The following information is from the IRS web site for filing electronically.

http://www.irs.gov/Tax-Professionals/e-File-Providers-&-Partners/Filing-Information-Returns-Electronically-(FIRE)

and in Publication 1220 - Specifications for Electronic Filing of Filing Form 1097, 1098, 1099, 3921, 3922, 5498, and W-2G.

What is an information return?

An information return is a tax document used to report certain types of payments made by financial institutions and others who make payments as part of their trade or business as required by Internal Revenue Code Regulations. Forms 1042-S, 1097, 1098, 1099, 3921, 3922, 5498, 8027, 8955-SSA, and W-2G may be filed electronically via the FIRE system.

Who Can Participate?

Anyone with a Transmitter Control Code (TCC) who is required to submit the above information return forms to the IRS can file electronically. The law requires any corporation, partnership, employer, estate and/or trust, who is required to file 10 or more information returns for any calendar year, must file electronically. IRS encourages filers who have less than 10 information returns to file electronically as well.

What are the benefits of electronic filing?

By transmitting your information returns through FIRE, you can process your files faster and with fewer errors. Listed below are a few benefits of electronic filing:

•FIRE can accept multiple files for the same type of return.

•Combined Federal/State Filing Program (CF/SF) available for participating states.

•Fill-in Forms are available for Form 4419, Application for Filing Information Returns Electronically (FIRE) and Form 8809, Extension of Time to File Information Returns.

How to transmit through FIRE

A TCC is required to transmit information returns through the FIRE system. The most efficient way to submit an application to file information returns electronically is to submit the Fill-in Form 4419, Application for Filing Information Returns Electronically (FIRE), from the FIRE home page. You may also go to Forms and Pubs and select the paper version of Form 4419, Application for Filing Information Returns Electronically (FIRE). Be sure to submit your application at least 45 days prior to the due date of your information returns.

Your FIRE TCC will be deleted if you don’t file any of the above information returns (except Form 1095) for two consecutive tax years. Once deleted from the database, you will need to submit another Form 4419, Application for Filing Information Returns Electronically (FIRE).

Password security requirements for the FIRE System

Passwords must be 8-20 characters and include at least one uppercase and one lowercase letter, one number, and one special character #?!@$%^&*.,’-

INFORMATION FROM PUBLICATION 1220

Below are snippets of the publication. Please refer to the full Publication 1220 from IRS.gov for additional information.

Updates to Publication 1220 after its annual release will be listed in Part E. Exhibit 2, Publication 1220 Tax Year 2022 Revision Updates

1.Removed all reference to paper Form 4419 which is obsolete as of August 1, 2022.

2.The IRS is continuing its transition to the new Information Returns TCC (IR-TCC) Application for Filing Information Returns Electronically (FIRE) for customers who received their TCC(s) prior to September 26, 2021. Customers must take action to keep their existing TCCs active.

3.Beginning in September 2022, FIRE Transmitter Control Code (TCC) holders who submitted their TCC Application prior to September 26, 2021, will need to submit and complete the IR-TCC Application. The IR-TCC Application can be done at any time between September 25, 2022, and August 1, 2023. Your TCC will remain active for use until August 1, 2023, after that date, any FIRE TCC that does not have a completed IR-TCC Application will be dropped and will not be available for e-file. Visit About Information Returns (IR) Application for Transmitter Control Code (TCC) for Filing Information Returns Electronically (FIRE) for more information.

4.Part B Sec. 5 Test Files – added verbiage to include file limitation of 125 per TCC for a calendar year.

5. Part C Sec. 3 Payee “B” Record, Form 1098-F

•Updated Field Position 552-590, Field Title

•Updated Field Position 630-668, Field Title & General Field Description

•Updated Field Position 669-673, Length & deleted Indicators F, G, H & I

|

TSO is available to issuers, transmitters, and employers at the numbers listed below. When you call, you’ll be provided guidance to essential elements pertaining to technical aspects for the new IR Application for TCC, filing information returns through the FIRE Systems, self-help resources, and referrals to tax law topics on IRS.gov. Below are some examples of essential elements:

•Form identification

•How to obtain a form

•Related publications for a form or topic

•Filing information returns electronically

•FIRE file status information and guidance

Contact TSO Monday through Friday 8:30 am - 5:30 pm ET. Listen to all options before making your selection.

