Overview

The first step is to open the 1099 module and select menu item Revenue 1099. This will extract for the 1099 Misc for Royalties and 1099 NEC for working interest.

The type of vendors, or tax classes that qualify for a 1099 form are individual, sole proprietor

•Partnership

•Trust, estate

•LLC Partnership

•And other

The extract is based on check dates from the Revenue check history and not from the General Ledger or Bank Rec check history. Therefore, 1099 information does not have to be processed prior to running the next year’s revenue cycles.

Also, if an owner’s tax class is set to foreign withholding, it will create the 1042 foreign withholding extract also.

1099 Extract Revenue - Process

1.Perform the Pre-Extract in the months preceding the Year-End 1099 Extract.

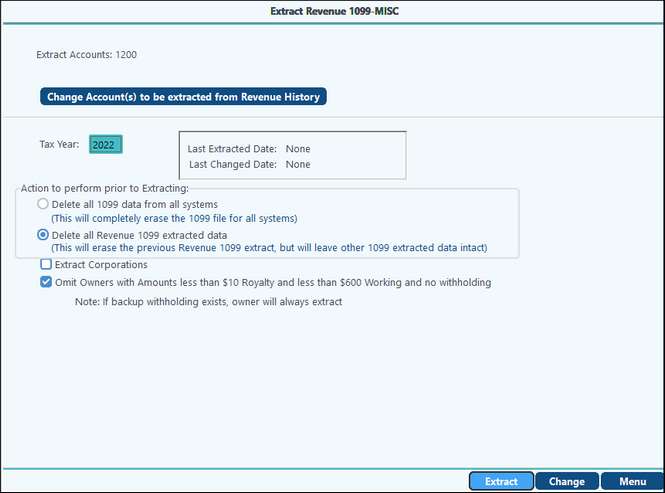

2.Ensure that the accounts to be extracted are correct.

3.Choose the needed Action to Perform Prior to Extracting option.

4.Choose Include/Omit options if needed.

5.Click on the Extract button. A series of progress bars will be informational as to the progress of the extract. When completed, the system will inform you of how many records were extracted successfully.

Selecting A/R Accounts

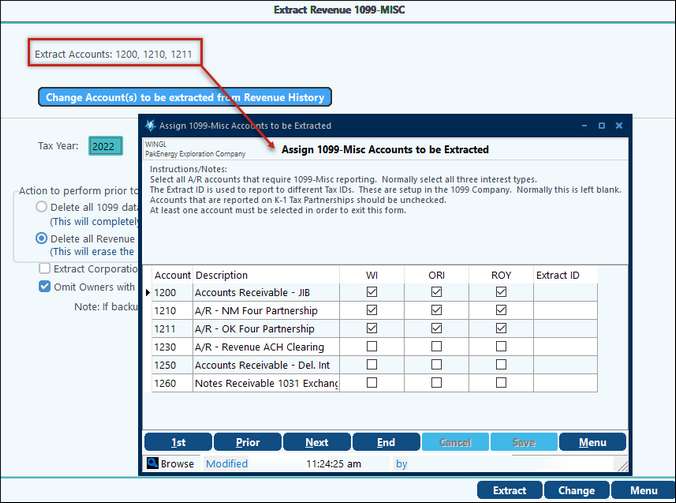

Now that you know who qualifies for a 1099, you now must determine which AR accounts to extract. Typically, this is a one-time setup. The only time you will need to make a change, is if you have added an AR account or interest type.

Limiting the accounts incorrectly will result in owners not being extracted.

Notice at the top of the screen that the extract accounts are shown, to change these, click on the Change Accounts to be extracted from Revenue History button.

Select the accounts and interest types that you would like to report. Typically, the Extract ID is left blank. However, if each A/R account is tied to a different reporting Tax ID, then the Extract ID is used to distinguish which Tax ID to tie with a 1099.

Action to perform prior to Extracting:

•The first option is the “Delete all 1099-MISC data from all systems”. Selecting this option will delete all 1099 AP, Revenue, and G/L data that has been extracted. This option is rarely used.

•The second option is the “Delete all Revenue 1099-MISC extracted data”. Selecting this option will erase any Revenue 1099 extracted data but will not erase extracted data from A/P or G/L extracts. This is the default option and the most commonly used.

Include/Omit

•Extract corporations – Selecting this option will include corporations in the extract. Many clients choose to include Corporations in order to provide the 1099 supporting schedule to all of their owners. Clients are not required to do this but have found that they field fewer questions from owners when this report has been provided.

•Omit owners with Amounts less $10 Royalty and less $600 Working and no withholding – Selecting this option will omit owners who do not meet reporting minimums.

You also have the ability to send your 1099's to another company to be printed. Check what you want extracted and enter the company Extract ID that you want to send the entries to. When you click Extract, it will send the entries to that Extract ID.

NOTES:

•If you have already extracted prior to indicating a different company; it does not delete that extraction. If you are sending 1099 information from more than one company, it will add to the extraction. When the extract is finished Pak Accounting will provide a notification when it is complete. Additionally, when the extract is complete you will hear the WolfePak yodel.

•When extracting Revenue entries, the detail that was escheated to the state will not be included.

•When extracting, progress bars will indicate if the extract is still running or if it has completed.

TECH TIP: Products that were distributed in a revenue cycle with the product code of INT or DIV will not extract with the 1099. They have their own extracts. See Other 1099/1098 Extracts.