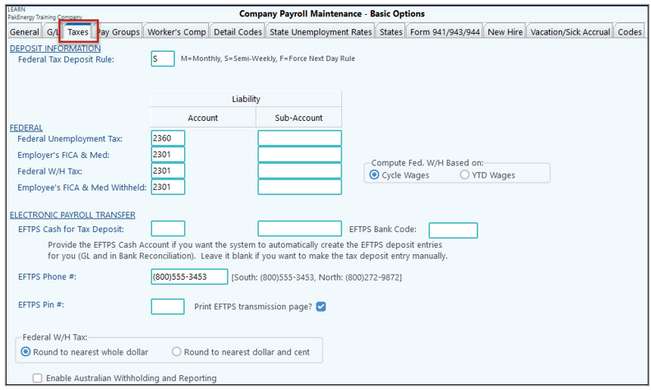

Eventually, the taxes taken from an employee’s check, and the company’s portion, will need to be sent to the IRS. The Deposit Information section will state how often (Monthly, Semi-Weekly, or Force Next Day). This will also populate the Tax Date on the Start Payroll Cycle Screen so you know when it’s due.

The Federal section is where you will record the tax liability. So, during the Payroll Cycle the employee and employer’s taxes will go into these accounts, then later, when they are paid, these same Liability Accounts will be offset.

The Compute Fed W/H Based on should be left at Cycle Wages. This determines how taxes are calculated at the employee level.

•If set to Cycle Wages, the system will take the amount of the current cycle times the number of Payroll Cycles (set in Employee Master - Taxes) to get an annual base. The taxes are then figured from this amount. However, the YTD Wages option will look at the YTD amount on the current cycle and base the taxes on this amount. Since tax brackets are based on annual wages this can make a huge difference in the amount of taxes taken from an employee’s check.

Last, if populated, the Electronic Payroll Transfer section will record the tax payment. You will still need to go online to make the actual payment, but the system will make the Journal Entry for the payment. If this section is not filled out, then you will need to record the payment manually either through A/P or as a Journal Entry. In either case, you would need to make sure to hit the same Liability Accounts listed on this screen.

Taxes |

|

|---|---|

Federal Tax Deposit Rule |

M - Monthly deposits S - Semi-weekly deposits - generates 941-B automatically when the 941 prints Refer to the IRS Circular E for more information concerning your Company's tax deposit filing status. The system defaults to Monthly; but some larger companies may be required to deposit semi-weekly. F – Force Next Day rule – forces the system to calculate the tax date as the next day after the payroll cycle. It is used for large companies that have to make their deposits immediately after each cycle (i.e. companies who get the schedule B on the 941) |

Fed Unemploy Tax: Employer’s FICA Federal W/H Tax Employee’s FICA/Med |

Acct/Sub-Acct where the liability side of the accrual should be posted in general ledger for the listed taxes. There are several different ways you can record and pay your payroll taxes. Our example takes the tax to a liability account. The offsetting expense account is setup in Master File Maintenance/Accrual Accounts. The entries will automatically be recorded when the payroll is updated (Debit to the Liability and Credit to the expense accounts). |

EFTPS Cash for Tax deposit |

Populating this field will create a Draft Payment entry to the cash account for the EFTPS payment of taxes. (credit cash and debit the tax liability accounts listed above). The entry is created when the Payroll cycle is updated. |

EFTPS Phone # |

EFTPS Number: If you are filing semi-weekly deposits and are using EFTPS to file, enter “South’s” number in the field. If you are filing Monthly deposits and are using EFTPS to file, enter the “North’s” number. |

EFTPS Bank Code |

Bank Code to pay the EFTPS payment. Only enter if you want the system to make the cash entry, otherwise leave blank. For Bank Reconciliation purposes. |

EFTPS Pin # |

Identification Number given to you by the IRS for Electronic Federal Tax Payment System. |

Print EFTPS transmission page |

Uncheck if you are paying payroll taxes by check and do not want to print a transmission page. |

Compute federal W/H based on Cycle wages |

Cycle wages (most used) - normal default setting to compute federal withholding based on the wages in the current cycle. |

Federal W/H tax |

Nearest Whole Dollar (Default) - rounds federal withholding to the nearest whole dollar Nearest Dollar and Cents - rounds federal withholding to the nearest dollar and cents using the federal tax tables. |

Enable Australian Withholding and Reporting |

Provides the ability to withhold based on Australian tax rules. If this feature is enabled, the employee master will have a place on the taxes tab to indicate the country. Additionally, other options specific to Australian withholding will be shown in reference to the tax scale, HELP debt, and Financial Supplement Debt. A new section under Year End, Reports-PAYG, will also be added to the Payroll menu that has an extract and two tax forms for Australian reporting. |