Overview

What is the IRS FIRE System?

The IRS FIRE System provides the ability for certain information returns to be filed electronically via a transmittal file (Forms 1099, 1098, and 1042). FIRE stands for “Filing Information Returns Electronically.” It saves time and money. Electronic filing takes care of your reporting responsibility to the IRS. It DOES NOT relieve you of your obligation to the recipients (i.e. owners, vendors). The recipient forms must still be mailed out by the client.

What is needed to file electronically?

Authorization: Submit Form 4419 by November 1 to be able to file electronically. It could take up to 45 days to process this form. The earlier this form is filed, the better.

A Transmittal Control Code (TCC): Once Form 4419 is approved by the IRS, a TCC will be assigned to the company on Form 4419 and mailed to the address on the same form.

Do I have to file electronically?

Maybe….

If the company has more than 10 of any one type of information return, then you must file electronically. In addition, this requirement is per entity, not all entities collectively.

FYI: There was a change on this requirement for the 2023 tax year. The requirement changed from 250 to 10.

Filing electronically saves the purchase of the IRS preprinted “red” forms for your company. In addition, the 1096 for the IRS is included in the electronic file which saves the purchase and generation of that form as well.

If you file paper forms with the IRS, you will need to purchase the IRS preprinted forms for each type of information return being filed. In addition, each return being filed will need to also include the corresponding IRS preprinted 1096 form. It is always a good practice to buy a few extra of the information return as well as the corresponding 1096 forms in case of errors.

The PakEnergy Forms Department can efficiently handle form needs and purchases as well as ensure that the client has the proper amount needed.

See IRS FIRE System for more information including logging in and uploading files.

Please note – the system does not support a second filling date at this time.

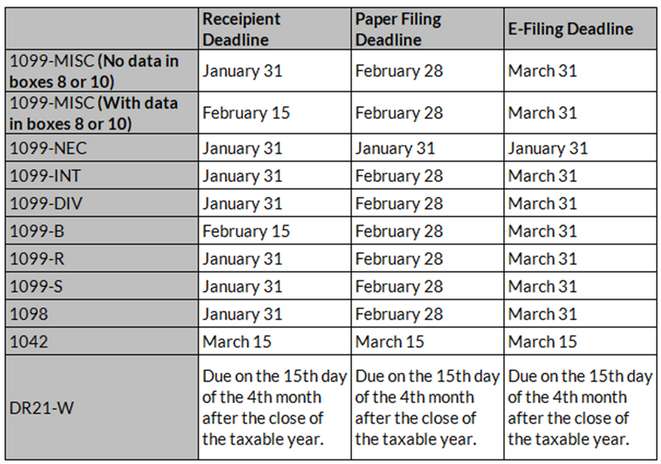

Filing Dates

1099 Check List

1.Under Master File Maintenance enter the Payer information in Transmittal and Company, enter all State Tax ID numbers necessary as well as Set 1099 Year.

2.Identify which systems 1099s will be extracted from:

A.Accounts Payable - See AP 1099 Extract

i.Run the Review Vendor Coding before creating the Year End AP 1099 Extract.

1.Run the "New Vendors For This Year" report.

2.Run the "Vendor Reporting" according to organizational needs.

B. Revenue - See Revenue 1099 Extract

i.Run the Revenue Pre-Extract in the months preceding the Year End extract.

C.Other Extracts - See Other 1099/1098 Extracts

3.Extract 1099's for AP and/or Revenue.

4.Review the Payee Maintenance for accuracy. There are multiple menus depending on the type of extract.

A.Also see Common 1099 Problems.

5.Print Error Listing.

A.Correct the error(s), if any, that are listed on the report. Check the totals.

B.Repeat steps 5 and 6 until there are no errors.

C.Create TIN Matching file, if necessary.

D.Also see How to tie 1099 Supporting Schedule

6.Print 1099s to be mailed to Payee(s). These should be mailed on or before January 31.

7.Initiate proper filing method (paper/electronic) for your organization by the corresponding dates. See IRS FIRE System .

Filing Methods:

•Paper Forms: Only if you have less than 10 vendors/owners

•Electronic Filing: Required if more than 10 vendors/owners

NOTES:

•These are due on or before January 31. The system does not support a second filing date at this time.

•To apply for a transmitter # (TCC): Complete Form #4419 (Application for Filing Information Returns Electronically) (website = http://www.irs.gov)

Accompanying Forms:

•Paper Form Transmittal: Form #1096 (Printed using IRS Preprinted form or Office copy on blank paper).

•Electronic Transmittal: Forms not required.