Have you ever looked at your Pay Stub? I mean really looked at it? There is an area for your gross pay, your deductions such as insurance, and your taxes. There may even be an area for your Sick and Vacation time. Where does all of that come from? How is all of that calculated specifically for you?

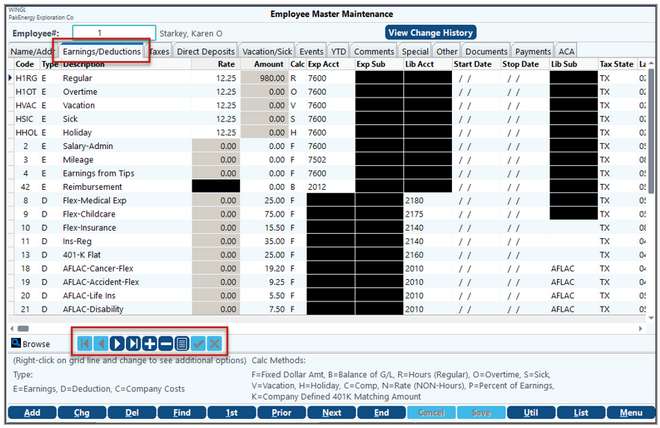

This screen determines which earnings and deductions will normally appear on this employee's pay record. The items can be any of the detail item types you set up in Company Maintenance > Basic Options > Pay Detail screen. The more information you are able to pre-fill here, the easier your cycle will be.

To add a new Detail Code, click on the “+” in the navigation bar, right-click on the screen and select Add, or double-click on one of the existing codes and click Add from the next screen. However, do not click on “Add” from the bottom of this screen, this will add a new Employee, not Detail Code.

Double-clicking on an existing Detail Code will allow you to edit it. This edit screen is where you add each Pay detail for the employee. (Such as, Hours, Overtime, Insurance Deductions, etc.).

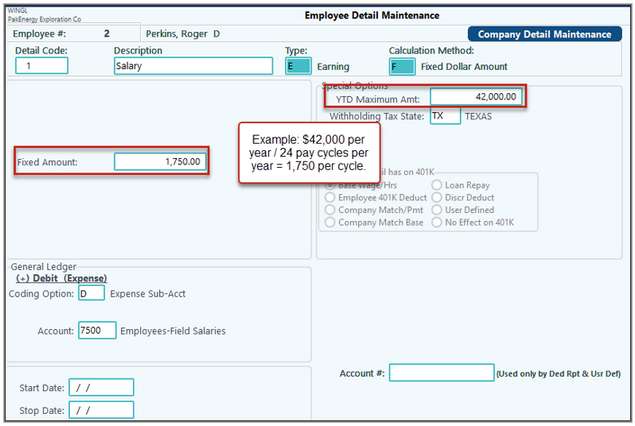

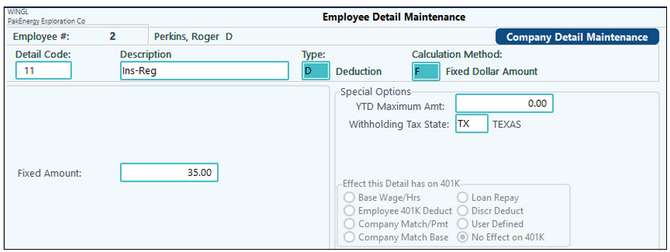

Make sure that the items (amounts and quantities) you enter here are PER PAY PERIOD.

For example, if you have a salaried employee, you will not enter in their entire annual salary in the Fixed Amount field, just what they get paid each cycle. You could enter in the Annual Salary into the YTD Maximum field if you choose – this field is completely optional and can be left at 0.00. If this is set, then when the employee reaches this amount, the system will not pay more than this. Be careful if they receive a raise – you would need to update both fields.

The same goes for monthly deductions, only enter in the amount being deducted per pay period. If my insurance is $70 per month and I’m paid twice a month, then only $35 should be deducted per pay period.

