What are Stub Line Items? Stub Line Items define the various types of amounts (income and expense) that a purchaser might have on their check stub. This maintenance is located under Company Maintenance > Stub Line Items. It allows you to set up all check stub item descriptions that you might need to use when you set up each Purchaser Maintenance. However, if doing a QuickStart with one of Pak Accounting’s templates, many of the most common Line Items will already be set up for you. You would only need to set up any ones not already here.

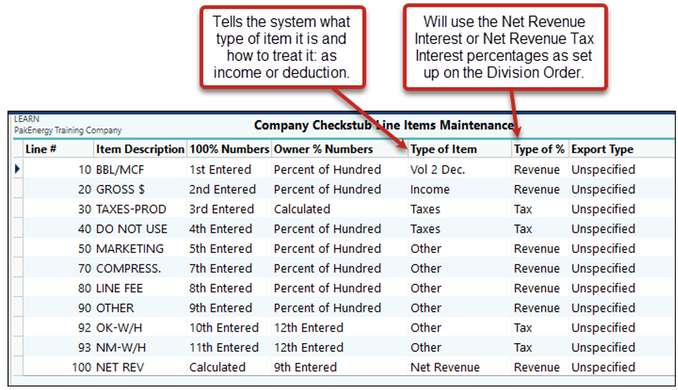

The Item Description, the Type of Item, and the Type of % are the most important columns. This tells the system what it is and how to treat it. The Line #, 100% Numbers, and Owner % Numbers are defaults that can aid in the Purchaser setup.

Line # |

You can delete any unnecessary line items for your company. The following fields are mandatory for using check stub: Line 10-Volume, Line 20-Gross Notes: Gross is the only line item that uses Income as its Type of Item, and Line 100-Net Revenue. Net Revenue is typically the last Line # added in the Check Stub Line Items Maintenance All other fields can be tailored to your company's specific needs. |

|---|---|

Item Description |

Description of the line item. |

100% Numbers / Owner % Numbers |

Specify the default entry type if this line item is used in Purchaser Setup. This is typically overridden in the Purchaser Setup menu. |

Type of Item |

•Volume - 0 Decimals •Volume - 2 Decimals •Income (only use once with Gross) •Net Revenue •JIB •Taxes •Other |

Type of % |

This is specified so the system can cross check and/or compute the owner's amount from the 100% amount and vice-versa. The 3 different percentages are defined on each division order: Revenue, Tax, Working (with JIB). |

Export Type |

Used with our Investor Interface option. This option will allow you to include the Full Revenue File codes on Taxes and Other deductions. |

NOTES:

•If you add a new line item you must code the G/L accounts on the Owner % Account Maint and 100% Account Maintenance.

•Do NOT change any of the Line # (i.e. changing the actual Line # column from one value to another), only add new ones, change descriptions, etc. The columns "Type of %" and "Type of Item" should NOT be changed after you set up purchasers.

•***IMPORTANT**** In order for the stub line items to populate in Purchaser Setup, a default purchaser must be set up in Sub-Account Maintenance (F12) under the PURCHASER Sub-Table. The only items that have to be entered on the Sub-Account Maintenance are the Sub-Account code and the name. Next, go to the Purchaser Setup in the Check Stub module. The Default Purchaser will appear on the screen with all of the stub line items that were entered in Stub Line Maintenance. Now additional purchasers can be added in Purchaser Maintenance.