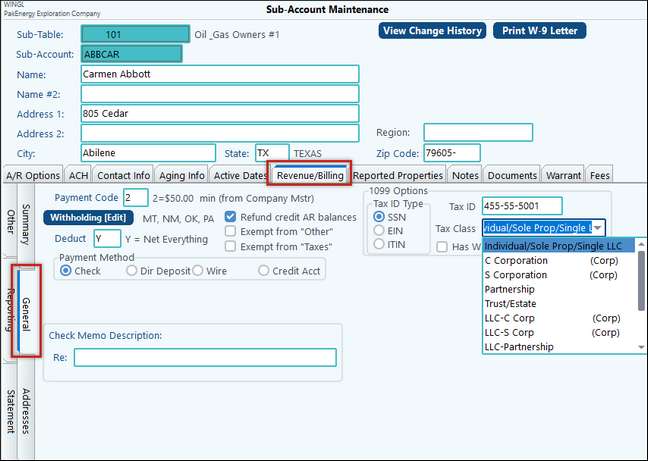

Revenue 1099 Extract: Owners that will qualify for a 1099:

Types available and will qualify for 1099s are:

1.Individual/Sole Prop/Single LLC

2.Partnership

3.Trust/Estate

4.LLC-Partnership

5.Other

C Corporation, S Corporation, LLC-Corp, & LLC-S Corp, are optional during extract by choosing the "Include Non-Attorney Corp" Option.

Below is a table that will help you identify whether a 1099 or 1042 should be used.

Extracts are based on check dates from Check History. Therefore, 1099 information does not have to be processed prior to running the next year Revenue cycles.

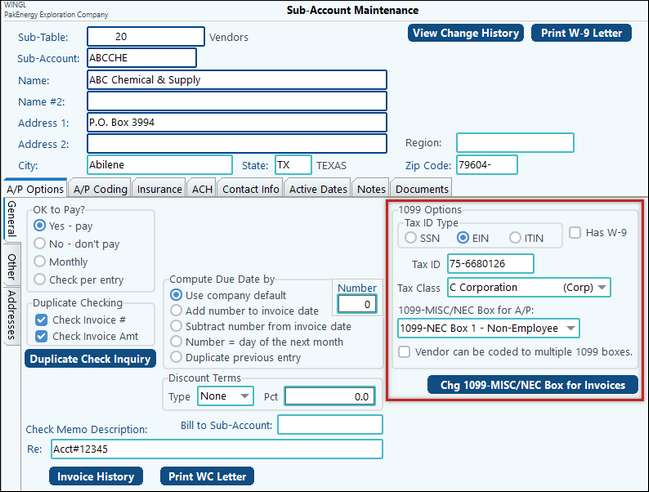

AP 1099 Extract: Vendors that will qualify for a 1099:

A/P options tab in Sub-Account Maintenance [F12] is where you fill in the 1099-Misc box and Tax ID information for each vendor.

Extracts are based on check dates in Bank Rec Check History or payment records from A/P invoice history, depending on the Extract Source used. Therefore, 1099 information does not have to be processed prior to print Accounts Payable checks in the next year.

NOTE: Pak Accounting has the ability to format foreign addresses per IRS specifications.

When the 1099 extract is successful for AP/Revenue, the system will display a message informing you of how many records were successfully extracted.