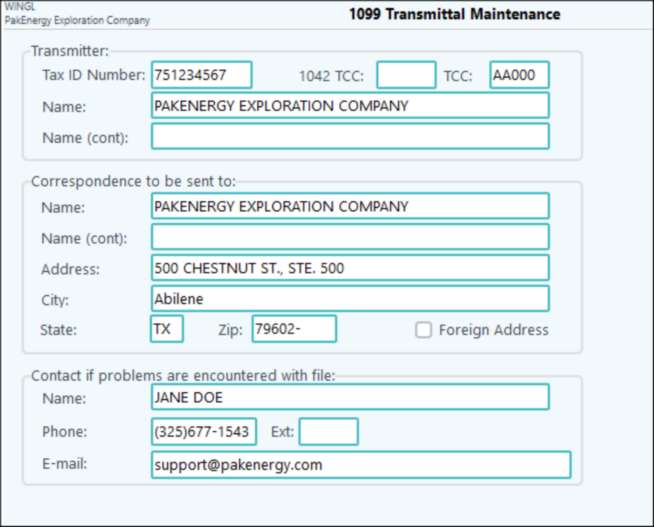

If you qualify to transmit the 1099's Electronically, verify the information on the 1099 Transmittal Maintenance. Make sure you enter the company's Tax ID Number and TCC code - (Transmitter Control Code (TCC) - This is the code assigned by the IRS upon their receipt of your Form 4419 "Application for Filing Information Returns Electronically (FIRE)". The only non-required fields on this screen are the "Name (cont.)" and "Ext.".

Also see IRS FIRE System for more information including logging in, test files, and common issues.

NOTE: The Tax ID number, Contact Name, and Phone information must be filled in or an error message will show on the Edit listing.

TECH TIP: If you are transmitting the 1099's on behalf of another company (i.e. you are a CPA firm transmitting 1099's for a client), this page is for your information.