Overview

CDEX is the name for the industry standard format for "Check Stub Data Exchange". For a small transaction fee, you can arrange to get your Check Stub information sent to you electronically. The Check Stub Program imports and validates the raw CDEX data, eliminating the manual entry of the stub detail. This can save a company a great deal of data entry time on larger volume stubs. Check stub exchange providers of the CDEX services along with their web addresses are as follows:

•Oildex: http://www.oildex.com/

Company Maintenance Options and Timing Issues:

Because you will normally post the deposit from the check stub CDEX batch file on a different day than the money is deposited into your account, Pak Accounting strongly recommends using a "Purchaser Clearing Account" or set up a default CDEX account in Check Stub Company Maintenance > Electronic Import (CDEX). In addition, Pak Accounting also recommends you set up that account to access the Purchasers Sub-Table so that if the account does not clear, you can easily trace it to a particular purchaser. Setting up the Purchaser Clearing account allows the user to access detail for each Purchaser.

Also See:

Setup Information

Prior to using the CDEX Import feature there are some important setup instructions that must be followed:

STEP 1: Set up Purchaser Clearing Account

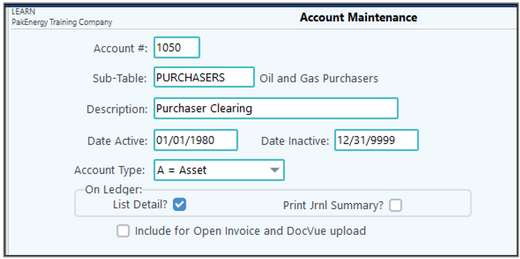

•Set up the Purchaser Clearing Account in Account Maintenance [F11]. (We used account 1050).

STEP 2: Check Stub Company Options

•Set Clearing Account Default

•Setup State Withholding Cross-Reference

STEP 3: Purchaser Maintenance Setup

•Purchaser Code Cross-Reference (CDEX Purchaser tab).

•Product Cross-Reference (Products tab).

Step 1: Set up Purchaser Clearing Account

In F11, Account Maintenance, create a clearing account that has the Purchaser Sub-Table attached.

Step 2: Check Stub Company Options

Set Clearing Account Default

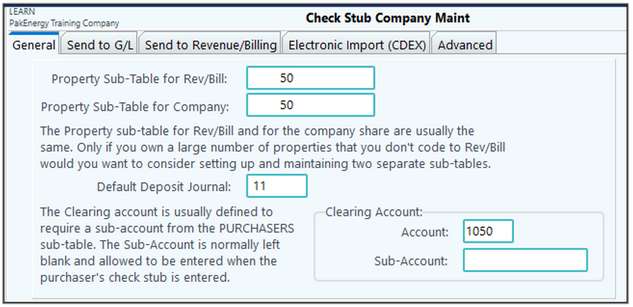

In Company Maintenance > #90 Company > General tab, enter in the Purchaser Clearing Account. This account will default when importing. Typically, the Sub-Account field is left blank if importing from more than one Purchaser.

Setup State Withholding Cross-Reference

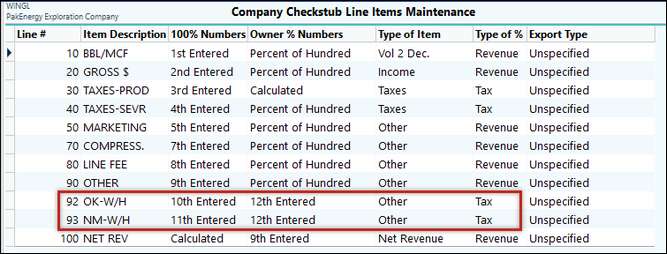

The State Withholding codes are set up in Company Maintenance > Stub Line Items.

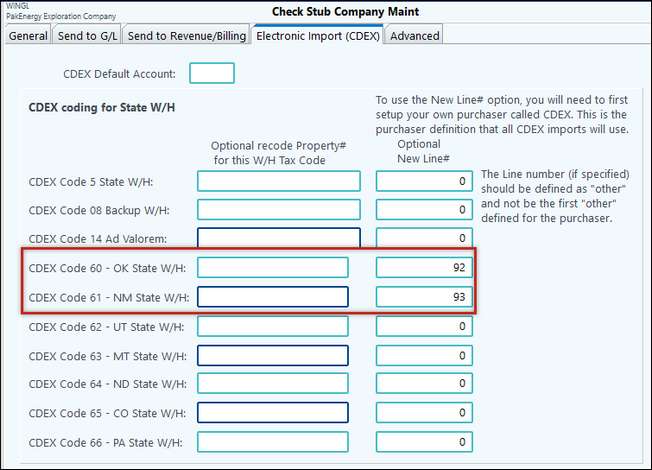

Next the state withholding for CDEX will need to be set up in Company Maintenance, Company, Electronic Import (CDEX) tab. This redirects the CDEX code for the state withholding to the Line number set up in the system for the same state withholding. The states that are supported include CO (Colorado), MT (Montana), NM (New Mexico), ND (North Dakota), OK (Oklahoma), and UT (Utah).

