Overview

The AP 1099 extract works as it always has to report vendor payments as non-employee compensation. The difference is that instead of the extracted populating the 1099-MISC Payee Maintenance, it now populates the 1099-NEC Payee Maintenance. All other options still work as they have in the past.

Vendors that typically receive a 1099-MISC (Tax Class):

•Individual/Sole Proprietor/Single LLC

•Partnership

•Trust/Estate

•LLC-Partnership

•Other

Extract AP 1099 Entries - Process

1.Click on the Review Vendor Coding button to verify accuracy of the extract. Run the "New Vendors For This Year" report and then the "Vendor Reporting" option(s) to look for errors that should be corrected.

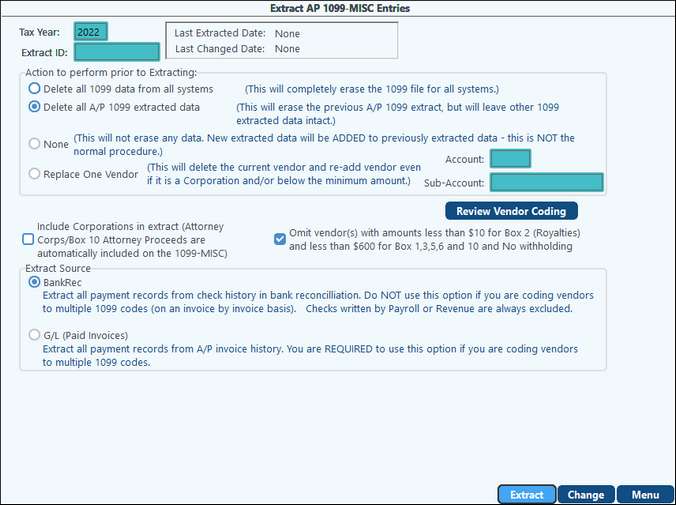

2.Chose appropriate Action to Perform Prior to Extracting option.

3.Select needed Include/Exclude options if necessary

4.Chose Extract Source

5.Click on the Extract button. (All AP accounts will be included in the extract.)

6.If necessary, correct any errors that are found and re-extract AP 1099's other wise the system will inform you of how many records were extracted successfully.

1099 Extract AP

Action to Perform Prior to Extracting |

1.Delete all 1099 data from all systems- This will delete all 1099 data from all systems. 2.Delete all AP 1099 extracted data- A/P 1099 data will be erased but all other systems 1099 data will remain. 3.None- No data will be erased. Any newly extracted data will be added to the existing extract. This is NOT a normal procedure. 4.Replace One Vendor- No data will be erased. New data extracted will be added to the existing extract. This option will allow for one vendor to be added when the account/Sub-Account fields. |

|---|---|

Include Corporations in extract (Attorney Corps/Box 14 Attorney Proceeds are automatically included regardless) |

If checked, vendors with a Tax Class of C. S, LLC-C and LLC-S Corporation will be included in the extract. |

Omit vendors with amounts less than $10 for box 2 (Royalties) and less than $600 for Box 1,3,5,6,7 and No Withholding |

This option will only include the mentioned vendors if unchecked. Vendors that do not meet these requirements will not be extracted. It is recommended that you review the "Vendor Reporting-Less than $10 Royalty and $600 " accessed via the "Review Extract" button, click on "Vendor Reporting", and choose the "Less than $10 Royalty and $600 Working" option to ensure that these vendors are being reported correctly. |

Extract Source |

Bank Rec: Extracts based upon check dates from Check History in Bank Reconciliation. G/L (Paid Invoices): Extracts based upon the vendor check box selection in your Sub-Account Maintenance 1099 Options. This option pulls all payment records from the AP invoice history. This source is the required extract if your vendors have multiple 1099 codes. |

Review Vendor Coding |

This option allows the user to create and review the AP 1099 Review Report to ensure accuracy of the AP 1099 extract. Taking the defaults will provide a preview of what could be extracted. There are two types of reports that can be reviewed: 1.New Vendors For This Year: The "New Vendors For This Year" report will provide a list of only new vendors for the specified tax year. The purpose of the report is to allow you to "zero in" on these vendors in order to discover any discrepancies that could have occurred during vendor setup and to correct them. 2.Vendor Reporting. The "Vendor Reporting" option provides three different options that may be utilized individually or collectively as is necessary. Please note, this report is NOT looking at your extract options but is looking at the default options of the Bank Rec extract, excluding corporations, and omitting amounts if under the minimums. a.Being Reported - provides a list of the vendors that will be reported along with the dollar amounts of the checks written to them. b.Vendors coded as Corporations - provides a list of vendors not being reported because they are a corporation. c.Not Reported Due to Coding - provides a list of vendors and their amounts that are not being reported due to specific options chosen on the vendor's individual Sub-Account maintenance, such as tax class set to corporation or the 1099 box set to "Don't Report". d.Less than $10 Box 2 (Royalties) and $600 Box 1, 3, 5, 6, 7 and 14 and No Withholding - provides a list of vendors that do not meet the reporting limits along with the amount that is shown to have been paid. These reports allow you to look for any errors, make the corrections, and to view the reports again to ensure that all corrections were made. *1099 Box column - DR represents Don't Report *1099 Y/N column - DL represents Dollar Limit

NOTE: If the Review Coding Vendor does not match the 1099 Payee Listing, the primary reason is that there were manual changes made to the 1099 Payee Maintenance. Another reason could be that the vendors were coded to multiple 1099 boxes but the Bank Reconciliation extract was used. Also see: Common 1099 Problems |

NOTES:

•You must decide what kind of extract should be performed to create the 1099's. However, these extracts can be layered by choosing an "Action Prior to Extracting" that does not "Delete all 1099 data from all systems".

•The 1099 extract is based on original checks issued. If a replacement check has been issued, it is not considered in the 1099 extract unless the original check was voided. This also applies to the Review Extract.

•Corporations will not extract unless the "Include Corporations in Extract" box is checked. However, Attorney corporations are automatically included in the extract.

•Vendors paid by Credit Cards will not pull on the 1099 Extract, since you paid the credit card company, not the vendor.