large credits but have offsetting charges that will soon follow, it may be beneficial to have the Refund option unchecked.

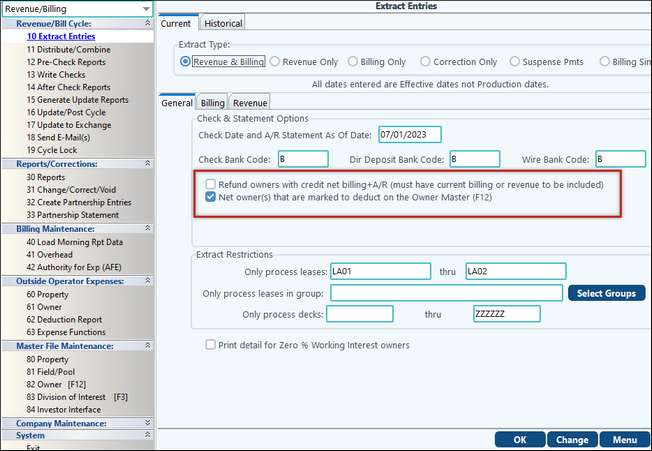

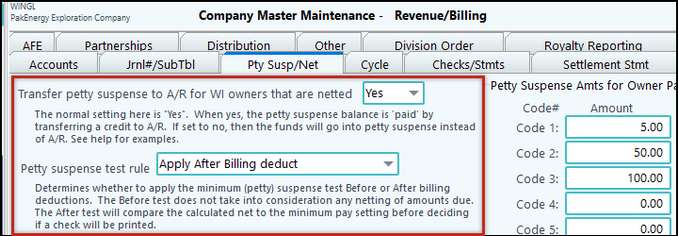

Netting is the bridge between Revenue and Billing and occurs at the owner level on an owner by owner basis. It creates a deduction that ties the two together. The deduction can be a credit if “Refund of Credit JIB” is chosen for the cycle. For netting to work, the owner must be marked with one of the following three Deduct codes: W=Net Working Interest, Y=Net Everything, O=Net Working & Override.) Netting only transpires when an owner would be paid. The netting deduction will then determine what the owner gets paid by making applicable adjustments. Additionally, the netting option can cause an owner to not receive a payment based on the minimum payment rules specified. If the amount owed is more than the revenue, the netting option will clear the revenue and the owner will receive a statement for the remainder of what is owed. However, another situation that can occur happens if there is more revenue than expenses and the netted amount is below the minimum amount dictated by the minimum suspense amount for the owner. Pak Accounting has addressed this problem with a feature that will allow you to net without writing small checks. Additionally this feature allows for an explanation to be added to the owner’s statement explaining the reason why the owners are getting a bill for expenses without the credit for the income and thus not getting a check. This feature is “Transfer petty suspense to A/R for WI owners that are netted” and is found in the Company options, Petty Susp/Net tab. To use this option effectively, the cycle option “Refund owners with credit net billing + A/R” must be checked. Running the “Refund” option should not pose a problem if the AFE system with separate reporting and prepayment accounts, is used properly.

Revenue that is not in legal suspense is payable based on the owner’s Petty Suspense code setting. This setting can be overridden at the cycle level by using the Suspense Pmts option. This option allows suspense to be flushed for an individual owner based on the age of the suspense. This helps to stay in compliance with state laws regarding flushing suspense for all owners when it is not necessary. Revenue deductions (taxes and others) are ALWAYS deducted from gross revenue to arrive at the net amount to be paid. The “Petty suspense test rule” determines whether the minimum petty suspense test will be applied before or after billing deductions. Billing deductions include A/R balance forwards regardless of when it was billed. Any balance forward is treated as a part of what the owner owes. This allows the system to work consistently whether Billing is run with the revenue cycle or separately from it. The cycle option “Refund owners with credit net billing + A/R” will pay the owner any credit expense balance if checked. Example 1: owner with pay code set to $50.00 to write a check and the company options set to NO to Transfer petty suspense to A/R and the Petty suspense test rule set to Apply before billing deduct.