•866-455-7438 (toll-free)

•304-263-8700 (International) (Not toll-free)

•304-579-4827 for Telecommunications Device for the Deaf (TDD) (Not toll-free)

The IRS address for filing information returns electronically is https://fire.irs.gov/. The address to send a test file electronically is https://fire.test.irs.gov/.

Questions regarding the filing of information returns and comments/suggestions regarding this publication can be emailed to fire@irs.gov. When you send emails concerning specific file information, include the company name and the electronic file name or Transmitter Control Code (TCC). Do not include tax identification numbers (TINs) or attachments in email correspondence because electronic mail is not secure.

|

Forms 1097, 1098, 1099, 3921, 3922, and W-2G are filed on a calendar year basis. Form 5498, IRA Contribution Information, Form 5498-ESA, Coverdell ESA Contribution Information, and Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information, are used to report amounts contributed during or after the calendar year but no later than April 15.

Form

|

IRS Electronic Filing

|

Recipient/Participant Copy

|

1097-BTC

|

March 31

|

On or before the 15th day of the 2nd calendar month after the close of the calendar quarter (on or before May 15, August 15, November 15, and February 15 of the following year).

|

1098

|

March 31

|

January 31

|

1099

|

March 31

|

January 31

February 15 for Forms 1099-B and 1099-S. This also applies to statements furnished as part of a consolidated reporting statement.

|

1099-MISC

|

March 31

|

January 31

February 15 for amounts reported in boxes 8 or 10.

|

1099-NEC

|

January 31

|

January 31

|

3921

|

March 31

|

January 31

|

3922

|

March 31

|

January 31

|

5498

|

March 31

|

January 31 – for FMV/RMD

May 31 – for contributions

|

5498-SA

|

March 31

|

May 31

|

5498-ESA

|

March 31

|

April 30

|

W-2G

|

March 31

|

January 31

|

Note: If any due date falls on a Saturday, Sunday, or legal holiday, the return or statement is considered timely if filed or furnished on the next business day.

|

Connecting and Logging into the FIRE System - Part B - Sec 2

You must obtain a TCC before you can establish a FIRE Account to transmit files through the FIRE Systems (Production and Test). The system will prompt you to create your User ID, password, 10-digit Personal Identification Number (PIN) and secret phrase. Each user should create their individual FIRE Account and login credentials. Multiple FIRE Accounts can be created under one TCC. Refer to the FIRE webpage for additional information on account creation. The FIRE Production System and the FIRE Test System are two different sites that don’t communicate with each other. If you plan on sending a production file and a test file, you’ll need an account on each system.

You must enter your TCC, EIN and Business Name exactly as it currently appears on your IR Application for TCC. Once you log in, your information will fill in automatically when you submit files.

1st Time Connection to FIRE Production and Test Systems

|

Returning User to FIRE Production and Test Systems:

|

•Click “Create New Account”

•Input TCC, EIN and Company Name

•Create User ID

•Create and verify password and click “Create”

•Input required information and click “Submit”.

•If the message “Account Created” is received, click “OK”

•Create and verify the 10-digit self-assigned PIN and click “Submit”

•If the message “Your PIN has been successfully created!” is received, click “OK”

•Create and verify the Secret Phrase along with validation fields and click “Create”

•If the message “Create Secret Phrase – Success” is received, click “OK”

•You will be logged out automatically and will need to log back in to confirm User Account was successfully created.

oIf one of the following error messages are received, check secret phrase criteria and retry, or check the spelling of your secret phrase. Error messages are:

▪Invalid Secret Phrase. Secret Phrase does not meet the Secret Phrase requirements.

▪Invalid Verify Secret Phrase. Secret Phrase does not meet the Secret Phrase Requirements.

▪Secret phrases do not match.

Note: If you’re using SPAM filtering software,configure it to allow an email from fire@irs.gov and irs.e-helpmail@irs.gov. Turn off any email auto replies to these email addresses.

|

•Click “Log On”

•Enter the TCC

•Enter the EIN

•Enter the Company Name

•Enter the User ID (not case sensitive)

•Enter the Password (case sensitive)

•Read the bulletin(s)

Password Criteria

•Must contain a minimum of 8 characters

•Limited to a maximum of 20 characters

•Must contain at least one special character # ? ! @ $ % ^ & * . , -

•Must contain at least one upper case letter (alpha character)

•Must contain at least one lower case letter (alpha character)

•Must contain at least one number (numeric character)

•Passwords must be changed every 90 days; the previous 24 passwords cannot be used

•Passwords cannot contain the User ID or User Name

Note: If you have a FIRE System account (Production and Test) with an established Secret Phrase and forgot your password, you may reset your password using your established Secret Phrase.

|

|

Uploading Files to FIRE

|

Filers may upload a file to the FIRE System by taking the following actions:

•After logging in, go to the Main Menu

•Select “Send Information Returns”

•“Submit”

•Verify and update company information as appropriate and/or click “Accept.” (The system will display the company name, address, city, state, ZIP Code, telephone number, contact, and email address. This information is used to email the transmitter regarding the transmission.)

