A common question that is asked around year end is: “What document can I give to the CPA that shows an owner’s operating expenses by well?” The answer is the Cash Flow by Owner Report.

The Revenue Supporting Schedule

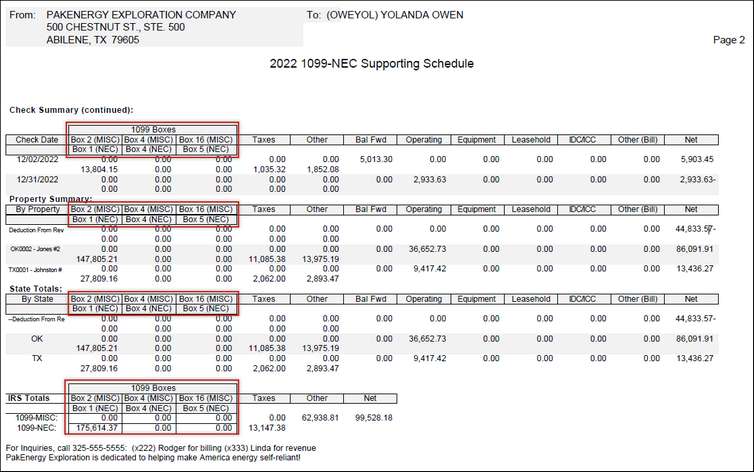

Important things to note for Supporting Schedules:

All amounts for the 1099-MISC and the 1099-NEC will show on the supporting schedules printed from the MISC or NEC section. However, the IRS Totals at the bottom will be provided for the type of 1099 being printed. If the client is printing 1099-MISC with supporting schedules, then the IRS Totals at the bottom of the schedule will be for the 1099-MISC. If the client is printing 1099-NEC with supporting schedules, then the IRS Totals at the bottom will be for the 1099-NEC. This is to aid in reconciliations. Shading has been added help distinguish between check dates, etc.

The note at the bottom of the Supporting Schedule coms from the settings in the Revenue module > Company > Cycle tab.

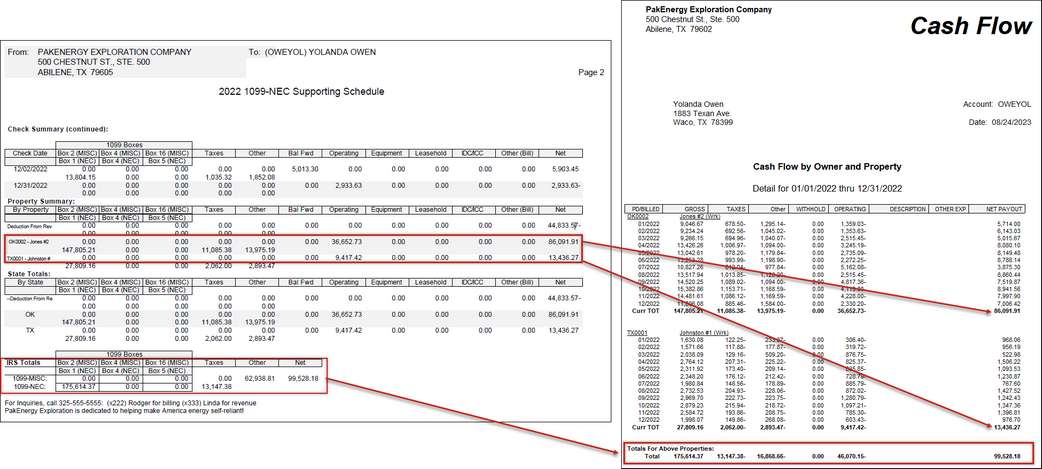

Cash Flow by Owner Report

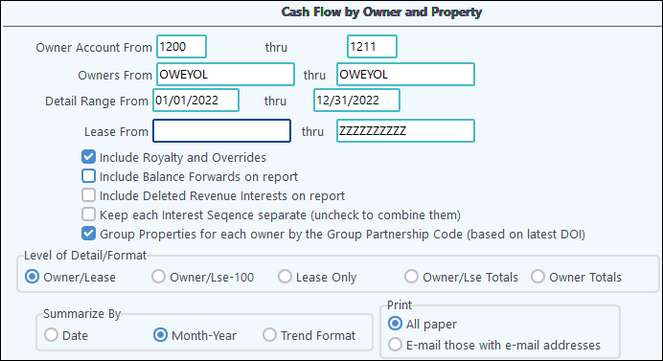

This report is found in Revenue/ Billing > Reports > Owner tab > O-4 Cash Flow by Owner

Make sure to include all AR accounts. Adjust the Detail Range to be the current year.

Compare the amounts on this report to the Property Summary section of the Supporting Schedule.