The payroll cycle is used to write employee paychecks, update the historical information, and make General Ledger entries. Whenever it's time to run payroll, begin by starting a cycle. The cycle is considered to be complete when it is updated. Once updated, the payroll reports cannot be rerun, but many historical reports are available.

When starting a new cycle, employees to be paid are automatically selected based on the pay groups you choose. Employee information is copied into the Pay Summary file. Using the summary file maintenance screens, hours, earnings, and deductions are changed as necessary. Calculated items such as tax withholding are displayed as amounts are entered.

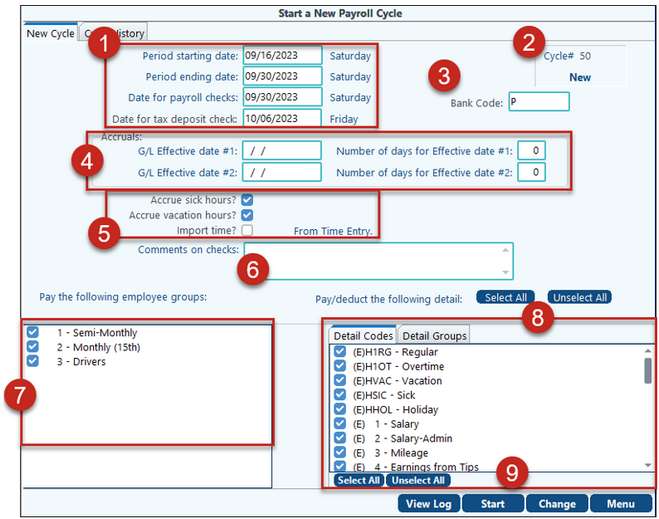

Start Payroll Cycle Steps:

When you are ready to run payroll, begin by starting a cycle. On the selection screen, enter the appropriate dates; select which employee groups and detail codes will be included in this payroll.

When the screen is complete, press Start to continue. The system will select the employees to be paid, and move the information into the Pay Summary file, with a pay record for each employee.

Start New Cycle |

|

|---|---|

1. Period starting/ ending date: |

The pay period ending date prints on the payroll and check registers. This date is used to compare the start/stop dates coded on the employee deduction detail items. |

1. Check Date |

Date printed on payroll checks. Governmental reporting uses this date to determine the year and quarter for reporting the checks. G/L entries to cash and the tax / deduction liability accounts are posted using this date. |

1. Tax deposit check date |

Date used for the Tax Deposit. This will default depending on the tax setup on Basic options / Taxes tab. |

2. Cycle # |

It will indicate either New (cycle hasn’t been started) or Existing (cycle has been started). |

3. Bank Code |

The Bank Code will default to the option in Basic Options – Taxes tab; however, it can be overridden. Please note, if the wrong bank code is selected when the cycle is started, the only way to change it would be to clear the cycle and start over. |

4. Accruals: |

If the payroll spans more than one accounting period, these dates can be used to properly accrue expenses into the correct period. These dates will only appear if the Payroll Payable Accrual account is specified in Basic Options G/L tab. For example, on weekly cycle, the payroll beginning date might be 11/23/22, and the ending date 12/07/22. Enter effective date 1: 12/07/22, 7 days, and effective date 2 = 11/30/22, 7 days. This would book the first 7 days of payroll expenses to November, and the last 7 days to December. |

5. Accrue sick hours / Accrue vac hours |

Check the box to accrue sick/vacation hours for each employee. The amounts accrued will depend on the setup in Company Vacation Maintenance. If the box is not checked the system will not make any sick or vacation calculations for this payroll. |

5. Import time |

This option lets you import employee time-card data from one of Pak Accounting's time entry systems or from another program. |

6. Comments on all checks: |

Enter a comment to print on all checks - “Merry Christmas”, “Don’t forget the company picnic”, etc. The comment will print on the stub portion of the check. |

7. Pay the following employee groups |

The system selects employees to be included in the payroll process based on the employee's group code. Only the employee groups defined and named in the Company's Master File Maintenance > Basic Options > Pay Groups Tab - Field Names screen will show up here. Employees are assigned to Pay Groups on the Employee Name/Address screen. |

8. Pay/deduct the following detail |

These are the detail codes set up in Company Options. The amounts for these detail codes are setup on the Employee Earnings/Deductions screen, but can be overridden for this payroll using Pay Summary Maintenance. Any new detail codes will not be checked and will be highlighted in blue. You also have the ability to "Group" Detail Codes together to enable automatic selection of detail codes based on the group selected. To use this feature simply check and uncheck the detail codes to be paid as part of this group and click Save Group. This will save the group of detail codes in order to allow you to choose the proper detail codes for each type of payroll. For example, setup a group of detail codes for Hourly payroll and another for Monthly payroll. |

View Log |

This shows a log of this cycle including if it was erased and restarted. |

Start /Erase |

Click Start to start your cycle. Once this cycle has started this button will change to Erase. The Erase option is used to clear the cycle. |

When the screen is complete, press Start to continue. The system will select the employees to be paid, and move the information into the Pay Summary file, with a pay record for each employee.

The system will ask you to confirm the cycle and the number of employees to be paid. Click on OK.

Note: You may change the check date after starting a cycle without erasing the existing cycle by going back into Start Payroll Cycle and simply changing the date.

Also see: Cycle History

Also see: Detail Groups