•Select one of the following:

oOriginal file

oReplacement file

oCorrection file

oTest File (This option will only be available on the FIRE Test System at https://fire.test.irs.gov/).

•Enter the 10-digit PIN

•“Submit”

•“Browse” to locate the file and open it

•“Upload”

Note: When the upload is complete, the screen will display the total bytes received and display the name of the file just uploaded. We recommend that you print the page for your records. If this page is not displayed on your screen, we probably did not receive the file. To verify, go to “Check File Status” option on the main menu. We received the file if the file name is displayed and the count is equal to ‘0’ and the results indicate, “Not Yet Processed.”

|

|

Checking the Status of Your File

|

It is the transmitter’s responsibility to check the status of submitted files. If you don’t receive an email within two days or if you receive an email indicating the file is bad:

•Log into the FIRE System

•Select “Main Menu”

•Select “Check File Status”. The default selection to the File Status drop down is, “All Files.” When “All Files” is selected, a valid date range is required. The date range cannot exceed three months.

•Enter the TCC

•Enter the TIN and “Search”

Note: During peak filing periods, the time frame for returning file results may be more than two days.

|

File Status Results:

•Good - The filer is finished with this file if the “Count of Payees” is correct. The file is automatically released for IRS processing after ten calendar days unless the filer contacts TSO within this time frame.

•Bad - The file has errors. Click on the filename to view the error message(s), fix the errors, and resubmit the file timely as a “Replacement” file.

•Not Yet Processed - The file has been received, but results aren’t available. Check back in a few days. |

|

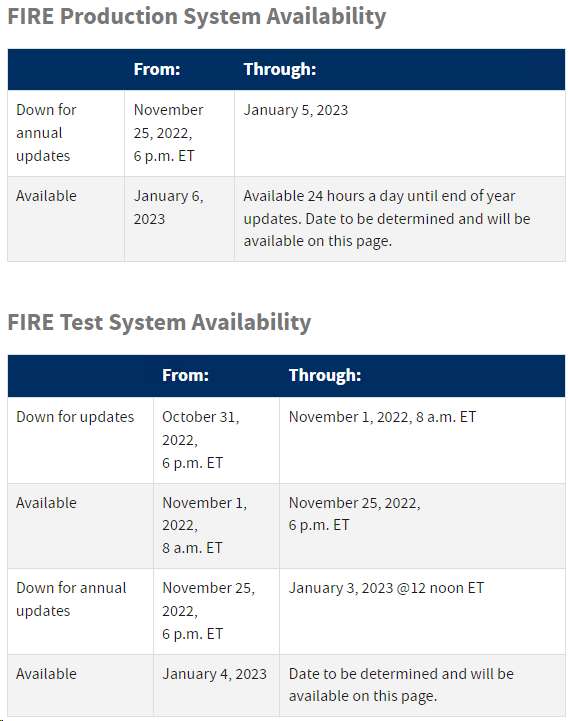

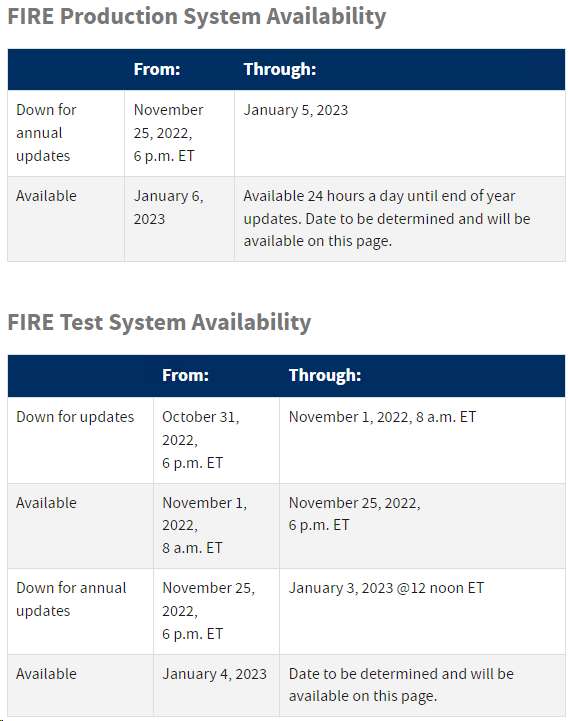

Note: The FIRE Systems (Production and Test) have regularly scheduled maintenance windows every Sunday and Wednesday from 2 a.m. ET to 5 a.m. ET. See more information: FIRE Availability

