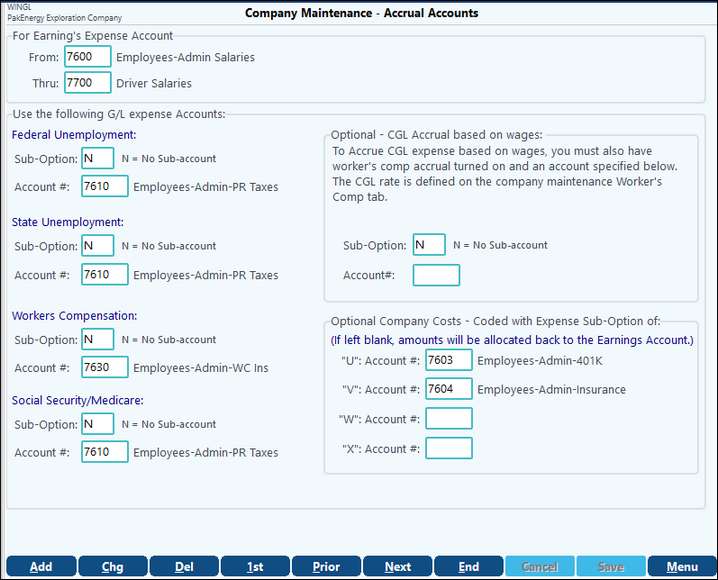

Accrual Accounts are where the company's Expense Accounts are defined and are only used if the corresponding compute accrual option is checked on the Company Maintenance > Basic Options > G/L tab. It is recommended that the accrual accounts be setup for the whole range of Payroll Accounts and not individual setup for each account.

Earning’s Expense Accounts |

Enter the range of expense accounts for earnings. |

|---|---|

Use the following G/L Expense Accounts |

|

Federal & State Unemployment, Worker’s Comp & FICA |

Sub Option: N = No Sub-Account E = Sub-Account is Employee # D = Sub-Account is Department # A = Reallocate expense using this account Account # - enter account number to post expense. Sub-Table attached to the Account should match the Sub-Table used under Sub Options (None/Employee/Department) |

CGL Accrual |

Rarely Used, for companies who have CGL insurance based on the Payroll dollars, accrues the Liability just like Workers comp. |

Optional Company Costs |

Coded with Expense Sub Option – used for detail codes you have setup to record company costs. The associated company cost setup must use the “U,V,W or X”. |

Liability Accounts are defined:

Federal Unemployment: Company Maintenance > Basic Options > Taxes tab

State Unemployment: Company Maintenance > Basic Options > States tab (by state)

Workers Compensation: Company Maintenance > Basic Options > States tab

Social Security/ Medicare Company Maintenance > Basic Options > Taxes tab