Why are my Name 1 and Name 2 fields switched on the printed form?

See Sub-Account Maintenance > Name #2

Research

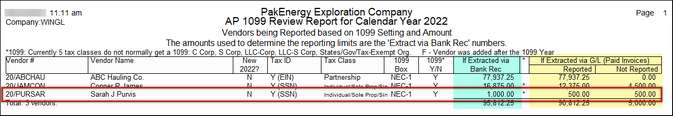

When you notice a vendor isn’t extracting correctly, the first place to check is the Review Vendor Coding. This report was discussed in detail in the AP Extract section of this document.

The first report will show the vendors being reported.

•Look at the Bank Rec extract amounts vs the G/L Paid Invoice amounts. Sometimes these can be different with one above the limit and one below. If the amount is different than your extract option, the invoices will need to be researched in Sub-Account Maintenance.

The second report will show the vendors coded as a corporation.

•If the tax class is a corporation, those vendors will not pull into your extract. If you want to include your corporations then make sure to select the option to include corporations in your extract.

•If the tax class is incorrect, it will need to be fixed in Sub-Account Maintenance.

The third report will show Not Reported Due to Coding.

•If the 1099 Box is set to DR, Don’t Report, then those vendors will not pull into your extract. If this is incorrect, it will need to be fixed in Sub-Account Maintenance.

The final report will show less than $10 Royalty and $600 Working.

•If the Bank Rec amount is different than the If Extract via G/L, then you may need to change the Extract Source type.

•If the amounts are correct and you would like to include these on your extract, then make sure to uncheck the box to omit vendors that are under the limit.

•If the amounts are not correct, we can research further under Sub-Account Maintenance.

It is important to review all these reports to verify the information is pulling as desired.

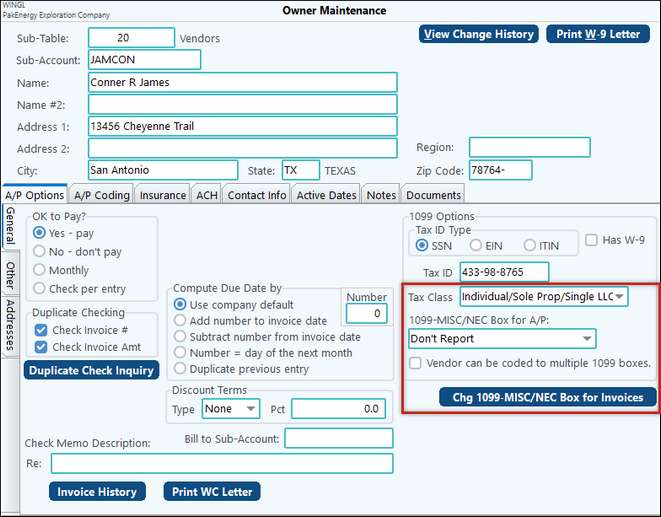

1099 information isn’t pulling for my vendor (check the following):

1.Tax Class - If the vendor is a Corporation or non-profit, a 1099 will not be created unless the option to included corporations is selected in the extract. Use the drop-down arrow if this is incorrect and needs to be changed.

2.1099 Box for AP – Does this have a box designation or is set to Don’t Report?

•If this is incorrect, select the correct designation.

•If the vendor is set to Don’t Report, no 1099 will be created. This box can be changed, but it does not necessarily change the history.