It is the transmitter's responsibility to check the status of the file. See Part B. Sec. 3, Checking the Status of your File. If a file is

submitted timely, but is “bad,” the filer has up to 60 days from the date the original file was transmitted to submit an acceptable

replacement file. If an acceptable replacement file is not received within 60 days, the payer could be subject to late filing penalties.

This only applies to files originally submitted electronically.

If the file is good, it will be released for mainline processing after ten calendar days from receipt. Contact the IRS within the ten day time frame if the file should not be released for further processing.

|

A test file is only required if you’re participating in the Combined Filing/ State Filing Program for the first time. The submission of a test file is recommended for all new electronic filers to test hardware and software. See Part B. Sec. 2, Connecting to FIRE System.

The test file must consist of a sample of each type of record:

•Transmitter “T” Record

•Use the Test Indicator “T” in field position 28 on the "T" Record

•Issuer “A” Record

•Multiple Payee “B” Records (at least eleven “B” Records per each “A” Record)

•End of Issuer “C” Record • State Totals “K” Record(s) - if participating in the CF/SF Program

•End of Transmission “F” Record

Note: See Part C. Record Format Specifications and Record Layouts, for record formats.

The IRS will check the file to ensure it meets the specifications outlined in this publication. Current filers may send a test file to ensure the software reflects all required programming changes. However, not all validity, consistency, or math error tests will be conducted. There is a limitation of 125 files per Transmitter Control Code (TCC) in Trading Partner Test (TPT).

Provide a valid email address on the “Verify Your Filing Information” page. You’ll be notified of your file acceptance by email within two days of transmission. When using email filtering software, configure software to accept email from fire@irs.gov and irs.e-helpmail@irs.gov. Turn off any email auto replies to these email addresses.

It is the transmitter’s responsibility to check the results of the submission. See Part B. Sec. 2, Connecting to FIRE System.

Note: During peak filing periods, the time frame for returning file results may be more than two days. The following results will be displayed:

•Good - The test file is good for all files that are not testing for the CF/SF Program.

•Good, Federal/State Reporting - The file is good for the CF/SF Program.

•Bad - The test file contains errors. Click on the filename for a list of the errors.

•Not Yet Processed - The file has been received, but results aren’t available. Please check back in a few days. 3 |

Item

|

Issue

|

Resolution

|

1

|

You have not received a file status email.

|

To receive emails concerning files, processing results, reminders, and notices, set the SPAM filter to receive email from fire@irs.gov and irs.ehelpmail@irs.gov. Turn off any email auto replies to these email addresses. Check the File Status to ensure your information was transmitted.

Check “Verify Your Filing Information” page in your FIRE Account to ensure the correct email address is displayed.

|

2

|

You do not know the status of your submission.

|

The results of a file are posted to the FIRE System within two days. If the correct email address was provided on the “Verify Your Filing Information” screen when the file was uploaded, an email will be sent regarding the File Status. If the results in the email indicate “Good” and the “Count of Payees” is correct, the filer is finished with this file. If any other results are received, follow the instructions in the “Check File Status” option. If the file contains errors, get an online listing of the errors. If the file status is good, but the file should not be processed, filers should contact TSO within 10 calendar days from the transmission of the file. You must state if you want the file made bad or closed.

|

3

|

You received a file status of "Bad.”

|

If a file is "Bad", make necessary changes and resubmit as a Replacement file. You have 60 days from the original transmission date to send a good Replacement file.