The system is going to write a check for under 50.00 but the rules as are based on the income before billing deduct of 1540.43 which is well above the minimum to write a check. Example 2: owner with pay code set to $50.00 to write a check and the company option set to NO to Transfer petty suspense to A/R and the Petty suspense test rule set to Apply After billing deduct.

The system will not write a check in this example due to the netted amount of 45.70 being below the 50.00 minimum pay code setting of the owner. In this case the owner’s statement will not show any income because all of the income will go into suspense until it reaches enough to write a check. With Working Interests owners, it generally is very upsetting for them to get their share of the billing and NOT get credit for their share of the revenue. But this is exactly what happens in a traditional petty suspense situation based on whatever minimum payment threshold you give them. Giving them a very low minimum threshold lowers the possibility of them being caught in this “get a bill but NO revenue” zone, but you also run the danger of writing them a 50 cent check! Why not avoid it all together by turning the Transfer petty suspense to A/R to Yes and leaving the minimum payment amount at a reasonable amount. This will cause them to get credit for their share of the revenue (unless you have them legal suspense for some reason). Based on how you have the Suspense Rule setup below and their minimum amount code (and its corresponding amount); they could get left with credit balance up to the amount of their Minimum Payment code. Select Yes to take advantage of a more investor friendly option. If yes, the petty suspense balance is ‘paid’ by transferring a credit to A/R. Editor’s Note: If the expense exceed the revenue, then Pak Accounting will go ahead and handle this situation for you! Regardless of how minimum payment amount, the system’s special zero or no check logic kicks in and “pays” all the revenue, leaving the investor with a remaining balance still owed. However, if the revenue exceeds the expenses by only a penny or more, then this is where the Minimum payment amount prevents very small checks from being written and the Transfer a credit to AR becomes very important to have specified. Example 3: Same settings as example 1 except changing the transfer to A/R to YES. (Owner with pay code set to $50.00 to write a check and the company options set to YES to Transfer petty suspense to A/R and the Petty suspense test rule set to Apply before billing deduct.) The system is still going to write a check for under 50.00 but the rules as are based on the income before billing deduct of 1540.43 which is well above the minimum to write a check. So nothing different from the first setting to this setting because the income was over 50.00 and the suspense test rule was set to apply before the billing deduct. Example 4: Same settings as example 2 except changing the transfer to A/R to YES. Owner with pay code set to $50.00 to write a check and the company option set to YES to Transfer petty suspense to A/R and the Petty suspense test rule set to Apply After billing deduct.

The system will not write a check in this example due to the netted amount of 45.70 being below the 50.00 minimum pay code setting of the owner. In this case the owner’s statement will show the income unlike in example 1, the monies will not go into suspense it will create a credit balance into the A/R account. As it states on the statement for the owner, it will show as a previous credit balance forward for their next statement. With all of these examples Pak Accounting does recommend that you set your setting for Petty suspense test rule to Apply After Billing Deduct and set the Transfer petty suspense to A/R for WI owners that are netted to YES. This will allow you to get the most out of the system without having lots of explaining to do to your Working interest owners as well as making them happy. |

Prepaid expenses are expenses that are paid in full and then expensed over the time frame that is covered. A prime example of a prepaid expense is insurance. Generally insurance is paid a year in advance. Recording the full expense in one month is not accurate and affects the profit for that month. Therefore, the expense should be entered and recorded to a prepaid account and then reduced monthly by an equal dollar amount over the time frame of the coverage. Works Cited Costa, C. (2008). Alpha Teach Yourself Bookkeeping in 24 Hours. New York: Penguin Group. |

•A "budget" of expected expenses •Becomes a "Cash Call" when funds are requested in advance for the drilling and completion of the well or workover expense. •The working interest owners are asked to approve the major expenses before the work is begun (normally drilling and completion expenses of the well) •An owner may elect to go "non consent" and NOT pay the expenses in some instances.