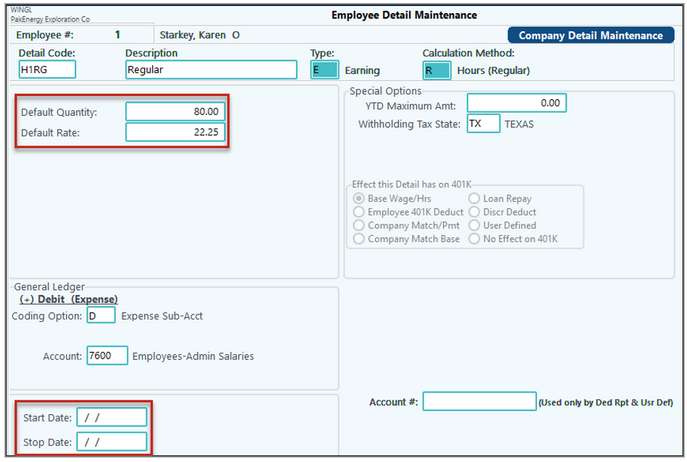

In this example, the employee will be working 80 hours every 2 weeks and she will be receiving $12 per hour. I will set the default so that it won't have to be entered in every cycle.However, this can still be overridden at the cycle level.

A Start or Stop date can also be added. For example, if I’m adding her in now, but she won’t be starting for 2 weeks, I could indicate that via the Start Date. Or, if she ever got a promotion and went to Salary, I could use the Stop Date for the Hourly detail code and a Start Date for the Salary detail code..

A Start/Stop date cannot be used if there is a change within the same detail code.

Earnings/Deductions |

|

|---|---|

Detail Code

[/?] |

Press the [/?] on your keyboard or click on the drop down button to display a pop-up list of the items previously defined on the Company Master > Detail Screen. After you enter them, the system sorts the detail items in numerical sequence. The fields on the rest of the screen may change depending on the detail code selected (earning, deduction, company cost, etc.) |

Description |

The system displays the description defined for the detail item entered. |

Type |

NOTE: This populates the Type of Detail Code selected, it cannot be changed here. Options are: C - Company Cost is ignored when calculating net pay, E - Earnings - Amount will be added when calculating net pay, D - Deduction will be subtracted to calculate net pay, T - Tax the entry also determines where (under which column) to print the information on the check stub and payroll register. |

Calculation Method |

Determine how the detail amount is calculated. (Options may vary depending on the Detail Item chosen above). NOTE: This is from the company settings, it cannot be changed here. Options are: B – Balance of G/L Account, C – Comp Hours, F – Fixed dollar amount, R – Regular Hours, O - Overtime, P - Percentage of earnings. The percentage is based on total earnings. If P is selected, the system will prompt for "which percentage rate". N – Rate (Non-Hours), S – Sick Hours, V – Vacation Hours, H - Holiday, K - Company's matching portion of 401(k) account. Has no effect on employee's check, but must be entered to properly calculate company costs. |

Percent Base Definition |

If the detail item is defined in the Company Master as being calculated by a percent of earnings (such as 401K %), then this field will represent the percentage to be used: Enter 2.50 for 2 ½ %. If a percent calculation is not required, such as Salary, this field will not show. Also see Deduction Based on Net |

Rate |

This field will be visible for items that require a reoccurring rate for the item - such as Hourly. If a rate is not required, such as Salary, this field will not show. |

Quantity / Amt |

The standard recurring amount for the item per pay period. If the amount changes every payroll, then leave this field zero. |

Exp Acct/Exp Sub Liab Acct / Liab Sub |

Enter the Expense account and/or Liability account that the entry should be posted to. This will default to what is setup at the Company Level. |

Start/Stop |

These dates, if used, are compared with the Check Date. •If the START DATE is before or equal to the Check Date, then the Detail Coded should be included. •If the STOP DATE is equal to or after the check date, then include the Detail Code. •In other words, as long as the Check Date is between the Start and Stop Date, the detail code will be included on the cycle. If it is outside of either date, the detail code will not be included in the cycle. |

Tax State |

Withholding tax state for the employee. |

See Company Maintenance > Detail Codes Tab for more example of setups.