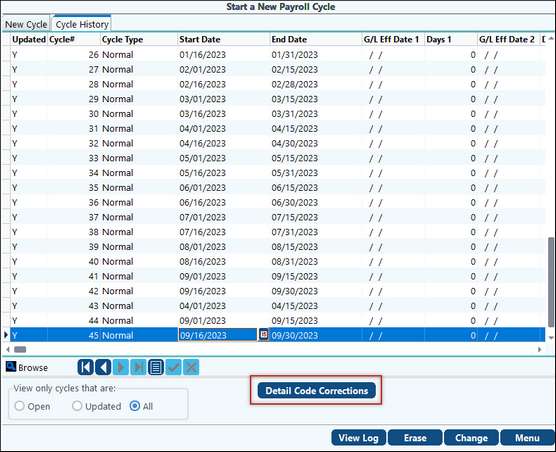

The Cycle History tab on the Start a New Payroll Cycle tab, lists all previous payroll cycle basic starting information.

Payroll Corrections: It is strongly suggested that you have your Customer Success Team assist you in this process.

Pak Accounting has an option to help make payroll corrections easier. If a detail code has been setup incorrectly, i.e. tax switches were set incorrectly, this correction utility will make this process easier.

Audit Process:

1.User will need to run the H-10 Totals by Detail Code for each employee to see the incorrect settings of detail code(s).

2.Correct the switches on the detail code(s) in question. Note: This utility will only correct types E or D.

3.Decide how you want to run the correcting payroll - all, active employees only or employees extracted in current cycle. The Customer Success Team would strongly suggest that you run this correcting cycle as a stand alone cycle and not mix with a current payroll cycle. User also needs to be aware of implications of dates. Check date in the correcting cycle determines the quarter that these corrections will be reported, i.e. 941, SUTA, G/L entries.

4.Start your payroll cycle after making these determinations.

5.Once payroll cycle is updated, run the H-10 Totals by Detail Code again to make sure corrections were made properly.

Once your cycle is started, menu out of Pay Summary. Go back to the Start Cycle menu and go to the Cycle History tab. Select the Detail Code Corrections button at the bottom of the screen.

Once you have this selected, then change the options on the screen for your corrections. Then select Generate. This process will need to be done for each detail code that needs to be corrected. Corrections will only be generated for employees that are setup with the detail code currently and will correct one detail code at a time.

Once Generated, the system will tell you how many employees it corrected.

This cycle can either generate checks to the employees or if they owe you money, can generate entries to an Employee Receivable account to be either written off or deducted from next regular payroll check. Now run payroll cycle as normal.