Step 3: Purchaser Maintenance Setup

Purchaser Code Cross-Reference (CDEX Purchaser Tab)

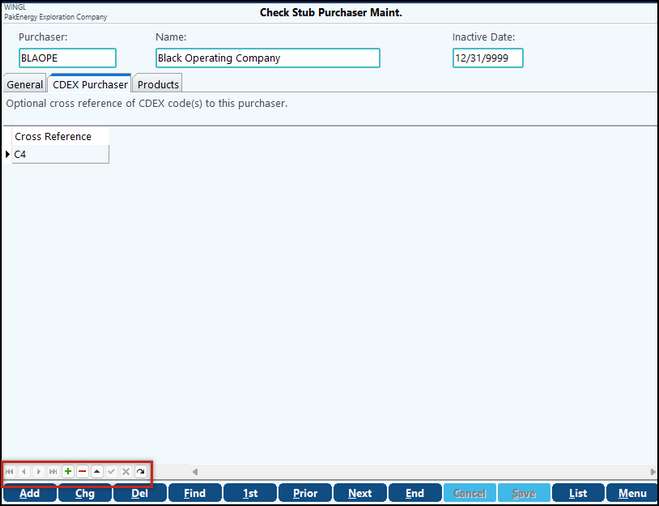

Each CDEX purchaser has its own unique 2 digit code. For instance, Devon is DE and Exxon is EX. Your Purchaser setup must follow this convention. Your CDEX provider can supply you with the codes.

Often times, these codes contain special characters. Since special characters are not allowed in the Purchaser field, Pak Accounting recommends setting up a Purchaser with a full code, then using the CDEX Purchaser tab for the 2-digit codes. In my example below, Black Operating’s CDEX code is “?2”. So, I entered in BLACK as the Purchaser code, then put the “?2” in the cross-reference.

Another benefit of the CDEX Purchaser tab is that if you have an existing Purchaser, this allows you to keep all your existing Division Orders and Check Stub history. There is no need to set up new Division Orders for the CDEX Purchaser.

NOTES:

•You must set up a CDEX Default for the Cross Reference to work properly.

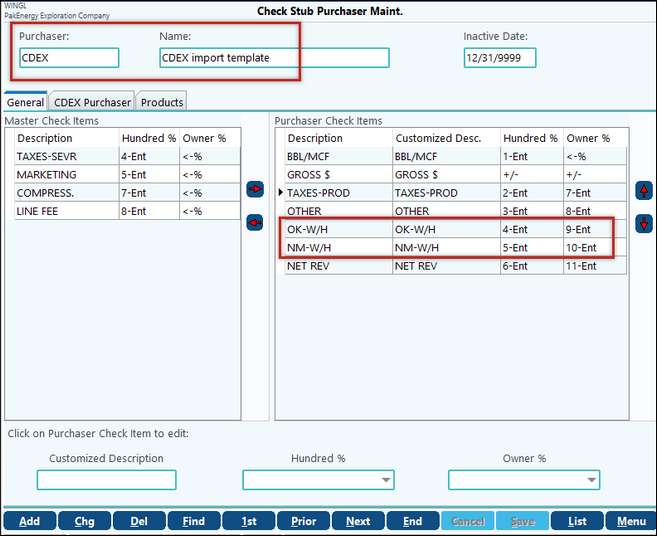

•When importing using the CDEX menu, the CDEX template is used, not the setup for the individual Purchaser.

•Prior to the CDEX Purchaser setup, the line numbers for OK-W/H and NM-W/H must be setup in Check Stub Company Maintenance/ Stub Line Items.They must not be set up as the first "Other" under the Type of Item column.

Update the Purchaser CDEX to include the withholding codes to be imported as individual line items from the CDEX file. The states that are supported include CO (Colorado), MT (Montana), NM (New Mexico), ND (North Dakota), OK (Oklahoma), and UT (Utah).

