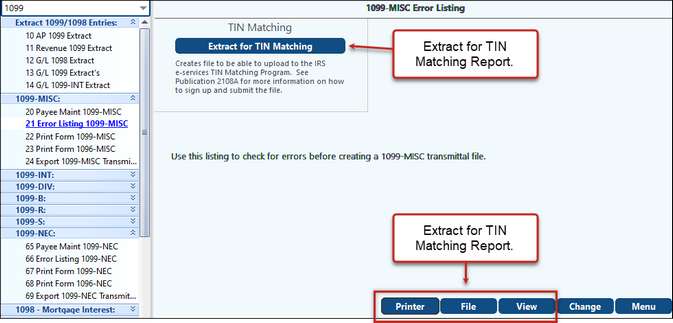

This menu has two different reports: the Extract for TIN Matching and the Error Listing. First, select the sub-system and click OK.

TIN Matching

TIN matching is designed to enable you to check the TIN (Tax Identification Number) provided by payee against the name/TIN that the IRS database contains PRIOR to filing 1099's. This process is provided to help avoid TIN errors and to reduce the number of backup withholding notices and is a service that is provided for free by the IRS. See Publication 2108A located at http://www.irs.gov/pub/irs-pdf/p2108a.pdf for complete details.

TIN Matching - Process

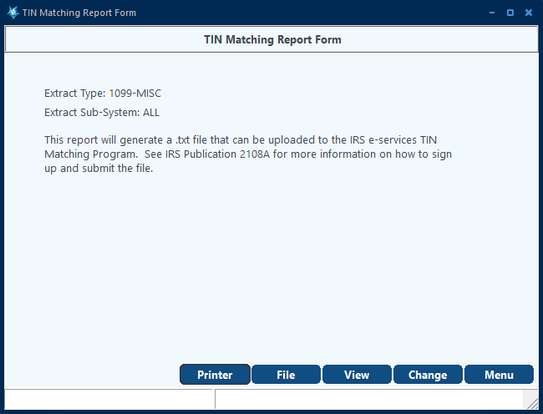

1. Click on the Extract for TIN Matching button.

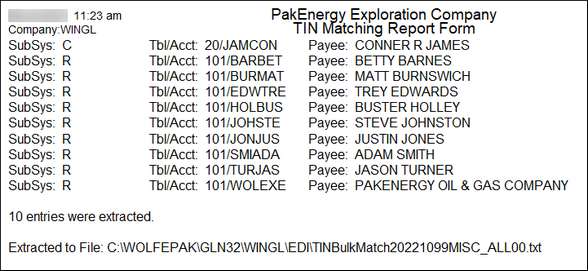

2. View and/or Print the generated report for any errors and file location.

A report will generate letting you know where the file is located to upload to the IRS. NOTE: The IRS will not accept a file where a same tax ID is used for multiple people. Therefore, the file will use the first Sub-Account only when there are multiple people with the same Tax ID's.

Note - if there are multiple owners that share the same last name and the first 5 of their TAX ID then multiple TIN Matching files will be created. This is to keep the IRS from falsely flagging these owners as duplicates and locking users out of the FIRE system for 72 hours.

Error Listing

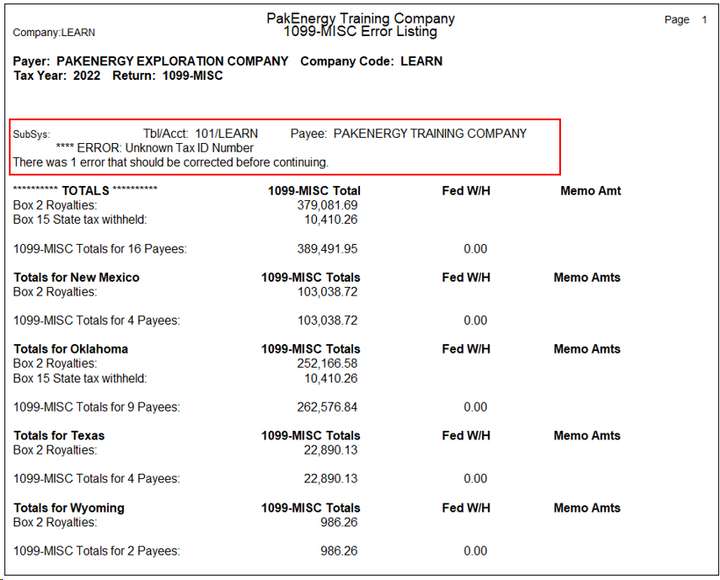

Selecting the "Error Listing" option on 1099-Misc menu can produce an edit listing that lets you know if there are any errors and also gives you company totals. All errors need to be corrected prior to printing or submitting 1099's. Corrections can be made in Payee Maintenance. However, it is recommended that any errors be fixed in within the system / module where they occurred or in Sub-Account Maintenance if applicable.To see the error listing click on the View button at the bottom of the screen. The listing may also be saved to a file or printed.

1099 MISC Error Listing - Process

1. Click on View at the bottom of the screen.

2. Review for accuracy and errors.

3. Print or Save to File.

4. Correct any errors.

5. Run the Error Listing again until all errors are corrected.

Also see Folder Transfer/Compare if needing to transfer files between WPA and a local folder.