PakEnergy Accounting's Oil and Gas Check Stub is a fast and easy way to enter revenue deposits received from Purchasers into both General Ledger and Revenue systems in one step. It automatically cross-references the Purchaser's Lease Numbers to your Lease Numbers and codes the various components (gross income, taxes, other) to their proper accounts. It is smart enough to compute any missing amounts based on the lease's percentage of ownership. This eliminates the need to enter the amounts into spreadsheets or be a calculator wizard.

If you are an Investor, you can enter checks, and even JIBS if netted, into this system. It will quickly and easily make all entries into the General Ledger system.

Deposits for revenue checks should be made separately from monies received for other purposes, such as from owners or customers. Oil and Gas checks are recorded in the Check Stub System; all other receipts are recorded through the General Ledger System, mainly in the Deposit Entry module. This will enable you to account for each deposit easily and efficiently.

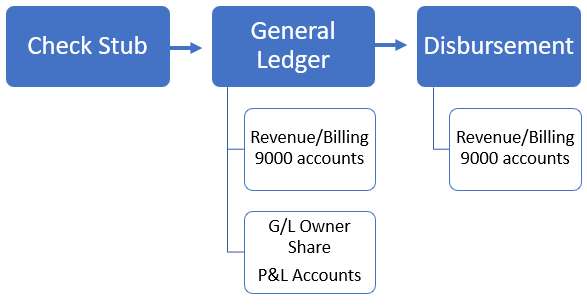

The flow of Entries into the General Ledger

Coding Structure

The system’s coding scheme starts with an account. The 9000-9999 range is typically set aside for Oil and Gas Accounts. The General Chart of Accounts are:

9000 – 9598 |

Joint Interest Billing Accounts |

9599 |

Billing Offset |

9600 – 9798 |

Revenue Accounts |

9799 |

Revenue Offset |

9800 – 9899 |

Royalty Accounts |

9900 – 9999 |

Offsets, Cutbacks, and Other |

Each of these accounts would need to have the Property/Lease Sub-Table attached to it. This way, all entries could be broken down to the Property/Lease level.

For example, account number 9601 could be Oil Sales, and account 9621 could be Gas Sales. Attached to both accounts would be the property Sub-Table that contains all a Sub-Account for each of our properties (leases).

Remember that Sub-Tables group all like Sub-Accounts together. Sub-Accounts are logical sub-divisions of accounts. Sub-Accounts are up to ten (10) characters (alphanumeric). For example, five Sub-Accounts called JONES – Jones Prospect, LA01-Oil City #1, OK0001 – Muskogee 3-A, TAYLOR-Taylor County Prospect., and TX0003- McNally 1-B might be used to represent five properties. Rather than have a separate Oil Sales Account for each property, you would have one Oil Sales Account, with Sub-Accounts that represent the individual properties. You would have one Gas Sales Account using the same list of individual properties.

However, the Check Stub module is not just for Operators. This module also allows Investors to track their Revenue and even Billing. Instead of using the 9000 range, you can use your normal P&L range.

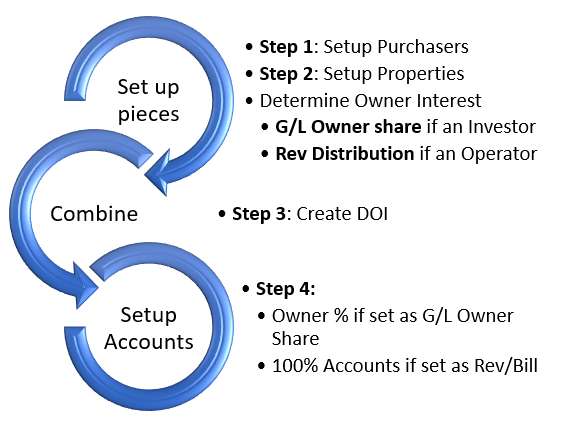

Setup:

Also see: Check Stub FAQ