Accounting Steps: For example:

|

•A billing cycle is a process where Pak Accounting takes each unbilled charge/ invoice and allocates to each partner (owner/investor) their proportionate share. The system will observe your cut-off date (usually the end of the month), and will automatically separate the billing of the expenses by property, category of expense and expense coding. •Also see Revenue Billing / Billing Cycle |

•A division of interest tells the system how to divide up the bills and how to distribute the revenue. •The % of interest will vary on the revenue side from the billing side because the royalty and override owners only share in the revenue and not the expenses. |

•Similar to a royalty interest in that override interests do not share in any expenses of the well, they ONLY share in the income •Commonly occurs as a share is "given" to key players in the lease acquisition. Examples include landmen, scouts, geologist. •Also see Revenue Billing / Key Terms |

Check stubs can sometimes be hundreds of pages long. To keep from delaying the actual bank deposit, the deposit and the check stub detail are broken up into two steps by using a Purchaser Clearing Account.

By separating the two operations, it easily facilitates: • Check to be deposited in Deposit Entry separately from the stub o Enter stub when you have time o Separation of duties • Corrects after a Bank Reconciliation • Timing issues if you receive the check separate from the stub o Direct Deposit of amount o Wire Payment Received o Paper Check o Electronic Receipt / Entry of the check stub detail via CDEX (Oildex) or via Pak Accounting.

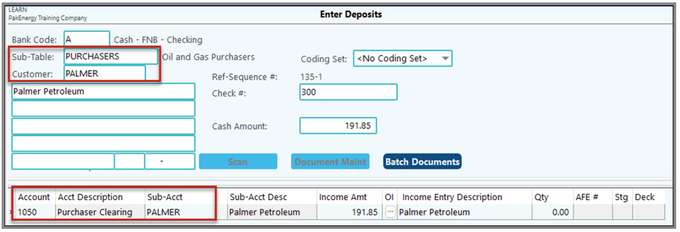

How to Utilize: 1. Set up a Purchaser Clearing Account in F11, Account Maintenance, that has the Purchaser Sub-Table attached to it. In our example we use 1050. 2. Add this account in Check Stub > Company Maintenance > Company > General tab - Clearing Account field 3. Entering Deposit: in Deposit Entry > Enter Deposits enter the clearing account into the Account field in the middle of the screen.

4. Entering Stub: in Check Stub > Enter-Deposit/Stub screen enter clearing account into Account field

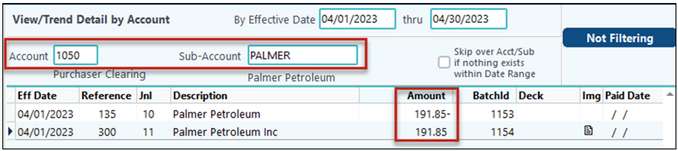

5. Review the Entries Once both sides have been posted, we can go into View/Trend to look at the Purchaser Clearing Account. If using Pak Accounting’s default Journals, the Check Stub will show as Journal 11, and the Deposit Entry will show as Journal 10. If both entries are posted, then the account should zero out.

If, for some reason, the account doesn’t zero out, then a little research will need to be done. Have both sides posted? If so, is each side the same amount? If not, which one is correct, and which one needs to be correct? |

•A revenue cycle is very similar to the billing cycle, except that it deals with income instead of expenses. The Revenue Cycle takes the revenue received from the purchaser and divides it up based on the Revenue% of the division of interest. The system will break down the revenue into 3 basic parts: Gross Proceeds, less taxes deducted, and less other deductions •Also see Revenue Billing / Revenue Cycle |

•A "royalty" interest is an interest a landowner is "awarded" for allowing people to drill for oil on their land. •Royalty owners do NOT share in any expenses of drilling the well, they ONLY share in the income of the well. • Also see Revenue Billing / Key Terms |

•Suspense is money held by the operator and not paid out to the owners/investors for various reasons •Petty suspense is money held because the amount is too small to write a check (would you really want to get a check for 25 cents. •Legal suspense is money held for reasons other than petty, such as: Waiting on a division order, No address (or incorrect address) for an owner, or owner deceased and waiting on division order • Also see Revenue Billing / Suspense |

•A "working" interest refers to an investor that shares with other owners to fund the expenses to drill and produce the lease. •Working Interest owners absorb all the costs to produce the well including exploration, drilling, completion and monthly operating expenses. •They share in the income after the royalty and override interests have been paid. • Also see Revenue Billing / Key Terms |