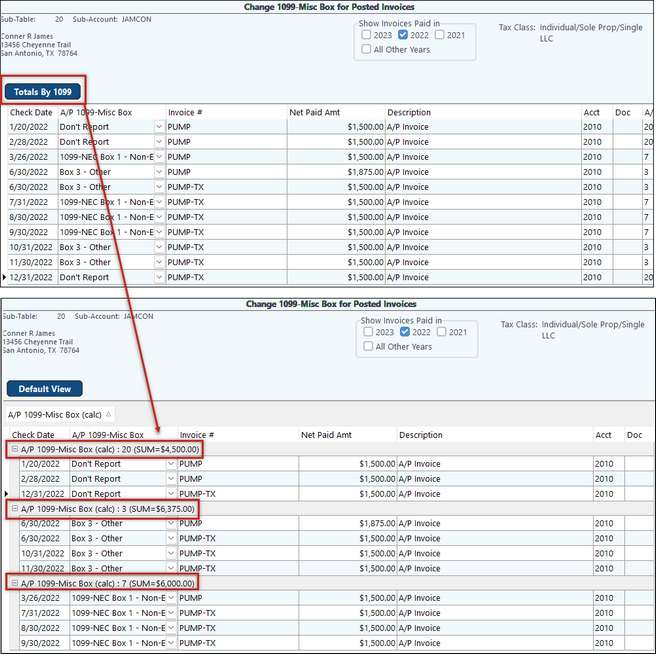

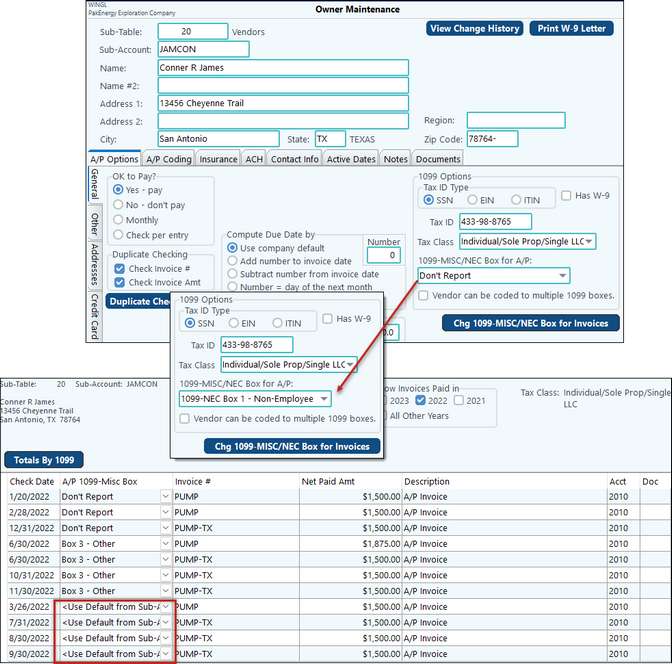

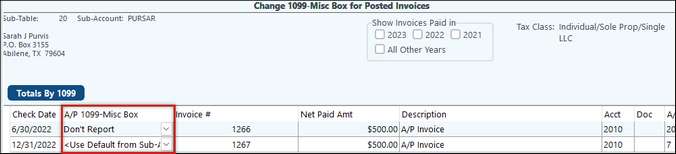

3.Change 1099 MISC/NEC box for Invoices – this shows the settings for each invoice.

•Invoices default to the “Use Default from Sub-Account”. However, if boxes have been manually added or changed previously, then changing the box on the previous page will not change the box on this screen.

•This screen is also an easy way to see if the vendor was paid enough to be included on the extract. Total amounts less than $600 for the 1099 NEC Box 1 Non-Employee, and less than $10 for box 2 Royalties will not be included on the extract unless the extract was set to include them.

•This menu has many helpful features.

oUse the Totals by 1099 box to sort the invoices and get totals for each Box setting.

oThere is also an option at the top to look at specific years.

Don’t Report Example

Conner James was set to Don’t Report, so the box was changed to 1099-NEC Box 1 – Non-Employee. Once changed, go into the Change 1099-MISC/NEC Box for Invoices to make sure the history was changed. However, only 2 invoices would have been changed automatically. The others will need to be manually changed, either to the correct box, or back to the Default setting.

NOTE: Remember: if vendor is set to be coded to multiple 1099 Boxes, then the A/P Extract Source must be set to GL.

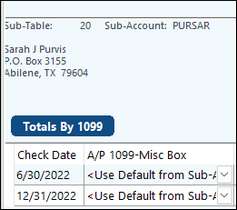

Under the Limit Example

In another example, Sarah Purvis is not pulling into our extract. She is showing on the Vendors Being Reported report. However, looking we can see there is a difference between the Bank Rec and GL columns. Since we are doing a G/L Paid Invoices extract, we need to review the invoices.

In Sub-Account Maintenance – Change 1099 MISC/NEC box, we can see that one of the invoices is set to Don’t Report. If this is incorrect, use the drop down arrow to change it to the correct box.

Now, they will both pull into the G/L Paid Invoice extract.