Note: If an acceptable Replacement file is received within 60 days, the transmission date for the Original file will be used for penalty determination. Original files submitted after the due date or an acceptable Replacement file sent beyond the 60 days may result in a late filing penalty.

|

4

|

You received an error that more than one file is compressed within the file.

|

Only compress one file at a time. For example, if there are 10 uncompressed files to send, compress each file separately and send ten separate compressed files.

|

5

|

You resent your entire file as a Correction after only a few changes were made.

|

Only send those returns that need corrections, not the entire original file. See Part A. Sec. 11, Corrected Returns.

|

6

|

You received an error that the file is formatted as EBCDIC

|

All files submitted electronically must be in standard ASCII code.

|

7

|

You receive a TCC/TIN mismatch error when entering your TCC/TIN combination in your FIRE Account.

|

Enter the TIN of the company assigned to the TCC.

|

8

|

Transmitter sent the wrong file.

|

Contact TSO Monday through Friday 8:30 a.m. – 5:30 p.m. ET. Listen to all options before making your selection.

•866-455-7438 (toll-free)

•304-263-8700 (International) (Not toll-free)

•Deaf or hard of hearing customers may call any of our toll-free numbers using their choice of relay service.

TSO may be able to stop the file before it is processed.

|

9

|

You sent a file that is in the "Good" status and is within 10 calendar days from the transmission of the file, and you want to send a different file in place of the previous one.

|

Contact TSO Monday through Friday 8:30 a.m. - 5:30 p.m. ET to identify options available. TSO may be able to close the file or change the status to "Bad.” Listen to all options before making your selection.

•866-455-7438 (toll-free)

•304-263-8700 (International) (Not toll-free)

•Deaf or hard of hearing customers may call any of our toll-free numbers using their choice of relay service. |

10

|

You sent a file in PDF format.

|

All files submitted electronically must be standard ASCII code. If you have software that is supposed to produce this file, contact the software company to see if their software can produce a file in the proper format.

|

|

Item

|

Issue

|

Resolution

|

1

|

"C" Record contains Control Totals that don’t equal the IRS total of "B" Records.

|

The “C” Record is a summary record for a type of return for a given issuer. The IRS compares the total number of payees and payment amounts in the “B” Records with totals in the “C” Records. The two totals must agree. Do not enter negative amounts except when reporting Forms 1099-B,1099-OID, or 1099-Q. Money amounts must be numeric and right justified. Unused positions must be zero (0) filled. Don’t use blanks in money amount fields.

|

2

|

You identified your file as a correction; however, the data is not coded with a "G" or "C" in position 6.

|

When a file is submitted as a Correction file, there must be a Corrected Return Indicator “G” or “C” in position 6 of the Payee “B” record. See Part A, Sec. 11, Corrected Returns.

|

3

|

"A" Record contains missing or invalid TIN in positions 12-20.

|

The Issuer’s TIN reported in positions 12-20 of the “A” Record must be a nine-digit number. Don’t enter hyphens. The TIN and the First Issuer Name Line provided in the “A” Record must correspond.

|

4

|

"T" Record, "A" Record and/or "B" Record have an incorrect tax year in positions 2 5.

|

The tax year in the transmitter, issuer, and payee records must reflect the tax year of the information return being reported. For prior tax year data, there must be a “P” in position 6 of the Transmitter “T” Record. This position must be blank for current year.

|

5

|

“T” Record has a “T” (for Test) in position 28; however, your file was not sent as a test.

|

Remove the "T" from position 28 on the "T" record and resubmit as a replacement. CAUTION: Do not remove the “T” from position 1 of the “T” Record, only from position 28.

|

6

|

A percentage of your “B” Records contain missing and/or invalid TINs.

|

TINs entered in positions 12-20 of the Payee “B” records must consist of nine numeric characters only. Do not enter hyphens. Incorrect formatting of TINs may result in a penalty.

|

7

|

A percentage of your Form 1099- R “B” Records have invalid or missing distribution codes.

|

When transmitting Form 1099-R, there must be a valid Distribution Code(s) in positions 545-546 of the Payee “B” Record(s). For valid codes and combinations, refer to, Form 1099-R Distribution Code Chart 2022, located in Part C. If only one distribution code is required, enter in position 545 and position 546 must be blank. A blank in position 545 is not acceptable.

|

8

|

"A” Record has an incorrect/invalid type of return and/or amount code(s) in positions 28-45.

|

The Amount Codes used in the “A” Record must correspond with the payment amount fields used in the “B” Record(s). The Amount Codes must be left justified and in ascending order. Unused positions must be blank filled. For example: If the “B” Record(s) show payment amounts in payment amount fields 2, 4, and 7, then the “A” Record must correspond with 2, 4, and 7 in the amount code fields.

|

|