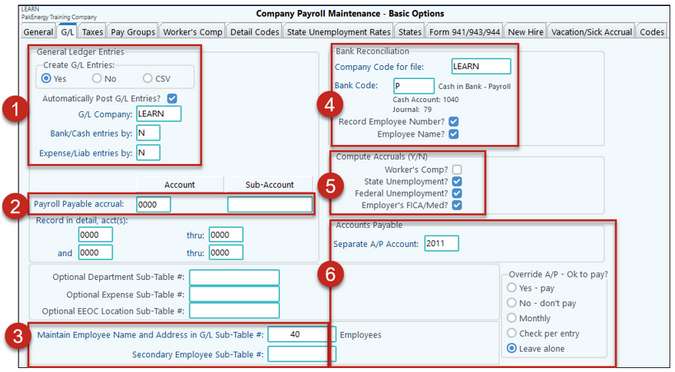

The GL tab has a lot of options on how the Payroll Cycle will interact with other modules.

1.What do you want it to do in the General Ledger?

2.Typically, the entries from Payroll will hit the General Ledger based on the Check Date. However, this option will allow the entries to be split when they cross a fiscal period. This option is used on the Start Cycle Screen; however, it is not typically used.

3.How do you want it to interact with Sub-Account Maintenance?

4.What do you want to record in the Bank Reconciliation/Check History?

5.This will tie into Payroll – Master File Maint – Accruals, which will be discussed later in training.

6.How do you want to interact with Accounts Payable?

GL Tab |

|

|---|---|

General Ledger Entries |

|

Create G/L entries |

Yes and the system automatically creates G/L entries when the payroll cycle is updated. The entries will be same as what is printed at the end of the payroll register. No and the entries will not be created for G/L. Use this option when entering historical data. CSV option is used to export entries into a CSV format (Specific for Customer, please contact your Customer Success Team before using this option) File name importgl.txt Col 1=TRSACC Char Width 19 Col 2=TRSDESC Char Width 30 Col 3=TRSREF Char Width 9 Col 4=TRSDATE Date Col 5=TRSAMT Currency Col 6=PERIOD Integer |

Automatically Post G/L Entries? |

Check and the system will automatically post the entries created to the General Ledger. Do not check and the system will send the entries created to the General Ledger unposted file and you will be required to manually post those entries.

|

G/L Company: |

A one to five character company code. Usually the company code for Payroll is the same as used in General Ledger. If the General Ledger entries should go to a code other than the Payroll's company code, then the proper G/L company code can be coded. NOTE: If you enter in a code that is less than the required length, the characters will be right justified and padded with zeroes. |

Bank/Cash entries by: |

S - Summary: makes a lump sum entry to the cash account N - Name & check: each payroll check is an individual G/L cash entry, with the employee name in description, and check number as reference. C - Check but no Employee name: Each check is listed as a G/L entry, but no employee name is on the transaction. This option determines how the payroll entries are made into the cash account. In most companies, even if the payroll system is secured, the G/L cash account may be readily accessible by employees or others. For this reason, using the N option is not recommended, since anyone who can view the cash account would be also able to view individual payroll checks and names. Also, this generates a large number of G/L entries that can become difficult to manage. |

Expense/Liab entries by: |

Same as above only applies to payroll expense/liability entries in G/L such as tax expense. |

Payroll Payable Accrual |

Acct/SubAcct used when posting the payroll accrual. The accrual feature is only used if you want part of a particular payroll to be posted in one month to the General Ledger and the rest of the payroll to be posted in a different month. The system will also make the accompanying reversing entries in the second month. Entering a zero in this field inactivates this feature. |

Record in detail, account(s) |

This allows an exception to the Bank/Cash and Expense/Liab entries. For certain accounts, such as overhead accounts, you may want to see the detail posted for payroll. Using this field, you can enter two ranges of accounts that will always be generated in detail. This could be used to detail job cost entries without detailing the other accounts. |

Optional Dept and/or Expense Sub-Tables |

Optional field, specify Sub-Table for departments and/or expense when wanting to track employees by department and/or expense. Look-up opens on Employee master maintenance for you to select the department Sub-Account. |

Optional EEOC Location Sub-Table |

Entering a location Sub-Table in this field allows for a location to be added to the employee on the Employee Master/Name/Addr Tab. The reports that have the ability to utilize the location field for reporting purposes are the E-8 Summary by Job Category, Sex, and Race, Employee Master Views, and the E-2 Detailed Employee List. See Employee Master/Name/Addr Tab. |

Maintain Employee Name & address in G/L Sub-Table / Secondary Sub-Table |

****REQUIRED**** Employee names and addresses must be maintained in a Sub-Table in G/L, enter the Sub-Table number here. This can be used for employee advances or employee receivables. When employees are added/changed in payroll, the G/L Sub-Table is automatically changed, without duplicate data entry.

***Optional*** You can also define a secondary Sub-Table in order to maintain employees in 2 different Sub-Tables. (i.e. Sub-Table 40 for employees as well as 20 for vendors.) |

Bank Reconciliation |

|

Company Code for File: |

Refers to the Bank Reconciliation file. Use the company code that corresponds to the cash account used for payroll. |

Bank Code |

During the Payroll Cycle Update, the system will add the checks written to the bank reconciliation file. NOTE: Bank Codes generally refer to a Bank Account. If the same checks are used for both payroll and accounts payable, then the same bank code should be used for both. If different bank accounts are used, then different bank codes should be coded. |

Check if the Employee's number is to be put in the Payee's Code field on the bank reconciliation file. Do not check if payee's Code field is to be blank. |

|

Employee Name? |

Check if the employee's name is to be put in the Payee's Name field on the bank reconciliation file. Do not check if the payee's Name field is to be blank. |

Compute Accruals? |

|

Worker’s Comp? State Unemployment? Federal Unemployment? Employer’s FICA/Med? |

For each expense type, indicate if you want the system to automatically accrue the company's share of these items (i.e. create G/L entries). This option has no effect on any historical reporting. If checked, the accrual will show up on the Pay Summary's company costs tab, company costs (COM) on the payroll register, and the corresponding General Ledger Entry. |

Separate A/P Account |

Enter an Accounts Payable account to be used for 3rd Party checks. See 3rd Party Payee |

Override A/P Ok to Pay |

For the Sub-Table specified for employees, select how to pay any A/P type (3rd party check) checks (i.e. per diem, reimbursements). Select the pay status: Yes - pay, no - don't pay, Monthly, Check per entry or Leave alone. |

The Liability Account/Sub-Accounts for Federal Unemployment and Employers' FICA/Medicare are defined on the Company Maintenance / Basic Options / Taxes tab. The State Unemployment liability G/L account and the Worker's compensation G/L account are defined by state on the State Tab. All of the expense account(s) are defined on the Company's Accrual Accounts.

NOTE: If your company is a Payroll only company and does not have a license for G/L, the Posting Allowed Date Range will always be 10 months back and 2 months into the future for the current date.