CDEX Purchaser Tab

This tab is used to cross reference a current Purchaser setup to your CDEX Purchaser Code. This allows you to keep all your existing Division Orders and Check Stub history. There is no need to setup new Division Orders for the CDEX Purchaser. When using the Cross Reference CDEX Purchaser it will look at the current Division Orders. To utilize this feature you must have the Default CDEX Purchaser setup.

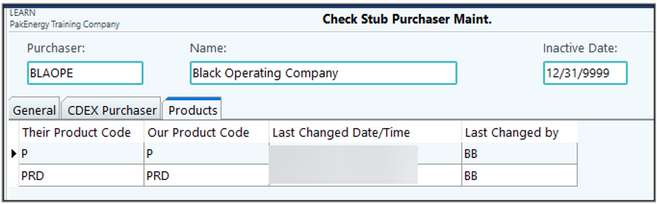

Product Cross Reference (Products Tab)

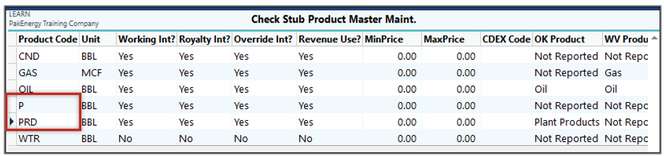

CDEX has industry standard product codes that must be used on the CDEX file. The system translates these product codes as follows. The 3-character codes MUST be setup under Master File Maintenance – Product and then added in Master File Maintenance – Purchaser – Product tab.

5, 30, 90 PRD

10,11 OIL

12,13 CND

20...23 GAS

For example, before importing I just had “P” setup for Products. But now that I will be importing, I created a new code “PRD”.

I then went into my purchaser and added this new code so my import will work correctly.

CDEX Interest Codes

(Immediately to the right of Net Column, column is labeled "T").

CDEX Code |

Description |

Pak Accounting |

|

|

|

B |

Blanchard |

ROY |

M |

Miscellaneous |

* 1 |

N |

Net Profit Interest |

WRK * 1 |

O |

Overriding |

OVR |

P |

Production Payments |

ROY |

R |

Royalty |

ROY |

S |

Special Overriding |

OVR |

T |

Tax |

* 1 |

W |

Working |

WRK |

X |

Buy/Purchase |

* 1 |

NOTES

•* 1 - On these CDEX Interest Types, the system will look thru the Division Orders for this Purchaser property, looking for a match on percentage and then uses whatever interest typed is coded on that Division Order.

•If the Division Order is coded to going to G/L, the type of Interest must match. If the entries are going to Revenue to be disbursed, then type is generally ignored.

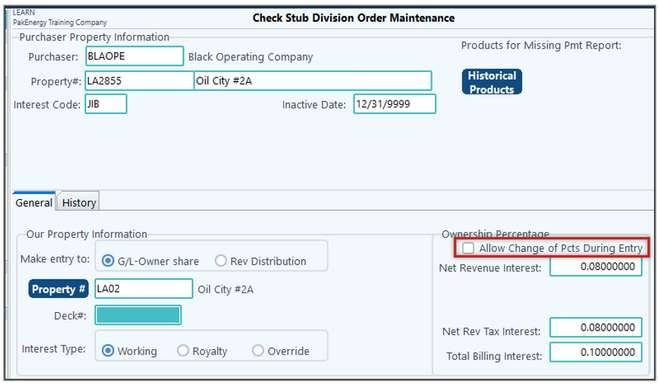

Just like when setting up any Division Order, the Property# that is entered must be the exact property number as used by the Purchaser when transmitting CDEX. It can only be up to 14 characters long. This is part of the key that is used to match information.

If the Division Order is coded going to G/L-Owner share, the Interest Code must match.

Also, on this screen is an option to "Allow Change of Percentages during entry".

•If you check the box, the system will not give you a warning if the revenue percentages do not match but the lease number does.

•If you leave the box unchecked, the system will give you a warning about the revenue percentage not matching the Check Stub Division Order Maintenance as described in the CDEX Edit Listing. This is the recommended setting.

CDEX Download Checklist

1. Download CDEX file using CDEX download instructions that come from Oildex.

2. Print Edit List for error reports in Pak Accounting to verify actual files were received.

3. Resolve errors on Pak Accounting report (i.e. fix property #, DOI, interest types, etc).

4. Import data into Pak Accounting & print full copy of imported file.

5. Keep a copy of the CDEX Import listing and Check Stub edit listing for each purchaser.

6. Sign back into CDEX & clear checks and purge data per instructions from CDEX.